With a recovery like this, who needs a recession: 62 percent of Americans don’t even have $1000 in savings.

- 4 Comment

The stock market just hit another record high. Yet only half of Americans actually own any stock. Real estate prices are ebbing closer to their previous bubble peak. Yet the homeownership rate is down. The unemployment rate is down dramatically but we have over 94 million Americans not in the labor force. This recovery seems so contradictory in many ways. One glaring example of this is by how little Americans have saved for a rainy day. Another survey was recently released showing that 62 percent of Americans don’t even have $1000 in savings. In other words, most people are one small emergency expense away from being on the streets. What this means is that many will simply rely on credit cards, friends, or family should an emergency arise. With a recovery like this, who needs a recession?

The dwindling savings rate

The survey although surprising simply correlates with other data we are seeing. Nearly half of retirees depend largely on Social Security as their primary source of retirement income.  Financial planning for all the hype that it is given isn’t really something many Americans apply.

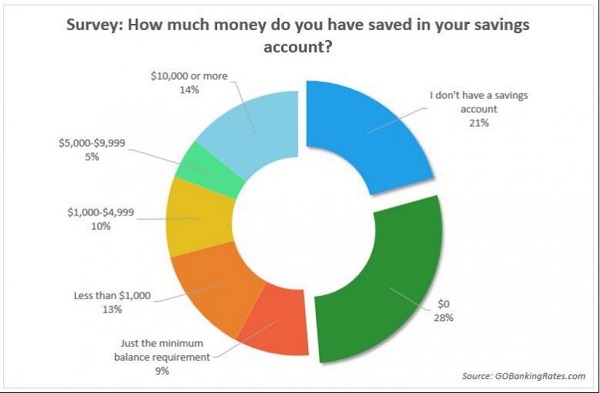

Take a look at the survey results:

Let us walk through this:

-1. 21% don’t even have a savings account

-2. 28% have zero dollars to their name (month-to-month)

-3. 9% have the minimum requirement

-4. 13% have less than $1,000

In fact, only 14% have $10,000 or more saved. Keep in mind this amount is small in the larger picture when you consider a basic new car costs $30,000 and many minor surgeries will costs many times more than that amount. So it is no surprise that we have a massive trend of going into debt: college debt, auto debt, mortgage debt, and credit card debt. That doesn’t seem like a solution.

Given the widespread information about saving money, it is more likely that Americans are simply having too many expenses given their stagnant income. When the end of the month comes, there is nothing left over. So saving becomes secondary to living daily life.

When I see surveys like this it also helps to explain the discontent being felt by the vast majority of the public versus what we see portrayed on the media. While the stock market hits a new high and real estate values soar, very few Americans are participating in this upward trend. They are being bystanders to the American dream.

It reminds of being a bank teller. Tellers do not make high incomes. Yet they are the front facing aspect of a bank. They need to dress and act the part. Yet the real money is being made behind the scenes on Wall Street far from the view of the public. The teller is no closer to the money in the vault than you are. In many cases they are trapped in the endless cycle of debt as well as things inflate thanks to banking policy that interestingly enough, has caused interest rates to plummet. So who really has an incentive to save money when they have a 0 percent savings account to look forward to? Many would rather spend it and with normal inflation, your purchasing power is eroding anyways.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Shorebreak said:

It appears half the people are living paycheck to paycheck, if employed, or drawing some sort of Social Security. The other half have some funds in their savings account but perhaps hold most of their money in retirement funds and brokerage accounts. Very few people put their money into low yielding certificates of deposit these days.

July 13th, 2016 at 7:26 am -

Peter Klopfenstein said:

Don’t expect the people that like the ant didn’t follow the fools to now share their hard earned savings with the grasshoppers who fiddled away the summer and listened to the Obamas of the insect world.

July 15th, 2016 at 8:58 pm -

Joseph E Fasciani said:

At 73 –and a long-time student of financial affairs, the concept of money, and of currencies– I understand how very grave the situation is, albeit the MSM will never even attempt to inform the sheeple, even after the collpase.

When my father was still alive –born 1905, immigrated to North America 1927– he taught me well what he lived through, and its many ramifications for all concerned.

I think all who write here and most of those who read know & accept history’s primary lesson: we do not have a single instance of the 1% with intent to correct their predations, nor act in the greater interest to save their societies. Not a single one. If I missed that one example I’ll gladly thank whomever informs me of it. But I say again: NOT ONCE in 5000 years history.

So we can expect to see the same inaction-action in our era, which Doug Casey calls ‘the Greatest Depression,’ with very good reasons.

Of course there will be dramatic actions such as bank closures, gold & silver re-pricing hugely, the military, paramilitaries, and urban police in major force 24/7, confiscation of the upper-middle class’s remaining properties under allegations of criminal activity, money laundering, and whatever else the feral gubbmint wishes to call the seizures and takings that will be made, a la the Roman Empire’s models, etc., etc.

July 16th, 2016 at 9:21 am -

sharonsj said:

I’m 72. My Social Security isn’t enough to cover all my expenses, so I try to make extra money wherever possible. I spent the last two weeks selling my belongings at flea markets. The very next day, the $150 I earned was given to the emergency vet because my dog was sick. Then, in order to save my dog, since I was now broke, I had to take out a pet care credit card, and I’m not even sure how I can pay that.

A friend my age has her house in foreclosure. Another friend in her 40s–she and her husband both work and they still can’t raise enough money to completely fix their home, damaged in the great flood three years ago. In fact, only two of my friends could be considered middle class any more and they’re probably the only people I know who have more than $1000 in the bank.

July 23rd, 2016 at 1:26 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â