What does it mean to be Middle Class in 2010? – No College Degree, Massive Amounts of Debt, One Health Crisis from Bankruptcy, and Beholden to the Banking Elite.

- 11 Comment

Being middle class today does not carry the financial security that it once carried in the 1950s and 1960s. Interestingly enough, many Americans at that time did not own stocks yet somehow they managed well because they had access to affordable housing without toxic mortgages and many had the ability to work with one company and have some kind of security from their company. It was a mutual relationship as even Henry Ford shook the auto manufacturing world by upping wages for his workers. Yet today, we are being fed distorted information from Wall Street that we need to have this system where workers are disposable entities only to increase the profits of the corporate class. If people are hurting so much why are we paying billions in bonuses to a small group of people that really haven’t helped the country? In fact, many of these are directly responsible for our current economic problems. At the root, this has been the cancer that has eaten away at what it means to be middle class. Social government welfare for Wall Street and Darwinian capitalism for the rest of us.

The middle class has it extremely tough today not because of random events but purposeful and directed robbery from Wall Street. This was a methodical and planned dismantling of the system. First, let us walk through some details of the middle class to create a profile:

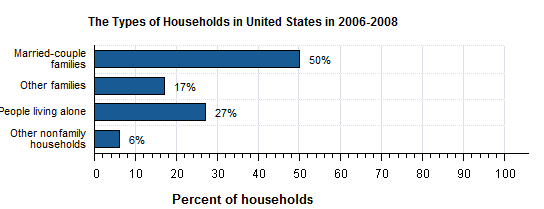

Source:Â Census

The most common household formation in the U.S. is a married couple. Certainly this has changed over time but this is the most common arrangement in the U.S. But this has also led to the two-income trap that we have heard about so often:

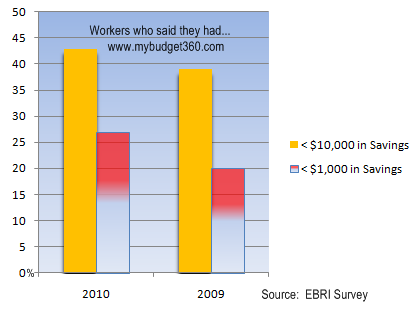

Even though nominal wages are much higher today, inflation has eroded the buying power of Americans so much that even two incomes today cannot compete with one income forty years ago. After all, if you could buy a car with $200 then $1,000 would seem like a lot. But what is a $50,000 household income when home prices cost $250,000? This is really the essence of what has broken the middle class apart. Prices rose to astronomical levels because Wall Street created speculative casino products and injected the virus into the system. The middle class today is fearful of even having enough to retire. But beyond even retiring, many people have very little saved:

Now Wall Street would lead you to believe that people should just pucker up and save more. Bailouts are only for Wall Street folks yet average Americans need to resurrect the ghost of Horatio Alger and pull themselves up from their bootstraps or hope that a rich uncle leaves them a nice inheritance package. Yet what they forget is that we have a large part of our population that don’t even qualify as middle class:

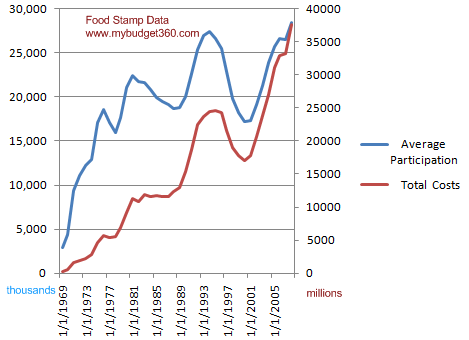

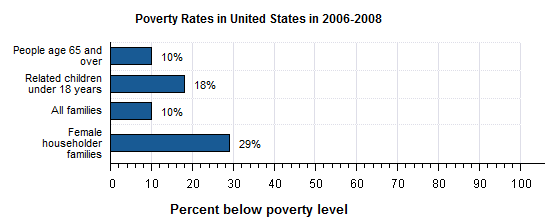

38,000,000 Americans are receiving some form of food assistance. These people are living day to day so saving isn’t even in their equation. They are just trying to get by. These are the folks waiting at midnight at Wal-Mart waiting for their debit cards to reload just so they can buy food for their family. Do you think they are interested in investing in the next hot stock? Even as hard as it is to be middle class, poverty has been amplified in this recession:

10% of all U.S. families are in poverty. Yet the rate is a bit higher if we actually go by food stamp data. The average household size is 2.61 in the U.S. so many families are struggling with children as the above data reflects. Yet you would expect the middle class to have a better chance at going forward but more and more middle class families are entering what is now being called the working poor.

