Comparing the inflated cost of living today from 1950 to 2014: How declining purchasing power has hurt the middle class since 1950.

- 22 Comment

Inflation has a subtle eroding effect that impacts entire economies. In the United States, we have been fortunate to have relatively stable rates of inflation for two generations. Even in times of high inflation like the 1970s, people were able to adjust unlike places that experience uncontrolled inflation like Argentina is currently facing. Also, wages rose in tandem which helped buffer the pain of higher costs. Today however, inflation has eroded the purchasing power of the middle class. Only when we look at longer periods of time do we see the large impact inflation has on our ability to buy real goods and services. People found a piece comparing 1938 and 2013 prices on various goods and items to be enlightening. Since our middle class did not fully emerge until the end of World War II, it might be useful to compare the price of items back from 1950 to where things stand today. Has inflation had a big impact on our purchasing power since 1950?

1950 living versus that of 2014

It might be useful to first look at a few common items from 1950:

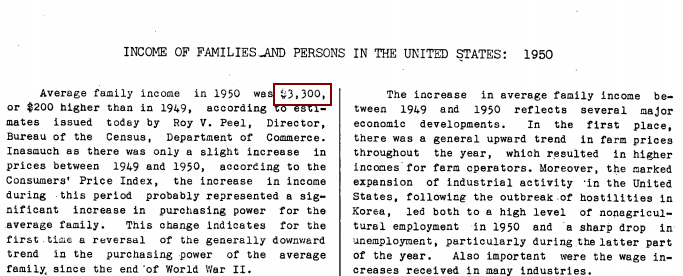

The average family income:Â Â Â Â Â Â Â $3,300

The average car cost:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,510

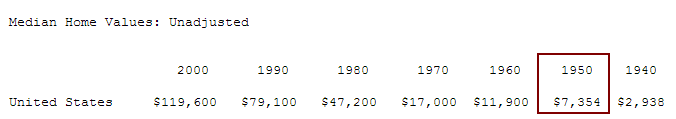

The median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â $7,354

These are three very important metrics when it comes to measuring purchasing power in the United States. Since we consider having a car and a home as cornerstones to a middle class lifestyle, it is useful to look at these figures since we can easily grab these figures from reliable sources.

See below for source data:

Source:Â US Department of Commerce

Then we can see the median home price:

Source:Â US Census

A Ford car could be had with a price range of $1,339 to $2,262 depending on the model. Income is an important measure because it gives us an insight into how well families are doing and how much money is being spent on certain items. So let us derive ratios for each of the items for the 1950s:

Home price / income =Â 2.2

Car cost / income = Â Â Â Â Â Â Â .45Â

This is important here. The typical home cost 2.2 times annual income while a car cost .45 times annual income. Let us now fast forward to 2014 and see where these things stand:

The average family income:Â Â Â Â Â Â Â $51,017

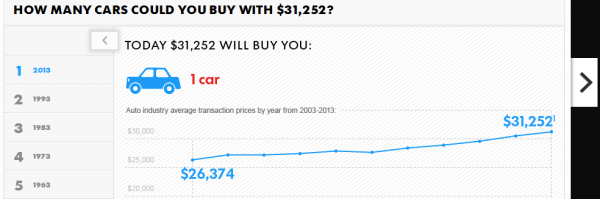

The average car cost:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $31,252

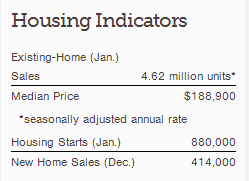

The median home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â $188,900

Let us show the data here:

Source:Â National Association of Realtors

Household income was pulled from Census data based on what the typical household earns. Inflation has a subtle way of eroding purchasing power. Let us pull some ratios here:

Home price / income =Â 3.7

Car cost / income = Â Â Â Â Â Â Â .61

Housing has gotten dramatically more expensive. The cost of a new car has gone up but not so noticeably when looking at inflation data. Inflation has largely eaten away at income on other fronts like college tuition and healthcare. These were much more affordable back in the 1950s relative to overall income.

