When does college become too expensive? Tuition growth continues to outpace income growth and the student debt bubble continues to expand with the vast majority of debt going to the young.

- 2 Comment

When does college become too expensive? Will there be a bell going off like during a boxing match? What is the price tag that makes getting an education too expensive? It is obvious in the current economy that many prospective students cannot afford a college education without going into joint breaking levels of debt. Many of the opportunities that provide good career prospects do require a college education or formalized training. These goals are difficult to achieve without going into debt. And that is why Americans are now carrying well over $1.2 trillion in student debt. This is also the most delinquent sector of debt in our economy highlighting that many students are unable to pay their student debt back. Because there is no formal way of discharging debt via bankruptcy, this debt is like an iron albatross that is carried forever usually by those least likely to afford it. When we look at inflation in tuition, it continues to outpace actual income growth. This is problematic for parents when sending their kids off to college. Many have to finance with expensive debt given that the Fed is offering near zero percent loans to banks yet somehow, is unable to push rates down for student borrowers. Cheap borrowing for banks, expensive rates for students. It shows you where the Fed’s priorities are in the current economy. So when does a college education become too expensive?

Student debt largely on the backs of the young

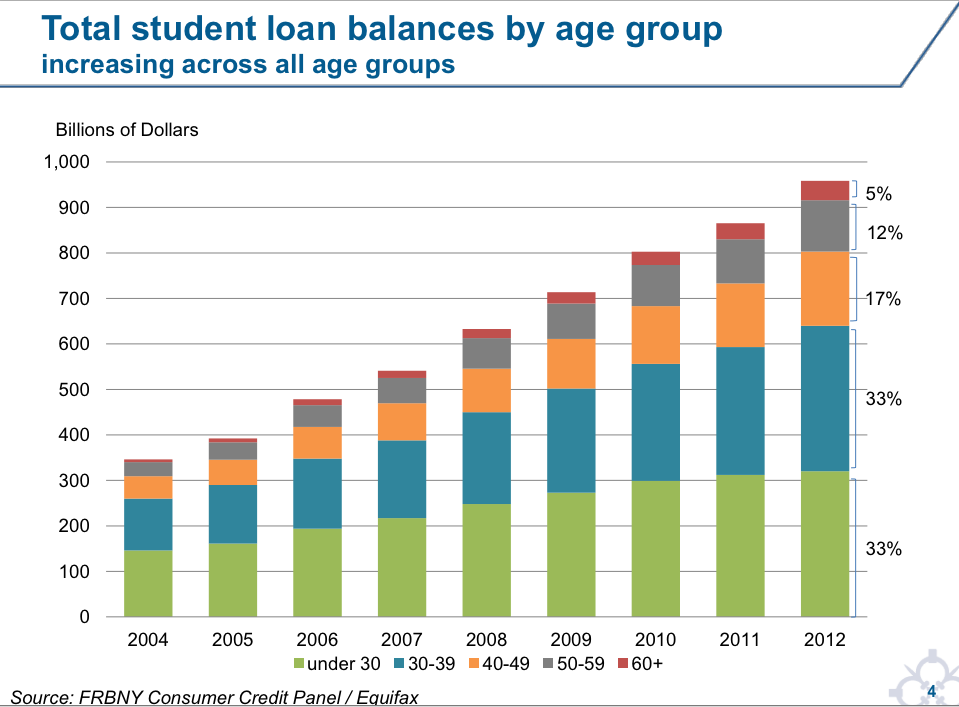

Most of the student debt growth has occurred since 2000. We are talking about going from roughly $200 billion in student debt to over $1.2 trillion. Most of the increase has come through the age of debt based living. When we look at which groups carry the heaviest burdens here we realize that most of the debt is piled on the backs of the young.

Younger Americans entered into one of the weakest economies producing low wage jobs and also, a time when college tuition was at record high levels. Take a look at debt burdens here:

Over 66 percent of the $1.2 trillion in outstanding student debt is on the backs of those 39 and younger. That is a hefty chunk especially when you consider how many older Americans have college degrees from the 40+ age group that went to college during more affordable times.

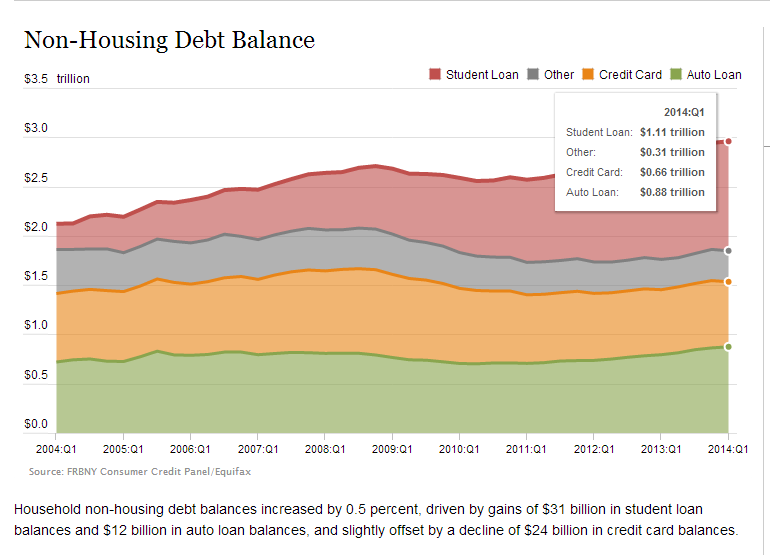

If we look at a little bit of history, only 10 years ago we would find that auto debt and credit card debt had higher outstanding balances compared to student debt. That is no longer the case:

