Retirees face a perilous financial decade ahead – Over 30 percent of workers have less than $1,000 saved for retirement. Defined-benefit plans down to 20 percent from over 60 percent in 1983.

- 8 Comment

While financial institutions can rearrange assets and play around with accounting rules modifying reality the progression of age is hitting millions of Americans. There is no pause button when it comes to growing old. Recent surveys are highlighting a very challenging road ahead for retirees. A survey released by the Employee Benefit Research Institute (EBRI) shows a cardinal sin for many Americans. Many have not saved for retirement. There are a variety of reasons why this has happened. Stagnant wages and rising costs to live life have consumed a bigger proportion of disposable income. The defined-benefit plan is also going the way of the dinosaurs. The pension, once a cornerstone of retirement for Americans is now becoming a relic of the past. What happens when you have the biggest cohort of retirees hitting with a nation deeply in debt?

30 percent have less than $1,000 to get through retirement

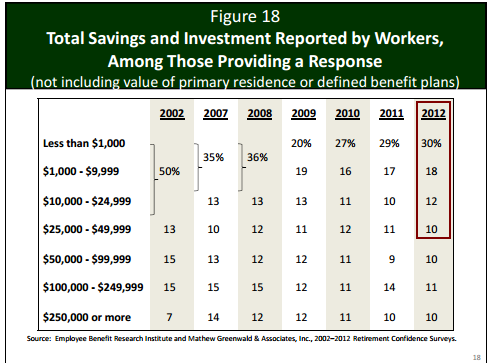

The data on retirement is rather ominous given the large flood of retirees now entering the system. The recent survey by the EBRI found some troubling statistics:

Source:Â EBRI

“Many workers report they have virtually no savings and investments. In total, 60 percent of workers report that the total value of their household’s savings and investments, excluding the value of their primary home and any defined benefit plans, is less than $25,000.â€

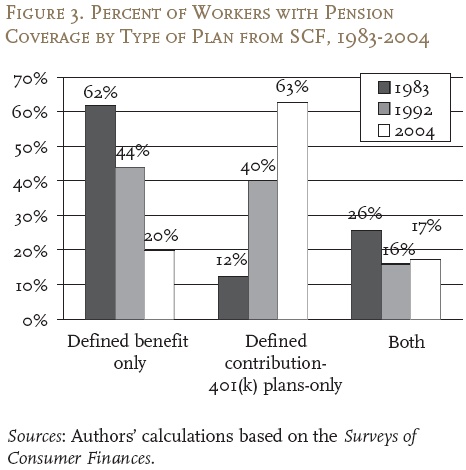

Given that the per capita wage is $25,000 it is understandable that many Americans have been unable to save for retirement. As we mentioned before, pension plans have become much rarer in today’s work environment. Employers have largely shifted to 401k plans where saving was largely the worker’s responsibility:

Source:Â Surly Trader

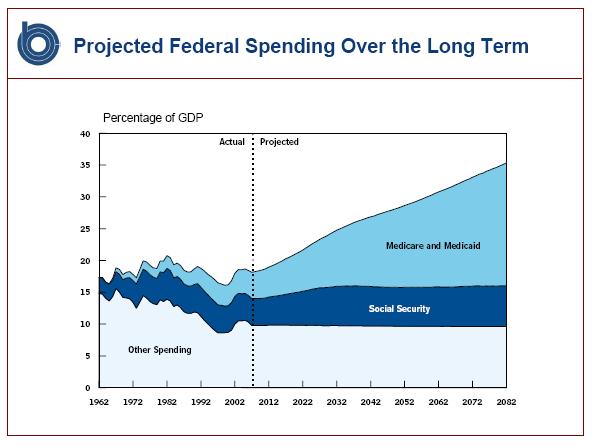

In 1983 62 percent of Americans had access to some form of pension through their work. Today that figure is down to 20 percent and probably less given the above data was pulled in 2004. Americans have done a poor job saving for retirement and many will be relying on Social Security. Yet Social Security is not really the biggest challenge from the nation’s perspective although it is expensive. That award will be given to Medicare and the rising costs of healthcare:

Expect very little to be done in regards to Medicare this year because of the election. Regardless of political affiliation, the chart above is flat out unsupportable but leave it to our elected officials to kick that can down the road for another day.

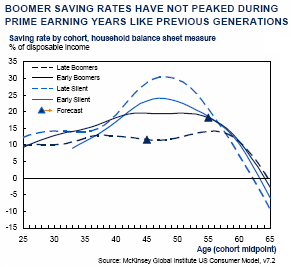

Another survey found that the wealthiest generation ever, the baby boomers, did a very poor job saving for retirement overall:

“(WSJ) A new study finds that the baby-boomer generation — the 79 million Americans born between 1945 and 1964 — has broken that rule with a vengeance and are ill prepared for retirement as a result.

