How many Americans live paycheck to paycheck? A nation living precariously close to the financial edge.

- 3 Comment

The fuel that drives our economy is spending. There are few nations that rival our ability to spend. We spend with the gusto of a shop-a-holic. The assumption is that we simply have the money lying around to spend at this level. That is simply not the case since most Americans are flat broke by most standard definitions. For example, I was reading through the recent Money magazine and found that 55 percent of households making $100,000 a year or less are living paycheck to paycheck. This is the bulk of our entire nation. The median household income in the US is $50,000. This was from the most recent survey conducted this month! The economic recovery is now going into its fifth year yet Americans are no closer to planning for a stable retirement. Most Americans are not adequately planning and preparing for retirement. In fact, a retirement train wreck is barreling down on us. If 55 percent of households are living paycheck to paycheck, then stashing money away for the far away future is probably not on their immediate radar. We have become a nation that is precariously living on the financial edge.

The paycheck that is losing ground

A really big reason why Americans are losing ground is because inflation has eroded purchasing power. Simply put the average dollar is not going as far anymore. Going back to the survey, it also detailed how 66 percent of households making $100,000 or less would hit a big brick wall if an unexpected $10,000 expense came up. This is not such a big emergency. Consider a major house repair or a mild medical emergency would wipe this amount away.

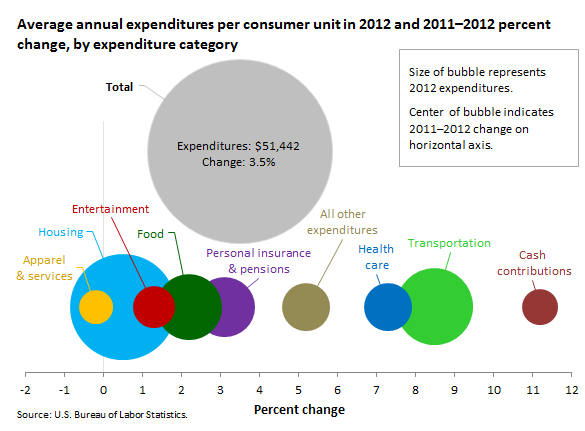

Americans are simply seeing their standard of living erode. Take housing for example. Housing eats up the biggest portion of household spending:

Housing eats up about 30 to 40 percent of disposable income. With a low rate environment large banks have decided to take a liking to housing. This has pushed housing values up and rents have also increased during this time. Conversely, incomes have not grown. So what occurs is more money is getting dumped into the housing bucket. How is this good? It really isn’t unless real wages also were keeping track with changes in costs. It also means less money for saving which is the core issue.

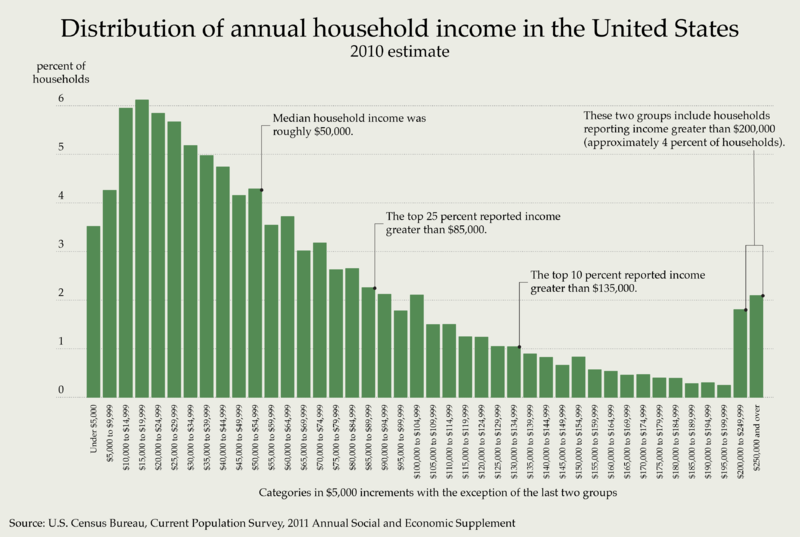

Americans think the nation is wealthier than it really is. Whenever you see the financial press trying to define middle class, they usually throw out an annual income of $200,000 or $250,000 per year. That is absolutely not the case (the statistical middle class is $50,000 per year). Take a look at income in the US:

To be in the top 10 percent of households, you would need an annual income of $135,000. 75 percent of households fall under $85,000 a year or less for their annual income. The survey sheds light on how addicted to spending Americans are. It also shows the growing struggles in saving money because the cost of living is outpacing income growth.

The largest growing sectors of employment in the US are part of the low wage economy:

What was illuminating from the survey was that nearly 50 percent of Americans mentioned that if they lost their current job, it would be very difficult to find another similar paying job in the market. This isn’t some paranoia but reality based. Look at the top employment fields above. The market is flooded with low paying jobs.

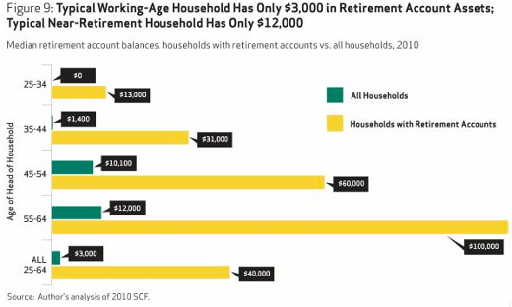

Many Americans are living paycheck to paycheck simply because the bills eat up every penny of net disposable income. Saving for retirement? That is simply not a pressing matter for most. When we look at retirement surveys the facts are grim:

The typical working household only has $3,000 saved for retirement! That is absolutely nothing. One to two months of bills. You would think things are better today with a record in the stock market but this would assume Americans had savings invested in the market in any meaningful way. Hard to do that when you are living paycheck to paycheck.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

Walter Ruggieri said:

Your articles are always awesome. Thank you for you hard work!

I find that we are all getting slowly squeezed. Taxes are higher, food is higher, gas is higher, health care is higher, even my daily coffee is higher. Now, my paycheck has not changed in 5 years! So I am being squeezed from all sides and at some point, I will not have the money to pay for something. When that happens, I will be bankrupt. How many Americans are in my position? A lot and many more are getting there as well.

April 19th, 2014 at 12:59 pm -

Homer Goodall said:

My income is $12000 per year and the Government took $3000 of it. We are sinking and sinking fast. We are not in a recovery, but instead a depression

April 19th, 2014 at 4:53 pm -

Vlad said:

Does that include things like 401k’s and the like? Some stats seem to included and some don’t and I’m not sure if your stats do.

April 22nd, 2014 at 12:03 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â