The loud noise of inflation: Fed underplays current rise in inflation as noise while Americans see higher home prices, tuition, food costs, and energy prices.

- 0 Comments

It was interesting to hear the Federal Reserve mention that the higher than expected inflation numbers are merely noise. It is highly unlikely that most Americans feel the current rise in prices as noise. Inflation has a way of eating into every penny that you have especially when the market is flooded with debt. Just think of the price of items ten years ago and you will realize that practically everything has increased in cost including; housing, rents, college tuition, healthcare, food, and energy. It is also the case that wages have simply not kept up with price hikes. In other words, the cost of important items is trailing the growth of wages. What we have is a decline in the standard of living brought on by inflation. It happens slowly and many fail to realize it is happening. You see it over the last few years with banks flooding the housing market and crowding out regular families. The Fed has been the number one buyer of mortgage-backed securities and the repercussions are very noticeable in the housing market. The markets saw a stiff rise in commodities recently as people suddenly realize that the Fed is fully addicted to debt and is disconnected from what is happening with average families.

The noise of inflation

The Fed is hungry for inflation. Trying to control inflation is like trying to control a wild tiger. The Fed’s recent comments on inflation are largely disconnected from the lives of working families:

“(WSJ) Recent readings on, for example, the CPI index have been a bit on the high side,†but the data are “noisy,†Ms. Yellen said at a press conference following a meeting of the Fed’s policymaking committee. “I think it’s important to remember that, broadly speaking, inflation is evolving in line with the committee’s expectations. The committee has expected a gradual return in inflation toward its 2% objective, and I think the recent evidence that we’ve seen, abstracting from the noise, suggests that we are moving back gradually, over time, toward our 2% objective.â€

This is an odd target here. The reason this is odd is that wages are not increasing and the Fed certainly doesn’t mention targeting wage growth. So even targeting a 2 percent inflation rate is destructive to households not seeing jumps in wages. Take a look at the noise below:

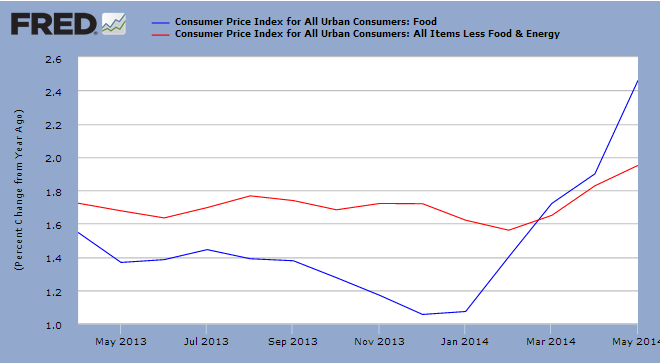

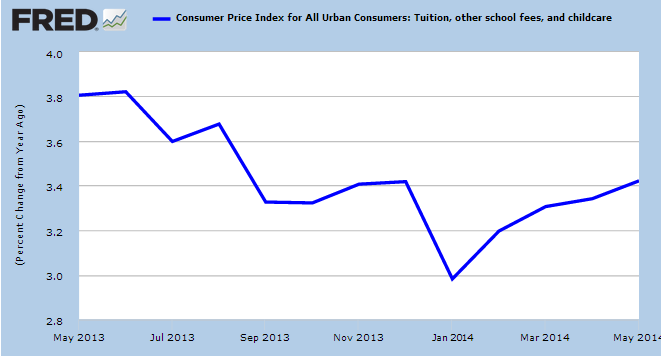

Food and energy costs are increasing at the fastest rate in over a year. These are costs that fall on the backs of Americans on a daily basis. You also have tuition increasing at a rate above 3 percent:

This looks like more than noise to me. We have a generation of Americans now unable to buy homes and going with rentals. Call them Generation R. Now why is homeownership such a hard task to accomplish for younger Americans? The answer involves depressed wages, high student debt, and housing prices going up thanks to investor demand. In the end, more disposable income is being siphoned away (this is how inflation feels in the long-term if wages don’t keep up).

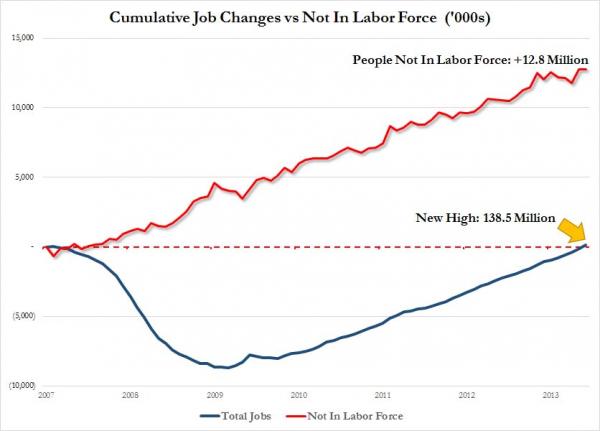

I suppose to big banks and big investors this does seem like noise. I’m sure having 47 million Americans on food stamps seems like noise and the startling reality that 13 million Americans have been added to the “not in the labor force†category since the recession ended is also just noise:

This is more than noise. This is the devouring sound of inflation. It has a deep impact on the way you live your life and your standard of living. Do you really trust in those banks that led the country into the biggest financial crisis since the Great Depression? The Fed has given them full authority to manage the economy and it is no wonder that their balance sheets look incredibly happy while most Americans continue to face a declining standard of living.

Let us all chant “it is only noise†as we pump that gas into our cars. Let us chant “it is only noise†when we see college tuition go up year after year. Let us chant “it is only noise†when we see our grocery bill surge. Let us chant “it is only noise†when we see housing values increase thanks to floods of investor money. Get those inflation ear plugs out, because I have a feeling we are in for a whole lot of noise.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!   Â