The study, by the McKinsey Global Institute, the think-tank arm of the consultants McKinsey & Co., carefully examined the saving behavior of various generations. The “silent†generation, the 52 million Americans born from 1925 to 1944, followed the classic pattern closely, with their household savings rate rising from below 15% in their early 20s to about 30% in their late 40s. But that pattern is almost absent for early boomers, those born 1945 to 1954; their saving rate tops out about 20%; and it’s completely absent for late boomers, those born 1955 to 1964, whose saving rate so far has remained stuck at around 10%.â€

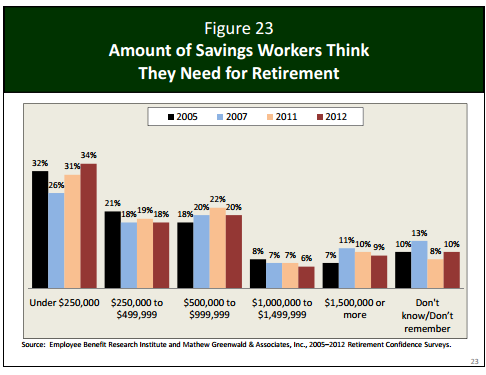

While those in the silent generation, people born with memories of the Great Depression, saving money was a big deal; many of the subsequent generation went down a different road. Baby boomers as the chart above highlights have done a poor job and many simply relied on debt to purchase into the consumption lifestyle. This isn’t a question of not knowing that you need money to live into retirement. Most understand that they need a sizeable portion for retirement:

This is a perfect example of understanding reality but actions do not go together. Roughly 60 percent of Americans realize they need $250,000 or more to live into retirement. Yet 60 percent of Americans have saved up $25,000 or less for retirement! How will people catch up? Many will not given that roughly 10,000 baby boomers will retire each day for the next 19 years. Is it any surprise that net worth figures look bad for both young and old alike?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!8 Comments on this post

Trackbacks

-

keep it simple said:

That’s quite a time bomb. Thanks for doing the research.

March 24th, 2012 at 11:17 am -

expatriot said:

That’s shocking at how little people have saved. It’s gonna be weird seeing baby boomers with nice clothes digging through dumpsters for food. It’s no ones fault but their own. I take pride in being a saver, the boomers took pride in their houses, they took pride in telling their friends what colleges they sent their kids, they took pride in buying expensive alcohol only to wake up the next day with a hangover and no memory of the night before. The boomers might have “lived the best” but they’re going to fall the hardest and fast. They better be real grateful for their $1000 a month social security retirement check, they’re going to need it.

March 24th, 2012 at 9:43 pm -

Mike said:

This ignores the fact that 30% of the workforce are govt. employees-

teachers, firemen,etc.

They do not have to save a dime. They are guaranteed liberal retirement benefits, free or low cost health care, cost of living raises, and a host of other perks.

Many of my relatives are govt. workers. Their retirement incomes will be between $45,000. and $100,000. per year.March 25th, 2012 at 7:44 pm -

KENNY G said:

In the end there be the peasant public and the connected and controlled police force and the corporations owned by the elites and you won’t be able to buy or sale without being connected via “the mark of thr beast”………….,get ready because it’s Biblical.

March 25th, 2012 at 8:43 pm -

Teri Pittman said:

My mom wasn’t able to save for retirement either. (Single mom in the 50s, worked a number of low paying jobs, etc.) So let’s not trash the boomers. This concept of socking away hundreds of thousands of dollars for some prolonged retirement is a new idea, not an old one. Folks relied more on their children to provide for them in their old age, than they did their savings.

March 27th, 2012 at 5:19 pm -

Maddog said:

In response to Mike:

Fed employees are required to save towards retirement either under CSRS or FERS. Their health benefits are lower than average because of competive pools and Fed subsidies to Heath program and fees have gone up every year. COLA’are not granted every year.

Don’t get me wrong, the Fed is bloated beyond belief. Particulary true in last decade. Fed needs to be cut by at least 25% with some Deoartments going away or dractically cut such as Education, Energy, EPA and Commerce.

April 3rd, 2012 at 7:25 am -

WorkinghardnoSS said:

Someone commented that teachers, firefighters public employees are guaranteed to get a fat pension? Wrong! I’ve served as a teacher in California schools for more than 14 years. Because I had a previous career that paid into SS and because of a law called the Windfall Exemption Provision enacted in 1983 by Reagan- my SS that I paid into will be cut to almost nothing- My windfall? A pension of $600 from CalStrs.(California teachers don’t pay into SS) There are hundreds of thousands of teachers and veterans and others who had two careers, worked hard, paid their taxes and got a nasty surprise when they retired. This law intended to penalize fat dual dippers has no bottom exemption so people like me mothers and two careers are penalized. what’s more another regressive SS penalty- the Government Pension Offset will take away ALL of any SS survivors benefit to me from my husband. Though he’s paid into SS at a high level for 30 years- if he goes first his widow must live on $700 a month. This is in no way fair as legislators vote in huge benefits for themselves. That’s what America has come down to . teachers with years of hard work needing food stamps to survive.

October 3rd, 2012 at 12:13 pm -

Douglas Blacklock said:

I am one who has less than $1000 for retirement. In fact, my plan is not retirement but to work as long as God allows me to.

March 2nd, 2014 at 5:41 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!