No quantitative easing for oil – The Federal Reserve can digitally print money into existence but this does not create more oil. Federal Reserve has a comic book section?

- 2 Comment

The Federal Reserve continues to support a flawed banking system that has ignored the urgent calls for reform in spite of the greatest financial collapse since the Great Depression. Bankers and fellow politicians understand that each day that passes without serious reform allows one more day for the painful memories of 2007, 2008 and 2009 to be slowly erased like castles in the sand. It was rather clear who led us into this mess in 2007 and most would agree it was the financial sector and their ill advised reward systems. It was greed run amok yet today you have some politicians trying to argue in favor of the banks that fault is really too hard to ascertain or place on only one group therefore no real changes can take place. At the very least hands off the compensation packages of the top 1 percent in the financial sector that have pilfered the wealth of the nation is their core argument. The Federal Reserve is not a government institution and contrary to public perceptions is mainly designed to protect the banking interests, not the interest of the people. Searching for more data I stumbled on comic books put out by the Fed.

Federal Reserve comics

Source:Â New York Fed

Interestingly enough we don’t find a mention of the giant banking powers that helped put together this system back in 1913. Largely designed to protect larger banks from competition, the Fed was brought into existence under the guise of nationwide stability. I think people that lived through the Great Depression might argue that the Fed didn’t exactly provide stability back then. And what about our current fiasco? Would the millions of investors that bought junk mortgage backed securities think the Fed help provide stability? If stability was one of the main missions of the Fed it has failed many times throughout history.

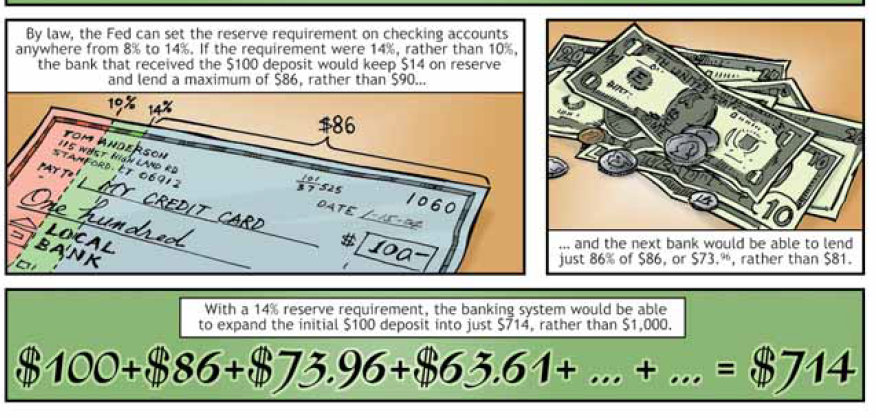

Yet I do have to give it to the Fed that they really don’t hide what they are doing:

I know the above isn’t shocking to many readers but ask most Americans and they would be stunned to find out that many banks can create money out of thin air. With a 14% reserve requirement a bank with a $100 deposit would ultimately create $714 worth of “money†throughout the system. This is how the Federal Reserve system largely targets inflation over time. We are seeing more and more pressure on many items including food prices going upwards because a weaker U.S. dollar is chasing items that are largely finding more and more demand.

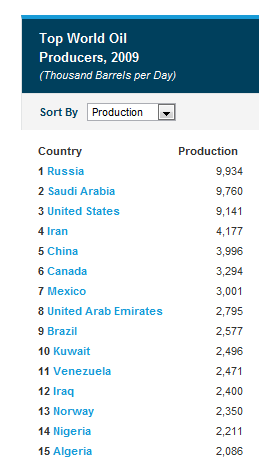

The Fed has a hard time combating against items like oil where production is based in reality instead of fictional digital programs like quantitative easing that allow the Fed to buy up junk paper in exchange for U.S. Treasuries. In other words our money gets weaker. Yet look at world oil production per day:

People forget that the U.S. is number three in oil production but the big issues we have occur when we look at the consumption side of the equation:

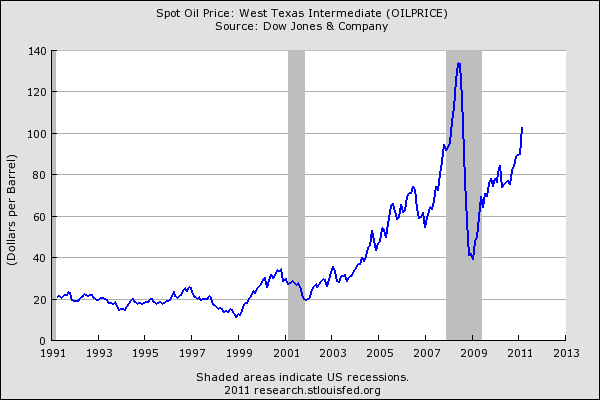

Much of our trade imbalance each month occurs because of this oil consumption. With a rising China and India demand for oil will continue from many of these nations with large populations that demand the same goods we use. No amount of printing money can create more oil reserves. The amount of oil is finite and there is only so much that can be produced per day. What this means is that it is likely the case that we are going to see expensive oil from here on out. We may experience minor corrections but the overall trend is now going to be higher:

The Federal Reserve can control banks and print as much as they like in a world detached from the limits of nature. Yet our oil based economy uses a commodity that is finite in nature and no amount of printing money will create more fossil fuels. The Fed was designed in a time when it was thought that we would never reach a point of running out of any good in the world.  It was the perma-growth model. It is no surprise that the housing bubble was born at the hands of Alan Greenspan who created an environment for massive mortgage market speculation that caused the housing market to rally as if it would go on forever like some endless well. The belief was that unlimited demand would somehow keep housing prices going up. In the end there is a finite limit but not before big banking interests were able to take money out of the system at each step.

The Fed can give us a comic book on how things work but most working and middle class Americans need only look at their paycheck and the cost of daily living to know where things stand. The Fed is debasing the currency to protect banks and transfer wealth from the middle class to the top 1 percent. Not sure if that is covered in the comic book.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Auntiegrav said:

Thanks. I’ve been trying to explain this to people. Can’t find a place to comment on Robert Reich’s “Tax the Rich” plan, though.. The rich are rich because we all burned up the oil to make them that way. Taxing them now to try and raise everyone’s standard of living is a bit too late. Should have taxed everyone in the first place. Sales taxes instead of income tax/subsidies might have done some good 20 years ago, but the belief in Progress will not go away until Progress fails.

April 6th, 2011 at 9:48 am -

Communal Award said:

You can buy OPEC oil only with US dollars.

How can you get US dollars if Americans doesn’t need/buy anything from you.

Looks like USA is operating a Ponzi/Pyramid scam on global scale since Nixon Shock.

https://secure.wikimedia.org/wikipedia/en/wiki/Nixon_ShockJune 18th, 2012 at 12:48 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!