Americans have no savings and with very good reason:Â housing, education, and health care have seen extraordinary inflation while wages are stagnant.

- 6 Comment

It has now become a daily ritual in which story after story of broke Americans plaster the web. Yet somehow on the mainstream press, very little is discussed about this topic. Americans are largely broke because inflation is vey real. Housing, education, and health care costs have soared out of control while wages have remained stagnant. The way Americans continue to pay for these items is by going into loan shark levels of debt. There used to be a pretense that “we†actually cared about having a middle class but that is now thrown out the window. At this point, we are in a full on sprint towards low wage capitalism. Many people live on a paycheck to paycheck diet and are berated about saving more for retirement. The reality is, the new retirement model is working until you die.

In the land of no savings

Sunday morning, I wake up and take a stroll through the neighborhood. “Did you hear about Bitcoin? Wild right?â€Â I’m asked by a stranger at the park. “Sure seems wild. You own any?â€Â To which I get the following response, “I wish I had some money to even invest!â€Â I think we live in a world where most Americans are merely spectators to the wild gyrations of the market. They hear about investments too late or mistake speculation with actual investing.

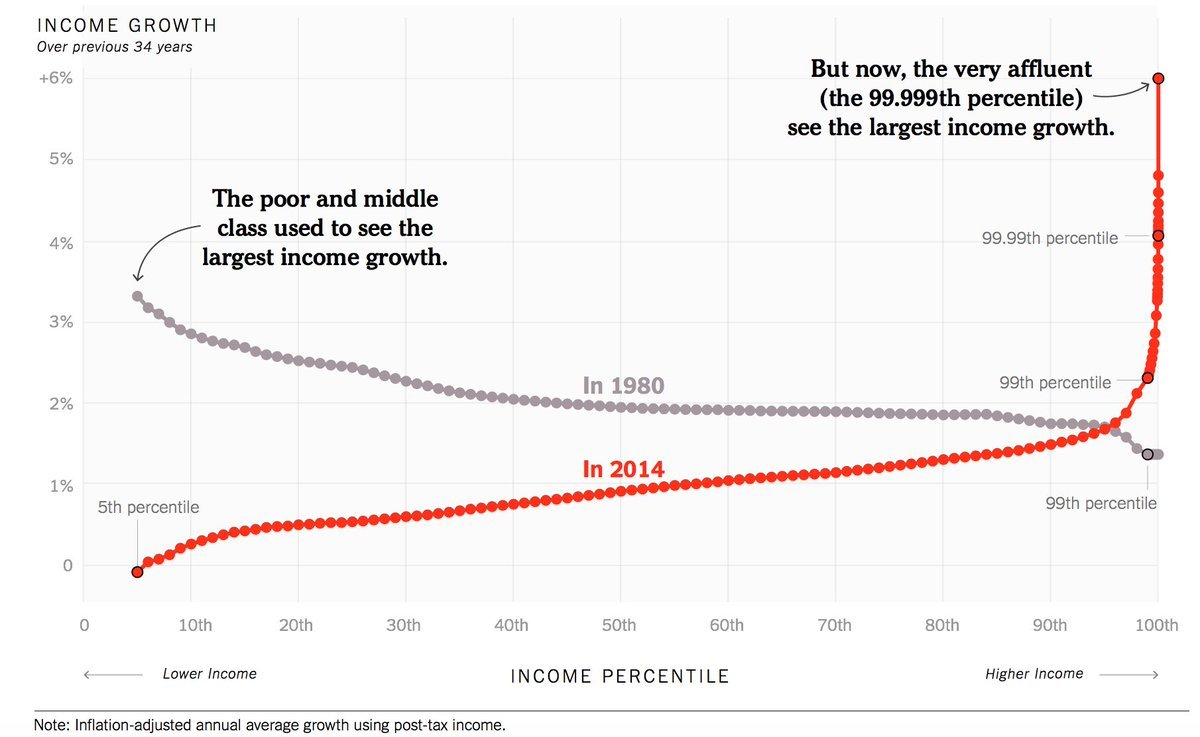

Most Americans impact their standard of living with their income from work. And most of the income gains since 1980 have now gone to the top 1 percent:

This is the new world we live in. Even to compete for a home, what was once the bedrock of a middle class lifestyle, is now seen as out of reach for many Americans. And of course people are still buying homes but they are going into wild levels of debt to do so. You have banks offering 5 and 10 percent down payment loans because people simply cannot save enough to buy a property. So what happens when that next recession hits and you have no buffer of safety?

