Banking and Housing Payments Devoured the Middle Class Income – 1 out of 10 Americans on Food Stamps and how the Fed Slowly Devalued the Dollars in your Wallet.

- 7 Comment

It is a challenge to say that things are getting better when every month that goes by more Americans are losing their jobs or needing to apply for food assistance. In the latest data for food assistance through SNAP we find that 200,000 more Americans were added to the program. That now brings the total number of Americans on food assistance to 38,183,000. 1 out of 10 Americans are receiving food assistance. For 2009 this cost the government $50 billion, up from $34 billion in 2008 and $30 billion in 2007. It should be no surprise then that average Americans are questioning the viability of a middle class in the upcoming decade.

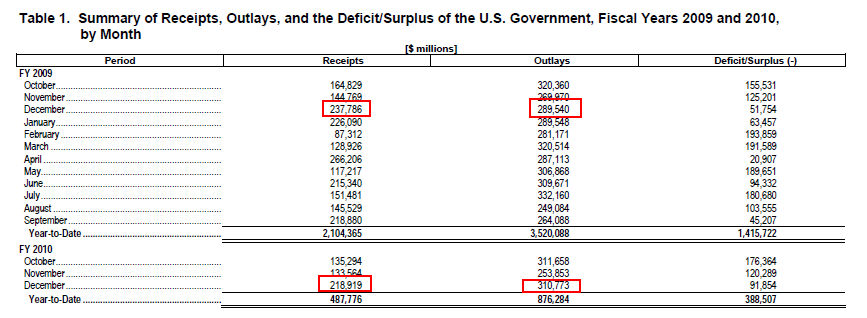

But even when we look at the balance sheet of the government, things are still not improving:

Source:Â U.S. Treasury

Take a look at the amount of revenue (taxes) the government brought in for the month of December. $218 billion was taken in. But look at data from December of 2008. The government at the peak of the crisis brought in $237 billion. So this December was even worse than the one ending 2008. How is this a sign of recovery? You would assume that receipts would be going up if things were in fact getting better. All we see is the spending side of the equation going up and the only sector in the economy turning a solid profit is the banking sector that is now running a new form of corporatocracy. It would be one thing if we were adding jobs each and every month but even the massive amounts of bailouts have yet to yield any visible help for average Americans.

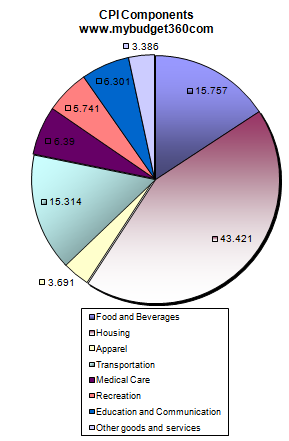

In the past few decades Americans have seen more and more of their income being eaten up by the housing sector of the economy:

This latest decade saw a much larger share of income going to housing than any in the past. Unlike stocks, every American needs to live somewhere and will need to either pay a mortgage if they own or pay rent. The banking sector found a method of siphoning off wealth from the biggest asset Americans hold. We have seen this occur slowly over the decades:

1950

Median household income:Â Â Â Â Â Â Â $3,319

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $7,354

Home price / income = Percent of 221

1960

Median household income:Â Â Â Â Â Â Â $5,620

Median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $11,900

Home price / income = 211 percent

Running those numbers today, we find that nationwide the cost of a home eats up more and more income:

Median Household income:Â Â Â Â Â Â $52,029

Median U.S. home price:Â Â Â Â Â Â Â Â Â Â Â Â $172,600

Home price / income = 331 percent

The above data is pulled from years of Census data but shows clearly that housing has eaten more and more into the income of average Americans. In a purely fiat money system, banks can create money out of thin air. The Federal Reserve has done this through the monetization of debt. Now think about this, if a participating member bank borrows say $1 million from the Fed it can then turn around and lend the money out through loans up to $9 million courtesy of fractional reserve banking. With current interest rates, if it borrows from the Fed at near zero even a 5 percent return on bread and butter mortgages would yield $450,000 a year for doing absolutely nothing but being a middleman. And some banks have gone ahead and issued credit cards with 79.9 percent rates. When Bear Stearns and Lehman Brothers failed their leverage was even higher at 20 and even 30 to 1. The other investment banks are near those levels even today yet with full government support.

