California Foreclosure Prevention Act: Creating an Army of Lifetime Renters in California.

- 4 Comment

On June 15th California implemented another foreclosure moratorium. The California Foreclosure Prevention Act (CFPA) was signed into law by Governor Schwarzenegger which adds another 90 days to the foreclosure process. If you recall, a similar law was put into place in 2008 and turned out to be an utter failure. So what do we do? We virtually create another replica plan for a second go around. The plan will fail on so many levels and we will discuss the reasons why in this article. California has taken a major beating since it was part of the housing bubble mania and is now at the forefront of the bubble bursting.

The problem with dealing with the current foreclosure issue in California is how the issue is being framed. Take this perspective for example:

“(SF Chronicle) The goal is to compel banks to do systematic loan modifications across California to reduce our foreclosure rate, which is the highest in the nation,” said Assemblyman Ted Lieu, D-Torrance, who wrote the bill. “Until we slow that down, the California economy cannot recover.”

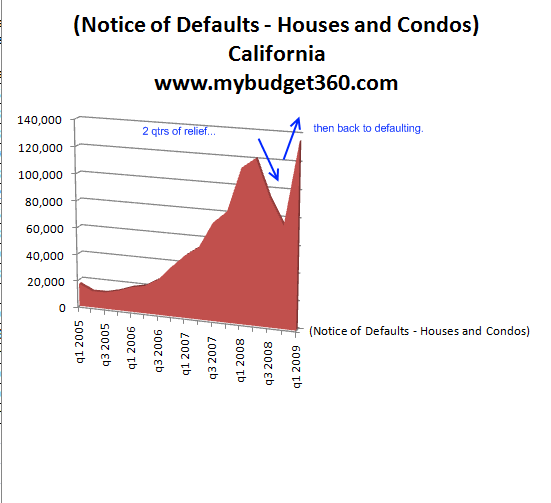

I appreciate the perspective but dropping the foreclosure rate in the short-term to pad statistics is flawed for many reasons. The way the plan is devised, it will create an army of lifelong renters with onerous mortgage terms. This is helping no one except servicers to get a nice kick back for modifying the loan and padding foreclosure data in the short term. Take a look at how the last moratorium turned out in California:

So what we have in q3 and q4 of 2008 is a drop in notice of defaults but then a skyrocketing catching up in q1 of 2009. Q2 of 2009 will be high yet again but we may see a drop for the next few months. This is simply a diversion and there is little that can be done for a 3 decade long housing bubble that simply needs to pop.

The problem with the new plan is that it tries to force borrowers into a plan that coincides with the current administration modification bill even if it means going with gigantic LTV ratios, artificially low teaser rates, 40-year amortization, and making the loan a balloon payment. This is essentially creating lifelong renters and servicers have every bit of incentive to avoid chopping principal down. Here is what we are told in the CFPA FAQ:

“While a sustainable loan modification may be different for different borrowers, the potential ways a loan may be modified include any of the following:

-An interest rate reduction, as needed, for a fixed term of at least 5 years.

-An extension of amortization period for the loan term, for up to 40 years from the original date of the loan.

-Deferral of some portion of the principal amount of the unpaid principal balance until maturity of the loan.

-Reduction of principal.”

The last option is not going to happen in a large number because we already know that the banking industry has lobbied hard against cram-downs which are basically principal reduction. If you look at this closely, a rate reduction for 5 years is basically the same thing that is going on with the toxic option ARMs and Alt-A mortgages! These are artificially low teaser rates. The fact that they are talking about extending the loan amortization to 40-years and including deferral of principal (i.e., negative amortization) is basically making these government sponsored option ARM loans! This is total insanity and any borrowers need to think twice about locking themselves into such bad loan products.

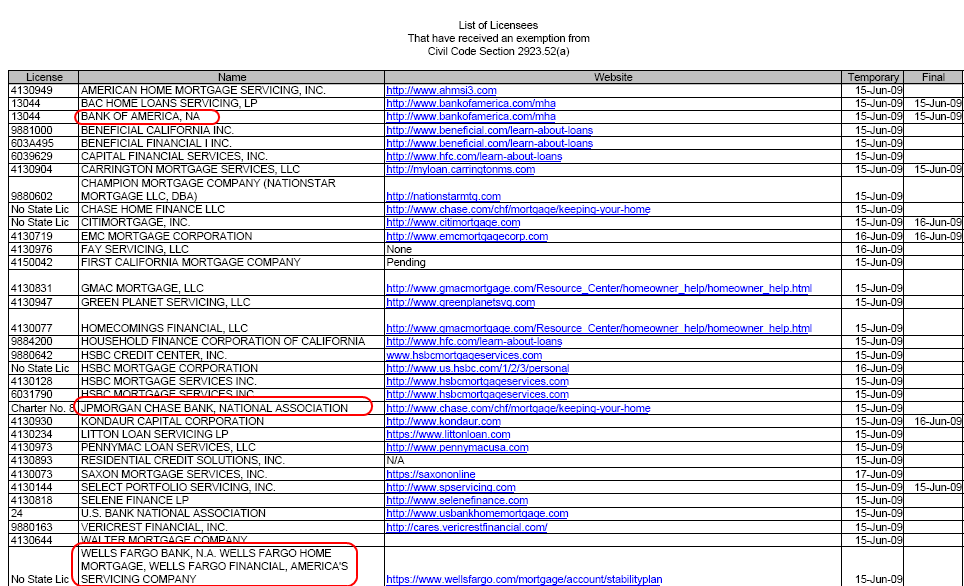

As if this isn’t enough, many lenders in California have already received exemptions from the program:

So you have essentially the three behemoths of Bank of America, JP Morgan, and Wells Fargo exempt. Keep in mind these 3 have swallowed up Wachovia, Countrywide Financial, and WaMu who were the ultimate toxic mortgage pushers. Oh, and this is for loans that fall under conventional limits which means most of those toxic pay Option ARMs and Alt-A largely are unaddressed by this.

