Millennials never recovered fully since the Great Recession and now Covid-19 is bringing a painful economic reckoning. Half of US households own no stock.

- 2 Comment

While the pandemic has caused unrelenting and blistering damage in every segment of our economy, the pain is simply not distributed equally. Many of our essential workers are in the least secure jobs, with weak healthcare support, low wages, and ultimately are in jobs that keep them financially stuck while risking their health. What is troubling about this scenario is that we are seeing crony capitalism rearing its ugly head yet again – with the large bailouts we still do not have a clear picture as to where trillions of dollars went and we are devaluing actual work to support opaque networks of money. We do know that Millennials and younger Americans are getting pummeled once again in this crisis. Millennials shoulder a disproportionate amount of the more than $1.6 trillion in student debt, have lower home ownership rates than previous generations, and are also taking a big brunt of the job losses from this pandemic. Millennials never recovered from the Great Recession and this economic contraction is hitting them even harder.

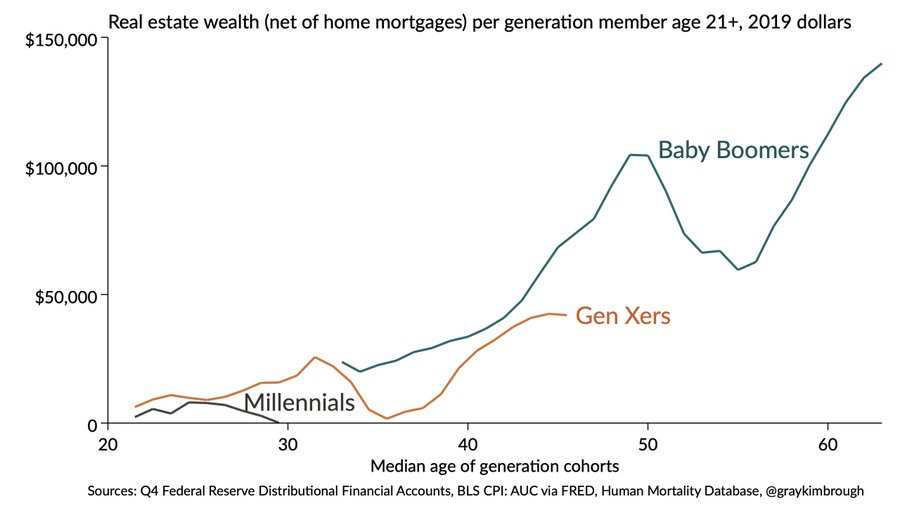

Real estate wealth lagging dramatically

Americans build wealth through real estate for the most part. This is largely accomplished through buying a home. Most don’t view their home as an investment but in large part a home is a forced savings account. Just like compound interest, continually paying a mortgage overtime will build equity and ideally after 30-years, you will have a paid off home. The problem is that Millennials were lagging in this respect because of the Great Recession but are now going to be hit harder in this Covid-19 crisis:

This chart is rather startling. It shows how far behind Millennials are from Baby Boomers and Gen X in terms of building up real estate wealth. It is hard to see how this will change any time soon. Part of this has to do with massive debt from student loans but also because of lower wages from the current economy. While Millennials were making some recent headway, that has reversed with this crisis:

