Falling off the American Dream treadmill – Real median U.S. household income falls under $50,000. Poverty rate has grown exponentially since 2000, during the housing bubble.

- 1 Comment

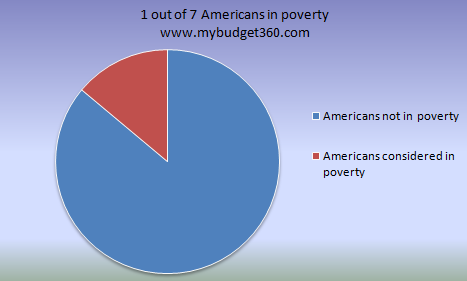

The U.S. Census Bureau recently released troubling data on the status of American families. The first disturbing point was that 43.6 million Americans now fall under the poverty category. This works out to 1 out of 7 Americans. The growth has come from many people falling off the middle class treadmill. While the echoes of recovery blast through Wall Street the grim reality for most people is that there is a greater and greater divide occurring. The top 1 percent still has significant control over financial resources and wealth disparity is as high as it was during the 1920s. While many American families wait in lines outside of Wal-Marts so their food assistance debit cards refill to buy food, those calling a recovery are usually those who have been protected via bailouts since the recession started.

The data on poverty is grim and disturbing:

Source:Â Census

This data takes into full account the deeper blow of the recession. The supposed recovery is nowhere to be found. 1 out of 7 Americans falls under the poverty line. This is also reflected in the fact that over 41 million American families are now receiving food assistance, an all time record high. The 43.6 million data point is hard to comprehend especially in the wealthiest country on the planet. Yet many more working class Americans are flying off the middle class treadmill and finding that the economy is very unforgiving for those without Wall Street or D.C. connections. The focus over the last three years has been to give money to banks to lie about their assets on balance sheets and also prop up failing companies who are still failing but allowed management to enrich their small circle of friends. The unfortunate among us don’t have lobbying dollars or typically a voice yet their numbers are growing.

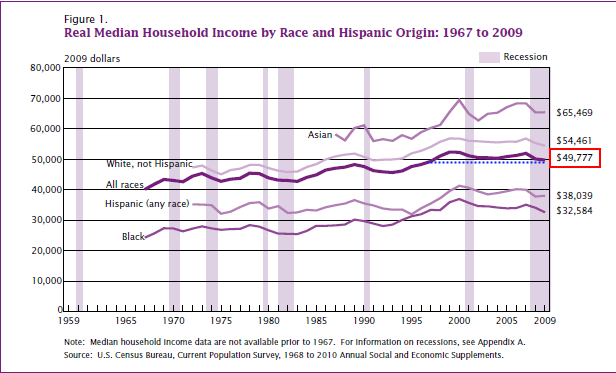

“Another unfortunate data point in the report shows that the median household income for Americans has now fallen under $50,000.”

Source:Â Census

The real median household income is now down to $49,777 putting us to levels seen back in the early 1990s adjusting for inflation. In other words, the vast majority of Americans have lost a decade of real earning power even in the face of a technology bubble and housing bubble. What is rarely mentioned during bubbles is groups of people make out like bandits amongst the large number of failed enterprises, many of these unscrupulously. In this case, it happened to be the banks yet no reform has taken place to rectify this financial injustice. So it should be no surprise that income disparity is only growing larger and larger in a new gilded age. The American Dream based itself on giving working Americans an avenue to lift up by working hard into the middle class. Instead, this is now working in reverse and many are being thrown off this path.

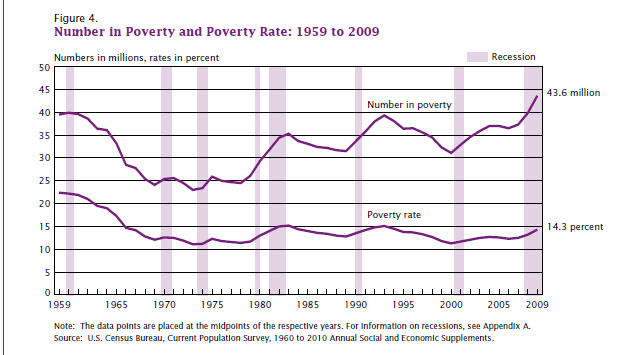

If we look at the below chart, the poverty rate has grown exponentially even during the housing bubble starting in 2000:

If politicians were actually paying any attention or if banks even cared about being financially prudent, they would have realized that Americans on par were getting poorer and poorer. The veil of debt allowed the illusion of wealth but in reality, our country was getting poorer on an overall basis. The middle class is shrinking and this is purposeful, targeted, and deliberate. The current economic structure is setup as a welfare state for banks where a select few have been blessed to not fail. Yet here we have 43.6 million of our neighbors and fellow Americans being allowed to fail. What kind of message does that send?

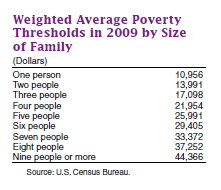

To fall into the poverty category, income levels have to be rather low:

A family of 3 would have to have an income of $17,000 or less to make it into this data set. Yet you have to also think about the 4 out of 10 American workers that work low paying service sector jobs that are only one or two steps above poverty.

Will these people be buying brand new homes going forward? Will they be buying new automobiles in the next year? How much are they really contributing to our consumer based economy? It should be obvious that having a healthy employment base is the most crucial thing in a solid economy. The Wall Street propaganda wants you to believe all is well because they now have more power to exploit the American worker and steal from the American taxpayer. The data is obvious but why aren’t Americans angrier at banks? In the 1930s Great Depression people knew where to direct their anger and it was squarely on Wall Street. The same has played out this time and there is no bigger sign that real financial changes need to occur or you can expect the gap of poor and rich to grow even more.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

JeremiadJones said:

Anger won’t fix the problem. (Although it might help cut out some of the waste.) Our “consumption based” economy is the problem. We’ve been benefiting from a sort of Ponzi scheme where our foreign suppliers pretend to send us useful stuff and we pretend to send them useful money to pay for it all. Unfortunately, most of the stuff we buy goes into a landfill sooner than later, but we’ll be making payments on it for decades.

What has to happen — what has been happening for the past 40 years or so — is an adjustment downward of unrealistically high American lifestyles. Take the dollar down about 30-40 percent relative to our trading partners, and we will become a manufacturing based economy again. Not that that will help, either. Alas. I read years ago that even China was then losing manufacturing jobs to automation. The future is less work, less play.

Hey, I’m not sure that’s entirely bad.

September 18th, 2010 at 11:06 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!