The contagion of the European Union and banking debt – 20 European Banks have liabilities above 50 percent of their home country GDP. Why an EU FDIC is highly unlikely in the short-term.

- 1 Comment

The crisis in Europe is boiling over yet again. The central connecting factor of all of this is too much debt relative to production. Debt in itself is not a bad thing. If you borrow modestly for a home and have sufficient income to cover your mortgage payment then this might actually be beneficial. When things go haywire is when you leverage up. You had people buying homes that were 10 to 12 times their annual income. This however is a modest example compared to investment banks that were levered 30-to-1 and in some cases even higher. The issue with the European Union is the lack of cohesion but also the amount of debt relative to their production. True colors do not shine in boom times but do come out in crisis. The issue at hand for the moment is that stronger more productive economies with moderate levels of debt will need to step in if they are to bailout the periphery where debt levels are extreme relative to the local country GDP. Politically you can see how this is not going well. In the US, even though the bailouts were geared heavily in favor of the banks, few doubt the power of the Fed in stepping in and bailing out a big bank in California all the way to New York. This is not exactly the scenario playing out in Europe.

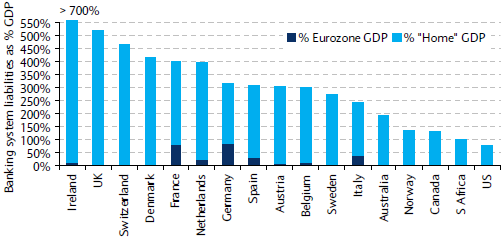

Banking system liabilities

The biggest bank in the US, JP Morgan Chase has liabilities of roughly 13 percent of US GDP. Compare this to the massive banking liabilities of some European banks:

20 European banks have liabilities upwards of 50 percent of their home country GDP! This is just incredible and actually demonstrates the deep issues in the European Union. This weekend there will be talks about methods of backing up all deposits in similar fashion to our FDIC. The problem of course is that you will have systems where banks are more stable like in Germany and France needing to go on the hook for the deposits of other countries with banking systems that are unstable. This is hardly going to go over well and the political changes hitting the EU are centering on who will end up picking up the bill.

It is unlikely that this will go over well and it is unlikely anything substantive will come from this week meetings. This is why anything that comes out of the meetings this weekend is likely to be weak and unlikely to provide any aid to the ailing system. Just look at the chart above. The only nations that have the financial strength to do anything are unlikely to tie their banking systems directly to these ailing economies. But then this begs the question of how much power does the European Central Bank really have over the member nations. Does this become more of a symbolic union or is this really a cohesive trading bloc?

They were also kicking around schemes regarding banks paying a central tax to create this insurance fund but this would take roughly a decade to have any meaningful capital to deal with the current crisis. In other words, this is now a methodical game of banking chess.

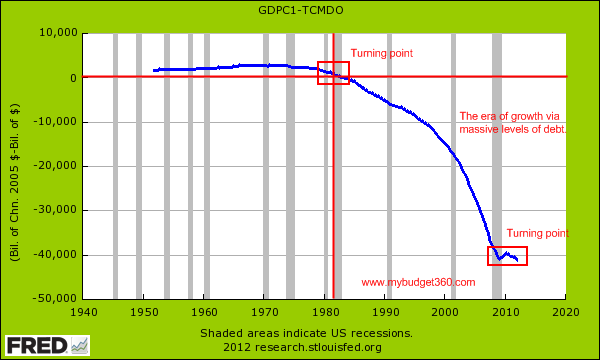

So while all eyes are on Europe for the next few years, the US still has tough times ahead because we have been growing on massive debt expansion:

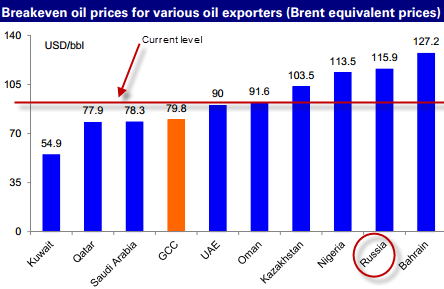

Since the 1980s, we have been spending money we don’t have to expand our economy. But in relation to the European Union we are in better shape. Because of this the safe haven trade is benefitting the US. All in all this is shaping up to be a challenging time for late 2012 and early 2013 since the US has major challenges ahead with Medicare and the massive number of baby boomers retiring. The European Union is already impacting global demand for goods as we look at China for example and just look at how oil prices will impact many nations around the world:

Source:Â Sober Look

Many oil dependent countries need oil at a certain point before it is profitable. But with demand curtailing, prices have fallen significantly. Things are always bigger than they appear when it comes to massive debt or bad trades including the JP Morgan Chase loss that is looking more and more expensive. The EU as the biggest trading bloc in the nation has some major challenges ahead and none of them are pro-growth.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

RUSS SMITH said:

Hi!, Patrons Of My Budget 260 Et Al:

In my humble opinion, as long as the monetary authorities look to paper money systems for thir spending authority, by continuing to look @ gold as peripheral money, our economic problems must persist and worsen until ? Greshams Law demands the Nations live by the truth of its’ monetary laws or suffer the consequences unavoidably until ? Gold gets a little recognition today finally bu not enough to convince Warren Buffet obviously and Warren has a lot of paper money assets under his jurisdiction that he doesn’t want to reliquish to gold money doesn’t he? Until individuals such as Mr. Buffet pivot their thinkig towards sound, hard money, OUR whole world will remained mired in uncontrollale debt until ?

RUSS SMITH, CALIFORNIA

resmith@wcisp.comJune 28th, 2012 at 7:57 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!