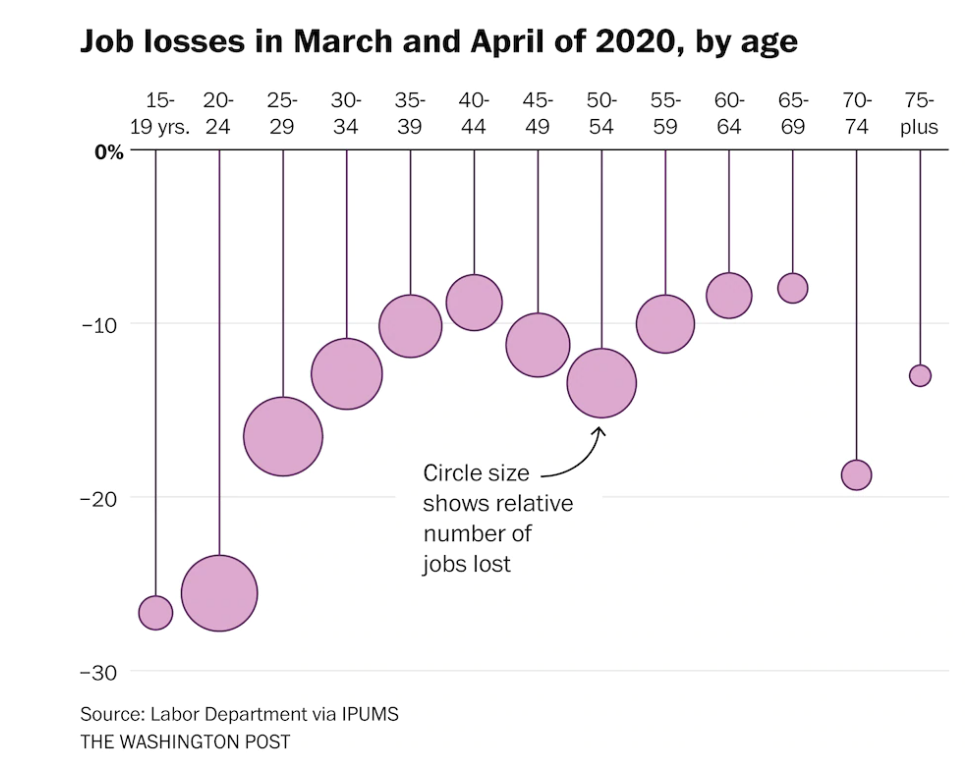

Many jobs simply evaporated with the pandemic. The chart above highlights the larger burden on younger workers. Many of the jobs lost were held by younger Americans. Obviously those without work are unlikely to buy a home and start the slow process of building equity. And how bad is the economy right now?

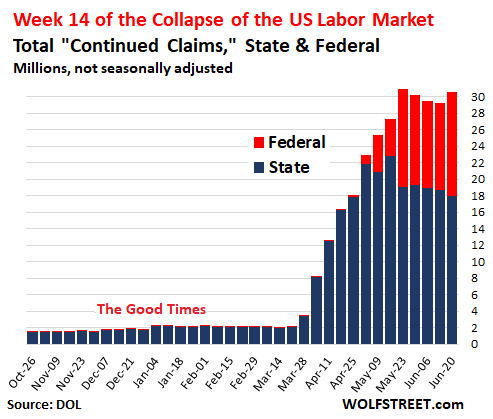

30.55 million Americans are officially getting paid unemployment insurance. Our true unemployment rate is upwards of 20 percent which is inching closer to Great Depression levels. It is hard to believe that just in March, our economy was near record low unemployment. However, this number was deceptive since many younger Americans were already living paycheck to paycheck and were barely making it. This pandemic has accelerated the reckoning that many were going to face in say 3 to 5 years and has pulled it into 2020.

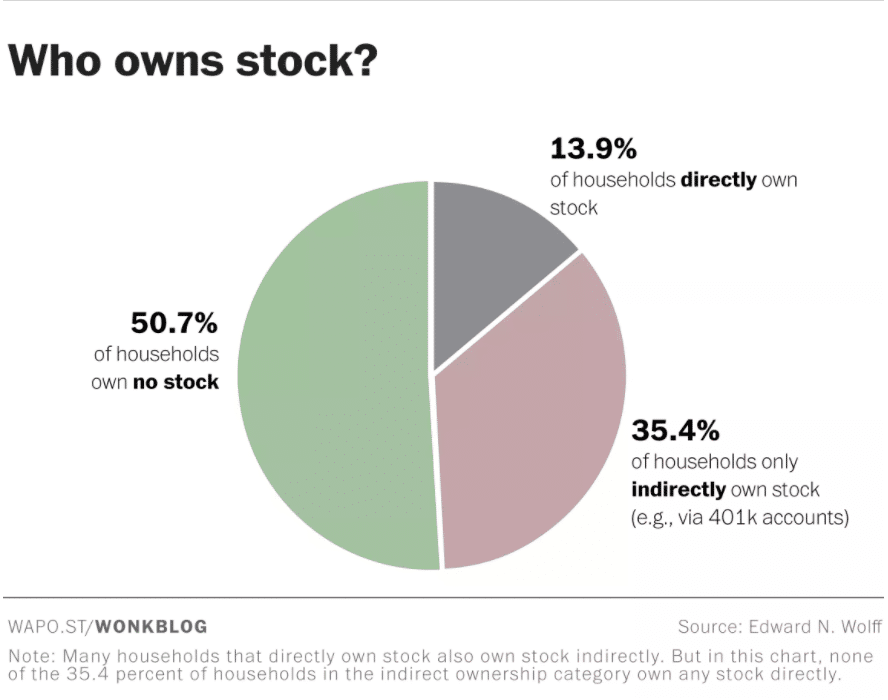

It is hard for a cohort to feel that their generation is simply going to have it economically worse than their predecessor, especially in the US. Not that this is a hard and fast rule and we have plenty of cases throughout history where stable and good economies suddenly edge lower. Yet the issue with what is happening right now is that we are back to crony capitalism in that we are bailing out those that least need it and simply sacrificing the poor and younger generations to keep the machinery going. We devalue earned income and over glorify investment income even though as a percentage, very few younger Americans have money in investments. In fact, most Americans do not own a significant portion of stocks:

