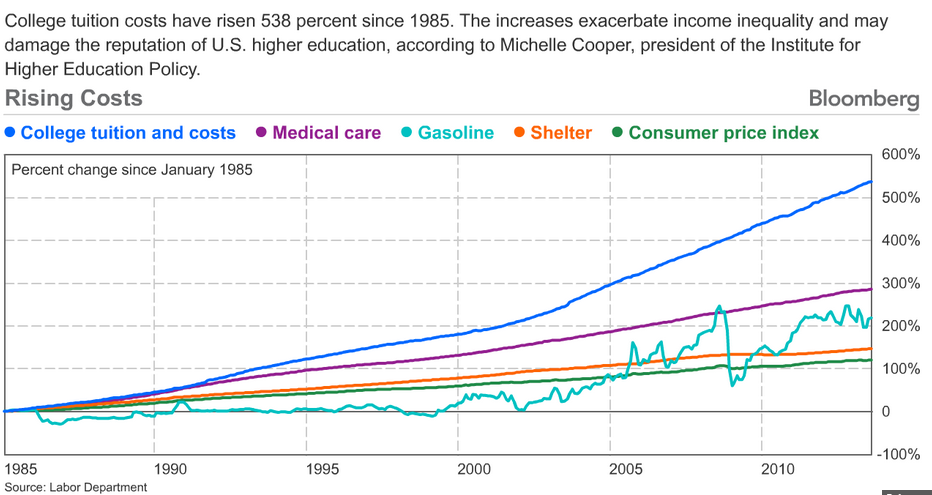

The mega inflation in college tuition: Since 1985 college tuition costs have soared by 538 percent. No surprise that total student debt is now over $1.22 trillion.

- 2 Comment

There was a time when college tuition was reasonably priced in the United States. In fact, college was downright cheap. These were the days when people worked a few hours a week at minimum wage jobs and were able to pay off their tuition on a semester basis. Too bad most of the new jobs in our economy are now low wage jobs and this is truer for those with no college degree. A Catch 22 for many. The per capita annual income in the U.S. is $26,000. You have many schools charging $30,000 or even $40,000 per year in tuition. Keep in mind the per capita income is based on the entire spectrum of workers, including those already with college degrees. So try imagining a student working at McDonald’s trying to carry the entire tuition burden of many schools. It just doesn’t work and that is why we now have a total of $1.22 trillion in outstanding student debt. Student debt is now the largest non-housing debt sector in the U.S. Student tuition has risen by 538 percent since 1985. This current generation is going to college at the most expensive time in history.

The rise of tuition

The reason college feels expensive today is because costs have outpaced virtually every other cost of living in the last generation. Wages have gone stagnant and many of the “good†paying jobs of today require some form of formalized training. What this means is that people need specialized skills to compete in the current employment market. Take jobs like engineering, computer science, accounting, or those in the healthcare industry. Unfortunately blue collar work no longer pays well in many cases. You can see this by looking at the gutted factories in the Rust Belt states.

Take a look at how fast college tuition has risen relative to other items:

This is simply out of control. The reason this continues is that student loans are made without any need to verify future potential to pay or even holding schools accountable. You have giant fund leakage into for-profits that serve in many cases like paper mills. Schools don’t even have to show career placement rates or salaries that would justify certain wages. Law schools have taken a big hit because of this. Of course, there is more to education than mere vocational prep. But when you are charging so much, students need to be more careful in terms of what they take on. A loan simply means you will be deferring future earnings for current spending. That makes sense for some fields but in others, it does not and that is why student debt delinquencies are rising.

Is college worth it? Students continue to believe it is and that is why the current amount of student debt outstanding is:

More than $1.22 trillion and growing at an outstanding rate. The fastest growing debt sectors are auto debt and student debt. It is hard to put an exact value on an education. I think people should take on no more debt than they expect to make in their first couple of years of work. For example, an accountant will likely make $40,000 to $50,000 per year as a starting wage. The total amount spent on education should be around this range. You can also apply this to nursing, computing, and engineering.

Since you have the ability to pay this debt over a long period of time, staying below the above range is helpful. Yet people are clearly not doing this. They are taking on way too much debt for their potential earnings. You won’t know exactly how much you will earn until you actually graduate and look for work. Then you get a quick lesson on the current economy. So it is important to be conservative here.

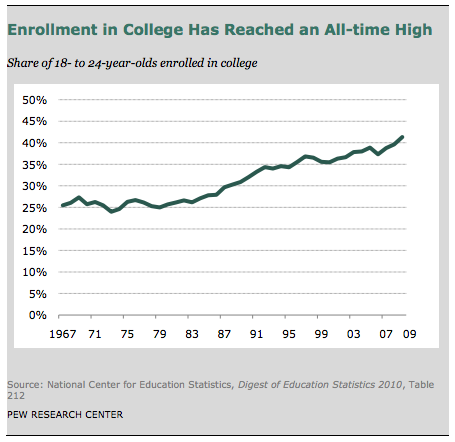

This is an important time to examine this since many more young Americans are going to college:

You can’t have mega inflation in college tuition as we have seen without problems hitting the system. Today we have many struggling with massive student debt and this will hinder a generation of Americans in consumption and preparing for retirement. Then again, these are issues to look at deep into the future or at least this is how our political process is viewing it. Maybe we’ll see another 500+ percent increase in tuition over the next generation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Sasha said:

The federal reserve has stolen so much

November 18th, 2014 at 7:35 pm -

Hey You said:

The increase in college tuitions goes to the college people as paybacks for the support of academic people for the current political office holders. You would think that academics would be more perceptive, but they have been trained by other academics who favor th old collectivism.

November 23rd, 2014 at 5:08 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â