Is college worth the debt? The cost of one year of college is higher than the per capita wage of a fully working American.

- 2 Comment

Going to college has become a rite of passage in America. We’ve left shamanic rituals deep in our human past and have come to accept college as a clear transition point into adulthood. In a consumption based economy, success is typically measured by your ability to consume. Spending prowess is not measured by sea shells but by how many credit cards grace your wallet. Unfortunately many in the once healthy middle class are falling off the wagon and finding it necessary to enter into a deal with the debt devil merely to keep the pretenses up. Last year roughly 90+ percent of non-housing debt growth occurred because of auto and student loans. Is college worth the cost? More to the point, is college worth the massive amount of debt being taken on? Clearly many prospective students have no other means of financing their education aside from going deep into the student debt market. College has become a rite of passage and the ticket for that journey has grown incredibly expensive.

Total student debt moving in one direction

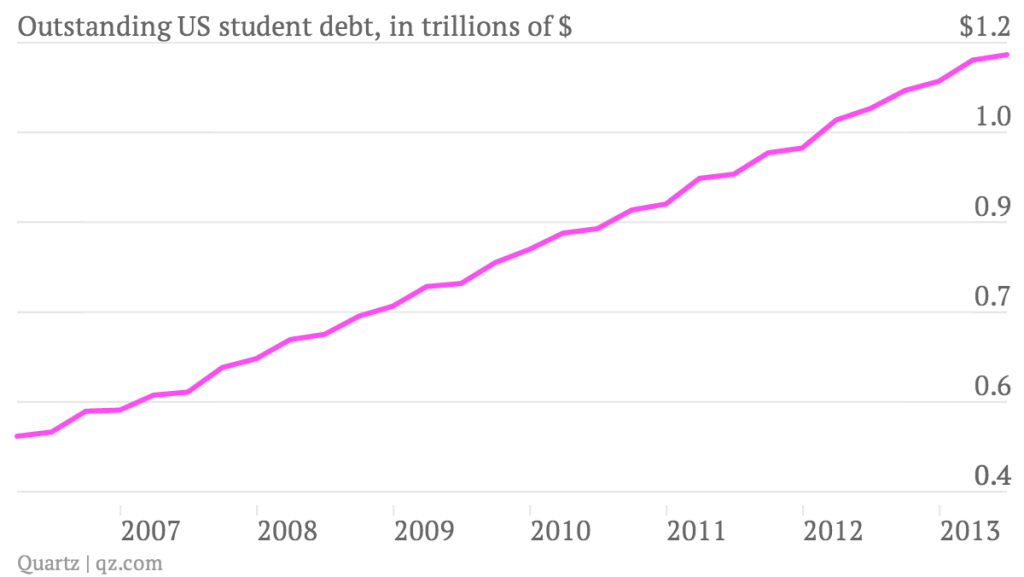

The second largest debt sector in the United States is now in the form of student debt. Over $1.2 trillion of student debt is circulating out in our economy. Much of this is on the backs of young Americans that are now finding a new and unforgiving economy.

The economy has recovered in an odd way. A small sliver of the population is capturing a large portion of the gains while the middle class disappears. This explains the odd duality of a peak in the stock market while there is a peak in food stamp usage. We are also at a very high peak in student debt outstanding:

Source:Â Federal Reserve

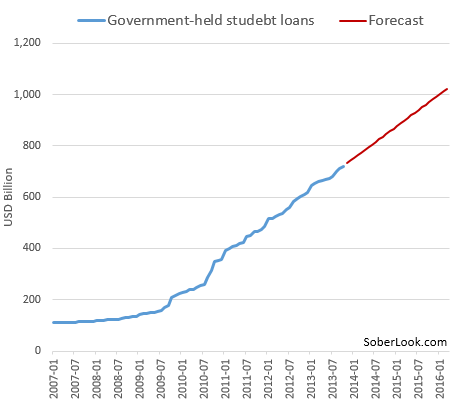

There is little mistaking the trend in student debt growth. The cost of tuition is soaring beyond any income gains. In fact US household income adjusting for inflation is back to where it was in the late 1980s. The government either owns these loans outright or is backing most of the student debt in the market:

It is hard to value a college degree. It makes it very easy to inflate costs when the government is willing to back any and all loans. So it is no surprise that institutions simply move forward and hike up fees. There is no check or method of evaluating the ability of students to pay back their debts. This leads us into our next point of the burden of student debt.