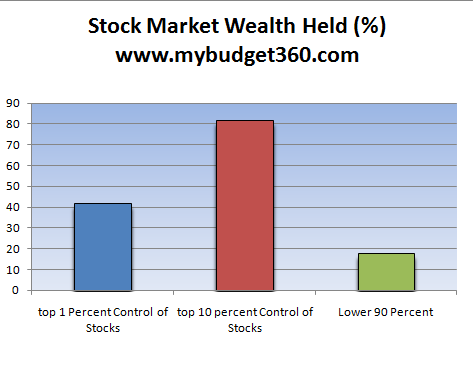

Wall Street and the banking system is at the core of this mess. They didn’t create poverty but they have amplified it by setting up a system that has now pushed millions of Americans into foreclosure. Why all of a sudden did Americans start gambling with their homes only when Wall Street got involved? They have created a new financial fiefdom where they can siphon off resources from the productive sector of the economy all from the comforts of their NY,NY offices. Even the idea that all Americans own stocks is not exactly accurate:

The top 1 percent control 42 percent of all financial wealth in this country. And wealth is the key here. So what if you have a $500,000 home if you have a $600,000 mortgage. You are not wealthy. So what if you have a leased BMW but have $30,000 in credit card debt. You are not wealthy. This is what Wall Street sold to America in the disguise of wealth. And people bought it up at the expense of the prudent. But that veil is now gone. And who has the wealth? This is what happens when you make a pact with the financial devil.

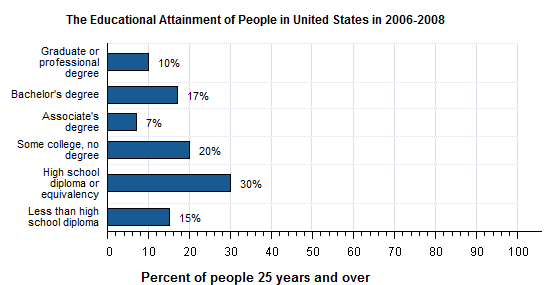

We must educate ourselves in order to have any fighting chance to have a solid middle class:

The sad fact above is these stats come at a time when public education is falling by the wayside. We’ve had some of the cheapest and best public universities the world has seen. That era is coming to an end as banks run the student loan market and for profit education is charging ridiculous amounts of tuition that are crushing the middle class. As of 2008 only 27 percent of Americans have a four year degree or higher. Now how will this number increase in a time when educational costs are going up and wages are stagnant? As long as you have a population that is unaware of what Wall Street is doing, they can keep doing their robbery in the open.

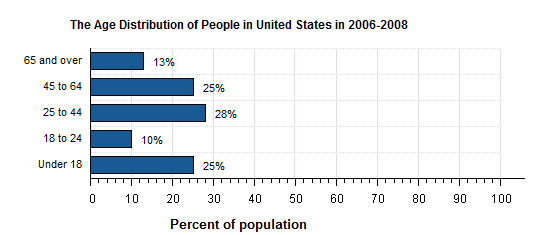

We also have an aging population:

