A road to unsustainable debt: CBO reports that US is on unsustainable budget course as spending exceeds revenues.

- 1 Comment

A recent CBO report came out with a rather sobering outlook of our governmental spending habits. The word “unsustainable†is probably not something you want uttered in a report about meeting a budget. Yet that has been our recent trajectory when it comes to spending. The massive financial crisis and subsequent bailouts have resulted in a titled economy favoring a small group of people. The same engine that led us into this problem is still humming along and the too big to fail have now become the way too big to fail banks. So unsustainability is the spine fueling the current recovery. Debt upon debt only works until you reach tipping points. US households hit that point a few years ago as the housing bubble imploded. To think that this path of acquiring debt upon debt to pay for expenditures is sustainable is going to cause deeper instability into an already shaky system.

CBO report

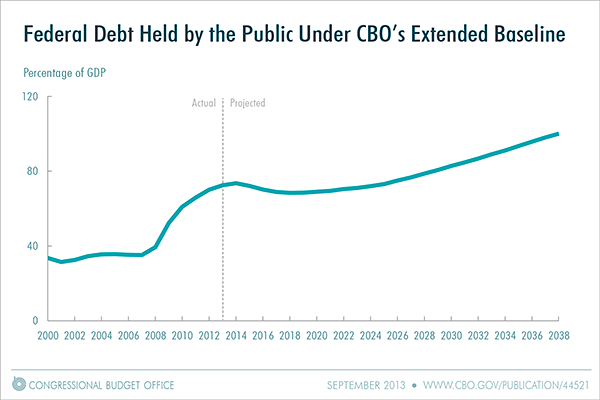

The CBO report of course has some dramatic changes occurring in the near term:

What is interesting is pre-crisis, Federal Debt held by the public was under 40 percent. Today it is at 80 percent and keep in mind this is much higher since other parties like foreign nations are now a larger owner of this debt (i.e., China). The path forward is not going to be easy. Yet the need to spend more is only going to accelerate with an aging population that is simply unprepared to face the financial challenges of retirement.

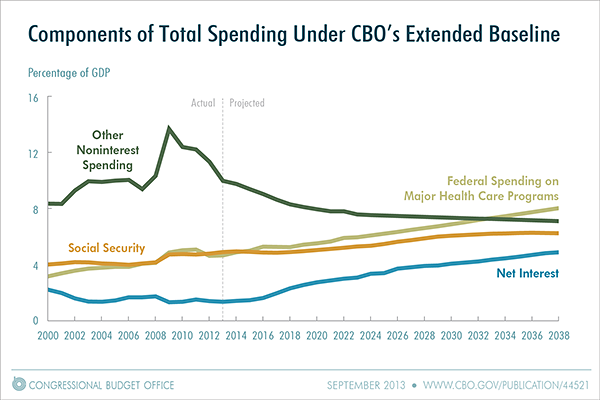

In the next decade we are going to see some major growth in where our spending goes to:

Costs like net interest, Social Security, and Medicare are going to consume a larger percentage of our spending. This is why our total public debt outstanding is enormous and is going to hit another debt ceiling in only a few weeks.

Debt to the Penny

Total public debt outstanding is now above $16.73 trillion:

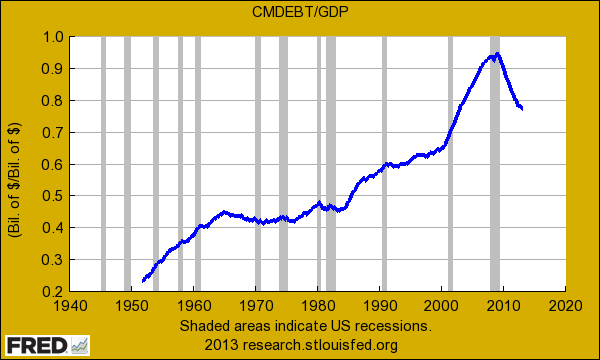

By the way, the latest GDP figure is around $16.6 trillion so we now owe more money than we produce in one year. Is this problematic? It was for households when they reached this level.

Households already reached unsustainable levels

U.S. Households seemed to reach a tipping point when their debt levels reached 100% of total annual GDP:

This actually makes sense on a very practical level. People were simply spending more than they were bringing in. Beyond that, many were spending money they didn’t even have by going into debt via mortgages, credit cards, auto loans, and the young through student debt. At a certain point, even servicing the debt was problematic.

The CBO report is sobering because it comes from the government itself. And you know this is a conservative estimate. Keep in mind these are rosy assumptions based on the current bull stock market and what appears to be an investor spurred boom in real estate. How sustainable are those trends?

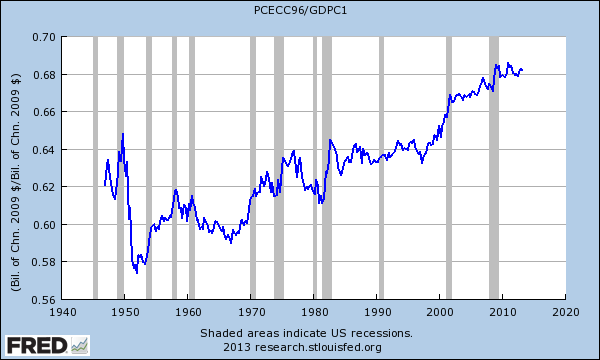

Consumption as share of GDP

Consumption is still a large part of GDP:

As we have noted, household incomes in the US have not kept up in the last decade. Over 50 percent of income went to the top 10 percent in 2012, the biggest gap in income disparity ever recorded for the US.

People need to keep spending to keep consumption going. If income is going to a smaller group, the economy is going to have a smaller group of people to depend on. There are only so many yachts you can purchase. A robust middle class is the backbone of a strong overall economy. The CBO report simply ties in with other unsustainable paths we are following. Do not be surprised when another financial crisis hits because as the report noted, this is simply unsustainable. And by definition, something that is unsustainable at some point will need to reverse and correct.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

kenny g said:

With the above facts known by most serious gold bugs why do we keep going for Benny BS……..

September 18th, 2013 at 10:01 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!