Credit Card debt over $1 trillion and 1 in 5 Americans have more credit card debt than actual savings.

- 1 Comment

What is worse than being broke? Having a negative net worth. New data shows that 1 out of 5 Americans has more credit card debt than actual savings. Then again, half of Americans have no actual savings to their name so this isn’t all that surprising. Yet this is a big problem given that many people are going into negative net worth territory through credit cards which are essentially ways to spend money you do not have. And you also have many young Americans going into big debt to support their college education (total student debt now is well over $1.4 trillion). Why are people going into such large amounts of consumer debt?

Credit card debt addiction

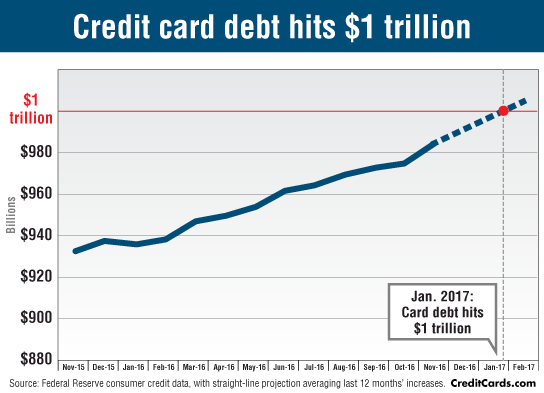

This is definitely uncharted territory even for debt addicted Americans. Take a look at how quickly credit card debt has grown over a short period:

And this is higher with the latest data showing total credit card debt at $1.027 trillion outstanding. People are going into massive debt and are paying 15 to 20 percent rates which could be used for saving and investing. This is the exact opposite of investing. People are basically paying crazy rates just so they can consume today. That is why so many Americans are too broke to buy a home.

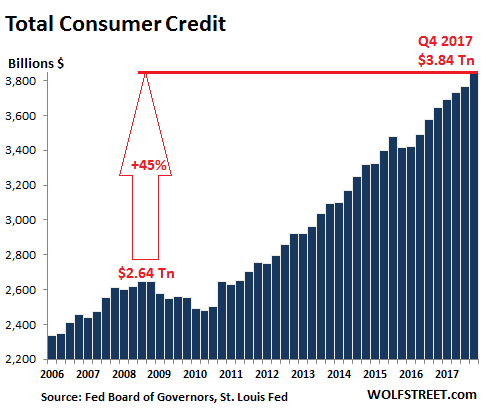

And consumer debt is ballooning in the form of auto loans as well:

Total consumer debt is now approaching $4 trillion. And we’ve talked extensively about auto loans and subprime auto loans. A car is not an investment! It will suck money out of your wallet. If you are in a pinch, you need to buy a used car that is economical. But many people purchase cars that cost nearly the same as their annual salary.

We are a culture that is addicted to debt. Credit cards are problematic in many ways and the amount of consumer credit floating out in the system is startling. There are a few red flags showing up:

-People are spending beyond their means

-With the middle class shrinking, people are using credit cards as a stop-gap measure

-The minimum monthly payment will keep you stuck in a treadmill of problems while you only pay the minimum amount off

So that TV that costs $1,000 will end up costing you $2,000 just because you pay off the minimum payment in some cases (could even be more). The fact that people are so willingly going into debt is troubling because the Great Recession was largely a crisis of people going into too much debt.

With credit cards, you have some serious issues and it is clear many people are not paying it off. Why else would we have $1.027 trillion in credit card debt outstanding? People are spending future income on consumption today. That makes sense but when you hear that 1 out of 5 have more credit card debt than savings it is disturbing. This is not a good sign and any slight correction is going to tip these households over.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

1 Comments on this post

Trackbacks

-

Rachel said:

Many people do spend carelessly using debt however, there is also a fairly large number of people who have no choice but to use debt such as credit cards to buy groceries, keep the water or lights on…until they can’t keep up the payments. Some of these same people did all the “right” things such as not having children out of wedlock or with a deadbeat, finishing college, etc. but their earnings are not keeping up with rising costs. Lastly, when you think about how many people are too afraid to ask for a raise, let alone those who actually manage to get one, the reality of people consuming through debt for the basics is even scarier.

February 22nd, 2018 at 5:02 pm