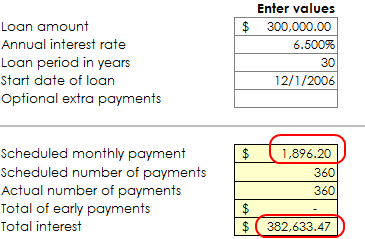

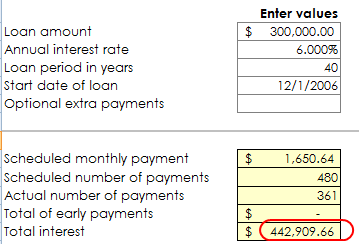

The problem also is that first lien holders are going to get a more exotic product after these modifications. Think of someone with a conventional 30 year fixed mortgage of $300,000 suddenly having it modified to a 40 year mortgage with a 5 year teaser rate. How does this help? If anything, it assures us a longer and more prolonged housing slump since at some point, the rate will go up again.

Most of these modifications will fail within a year. As recent data indicates, over 70 percent of modified loans have already failed. Why would this be any different? Except, we are going to be wasting $1,000 of taxpayer money per modified loan by kicking down the servicer. Why not just amortize loans over 100 years if the main goal is to chop the monthly nut?

All this program does is turn negative equity home owners into long time renters. After all, if people had equity all they would need to do is sell the home. The crazy thing about the modification is also the debt-to-income ratios allowed:

“The program targets a ratio of the borrower’s housing related debt to gross income of 38% or less, on an aggregate basis in the program.”

This is problematic. First, California homeowners are leveraged to the max. So we aren’t going to factor in other debt like credit cards, student loans, auto loans, etc? So say for example someone makes $5,000 a month (gross), they can have a home payment of $1,900. Sounds good right? Well after taxes we start seeing issues especially if we are only lowering the teaser rate and turning the loan into a 40 year product. Let us run a scenario here:

Now here we are running a quick and dirty example. As you can see, for extending the term of the loan for 40 years the borrower will save $246 per month. However, for this quick fix they will be paying approximately $60,000 more in interest over the long term. This again is a problem with our massive debt system. Short sighted thinking got us into this problem so why would short sighted thinking get us out? The U.S. Treasury and Federal Reserve are doing everything to devalue the dollar to create consumer price inflation but that isn’t happening.

The CFPA basically rewards servicers for creating a new class of pay Option ARM with government support and the borrower basically gets to live in a home with negative equity as a renter. Actually, it is worse than renting. We may be living through a lost decade of housing appreciation so if this borrower wanted to move in the next 5 to 7 years, they would actually have to cover the negative equity portion of the balance to leave the house. They obviously can’t sell and the principal is still at the inflated bubble price. Renters, can just pick up and leave. So it is more like servitude. How many people will jump into this is something we will look at closely. The fact that they would allow negative amortization and teaser rates is astounding. This is simply kicking the can down the road. Negative equity is a major reason why people default. Why would you want to pay on an underwater asset? Plus, California now has an 11.5 percent unemployment rate which isn’t exactly helping.

A better solution is what is occurring with foreclosures. A market bottom will be found. Many people will become renters but that is okay. Instead, policies like this simply prolong the inevitable decline while providing taxpayer money to the housing industry which lived it up during this mess. You can rest assured that the CFPA is going to be a failure and will only serve to pad the resume of certain politicians while prolonging the housing mess in California.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Loan Modification Attorney said:

What we need is legislation to force the lenders to reduce all loans do 31% DTI for 2 years. Thart will buy us time to sort it out.

June 22nd, 2009 at 6:22 pm -

Robert Watt said:

I’d bet my last paycheck from my outsourced that this is deliberate! Or are our leaders really that stupid?

June 23rd, 2009 at 4:02 pm -

jimbo said:

The banks must reduce principal and offer 5% interest rate. It takes two to tangle. The borrower shouldn’t of borrowed the money and the bank should not have lent it. The banks had taken the risk because the government backs them up. Wall St and the debt based economy are collapsing. Infinite growth on a finite planet is impossible. Todays economy is based on growth. Now the growth has reached its limits, a new economic paradigm is coming around. Bye Bye Goldman and your Wall St. buddies.

June 23rd, 2009 at 10:20 pm -

Robert Bana said:

There should be a moratorium effective immediately that loans acquired between the years 2004 and 2008 should have principals reduced at least 31% with a 4.5% fixed interest rate for 30 years. These banks already made their money from consumers who just want to live the American dream- to own a home and stay in it.

July 28th, 2010 at 11:10 pm