Who’s afraid of the middle class? As housing values reach new lows the stock market is up 100 percent from the 2009 trough. Too bad over 30 percent of Americans have $0 in savings.

- 0 Comments

The methodical shrinking of the American middle class is difficult to witness. What is even more troubling is this outcome was set in motion over a decade ago and little attention has been shed on what used to be a cornerstone of America’s success. Systematic robbery is now part of the financial fabric of our country. The fact that trillions of dollars in bailout money have flowed into the banking system yet little net effect has been reflected for the middle class is a testament to this deep capture. If you would only watch the mainstream press you would think everything is okay. Then again, we are talking about the megaphone of the financial system that failed to alert the country to the biggest credit bubble in our history. Why would they call any attention to a system they developed and exploited and ultimately exited with a taxpayer golden parachute? The really unsettling aspect of this financial crisis is that the trajectory is only accelerating in terms of stripping the middle class bare.

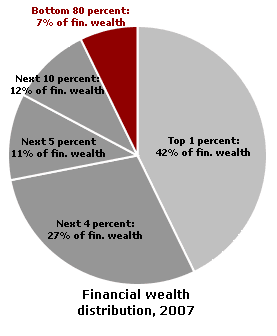

The control of wealth

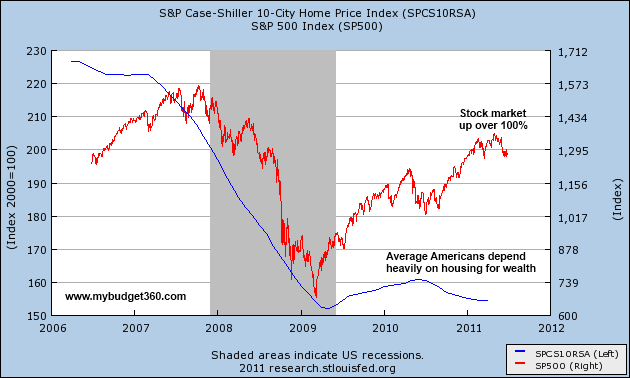

The top 1 percent in the United States control 42 percent of all financial wealth. This is wealth based largely on bonds and stocks. You have to remember that 1 out of 3 Americans do not even have a penny to their name so watching the stock market go up is like watching someone on television hit the lottery. It does little for their bottom line. At the same time they are confronting a world with more expensive food, higher healthcare costs, an education bubble, and a shrinking paycheck. Most Americans derive their net worth figure from home equity. Since the grand stock market recovery and historic bailouts were set in motion it is clear which sector in the economy has benefitted:

The stock market is up 100 percent from the lows reached in 2009 yet home prices have made new cycle lows. So you have to ask, what were those bailouts for in the first place? Just look above and you get a better sense. You will also have to remind yourself that a large percentage of financial wealth is aggregated in the hands of 1 percent of the population. This incredible income inequality rivals that of the 1920s. The trend of income inequality is only increasing:

The public seems to recognize that this is happening even though the media continues to ignore this crisis. After all, you need only look at your paycheck or go shopping one time to understand the reality that faces many American families. This disconnect is made more problematic because of the bilateral system we currently have courtesy of the financial sector and government. Many are led to believe that the pain being felt is simply a reflection of the free market shaking off the excess of the credit years. There is some truth here. Yet on the flip side, you have a tiny percent that made horrible bets during good times yet our being protected in some perverse form of crony socialism. Why is it that the worst banks were made bigger simply because their bets were so horrendous and giant in scope? This is the system that we now have to contend with.

When debt is no longer the answer

Housing and stock bubbles usually go hand and hand. During a housing boom people feel richer via the wealth effect and typically buy more goods. This pushes stock values up. Or if a stock bubble hits people feel wealthier and buy more expensive homes and push values up in many neighborhoods. This happened with the real estate bubble rescuing the stock market after the tech collapse. However, what we have now is a collapse in real estate yet a stock market that is going up. How so? Again you have to examine the trillions of dollars given to the financial sector. Companies and banks have invested globally with American taxpayer dollars while domestically the middle class is squeezed. A system like this will not last simply because people will not stand for outright cronyism.

