Jobs for middle class expansion are long gone – The struggles to create jobs that will create a vibrant middle class have vanished under the foot of banking dominance.

- 4 Comment

Most Americans realize that having a job is a prerequisite to gaining entrance into the middle class. If you work hard enough, chances are you would have access to some of the things promised to the middle class; access to affordable housing, a good education, and the ability for some sort of retirement. That ideal has been thrown out the window over the last few decades while the expansion of banking has created a cycle of boom and bust bubbles. The American labor force has been weakened from every angle while banking profits have soared beyond the rate of inflation (or any other measure for that matter). In fact, over the past decade average Americans are doing much worse adjusted for inflation. The defined contribution plan or pensions has given way to 401k/403b plans that push people into gambling on the casino known as Wall Street. Job protection is weaker than we have seen since the end of the Great Depression. Yet we are told that the economy is good without a solid job market?

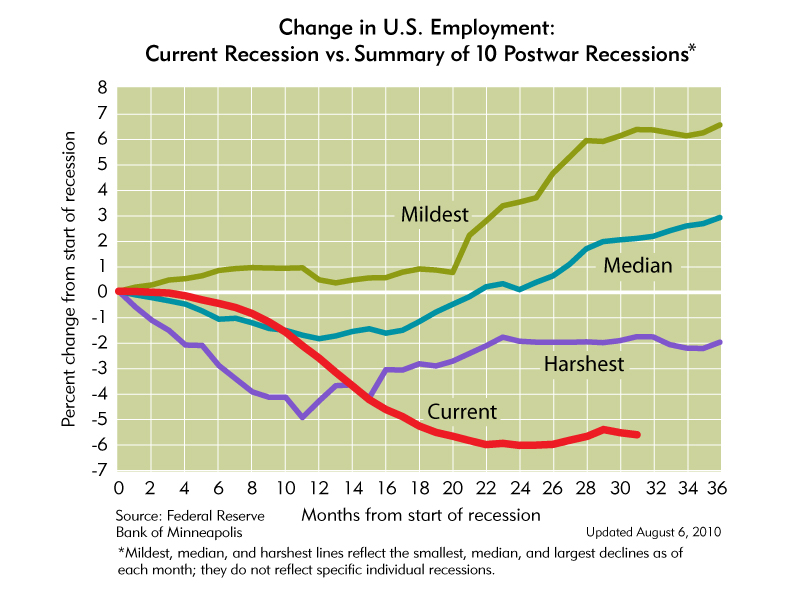

If you want to put this into perspective take a look at this chart:

Source:Â Minneapolis Fed

This is as bad of a recession as we have had in our generation. The employment market has been broken down piece by piece. If you think of the 1990s and the technology boom, the employment market seemed to be bustling and growing at a rapid pace. That is, until companies realized they could offshore jobs and pay overseas workers one-fifth or less for the same kind of work. Then the decade of 2000 came along and everyone was making money gambling in the housing market. The unemployment rate fell to record lows as everyone that wanted a job pretty much had access to one (even though wages were stagnant debt masked this major problem). When that bubble burst, typical American workers were thrown under the bus for the sacrifice of the banking sector once again. Ultimately that is the problem. From the start of the recession back in late 2007 the entire focus has been on protecting banks and keeping home prices inflated to keep banks propped up. Home prices fell while bigger banks consolidated power and became more powerful. What should have occurred was a focus on creating jobs to ensure a vibrant middle class in the U.S. That question never appeared anywhere for policy discussion.

