Suppressing wages and increasing corporate profits: The tough math behind the current economic recovery.

- 1 Comment

It should come as no surprise that the stock market is a very poor barometer on the financial health of Americans. We think of the stock market as a temperature gauge on how well Americans are doing. If that is the case, the record breaking highs in the stock market should reflect a very happy and well off economy. That unfortunately is not the case. There has been a deep structural shift in the last decade which only accelerated since the recession engulfed the nation. Corporations have increased profits largely by chopping wages and other compensation to employees. This is part of a global low wage trend that is now fully rolling over the United States. New data reflects this deeper morphing of our economy and also explains why many working and middle class Americans are finding it harder to keep up with the changing winds of the economy. Suppressed wages, higher corporate profits, and less compensation. What you would like to see is profits trickling down into the pocket books of Americans yet that is not the case.

Suppressed wages

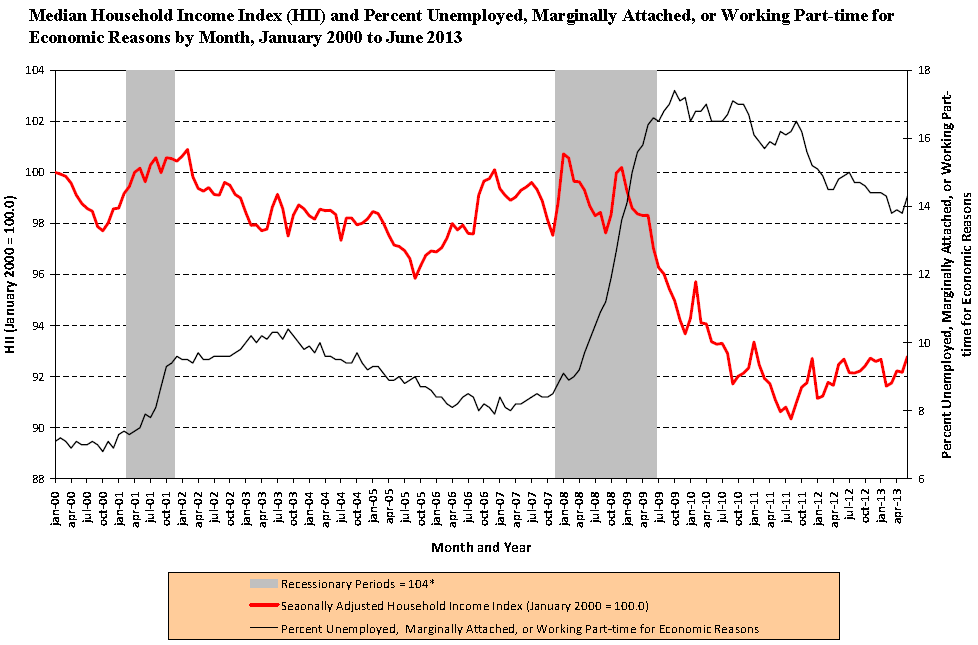

Household income continues to have difficulties bouncing back from the current trough:

What is important beyond the depression in wages is the number of workers marginally attached to the labor force, unemployed, or simply working part-time for economic reasons. This remains elevated above 14 percent. Compare this to 7 percent back in 2000 (an increase of 100 percent for this transient part of our labor force). So of course, if you can eliminate the higher expenses that come from hiring full-time workers corporate profits are going to increase dramatically. It also helps to explain some of the recent rise in the stock market. Yet many Americans own very little stock and also, many of the largest corporations have been expanding and adding jobs overseas while the corporate profits flow to a small group that continues to expand their wealth. Not a problem if this was a level playing field but you have the Fed conducting shadow bailouts to a very select group of people while forcing austerity down the throats of most Americans least able to afford it. This is the nature of the new global marketplace. It is hard to see this turning around since we are caught in a Catch-22. Many Americans now out of necessity need cheap goods (47 million of our countrymen and women are on food stamps). So we are left with the current system where a smaller upper-class is developing, a booming lower class is forming, and the middle class is shrinking like a grape in the sun.

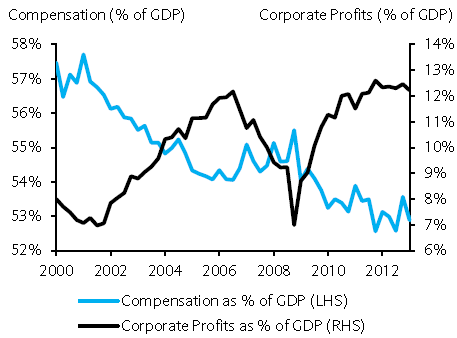

It is important to understand that corporate profits are up as a percent of GDP:

Correlation is not causation of course but it is hard to dispute the above information when measured with other pieces of data we are seeing. Americans for the most part are strained. Yet people act and buy items out of their own interest. There is no formal movement to change any of this. Even during the Great Depression, Americans were rather silent with economic issues compared to other parts of the world. There is still a deep belief in the overall nature of the system. However, a large part of the financial excess is going into the banking sector where little is actually done to benefit the economy. No need to completely revamp the economy but we definitely need a revamping of US banking. Large financial institutions have become glorified casinos. There was a time when finance and the real economy were intertwined for real results. A bank would lend to a local business to build a new location for growing demand. This is the point of finance, as a lubricant of the real economy. Yet today we have derivatives and side bets that not only destabilize the real economy, but are useless except in extracting money from the actual economy into a small portion of our population lingering behind Bloomberg terminals.

The first chart showing the suppression of wages should give you a clear understanding of what has happened in the last decade. Household incomes are down and a larger portion of our workforce is unemployed or working part-time for economic reasons. Yet we have this massive young population saddled with back breaking levels of student debt. We have some serious challenges ahead of ourselves but the momentum is very clear at least when it comes to the middle class. This is a shrinking part of our population unless we figure out a way to have a financial system that is willing to invest in its workers instead of using the middle class as a pawn for massive casino like speculation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

John Reagan said:

I’m not sure who you are referring to when you say the stock market is considered a barometer for our economy. All economists, stock traders and government wonks consider it a leading indicator as this tidbit from Wikipedia indicates:

7: The Standard & Poor’s 500 stock index — The S&P 500 is considered a leading indicator because changes in stock prices reflect investor’s expectations for the future of the economy and interest rates.

If you look at a chart of the S&P500 with recessions overlaid, you’ll notice that the S&P recovers before the broad economy does. It’s kind of hard to see, because this chart covers such a broad period it illustrates the ‘normal’ relationship between recessions and the market:

August 13th, 2013 at 5:32 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!