The Great Inflationary Lie: How you’ve been lied to about inflation and the cost of living since 2000.

- 5 Comment

You’ve been lied to about inflation. That is the truth. The banking apparatus wants you to believe that there is little to no inflation so they can continue with their money expanding ways but all you need to do is look at your spending and income and you will realize that yes, life is getting much more expensive. Media pundits operate in an enclosed bubble of information and have a hard time imagining that half the country is living paycheck to paycheck. Exit polls continue to “shock†them when people state that they are angry about the economy. “But housing is up and so are stocks!â€Â Sure, but homeownership is down and half the country doesn’t own stocks. There is serious inflation going on. All we need to do is look at 2000 as a starting point.

The big inflationary lie

Central banks need to show that inflation is under control to continue their money expanding ways. Of course, this is more financial trickery than real wealth creation. I mean think about it, if this were so simple why not give every American $100,000 directly into their bank account? Life as usual comes with tradeoffs. All the bailouts and programs implemented by the Fed have gone to help the small elite class in our society.

Here is how you play with inflationary data:

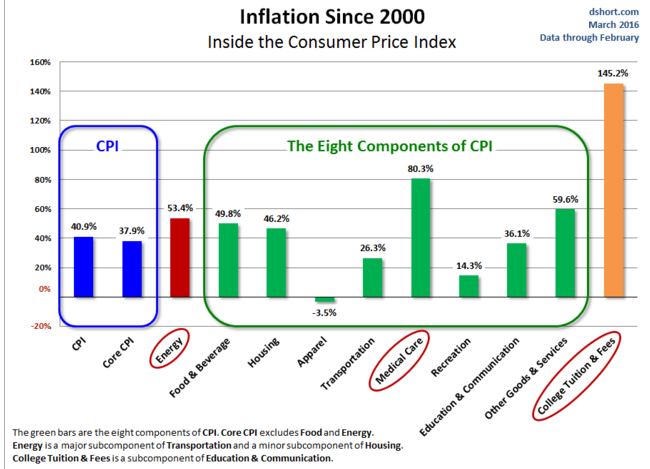

Based on the CPI, prices have been going up across the board. Housing is up 46% since 2000 and this is the biggest expense for Americans. But let us look deeper here:

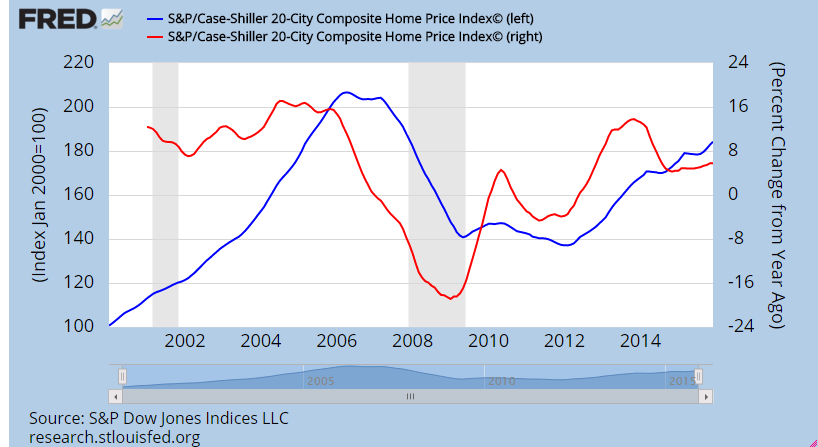

According to the Case Shiller Index, a much better indicator of home prices the cost of a home has gone up by a whopping 84%. But what about the CPI measuring it at 46%? Well let us explain the math here and you decide what makes the most sense:

CPI: Gets home values/costs by owners’ equivalent of rent (aka, what can you rent your house out for today – which of course is speculative and doesn’t address the actual cost of the home).

Case Shiller Index: looks at repeat home sales. In other words, measures the same home sold over time. That is, you are looking at real sales data here.

Of course the CPI missed the last housing bubble because of this and the Fed continually points to this measure to justify more quantitative easing and other such expansionary policies. Right off the bat, the biggest monthly expense isn’t even being calculated correctly.

Moving on to other categories. Medical Care is up 80% since 2000. With an aging population this is a major deal. With most older Americans following the “work until you die†retirement plan, rising medical expenses are going to cause big problems.

Look at college tuition and fees. College tuition and fees are up a stunning 145% since 2000 alone. This is why we have more than $1.3 trillion in student debt outstanding. The problem with the CPI is that college tuition and fees are a small portion of the basket of goods. For many young Americans college IS the major expense. So what you get with the CPI is a measure that simply does not reflect reality. According to the stock market and housing values, Americans should be thrilled. They are not.