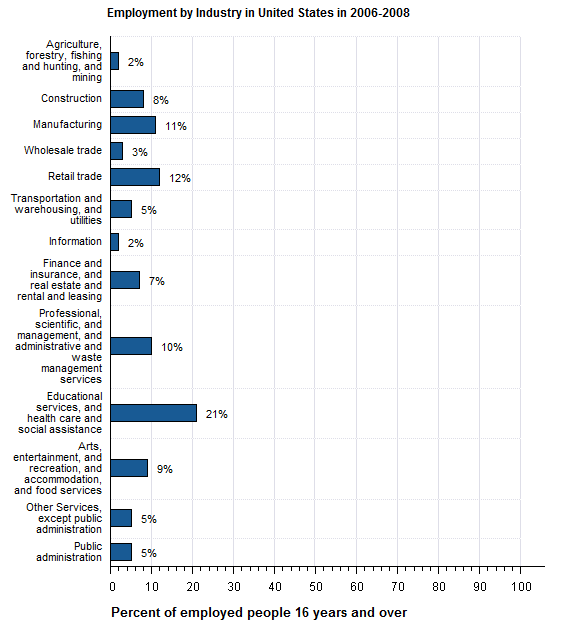

That 65 and over category is going to explode in the next decade as baby boomers enter retirement. Many were betting on housing appreciation and unrealistic stock market returns for a long and prosperous retirement. Instead, Wall Street has taken the money and many will have to work well into their retirement years. One illness can wreck their entire financial nest egg (if they have one). The notion that middle class meant a secure retirement is now gone. And with health care costs rising more and more money will go to this category. Education and health care are cornerstones of what we consider middle class living and this sector is enormous in terms of employment:

21% work in education services, and health care and social assistance. This number is likely to increase given demographic trends. Yet who are we really serving if students go into $40,000, $60,000, and even $100,000 in debt for degrees that don’t provide them adequate training to survive in a corporatist economy? The banks don’t mind because they can saddle a young person with a stream of income for multiple years and have the government pay the bill. How about we take banks out of the equation and require people to pay a sizeable portion of their education? Ironically, this would lower costs. It doesn’t have to all be upfront but allowing the current system to go on is criminal. If you want proof look at the housing market. Now that people have to document some income housing prices have collapsed. The for profit schools only require 10% of funds to come from the students and then the government matches 90%. In reality, these schools take that 10% on a credit card so this is really a zero down education.

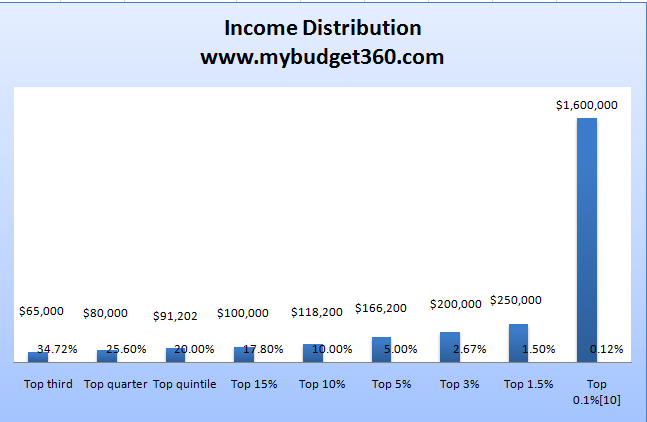

The story of Wall Street is the story of putting Americans into debt. If you really want to know where the middle class went you can look at the absurd amounts of debt. And this idea that everyone is rich is pure propaganda:

Only 34% of U.S. households make more than $65,000 per year. And that number is now much lower since this is based on 2008 data. When we look at luxury auto sales they do not reflect the actual wealth in our country. Much of it is pure debt financing. All hat and no cattle as they say in Texas.

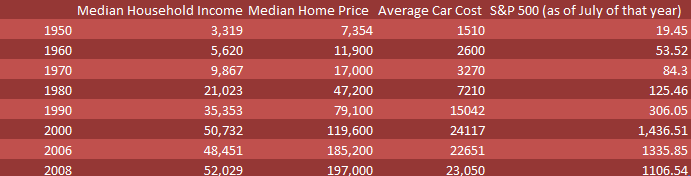

And we can see inflation eating away at purchasing power:

Just look at 1950. The median household income could purchase the median home with twice their annual income. In 2006 it required 4 times that income. Even in 1980, the median household income could buy 3 cars with that salary. Today, it is more like two. And this is even more distorted because we have more two income households.