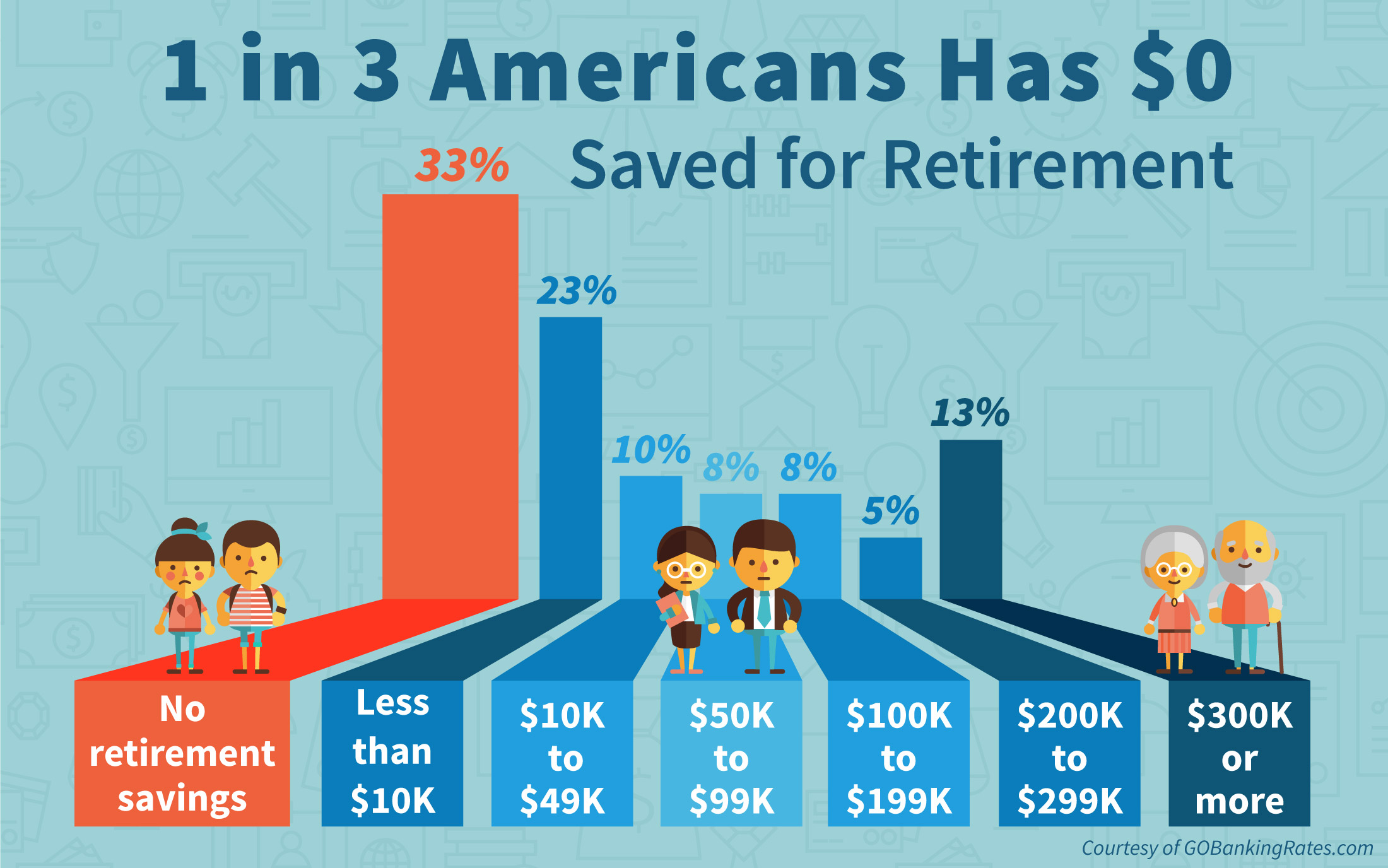

1 out of 3 Americans has no savings for retirement:

We have done a good job of bamboozling the public into believing in some sort of financial Disneyland. Things appear better than they are until you look behind the curtain. You have a lot of props and gimmicks but the substance is being eroded. For example, we now have more than $1 trillion in credit card debt outstanding. This is largely driven by Americans buying more than they can afford so they can keep up with the notion that they are still middle class. Credit card debt is really just spending your future earnings today. So you pull demand from the future into the present. This is not a sound path of wealth management.