So why bring this up? In the United States debt is treated as money. In fact, without debt we wouldn’t have money. I think this is lost on many. When someone goes to a bank and takes out a mortgage with virtually no money down, all of a sudden a liability and asset of a few hundred thousand is created out of financial alchemy. So when this housing bubble burst trillions of dollars evaporated from the system but it was nothing more than erasing previous debt that really had no actual backing.

So if the Fed can create money out of thin air through their banking web why is the economy still faltering? In boom and bust cycles we see a love and revulsion towards debt. Banks can be willing to lend out money but you can’t force average Americans to borrow. This past decade we saw the absolute disregard for prudent debt lending and now, many Americans are averse to taking out loans. In fact, now that banks are actually checking and verifying incomes it turns out that many middle class Americans really don’t qualify for additional debt.

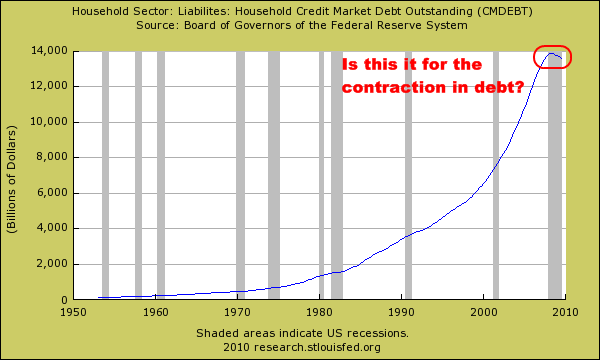

This brings us to our next chart looking at household debt:

Even after the stock market recovery, it is estimated that average Americans have seen their household net worth decline by $11 trillion since the peak of this bubble. Yet take a look at the chart above. Household debt still remains near the peak. And keep in mind that real estate was the biggest item of net worth for Americans and this has fallen by roughly $6 trillion. Yet the loans remain the same. And that is largely a reason for the flood of foreclosures and bankruptcies. While banks still have mortgages valued at peak levels the actual market value is much less. The U.S. Treasury and Federal Reserve made a troubling bet during the early days of the crisis that things would correct quickly. Actually, I tend to believe that the Fed knew all along that when push came to shove, the entire banking sector would be bailed out by the U.S. taxpayer since the Fed is simply the lender of first and last resort for member banks.

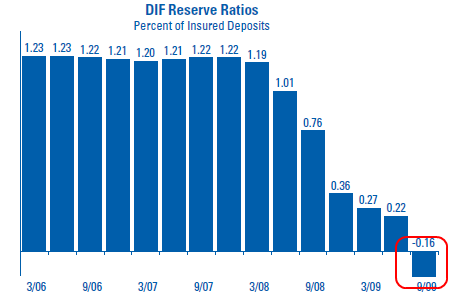

So this leaves Americans contenting with debt amounts that no longer reflect the value of their underlying asset. Yet the banking sector is now fully supported by the taxpayer. So with the current system in place, if banks do fail taxpayers are on the hook. The Fed has setup the perfect trap for middle class Americans. If average Americans decide to walk away from their underwater mortgages then the bill will be paid by taxpayers. After all, we are already told that the too big to fail by definition won’t fail. And the other option is to continue paying a mortgage on a home that is no longer worth its value. Many Americans simply cannot afford to do this. Do you notice how in no scenario the banks lose? This is another characteristic of the corporatocracy. And the FDIC which insures bank deposits is essentially insolvent:

And the FDIC backs $13 trillion in total assets with a fund that is insolvent! Now that is maximum leverage.