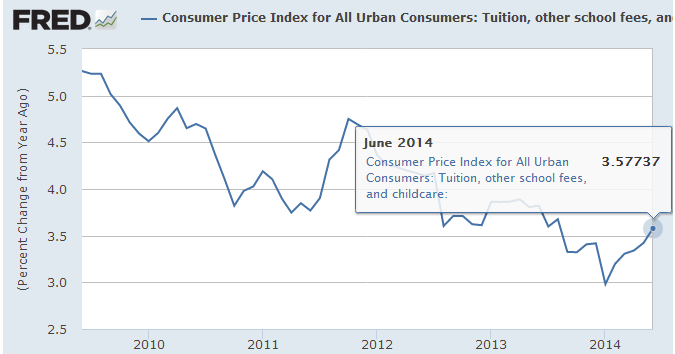

Student debt reigns supreme as the biggest non-housing debt sector in our economy. To answer the question regarding whether college is too expensive today, we can look at the current inflation rate for tuition:

Even though annual increases are slowing down, they are much higher than the overall inflation rate. Last month, the overall annual inflation rate measured by the CPI is hovering around 2 percent while college tuition continues to increase by 3.5 percent. This massive divide is forcing more and more students into debt if they wish to go to college.

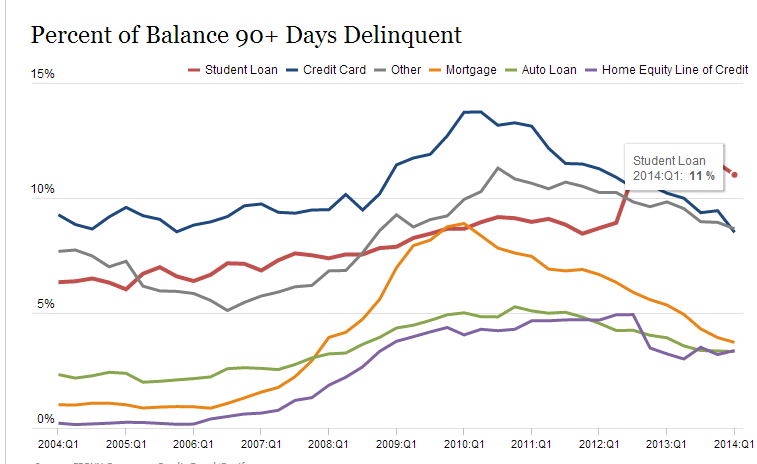

It is becoming very clear that many are simply unable to pay back their debts. Take a look at delinquency rates for various debt sectors:

Delinquency rates for college debt are the highest of all debt sectors. Considering student debt is the biggest non-housing debt sector in our economy, we should certainly pay attention. This problem is also sucking away future housing demand and studies have shown this. How can you afford to buy a home when you are already carrying a mini-mortgage of student debt? Various people are recognizing the issues here. Mark Cuban paralleled the student debt bubble with the housing bubble:

“(Business Insider) It’s inevitable at some point there will be a cap on student loan guarantees. And when that happens you’re going to see a repeat of what we saw in the housing market: when easy credit for buying or flipping a house disappeared we saw a collapse in the price housing, and we’re going to see that same collapse in the price of student tuition, and that’s going to lead to colleges going out of business.”

When the only way to pay for something is through massive amounts of risky debt that is already facing payback problems, you know the cost is becoming too expensive. The student debt bubble is real but because it is hitting the young, there is very little play of this in the media. Another study found that roughly half of employed recent graduates are working in fields that don’t require a college degree. These are all signs that the cost of going to college has already become too expensive and the only way to finance this is by riskier levels of debt. Is college too expensive? It sure seems that way when a big part of your client base is unable to finance their debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Bud Wood said:

We have 5 sons. In education, they range from high school drop-out through PhD Physics. Each has chosen his employment.

Their actual employments are somewhat equal. My guess is that childhood discipline and secondary school opportunities are the criteria for employment success rather than is a college degree.

July 28th, 2014 at 2:35 pm -

arno said:

The financial powers, having already sucked the juices from the bodies of the home lending scams, from the stock/bond mkt. scams. They are now wrapping their webs around the bodies of their current prey, the car loan, personal loan and tuition loan crowd.

July 29th, 2014 at 7:12 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!  Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!  Â