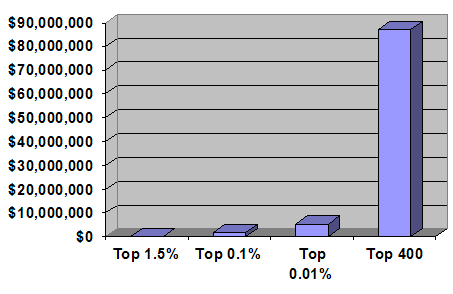

The wage gap only gets wider and wider in this country:

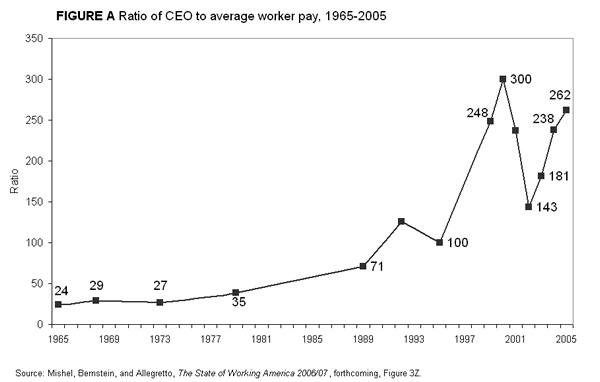

The inequality gets wider and wider as the pillaging of the middle class ramps up. We need only look at executive pay in comparison to average worker pay over time:

Source:Â EPI

“In 2005, the average CEO in the United States earned 262 times the pay of the average worker, the second-highest level of this ratio in the 40 years for which there are data. In 2005, a CEO earned more in one workday (there are 260 in a year) than an average worker earned in 52 weeks.â€

It is hard to keep a system like this going. It has even gotten worse recently.

“The CEO of JP Morgan, one of the big beneficiaries of the bailouts, received in his total compensation 843 times the median household income of the United States. This is where things stand. And how many people is JP Morgan kicking out of homes this year? How about the WaMu portfolio with all those toxic loans. What about the service fees now charged to customers in onerous ways? This is what we reward in America. There is nothing wrong with rewarding say Apple for providing iPods or iPhones that people choose to buy without governmental coercion. But here we have a bank that is largely benefitting simply by its connections to Washington D.C. and their service is gouging average Americans even further. Where is the benefit of the too big to fail for the public?â€

The CEO of JP Morgan received 843 times the median household income of a U.S. family. By the way this is one of the institutions that benefitted immensely from the bailouts yet here they are rolling out outrageous pay packages. Are we living through a digital gilded age?

Phony recovery

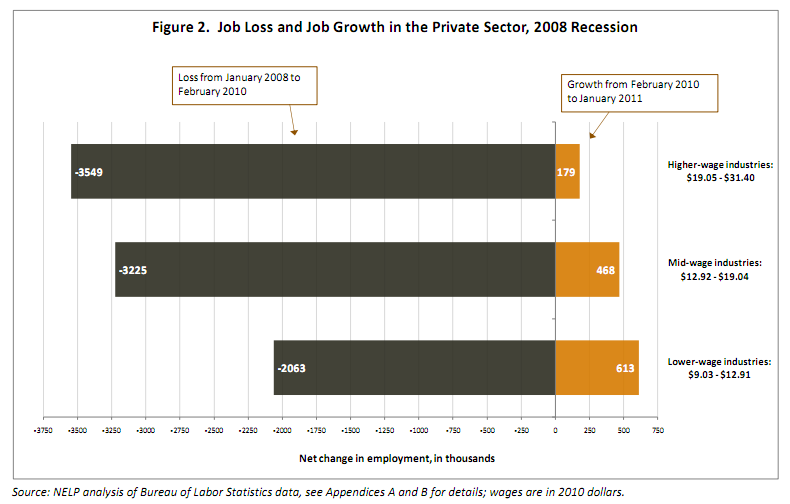

For all the talk of recovery we have lost millions of good paying jobs and many are being replaced by lower paying positions:

Source:Â NELP

“As you can see from the chart above most of the jobs being added in the recovery are from lower paying job sectors. The middle class is seeing more and more strains being placed on their monthly budgets. Trading good blue collar jobs in say building cars into burger flipping McDonald’s jobs.â€

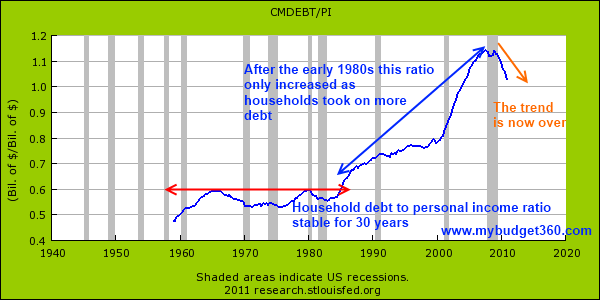

Much of the economic boom that seemed to be happening was largely based on household debt, not personal income growth:

The system is broken. It continues to break because those in power support policies that exaggerate the income divide and reward those that fail at the expense of productivity. The banking sector has caused more harm than good in the last few decades. Allowing it to run wild is simply a recipe for continued disaster. We already know that a continuation forward will mean a slower dismantling of the middle class. The banking system should be intricately tied to the success of real world businesses that provide jobs to middle class Americans and not on short term swindles that enrich CEOs while destroying the financial balance sheet of millions.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!