So the middle class is really facing a struggle in 2010. But this just didn’t happen. This was a forty year systematic robbery of the compact Americans had with government and the business community. Where we go from here really depends on how much people value the middle class and coalesce to bring Wall Street in check. So far things aren’t looking good.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!11 Comments on this post

Trackbacks

-

Andy said:

Top post and the analysis/grpahics were excellent. Debt is fast becoming “normal” and the American way of life. Sad, but true as the numbers show.

April 7th, 2010 at 6:27 am -

CrisisMaven said:

What still too few seem to realise is that it would need a strong and financially healthy middle class to bring the country back on its feet. It’s them who create new businesses, become Nobel laureates, CEOs, CIOs, CFOs and the likes, who create wealth and who eventually provide a leg up for the next lower rung in society to advance up the social ladder and join them eventually. But esp. the US with its unaccounted for and unfunded entitlements plus its imperial overstretch is already teetering on the brink of insolvency so that it will try to further milk and burden their middle class and the more it dwindles the less share the burden thus nearing breaking point or be driven to emigrate.

April 7th, 2010 at 8:51 am -

mmm said:

seems like if you leave out the top one percent of earners that the average income is like 26,000 dollars……and if you leave out the governmental class also, it goes down to like 15,000 dollars, which is funny considering their necessity protecting the top one percent and the money they take from them…………… sounds lIke a DEPRESSION WITH OUTSIZED PRICES AND THE TZARS, CZARS>

April 7th, 2010 at 11:29 am -

Dorson Orba said:

When you say entitlements I hope you mean corporate welfare. Social security is an insurance plan that workers PAY into. Unemployment insurance is PAID by employers.

Workers are indeed entitled to get what is paid for by or for them, but the word “entitlements” has become code for welfare. Neither of those programs I mentioned is welfare.April 7th, 2010 at 11:29 am -

Beth said:

This story is amazing because it is what I have been saying for the last five or six years and no one would believe because I’m not a financial expert, just a reporter from a small town in Ohio. Thank you I am emailing this to all my friends who have told me I’m nuts.

Thank you!April 7th, 2010 at 3:05 pm -

William S. said:

The chart showing wages vs price of house and car may be a bit skewed as the rate of taxation is perhaps 10 times as much today so what is left after taxes for a year work not gross income should be on the charts.

wm

April 8th, 2010 at 7:20 am -

Bill said:

Your analysis of the high cost of housing doesn’t go deep enough. You state that “Prices rose to astronomical levels because Wall Street created speculative casino products and injected the virus into the system.” Wall Street did find ways to get home mortgages off their books and they made money doing it. However, the reason homes are so expensive is that the government guarantees the mortgages via FHA, Freddie, Fannie and VA. Bankers can loan more money to home buyers and pass the risk along to the federal government while pocketing higher fees. Home prices would be about 1/3rd as high, on average, if banks had to keep the mortgages in-house and service the loans.

April 9th, 2010 at 7:46 pm -

Bill in NC said:

Social Security is NOT an insurance plan.

It operates as a direct transfer benefit, same as with all other welfare.

SS contributions are all diverted into the general fund, and all current year SS payments come from the same.

There are a few pieces of paper in an obscure filing cabinet that say they are SS “trust fund” bonds.

But they might as well be stamped “future unfunded federal liability”, because they have ZERO market value (non-negotiable)

Just like all welfare programs, you can bet SS will be “means tested” soon.

April 10th, 2010 at 6:22 pm -

DavInIowa said:

we’re toast….

April 11th, 2010 at 1:06 pm -

Craig said:

Very nice charts. Great post.

April 15th, 2010 at 9:03 am -

Lori Kelly said:

Really good information.

Everyone should be concerned about the disappearing middle class.

If the upper class does not think it is important to preserve the middle class, they better think again. They are wealthy because of middle class Americans.we started a forum to help middle class americans. please visit beingmiddleclass dot org and help us join together to save the middle class.

May 25th, 2010 at 2:14 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!