Over the past decade as the financial sector gained more and more power many Americans saw more and more money go to their housing payment. The housing bubble was merely the end product of the banking sector through Wall Street flooding the system with debt. If we live in a world where only one house is on the block and you have $1,000 and I have $1,000 and we both want the house the maximum we can pay for the home is $1,000 given our resources. But enter a bank that is willing to create debt of $10,000 in the form of a mortgage and say we are obsessed with the house; it is very likely we would be willing to pay $11,000 for the home. Is the home really worth $10,000 more? Of course not. But our $1,000 just got a lot less valuable. And this is the crux of a fiat money system. The government can force it as legal tender but if the value continues to erode people will begin questioning the system. It is only valuable to the point that people have faith in it. And right now many Americans are losing faith in the system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

beans McGrady said:

This is a good article. However, the problem stated is not caused by a fiat currency system. It is caused by a debt based fiat currency system. If congress created a government currecny, rather than a private bank ( the fed) that loans it to the government in the form of buying bonds (which are a promise to pay, just as dollars are, creating an unnecessarry for profit middle man), and reserve levels were raised to 100%, then the speculation and and profiteering that are causing this depression would be all but impossible. Historically this has been seen in both the Colonial Script and Lincoln’s Greenback of the civil war era. Both were debt free fiat currecies that functioned very well. A return to the gold standard would be catastrophic given that the IMF (another private bank) currently owns clos to eighty percent of the worlds gold. Silver might work, though it is unnecessary as debt free fiat currencies can work. It is the private central banks and their control of interest rates that create these artificial boom/bust cycles.

Cheers.February 7th, 2010 at 12:00 pm -

Mike said:

What is happening to America is no accident. It has been a well laid out plan to destroy America from within.

Please visit this website-

http://www.subvertednation.net/about-2/

Download the FREE BOOK which they have now banned from publication. Understand this is nothing new, and there is a reason the media is not giving you the full story, and why so many websites avoid the real issues.

February 7th, 2010 at 1:12 pm -

Dave Eger said:

Good information, but when was this posted? There is no date on the article. The reason why I ask is because I’ve seen that it’s actually 1 in 8, not 1 in 10 on food stamps:

http://www.nytimes.com/2009/11/29/us/29foodstamps.html?_r=2&partner=rss&emc=rss&src=igw

February 8th, 2010 at 12:28 am -

french said:

Thanks a lot, i think everybody should watch:

MONEY AS DEBT 1

AND

MONEY AS DEBT 2Thanks for your job !

February 8th, 2010 at 4:37 am -

c1ue said:

1 in 10 Americans – this is actually incorrect.

The population in the US now is approximately 315 million according the the Census bureau.

This is closer to 1 in 8

Otherwise a nice snapshot of the ongoing class war in the United States.

February 8th, 2010 at 6:41 am -

rolland carpenter said:

Good report! Did you see NYT Sunday? Front page article described our government’s gift to one (among many) Wall Street insiders. AIG got $180 billion, which was quietly passed on to the likes of Goldman Sachs. There was no legitimate “bail out”! This was fraud–taxpayer funds used to pay off gambling debts — so called “Credit Default Swaps”– a kind of unregulated insurance.

Now, we are told America must cut “Entitlements”– which no doubt includes earned and promised pensions to lifelong Social Security “contributors” and maimed war veterans.

February 8th, 2010 at 11:45 pm -

JC Lang said:

The numbers don’t tell the whole story. Houses built in recent years have grown larger, with attached 2-car garages, and other amenities. The fact is incomes have not kept up with the spending levels on homes and cars. People have grown accustomed to buying things they cannot afford, therefore the debt load is higher. Not because they don’t make enough money, but because they spend too much. We need to reverse the trend and become more austere. The current economic conditions are just symptoms of overexpenditures in both private and public sectors.

May 5th, 2010 at 10:22 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!