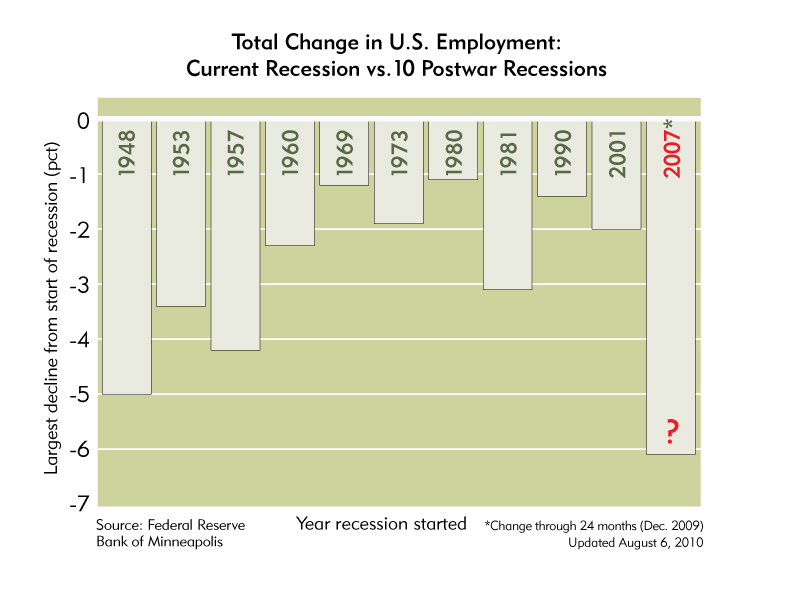

Here is another perspective on how bad the job market is:

With the latest jobs report we realize that employment growth is weak to non-existent in many sectors. The jobs that do come back are lower paying jobs in many cases. A recent article talks about the difficulty of employers to hire people back at lower wages:

“(Slate) What gives? Employers these days seem taken aback when highly qualified, experienced people fail to rush to apply for the openings they post. The article supplies several possible explanations: For jobs that require specialized skills, there simply might not be enough qualified applicants; employees accustomed to working at higher-paying office jobs aren’t eager to take lower-paying jobs at truck stops and restaurants; some of the unemployed might prefer collecting a few hundred dollars per week in unemployment benefits, while they last, to working a job that pays $8 per hour.â€

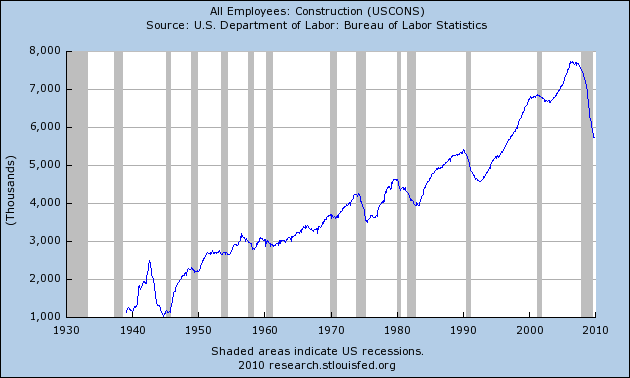

Though I agree with some aspects of the article, what they fail to focus on is lower level financial positions and construction work for example has been decimated in this massive housing bubble. These jobs are not coming back. Did many of those tech jobs ever come back after the tech boom and bust? Of course not. Many of these jobs won’t be coming back, at least anytime soon, because we have built way too many homes and have inventory for years to come. So to expect that these better paying finance jobs (i.e., mortgage broker, personal banker, real estate agent, financial analyst) or construction jobs to come back might be premature. The article goes on to focus on why some of the lower paying jobs sit empty:

“In theory, given the high level of unemployment, huge numbers of enthusiastic, qualified workers should be flocking to all the openings that are available, even if the wages aren’t fantastic. In this kind of climate, you should accept the offer you get and be happy with it. And for many jobs, that might make sense. Going from making $80,000 after being downsized from a local law firm to making $70,000 at one in the neighboring office building might be a bummer but would be manageable. Taking a 15 percent pay cut to stay on at the restaurant that just went bust might make sense. But the labor market isn’t a perfectly efficient one. Most companies, especially small ones, hire from local labor pools. And if you’re in an area where the population is stagnant, declining, or aging, the numbers may be working against you. If jobs require people to commute a great distance or to move themselves to another state, or to another hemisphere, employers may find they need to sweeten their offers.â€