You also have the sham of the unemployment rate. We have an army of 94 million Americans that are not counted in the labor force. You can read more about how this glosses over the true employment situation. Voters are angry because they operate in reality and not a market with pseudo figures derived from odd metrics. Of course, the banking system simply wants to flood the system with debt and bankers make their money in this process. But the market for this is tight and that is why we have subprime auto debt expanding as many good credit customers are gone. In other words, we are back to creative financing.

Is inflation real? Absolutely and it is understated. Household incomes are stagnant while prices are up. Low interest rates allow for prices to stay high to keep monthly payments low but the overall cost of goods is still high. Also, you can’t push rates lower than zero and that is the predicament we now find ourselves in.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Frank Facts said:

A few points:

Yes, inflation compounded over a long period of time will certainly amount to increasing prices. But nonetheless, by historic measures, 1-2% per year isn’t actually all that much. Further, that number doesn’t capture changes in prices of particular goods, which as you’ve mentioned, do not rise evenly. So, certainly college tuition prices disproportionately affect younger Americans. But, on average, inflation captures everyone — but again, that gets to the very idea of “average.” There’s not necessarily ever an “average” person — it’s a mathematical way of summarizing everyone.

Secondly, you hint indirectly that the number of Americans out of the labor force has grown. That’s true, but it’s not necessarily entirely driven by economic forces. Americans have gotten much older on average, with the baby boomers retiring and exiting the labor force rapidly. This explains a large portion of the declining labor force participation rate — and it doesn’t have anything directly to do with cyclical economic forces.

March 16th, 2016 at 6:00 pm -

BenefitJack said:

Not sure why you are using the CPI as a measure of inflation. The CPI is a calculation of period over period changes in prices for an arbitrarily selected market basket of goods. It is not a measure of inflation because it does not reflect economic decisions by individuals in terms of rapidly, daily, in the moment changes to the components in each person’s “market basket of goods”.

The price of beef goes to $10 a pound, well I’ll buy chicken or pork or cod or tuna or go meatless. Snap, snap, snap people make decisions, often unconsciously, or without deliberation as they walk down the aisles of the grocery store.

That is, I am reasonably sure the data are somewhat misleading in many respects. Consider food. Twenty years ago, fewer households ate out with today’s frequency. Twenty years ago, household composition was very different. Twenty years ago, people ate more meat, and beef in particular. So, unless the CPI takes the current “market basket” and restates the CPI change looking retrospectively, it will fails to reflect the adjustments people make as they change their purchasing patterns.

Fuel is another good example. Certainly, as the price of gas increased up to a national average of $4 a gallon a number of years ago, it added a significant layer of expense to most everything that is transported. Remember, that nominal cost of $4 a gallon was actually less, in inflation adjusted terms, than the $1.30 I paid 30+ years ago in 1982 at a U Totem in Pasadena Texas. Today, now that the average price per gallon has decreased to < $2, I doubt economists can document a corresponding reduction in prices of commodities affected by transportation costs.

My point is, when the news is posted on the internet or the nightly network news (is anyone watching that anymore), people hear it and generally accept it … without recognizing that the stated inflation rate, even if happened to be accurate for that individual, was more a random result, happenstance, not because the government numbers actually reflect inflation.

March 17th, 2016 at 6:56 am -

gman said:

what you are seeing is neither inflation nor deflation. it is wealth transfer. everything you have and do will be worth less. everything you need and want will cost more. you will work, they will spend. they will be the head, you will be the tail. you are the herds, the wealth of the nations is theirs.

as long as you permit it.

March 22nd, 2016 at 10:59 am -

Idahoser said:

it’s only possible because they fooled you into forgetting that there is an objective measure of value. We used to use it for money. Go ahead and be unconcerned about the supposed 1-2% per year, but in the end, your dollar buys what a nickel would buy when you carried silver in your pocket.

March 22nd, 2016 at 11:01 am -

Pete said:

All “money” in the western world is created out of thin air by bankers when they issue loans. (Yes, private bankers charge interest for loaning money they created out of thin air, but that is another issue) There is not enough money to pay the interest and the principal, so the money supply must be increased gradually, year after year. As the money supply increases,the value of the money is reduced. This creates the illusion of rising prices, when in fact, it is the money losing value, not the commodity value increasing.

The system is a legalized-counterfeiting, debt enslavement scam. We don’t need this parasitic scheme any more than you need a tapeworm in your intestines diverting fifty percent of your energy. The only way we can peacefully get rid of this oppression is to awaken as many people as possible by informing them of the true, evil nature of modern “money.” Most people have no idea.

March 26th, 2016 at 8:53 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â