The covert bailing out of the commercial real estate industry by the Federal Reserve. How the Fed bails out ritzy hotels and empty shopping malls on the back of taxpayer dollars.

- 5 Comment

Part of the success that the Federal Reserve has achieved with boosting up large banks stems from its secretive ability to forge shadow bailouts of residential and commercial real estate loans. The more secretive of the previous two comes from the commercial real estate (CRE) industry. During the height of the housing mania in the United States CRE values were estimated to be worth $6.5 trillion. A hefty sum no doubt and with $3.5 trillion in loans securing these properties, a significant cushion of equity was in place. Yet with the crash in all real estate values, banks were left holding a smoldering portfolio of empty shopping malls, luxury hotels, and in some cases fast food outlets. Today CRE values are estimated to be at $3 to $3.5 trillion putting many loans in a negative equity position reminiscent of many individual homeowners. This issue of bailing out CRE was never discussed openly with the American people because it would have never carried any political muster. So what the Federal Reserve accomplished was to create a system where banks were able to exchange toxic loans in place of U.S. Treasuries without taking up an open dialogue with the public. In other words a clandestine bailout.

The continuing shadow bailout

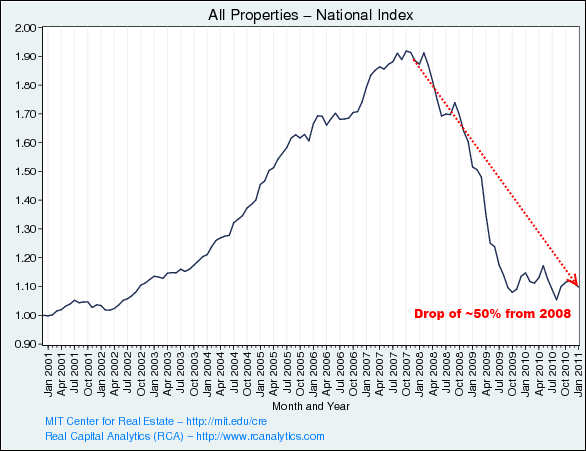

The problem with bailing out the commercial real estate industry is that it shifts costs from businesses and more crucially big banks to working and middle class Americans. The value of money that Americans now carry is becoming worth less each day with these continued actions. Do Americans make the direct connection? I think the Federal Reserve is making the bet that most will not understand this convoluted connection and simply go on with their daily lives blaming whatever other topic of the day is filtering in the financial press. Without a question however the Fed is making Americans poorer. The values of CRE have fallen dramatically and if we look at the current chart of their values, we see that they are making no immediate comeback:

Source:Â MIT

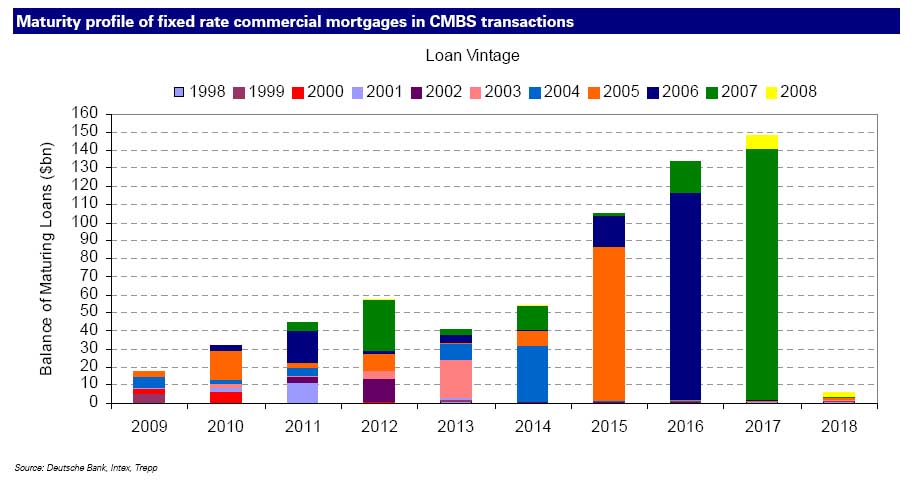

CRE values are down by 50 percent from their peak only a few years ago and if we are to actually adjust for inflation the figure gets even more dramatic. It is hard to imagine how values can go up. If you built a shopping mall in say an Arizona suburb that never drew the expected traffic, then it is likely the loan will not be serviced and the bank and borrower would be in serious trouble. This has happen thousands of times over across the United States. Most of the CRE troubles are coming online in the next few years:

Source:Â ZeroHedge

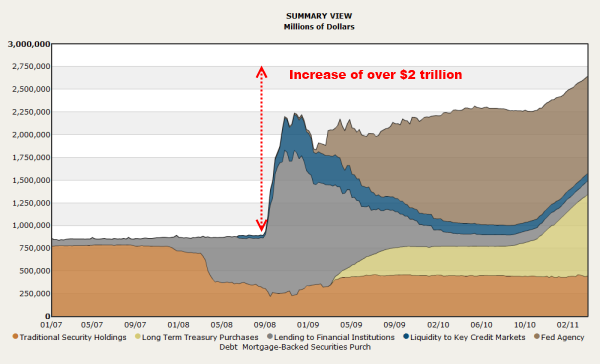

However instead of these loans going into default and becoming issues for banks, these are now on the Federal Reserve balance sheet and will cause problems for taxpayers. In many ways we are already seeing this being reflected through higher commodity and a weaker dollar. As the Fed talks about how open they are and how transparent their accounting is we simply need to look at their overall balance sheet and realize that most of the bailouts are still lingering in their hidden books:

Source:Â Cleveland Fed

What is interesting is that we are given an overall eagle eye view of their portfolio but we are not given deeper knowledge of what is in that $2.75 trillion portfolio. It would be a big difference between a shopping mall that is fully occupied from one that has zero traffic. In the first case you can get an actual value and it would be worth something. There are many shopping centers and malls built in the mania that really have no value and even serve as a piece of real estate blight in local communities.