I think things fall into two dramatic camps. You have the “screw the poor, they deserve it†camp and you have the “all capitalism is evil, therefore control every company†camp. Of course life falls in the gray area. Capitalism thus far has proven to be one of the stronger economic systems out there. But even in the U.S. we have some strongly socialistic systems in place: the military, Social Security, Medicare, public parks, public education, and on and on. I do believe that there is a basic price to live in a modern society. However, when it comes to business creation the free market does the best. Can you picture a government trying to design an iPhone, Facebook, or running Amazon? These companies do well because they operate (largely) in a free market.

With that said, the current system is stripping out the middle class from the United States. You have the financial sector speculating and essentially using cheap funds to inflate values in many areas. It is a system where very few Americans are participating in and many are losing out simply by the inflation that is being created. Americans have no savings for very good reasons. Will that change? That is yet to be seen.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

6 Comments on this post

Trackbacks

-

Carlos Garcia said:

The money being put into stocks by many and offshore by some is not being invested. Capitalism also undermines itself trying to cut wages and marginal costs all the time. Government is wasting money and pulling it out the economy but so is the free market controlled by fewer and fewer companies.

December 22nd, 2017 at 2:45 pm -

roddy6667 said:

Even poor people in America have new cars, $100/month cable TV, $100/month mobile phones, live on fast food instead of cooking at home, smoke and drink to excess, and lots of other wastes of money. I don’t think most of them are blameless for their situation.

December 23rd, 2017 at 8:22 pm -

DearSX said:

Most people make less than $15/hour or about $1800/month for expenses.

$900/rent

$200/Car

$200/Car Insurance + Gas

$400/Food

$50/Phone

$200/Utilities

$50/ Clothing

Total$ 2000 and I’m counting sick time/vacation, car repairs/tax, cost of a phone, appliances, household items, toothpaste etc.December 27th, 2017 at 1:29 pm -

Rachel said:

The writer is correct. It is very curious that millions and millions of Americans see and live this reality yet, the media does not ever address it. Meanwhile employers are wanting more and more work or education but giving less and less in benefits and pay. Open a Sunday paper and you will see a very small fraction of the job and career opportunities seen a decade ago. Even those online often lead nowhere for applicants. And so it is that many are stuck in single or multiple low wage jobs on the wage slave treadmill.

With regard to another comment, it is incorrect to believe that a majority or that all poor people in America have new cars and $100 phones, cable, etc. To say this is untrue and shows that the person saying it is completely disconnected from a lot of Americans.

Most poor Americans do not have $100 cable, if they have cable at all. They do not drive new cars, if they have cars at all. They are often unable to live independently and often must live with family, friends or multiple room mates to get by. Of those who do live alone, it’s not uncommon that they spend 40%, 50% or more of their monthly income on housing alone.

January 4th, 2018 at 9:32 pm -

Big M said:

People should realize that all bank “loans” are fraudulent, and that they owe the banks NOTHING. Once that sinks in, the rest will follow.

January 6th, 2018 at 5:27 pm -

libertarian jerry said:

The main reason that the average American cannot save is because the average American works,directly and or indirectly,8 out of 12 months of the year to pay all of his or her taxes. There’s the federal Income Tax,State Income Taxes,local Income and Wage taxes,Payroll taxes such as Social Security,Medicare,Medicaid,Unemployment taxes,etc.plus property taxes,sales taxes,value added taxes,passed on taxes,alcohol and tobacco taxes plus a myriad of hidden taxes and of course the insidious inflation tax. Probably over 60% of the population directly and indirectly are supported by the shrinking 40%,or less,of the population that creates real wealth in the American free enterprise system. This is the main reason why the average American family has to have 2 breadwinners. Basically one to live on and the other spouse to pay the taxes to support the net tax consumers. The tremendous growth in government in America,over the past 50 plus years,in order to support the warfare/welfare state has destroyed much of the productive middle class in America. America has become a nation of tax serfs.

January 7th, 2018 at 10:09 pm