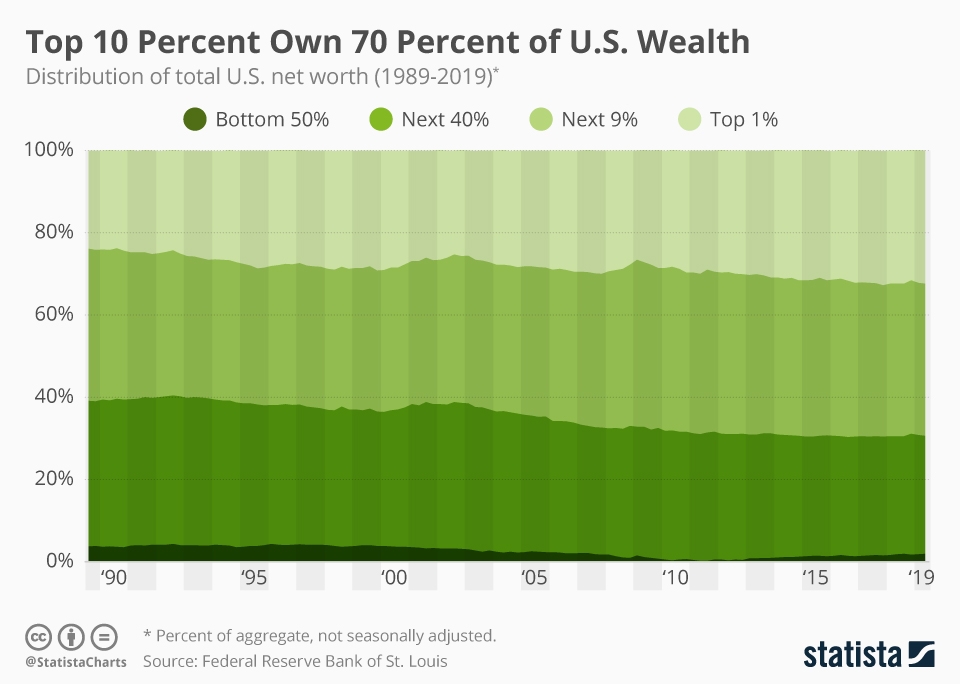

Half of Americans own no stocks. Another 35.4 percent own stock indirectly through retirement accounts (most are through work which of course is tough to save for retirement when you are not working), and finally 13.9 percent directly own stocks. Which then leads into the reality that the top 10 percent of US households own 70 percent of all outstanding wealth:

If this pandemic continues to cause economic damage in this format, Millennials may find themselves in a race where they are unable to catch up past generations economically.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Blather said:

Interesting. Most people are not interested in the Stock Market. Had my parents invested some prize money for real estate or the stock market (mutual funds) I told them you would be multi millionaires by now.

June 29th, 2020 at 2:27 pm -

John F. said:

Well you are right on the money with the millennial’s not doing well. my kids struggle at 32 and 30 with student loans and jobs that pay not so well. As a dad I worry about them as I cannot provide any financial help as My parents did to get a good start on raising my family. They (My son and daughter) are incredibly smart kids and will survive but I want them to live life not just survive. This whole generation is in a survival mode and what lies ahead as whole country is disconcerting at best. This congress in the capitol is teaching us how to be selfish and unbending. No wonder there is more violence and hatred. We learn from our leaders (If you want to call them that.) And the biggest of the leader sit atop the executive branch. I could go on and on but I’m getting away from what I think is a major problem that is killing many of the local towns and cities. We have a sizable set of folks 1948 to 1964 that are retiring. 1) Social Security will be draining faster than ever even though it is supposedly funded enough for decades. lf you get an event like the current covid mess. It will drain the treasury pretty quickly. Throw a few natural disasters in the picture and no rainy day funds for those either. 2) This is why I am typing this in the first place. We have a whole lot of public employees that are retiring and expecting well deserved pensions. But in most towns and cities. The budget has not sufficiently stockpiled funds over the years to cover these expenses. So when these mandated pensions are due. Who do you think will be paying these folks. You and I in the form of higher taxes that already straining these municipalities. High Taxes move out. Affordability of homes drops to compensate for the tax differential which is made worse by the fear of an unstable local government running the towns and cities. Young adults who would buy a home wait to see if the economy picks up and in turn waste 5 to 10 years deciding what to do. The sad reality lower home values, higher taxes and lower true home ownership. There is no money building up these long term coffers for the pensions. I typed mainly to bring awareness to a bear that is about to be awakened. Other issues have diverted any attention to this problem but this problem has no vaccine to make it better eventually. The solution are painful but if these people we elected worked on these problems (together) cohesively. We can lessen the burden on our future kids that will have to deal with. Thank You.

July 11th, 2020 at 8:29 am