One piece of CRE that does not fall in this category is a Ritz hotel:

“(WSJ) The developers of the Ritz-Carlton Highlands hotel at Lake Tahoe apparently have leaned a little too far over their skis. Bank of America Corp., the lead lender in the hotel’s $157 million mortgage, has filed a default notice against the property.

Developer and owner East West Partners, based in Avon, Colo., is “talking daily†with its lenders to resolve the situation, East West senior partner Blake Riva said. At issue: $10 million of the loan has matured without being paid, and the lenders want East West to pitch in another $8 million of capital.

Otherwise, East West and Ritz-Carlton, a unit of Marriott International Inc., say the hotel is doing well. Like many mountain-resort businesses, the Ritz is temporarily closed and slated to reopen by mid-May, after the “mud season†passes and vacationers return to the area on the California-Nevada border.â€

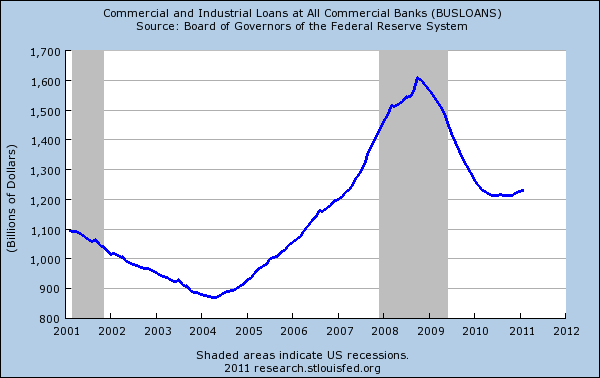

I find it fascinating that we are bailing out a place where 99 percent of Americans will never be able to afford yet are using their future earnings in taxpayer dollars to bailout this hotel. As banks talk about the wonderful economic recovery their production of loans tells you another story:

Banks are making fewer loans in the CRE world while pushing more and more of the toxic debt onto the Federal Reserve balance sheet. People need to remember that the Fed is a quais-governmental body that is mainly concerned with protecting the too big to fail banks. From its inception in 1913 this system was never designed for the mom and pop investor or the small town bank. The purpose of the Fed was to protect giant banking interests by consolidating banking power. As the Fed talks about economic success many Americans are asking, “economic success for whom?â€

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

Julio Gonzales said:

I don’t understand the Fed Balance Sheet figure. It’s been in several of these articles, and I can’t grasp it. I look at the legend, and all the words appear to be in English, but I don’t know what they mean. I feel I could understand the issues better if I could interpret this figure.

How about writing an article on the Fed Balance Sheet by itself, explaining what each component is?

j

May 2nd, 2011 at 11:11 am -

Zombee K said:

The developers are also criminals. They were building like crazy and still are because they know they have nothing to lose. All loses will be translated to future third world tax payer slaves. So why worry now. Enjoy life and have fun. However, the bubble has burst prematurely and alot of pain is going to come to people who thought the bad times will start after they’re long gone. Bad mistake. They will live to see the change of their own making.

May 2nd, 2011 at 8:57 pm -

tom good said:

gd story.

news: very little r.estate bubble in… Germany….

big r e bubbles Spain, ireland etcMay 3rd, 2011 at 11:48 am -

Jeannon Kralj said:

Very excellent article.

I do not completely understand the situation of commerical real estate in my state Texas. I would be interested in knowing how many large CRE properties are already foreclosed upon or are under water.

My town promised a big incentive package for a luxury shopping mall with apartments on top floor and, over the objections of most of the citizens, the deal was slimed through, with the full cooperation of our corrupt city “leaders.” The number of promised jobs in the special deal have not panned out. I doubt seriously if sales are going well at that luxury mall and a big restaurant there had about 5 customers on a Sunday afternoon. We the local taxpayers will be paying for that special deal for a long long time.

Also, in Texas, commerical properties are about 40 percent under appraised for property tax purposes. That is supposedly because Texas does not have a law that requires the sales prices of real estate sales to be available to county appraisal districts. A bill, SB299, in our state legislature to be able to start getting those sales prices is lying stagnant and none of our legislators seem to want to charge the just and accurate amount of property tax to these big real estate developers though doing this would largely solve our extreme budget crisis and school funding crisis.

http://costofgrowth.com/wp-content/uploads/2011/03/Appraisers-See-Flaws-in-System.pdf

http://costofgrowth.com/wp-content/uploads/2011/03/Time-for-Commercial-Property-Owners-to-Pay.pdf

Also, I have heard that several of our large downtown hi rise buildings are for sale and have been for a long time.

Texas has disguised its dismal economy rather well but the truth on the ground is that Texas is sinking fast too.

May 4th, 2011 at 6:03 am -

Garry B said:

Just like the mid eighties the banks are trying for a quick fix while regulators are required to turn the heat up on the industry. If in the eighties a fund would have been available at a reduced interest rate directly for struggling projects (many were viable but failed because loan terms could not be extended) Instead of foreclosing and forcing sales in a already weak market , adding further decline through bad judgement in handling projects in their possession. Almost 100% of the failed projects in 1986 became profitable and increased in value by 1992.If the developer could have held on ,The loan would have been paid back,The legal industry would not have been paid 100 Billion plus to sort out the mess, and the banking industry might still be in the banking business serving people>

May 4th, 2011 at 10:06 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!