Unable to pay it back

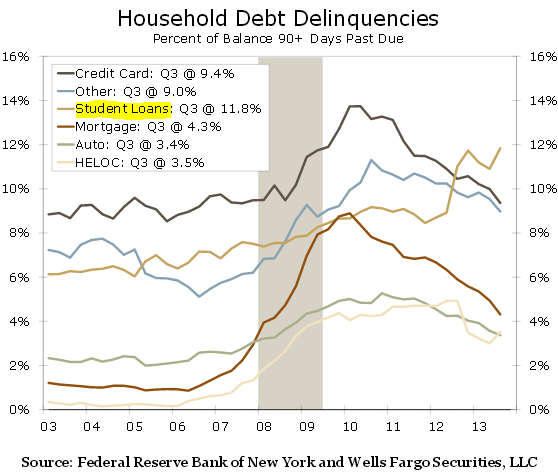

The most problematic form of loan in the United States is student debt:

Student loans are the only form of debt that now has double-digit delinquency rates over the entire pool. This is massive considering the total amount of outstanding debt is above $1.2 trillion. You have to question why it has become so difficult for students to pay back their debt. Didn’t the recovery start in the summer of 2009? Isn’t the economy roaring back as indicated by the stock market? Again, the financialization of this system based on debt has funneled most of the gains into a small group of people.

The growth of student debt has been nothing short of amazing.

Growth of student debt

From 2006 to today, student debt outstanding went from $400 billion to $1.2 trillion, a trebling in less than a decade.

Even now, student debt is growing at a blistering annual pace. Should this pace continue, in three years we should be quickly approaching $2 trillion in student debt. Not an issue if delinquencies weren’t so high.

I think there is a bigger problem occurring here and that is the addiction to massive levels of debt. The current system is fully addicted to debt. If I had a nickel for every old timer that told me he went to school and worked a part-time job and paid his way through college I’d likely be a millionaire. More to the point, they left with no debt. Big deal when it cost $500 a year for a state school. Yet these people should spend some time and look at the insidious nature of inflation on the cost of many items. For good schools, the typical annual tuition ranges from $20,000 at state schools to $40,000 and more at private schools.

The per capita wage of a working American is $26,000 so where are they going to find this part-time gig paying $40,000 a year?Â

Many are going to college to earn this much! In many cases for past generations, these people went to school when colleges were heavily subsidized and more affordable. That is no longer the case.

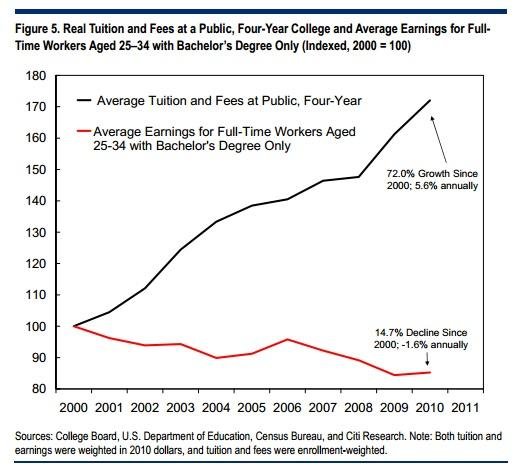

Along the lines of tuition inflation, is college worth the price? Many that went to school in “cheaper†times also entered the workforce at a better time. Many of the jobs being created today are in the low-wage segment of the economy. Pensions are gone and healthcare costs are soaring so a larger portion of disposable income is going to go into saving for retirement and also, making sure you are covered in case of a medical emergency that can bankrupt you. Although many young Americans have nothing to lose, hence their inability to garner good healthcare coverage anyway. If we measure college success by earning potential we are seeing that the worth has gone down.

Is college worth it?

Since 2000, the average tuition and fees at public colleges has gone up by 72 percent. At the same time, average earnings for full-time workers aged 25-34 with a college degree has fallen 14.7 percent:

In many cases, even for common jobs and those in the low-wage sector you have a tremendous amount of people applying pushing lower skilled workers all the way down into food stamps. So it is matter of compressing the middle class out of existence while the top has had some of the best gains in history.

There are ways to pursue a college degree and do it through affordable means but they are certainly more difficult and becoming more rare to accomplish. Take for example the common road of 2-years at a community college followed by 2-years at a 4-year institution. Many state schools because of weak budgets have slashed deep into public higher education. So you have cases where people take three, four, or even five years merely to get the basic classes finished before transferring.

The economy is pushing many young Americans into massive levels of debt. Much of this growth has occurred in the last decade so we are only now seeing the problems in delinquencies as many enter the workforce in mass and find their student loans asking for monthly payments they cannot support. It is important to examine the worth of a college degree when the price for one year of tuition is more than the annual income of many workers.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Justin said:

If I would have taken the money I spent on my college education and instead invested in gold or silver at their bottoms and sold at their recent tops, I’d be a millionaire rather than a low wage maintenance technician paying student loans and living with parents.

January 6th, 2014 at 8:05 am -

dbtunr said:

Depends on the major. STEM majors, Nursing, Teaching, Accounting are all worth while degrees especially if obtained from a state school. If all you have is a HS diploma or less, your ability to get anything other than a minimum wage job is very low.

January 9th, 2014 at 11:38 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!