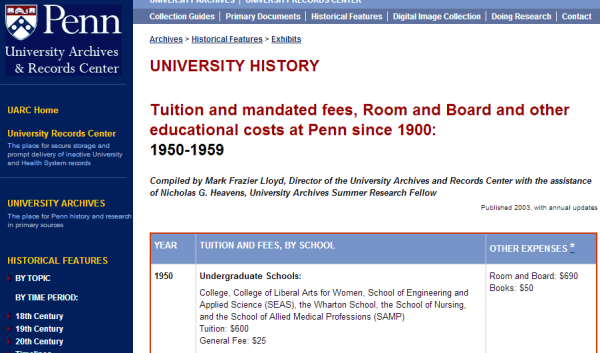

For example, in 1950 at the University of Pennsylvania annual tuition was $600:

We should run a ratio here as well:

Tuition / income = .18

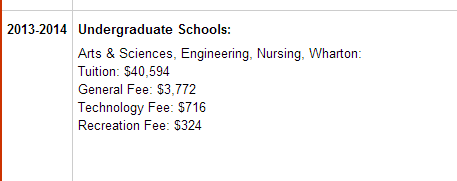

Let us look at current tuition costs:

Current tuition is over $40,000 per year.

Tuition / income = .79

This is a massive change. In 1950, a family sending their child to the University of Pennsylvania would only spend 18 percent of their annual income (if they paid in cash) to send their kid to study. Today it would consume 79 percent of gross annual income. Even if we look at net take home pay a regular family in no way could send their child to school without going into massive student debt.

A good portion of inflation over this time has been masked by massive amounts of debt and financing. Car purchases, mortgages, and college are now financed long-term. Low rates have masked this erosion but with rates reaching the lower bound of the range, the pain of inflation is now being felt by many households.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

22 Comments on this post

Trackbacks

-

LiberatedCitizen (@LiberatedCit) said:

Anyone who shops for food has seen rising prices and shrinking package sizes its very sad how the middle class in America has been systematically destroyed. Unfair trade agreements contributed immensely not only lost jobs but in lost sovereignty. People should know who to thank and also see a couple more things going on.

Liberal Politicians Launched the Idea of “Free Trade Agreements†In the 1960s to Strip Nations of Sovereignty

Why The Government Wants To Short Change American Seniors

Excerpt:

If President Obama had stood by his initial budget the chained CPI would have eventually impacted every American at tax time. That’s because the CPI is used to determine changes to tax brackets and, under the chained CPI, the thresholds for those brackets would increase at a much slower pace. That means we would all end up paying more in income taxes each and every year.

Most Economically Thriving U.S. Cities Have Greatest Income Inequality

February 23rd, 2014 at 2:10 pm -

Juan said:

It’s a shame you only covered those three items. They are big ticket items.

Some more service points could have been covered: ultilities; water, gas and electric, telecom services landline phone 1950s/now then cell phones now. Not to mention the services we buy now that didn’t even exist then i.e. cable/dish tv, internet service.

The cost of food, and just to show some perspective the cost of health insurance(which contrary to liberal mythology was not purchased by everyone). Health care costs for the generally healthy were minimal.

And the most important cost was left out: federal tax!February 23rd, 2014 at 8:23 pm -

Greg Murphy said:

This article is comparing oranges to bananas. Cars today should be more expensive today just from an engineering standard. Modern cars have air bags, emissions systems, mileage standards, etc. that did not exist 50 years ago. The same argument can be made for houses. A house 50 years ago had a 30 amp electrical service. Today that comes in at 200 amps. Most homes back then burned coal and had no insulation. Now you have heating systems with 90% thermal efficiency. Please find something better to compare other than cars or home, or at least calculate what it would cost to build today using standards from 50 years ago.

February 24th, 2014 at 12:42 pm -

Edward Knittel said:

You forgot an important matter. The family income of 1950 commonly came from one wage earner. Now the family income comes from two or more wage earners. So the situation is much worse than what your figures show.