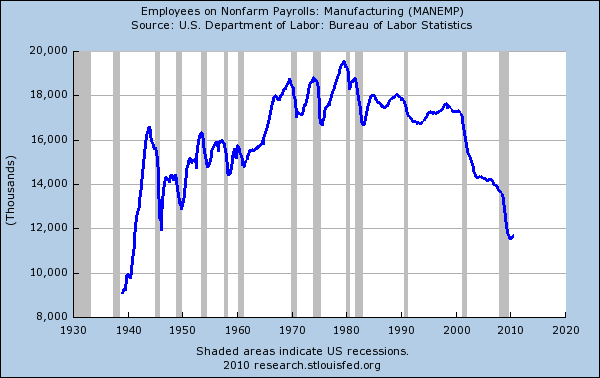

This is not realistic thinking. The median household income in the U.S is $52,000 and has gone down further in this recession. To think there will be $70,000 jobs that are plentiful in this market is not going to happen. Unless you work on Wall Street, try going out there and demanding a higher wage and see what happens. The fact of the matter remains that 4 out of 10 Americans work in low paying service sector jobs and this sector is growing. The article basically confirms the continuing erosion of the middle class. For manufacturing jobs, this has been going on since the 1970s:

We have grown by leaps and bounds with population but the actual number of nominal workers in manufacturing has fallen by half since the 1970s. These were good paying jobs that provided access to the middle class. The banking propaganda would lead you to believe that as long as you work in the service sector and give your money to some Wall Street broker that after 30 years, you too will have a little nest egg stashed away. How has that turned out with the current casino? Jobs in construction have also tanked in this recession:

You’ll notice after every recession above, construction jobs jump back in a v-shape when the recession ends. We are nowhere close to that and given the glut of commercial real estate and residential real estate, it is likely to remain depressed for years to come. Banks will continue to raid the taxpayer’s wallet and make sure they get their keep even though they are largely the most responsible party in this economic calamity. When the propaganda hits from investment banks, just look at the facts and where the jobs are (or in this case, where they don’t exist).

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

John Bailo said:

One could ask why should a “job” still be the way to wealth?

Most wealthy did not get that way though a “job” but through business and investing.

Our country is wealthy enough now, that any citizen should have easy access to enough capital to create their own job. Instead of Unemployment, many people should be a Startup Support…a way to fund people’s dreams and visions so they can participate using their skills and ideas.

August 15th, 2010 at 11:12 am -

milo said:

if the average household wage is 52 thousand..does this imply double wage households and income at 26,000 per person as the average wage, because if so, i was not ,once upon a time, doing so badly with my 27,000 in interest income……..now what? 4 thousand and panic.? this then thus 40 percent of the population?……………..

August 18th, 2010 at 1:02 pm -

Jetgraphics said:

Money is not wealth.

Prosperity is not dependent upon money.

Prosperity is the creation, trade, and enjoyment of surplus usable goods and services.

Obviously, there is demand, there is surplus labor and unused production facilities, but “something” is interfering in the creative process.

#1 culprit?

G-o-v-e-r-n-m-e-n-t.

Penalizing the productive for the benefit of the consumer will not generate prosperity, nor is it sustainable.August 18th, 2010 at 10:14 pm -

Tod G. said:

What is going on here, you ask? Its very simple. Interest is collected on money, which is created as debt. No money is created to pay the interest owed. So someone will definitely not be able to pay their interest. That interest is sizable, as with the average goods purchased in the US, 50% of the cost is there to cover the interest incurred in their manufacturing.

Think about that – things you buy are on average twice as expensive as they need to be. The end result of all this is people can’t pay off all the debt, and they take on new debt so they can pay the old debt. Now when you take out a loan there is some benefit to the economy – to the GDP. The benefit in the 1960s was about $1 of GDP for every $1 of debt money. Since then, it has dropped linearly, until in 1Q 2009 it actually went negative. Yes, more debt actually collapses the economy. This was about 6 years ahead of when the trend line indicated.

So if the economy actually fires up, more loans are taken out, and we sink further into the mire. LOTS of people must go bankrupt or manage to pay off their debt, of which there is some $50T, public and private. The fact is collecting interest and not creating money to pay it is a Ponzi scheme of the largest order.

August 31st, 2010 at 10:35 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!