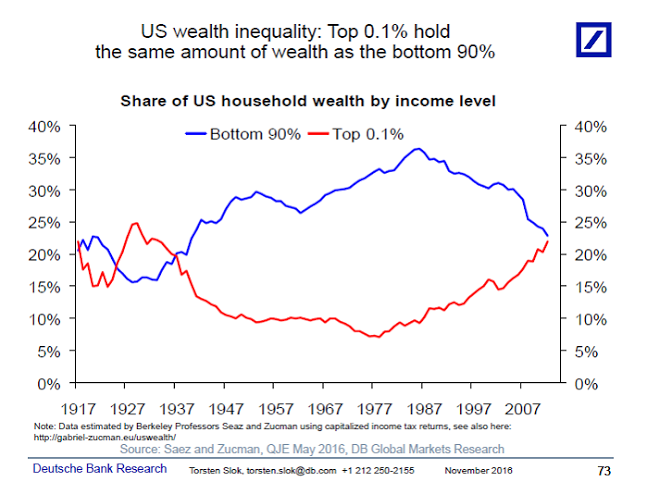

Nothing fake about the top 0.1% holding the same amount of wealth as the bottom 90%.

- 2 Comment

While people argue about what is real and fake news the widening gulf of inequality in the real world only continues to expand. This is actually happening and for the ultra wealthy that hold most of the wealth, all of this distraction is a good thing. The latest wealth report from Deutsche Bank Research shows that wealth inequality is at levels last seen during the Roaring 20s. The problem with this kind of inequality is that it has come from largely hollowing out the middle class and also creating a large crony financial system that is designed to suck out productivity in the real economy and shuffle it over to folks in suits sitting behind Bloomberg terminals. In other words, those that work and build the economy get shafted from the financial hubs of the world. This global financial drain does not adhere to national borders but is driven by the worldwide financial elite that collect trophy apartments in major metro areas. All this happens while your typical American family struggles to buy a home. There is nothing fake about the current level of wealth inequality.

The wealth spectrum

One of the most startling figures in the latest report is that the top 0.1% hold as much wealth as the bottom 90%. And this is happening in the United States, the wealthiest nation in the world.

Take a look at the current chart:

Source:Â Deutsche Bank Research

Now you might say to yourself, don’t the financial elites worry about this information spreading to the masses and creating some kind of revolt? No, because as we are seeing today the public at large is more interested in “fake news†and pointing fingers at each other instead of digging deeper into the issues. There are now niche industries online that simply cater to this “left and right†divide that ultimately has allowed the middle class to disintegrate into thin air.

The mainstream press has failed to listen to the issues of regular Americans and that vacuum has been filled up with other voices. Voices on both sides of the aisle. Some that actually care about protecting the U.S. middle class and others that don’t care because they would sell out their nation just to move a stock one percentage point up. What has made us as a nation stronger is our ability to connect with others and still be Americans yet that belief is disintegrating and this feeds into the crony capitalistic model of finance. They rather the public go after one another while not looking at the chart above. The poor are fighting the poor and missing the bigger game.

Wealth is power and power allows you to shape your environment. What many people face in the U.S. today is an economic model that has left them with little wealth and thus very little power to shape their environment. You have many young Americans deep into debt and looking at a very bleak future.

The dream of being successful in America is still very much alive and available to many but the apex to get there is simply getting much harder with all of the disinformation that is out there. Carnival barkers and financial charlatans sit and wait on every corner. Many of these people live in New York and Washington D.C. and claim to look out for your interests. Half of Congress is made up of millionaires.

People are paranoid and don’t know what to believe. But just look at your own budget. Look at how far your dollar goes today versus ten years ago. Wealth inequality is a symptom of a bigger issue in our current financial system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Steve Adams said:

More then 25%(from Credit Suisse) of Americans have a negative net worth. My 5 year old nephew with $20 of birthday money has a higher net worth them them.

The next 25%+ have almost no net worth. So a random 65 year old with a pension and a paid for house on the coast has a higher net worth then 50% of Americans.

Taking all of Zuckerberg’s and Buffet’s money would be fun but wouldn’t really help the 50%. To get out of that no wealth hole people need to stop borrowing for anything except a house and stop living like they are worth more then they really are.

November 30th, 2016 at 11:08 am -

jb said:

“others that don’t care because they would sell out their nation just to move a stock one percentage point up.”

“just one percentage point up”

Seems like an insignificant thing, but let’s do the math…

$10/shr so 1% = $0.10 x 100 million shares, but who we kiddin many enterprises have multi-billions of shares outstanding ($500,000,000)

That makes my 401k happy.

500 million opens a new factory, office branch or store that employs that college student looking for extra change to avoid a student loan.

The only valid complaint is–are there barriers to middle class or lower-income earners moving upward?

December 23rd, 2016 at 9:59 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â