February 24th, 2014 at 5:08 pm -

Charles Fazio said:

In 1963, I arrived at the University of Arizona with $800 in my pocket – savings from a hard working summer. Out of state tuition, and all fees, was $405 per semester. So I nearly paid cash for the first year!

The same expenses for my son, an out of state tuition and all fees, at the University of South Carolina, is nearly $40,000 per year. Have you ever saved $40,000 from a “hard working summer?”

Not incidentally, University endowments have increased dramatically during this time.

February 25th, 2014 at 8:15 am -

MJsand said:

Greg Murphy – you actually made the author’s point. The point of the article is not the value or quality of the items we purchase today. The point is that the cost of those items has gone up dramatically (and often for good reasons you mention such as improved safety, increased amenities, higher quality, etc.)…but the income we earn has not kept pace with the increased costs. The result is that we spend much larger percentages of our income on those items which causes us to go into debt and ultimately hurts the economy because we can no longer afford to spend on other things.

April 1st, 2014 at 8:14 am -

adam said:

Regarding the oranges to bananas comment, Murphy is correct. The average new house in 1950 was about 780 square ft. The average now is nearly 3 times than (over 2100 square feet). Also, with regard to tuition, there has been a large shift in how universities are funded. In the 1950s and 1960s a lot of money flowed into universities through the GI bill. At that time, there was an argument that higher education should be subsidized because, in the end, a better educated workforce benefited all of society. This began to change in the late 1980s and 1990s when it was then argued that because college-educated workers made more than uneducated workers, they should pay their own way. Tuition and fees have increased as federal and state governments have reduced university funding. Most universities now receive only a fraction of their funding from government sources. It was much different in the 19502.

June 5th, 2014 at 10:49 am -

Martin said:

Comments concerning a lack of “apples to oranges” such as Murphy are over-simplistic. He mentioned air bags and etc. I was in a 1975 Chevy once, that hit a light post head-on at about 45 mph. No one was wearing seat belts and no one was hurt. The driver was able to back the still running car up and drive away. In a 2014 model car all the occupants would be killed if not for the airbags and etc. So, you see the “value” statement made by Murphy and others is also not comparing apples to apples. The relative value of technology is a pointless argument. It is like saying that Tiger Woods is better than Bobby Jones. Since, the equipment is different, the golf courses are different, and they did not ever play each other… no real comparison is possible. The only thing you can say is that each was the best during their respective time. I would agree that the prices of some other things would be helpful in this analysis, like gasoline or electricity, or a ticket to a MLB game or a movie… but let’s not pick it apart too much. Because obviously if you look at quality of life for someone diagnosed with Polio or cancer for example… they would say it is better now. But I think if you look at this in general terms and compare basic staples, (which the author tried to do), you can see that the middle class is not doing quite as well. Nuff said.

October 6th, 2014 at 9:03 am -

yewzer said:

Don’t forget that in 1950, there weren’t nearly as many women working as there are today. Now you have to have both mom & dad bringing home money to do LESS!

March 24th, 2015 at 7:39 pm -

Publius said:

One important factor you do not mention in your otherwise thoughtful commentary is that, until it began in large scale 40 years ago, household incomes were largely supplied by a SINGLE wage earner who provided for a household largely managed by a single homemaker. The family cohesiveness was immensely greater as was social stability. The utter depravity and dissipation of contemporary American society is a horror show compared to 50/60 years ago, and that includes even the 60s!

November 4th, 2015 at 9:59 am -

Zael said:

Greg Murphy. Yes cars are incredibly more advanced and what not, but they are 10 times more easy and cheaper to make. Instead of 50 men making one car its 5 men and a machine. Technology cost Pennies to make. Your smart phone cost you roughly 50$ to make.

