Central banks and a global soft default: Current interest payments on public debt now exceed $415 billion per year. In 2000 $1 trillion in Fed debt was held by foreigners while today it is up to $6 trillion.

- 2 Comment

Global central banks are fully addicted to the opiate of debt. The financial system has created a rentier class that chases investment yield even when the economy isn’t necessarily growing. Think about that for a second. Why should someone expect a guaranteed return at any point in an economic cycle if the real economy is actually contracting? The U.S. for example while trying to play the role of responsible manager of debt is going full throttle when it comes to debt issuance. We have a spending, revenue, and financial system problem in the way incentives are structured. For example, all talk of the Fed tapering is really just hollow rhetoric. The Fed now has a balance sheet well into the $4 trillion range (or twice the size of California’s annual GDP). There is no sign of pulling back. U.S. debt to the penny is now at $17.5 trillion and growing as we spend more than we take in. People do realize that this principal is never going to be paid back right? This is why inflation is occurring in many areas of the economy even though the CPI understates inflation in many categories including housing, tuition, and healthcare. Global central banks are fully aware that most countries are already in a soft default. In other words, the trajectory ahead is to inflate our way out of this debt mess.

A soft default by any other name

The U.S. outside of a couple of years, has spent more than it takes in for well over a generation year over year. We continue to spend money we don’t have courtesy of foreign investors and our Fed that continues down the QE road. Yet these actions have consequences. You have global funds coming back home to roost for the elixir of cheap goods. The result? For most people we are now importing low wage capitalism. In many metro areas local families are now competing against big real estate investors and in some cases foreign investors merely to purchase a home to live in. There is always a cost to borrowing cheaply.

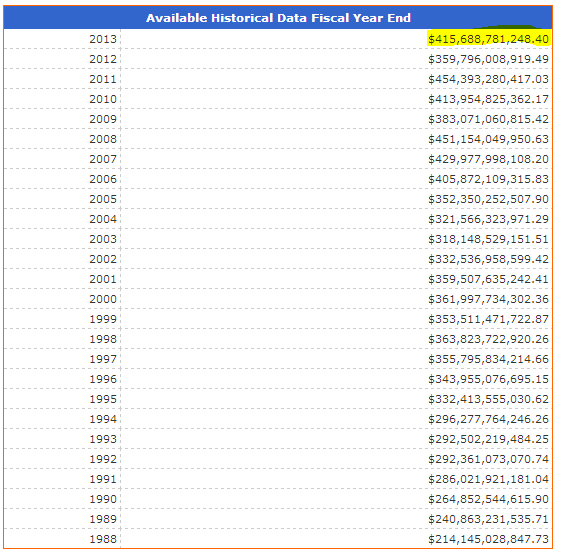

Total public debt outstanding is now well over $17.5 trillion, a figure higher than our annual GDP. Take a look at the total debt owed:

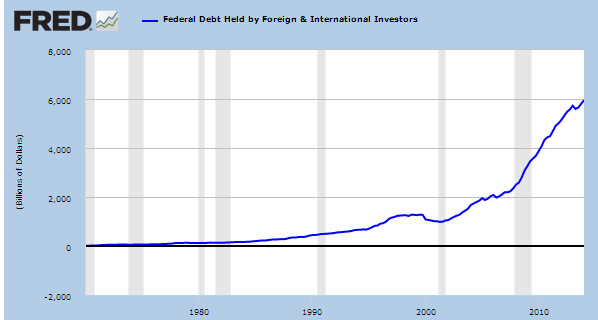

What we are finding out is that more of this debt is now being financed by foreign funds:

$6 trillion are now owed to foreign investors. Some tend to think this comes with no strings attached. Of course there are strings attached. A generation of people were able to enjoy a strong dollar, high wages, and plentiful cheap goods. Today we have a weak dollar, lower wages, and cheap goods are becoming more expensive as inflation in other goods chips away at purchasing power.

“In 2000 $1 trillion in Federal debt was held by foreigners. Today it is up to $6 trillion. It is naïve to think this trend wasn’t going to have longer-term repercussions.â€

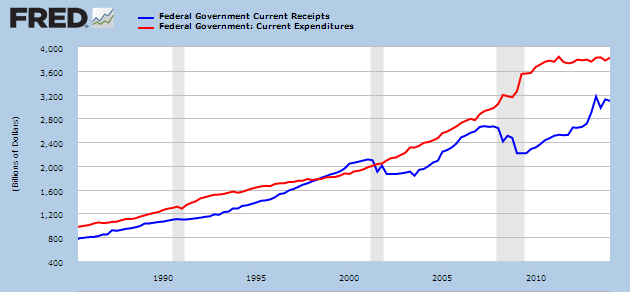

A large reason for this mega borrowing is that we are spending way more than we take in via tax receipts:

You can see that the Great Recession caused us to run some epic deficits. But what was the end result? Pricing out regular families from buying a home? Making college unaffordable to millions unless they commit to a lifetime of student debt? Giving access to healthcare but making premiums so high that most are seeing more of their funds consumed by these changes? Since most Americans are cash strapped and deep in debt, it appears that we have been auctioning off our debt to global yield chasers. The results for the top one percent have been fantastic. For the rest, not so much.

Interest expense

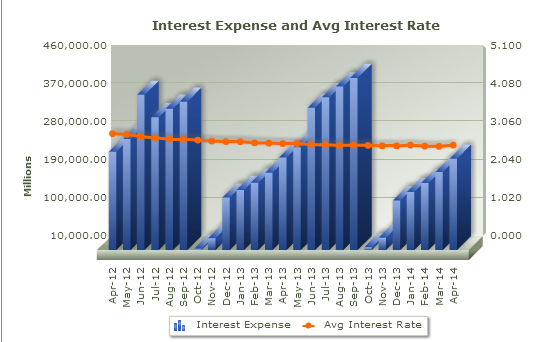

Remember all those toxic loans that gave you teaser rates for a short duration before things went sour? Take a look at how much we pay per year on interest payments alone:

We are now paying over $415 billion a year simply on maintaining our debt. In 2011 it was $454 billion. Didn’t we take on more debt? Of course and that is why the Fed is openly engaged in making rates as low as possible even if is fully artificial. The average interest rate is now hovering around 2 percent on all of this debt:

Source: U.S. Treasury

Assume that rates went up to 6 percent overall which is a low rate overall given the global risk in the market and we are looking at paying roughly $1 trillion per year simply on the interest expense without lowering any of the principal balance. So think about that next time you hear about taper talks and gear up for more non-reported inflation to consume most of your daily cost of living. This is a soft default by any other name and central banks are going to do everything they can to inflate the debt on their books away.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Gringo Bush Pilot said:

Could a major war be the answer?

June 5th, 2014 at 4:24 am -

theyenguy said:

You write, This is a soft default by any other name and central banks are going to do everything they can to inflate the debt on their books away.

I respond, yes it is a soft default, and through on going money printing operations, the central banks have indeed inflated the debt on their books, but that has finally come to an end with the Mario Draghi June 5, 2014 Mandate of Negative Interest Rates.

The wisest of all banks were those the Primary Dealers who demanded and received Interest Rate Swaps as part of POMO, and who went started to go short US Treasuries, TLT, beginning in January 2014, as the long-duration trade, EDV:TLT, and the flattening yield curve, FLAT, commenced, as now their shorts will start to increase in value and as their positions in Interest Rate Swaps soar as the Benchmark Interest rate increases in value.

June 6th, 2014 at 5:20 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!           Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!           Â