November 16th, 2015 at 12:49 pm -

Kevin said:

It is very simple, in the 50’s most households could be maintained by a single hard working wage earner, today it takes 2 people to maintain a household, I have tried to maintain a household on a single income but it just does not work, even if you cut everything extra thing out of your budget you still can not afford to live a basic life on a single income. The minimum wage of $10.00 an hour gives the person $1600 per month before any deductions, remove medical, Taxes, SSN, you are down to $1100 per month. $1100.00 per month is not even enough to pay the average mortgage, let alone utilities, food, expenses to get to work or anything else. So yes today we are far worse off then the average family in the 50’s and 60’s. The bottom line is, that is how our government wants it. They want the average person to be so dependent upon the government so that it will always keep the 1% in control of every aspect of your life. Once you become so dependent upon them for everything they can start to take away any freedoms you have and turn you into a slave cast.

November 16th, 2015 at 4:13 pm -

Anonymole said:

Great interpretation of the numbers. Now — expand it.

Food

Healthcare

Auto cost should include insurance

As should home cost (+ insurance + taxes)

Tuition is another great item thanks for including it.Now make the whole thing comprehensive.

November 20th, 2015 at 9:34 am -

swmiller said:

What is the fascination with the 50’s? Everything is way better now than the 50’s. For starter’s you are comparing homes that are vastly different. Most homes in 2014 come with greatly improved building materials and technologically advanced electrical, plumbing, etc, etc… Not to mention these days a garage for your car comes included in that 188,900 price tag. While you are, after adjusting for inflation paying about 9% more per square foot today than in 1950 I think the above trade off’s are well worth the 9% increase and you work don’t have to work as many hours to buy it.

Median Home Price 1950 Median square Footage Price per square foot

$7,354.00 983 $7.48

Median Income 1950 Hourly Hours worked for one square foot

$3,300.00 $1.50 4.987453374025093Median Home Price 2014 Median square Footage Price per square foot

$188,900.00 2350 $80.38

Median Income 2014 Hourly Hours worked for one square foot

$51,017.00 $23.19 3.4663455944388994The car same thing the median price then was based on a much more limited selection with far fewer options and safety features. Maybe you pine for a car without air conditioning but I like mine to be cool and comfy.

College is nothing more than supply and demand. Demand-driven up by subsidies and cheap loans prompting more people to go to college for useless degrees that are not supported by job market demand and take a life time to pay back.

You can keep your 1950’s I am staying right here in the 21 st century..June 23rd, 2016 at 2:43 pm -

David Austin said:

Get ready for hyperinflation! This isn’t rocket science! Everyone should understand that if the government keeps raising minimum wages, manufacturers and service providers will be forced to raise the prices of their products and services to survive. Up until now, prices have been slowly rising due to competitive pressure. Profit margins are narrower, but it’s about to get crazy. Businesses have had to borrow money because their cash reservoir is depleted and consumer debt is much higher too. Interest rates are the only thing saving us from a total collapse and that’d because for the first time in history, the Federal Reserve Bank kept them down during the Obama administration. Yes, you can credit Obama for this, but he’ll have to accept responsibility for the long-term impact on future generations. Our children will have to shoulder the burden of short-sighted politicians who don’t care about our children’s future. Pretty soon, the baby-boomers, who will live much longer lives, will be retiring and all the government subsidies and programs will grow to mammoth proportions. It doesn’t matter that most of us tried to prevent this from happening. They’ll blame us for not trying hard enough.

July 14th, 2016 at 9:00 am -

Jason Smith said:

Put simply, liberal, leftist economic policies are responsible for the destruction of the middle class. By printing money and keeping rates low with keynesian leftist policies, it has led to massive inflation in anything that can be financed, like housing, autos, education, even stock prices (buying on margin, and earnings/asset inflation). This has exacerbated wealth inequality, which normally occurs to a certain degree in capitalism, but has become much greater today than years past because the wealthy owned most of the assets to pre-inflation, that have now been inflated to extraordinary value to income ratios this story shows. The people who supported this keynesian agenda are the same ones who support more b.s. policies like raising min wage that we wouldn’t even be talking about if they hadn’t of started the printing presses in the first place. If you’re not mad, you’re not paying attention.

October 3rd, 2016 at 1:57 am -

barry said:

There are a lot of things that are not factored in to this equation for one payroll taxes were not that much but remember all the things you could deduct like all the interest on your bills.Years back it never cost you anything for health insurance or pension funds. And today technologies have come a long way but than you need to factor in the cost of all those to you today. For one the avg. cost to watch TV. back than was 0. WEll by now you may have guess what I am getting at There were benefits from your employer that didn’t cost you!! You could deduct more on your taxes !! And technical advancements have come at a cost to you !! So by the time you would factor all this in I would think that the avg. pay check back than compared to the ones now on a avg. you cleared a larger percentage than you do now. and thatis why most householes than could survive on only one income .

November 2nd, 2016 at 5:49 am -

barry said:

And I was born in the 40’s And would not trade that for today living After school we would meet up and play sports almost every day and not sit around playing games on cell phones and computers or texting our friends. We would meet and intermix with one another And that’s why there are so many children that have blood pressure problems and cholesterol.So no sir you can have today with all it’s advancement because we had so much more fun than !! Than today’s kids do now.

November 2nd, 2016 at 6:18 am -

Alexis Acosta said:

To the crazy Capitalist who say who say raising minimum wages will make the income worse,with rising cost. I say,if cost rises,refuse to buy. Let the economy crash and burn before allowing rich White greedy people to deprive you of your livelihood. If no one is buying their products the fat cats will sweat and weep. some one will come along and seize the market with cheap products,be it foreign or domestic,someone will be willing to generate less profits,instead of no profits.

All it take sis for you sheeple to tame your materialistic urges. I do not need a cell phone,I use a cheap prepay,that cost on 20 dollars every 3 to 4 months. I refuse to pay 50 dollars or more per month,out of principal. No CEO,nor executive,nor any man of any company in this world deserves to earn over 20 million per year. I do not care what you created,or how much money the company earns;the government should confiscate any salaries over 20 million and use it for public improvement;such as job creation,road creation/repair,free healthcare,co-op businesses,anything that benefits the public,except welfare. Instead of welfare,the money could go to free education,free job training,temporary housing,free premium drug rehabilitation. Anything that benefits society as a whole. Tax the rich and tax the Hell out of Capitalism. That is the only way to tame it,without going full Socialism or Communism. Capitalism with heavy Socialism is the ideal system of government that benefit everyone. Regulate the Hell out of everything. Regulate inflation,regulate housing cost. Regulate housing like automobiles. old homes should cost less,just like old cars,unless you did a rebuild from the frame up. Slapping a new coat of paint,new doors and windows is not enough.

No one in a government job should earn more than 100k per year,not even the President. 100k should be the maximum of any government held position. Money corrupts,money brings greed.

I am Black American Democratic Socialist.May 14th, 2017 at 7:04 pm -

Michael King said:

One thing that is left out. Is in 1950 a lot of those were one income family’s to get that $3300 a year. The 2014 $51000 is mostly two incomes. So it’s even worse than this says.

August 22nd, 2018 at 7:06 pm -

Jack Negrelli said:

This is great information for a two adult household where both adults make middle class money. What about the people who can’t get work at 30k or more a year even though they’re well qualified to make more, because they don’t fit the psychological profile adopted by employers who want you to spend more than three quarters of your time at the office. Even though there are plenty of people who are equally qualified to handle the excess work that they can hire so that people aren’t giving their lives up. Not to mention it takes at least 40k to put a down payment on a house where rent costs 1200 dollars a month for a one bedroom apartment, making meager living savings null.

Our economy thrives on the sacrifice of employees because employees are expendable. That’s not the American dream I was taught about. That’s tantamount to oppression.

April 20th, 2020 at 8:40 am -

Richard Head said:

I can’t afford a mortgage on my job shoving chicken nuggets into a bag. My wife waits tables p/T over at the choke n puke but gets few tips as she is flat chested. We spend our time off hula hopping and dreaming of the Fabulous Fifties.

August 19th, 2021 at 11:50 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!