Credit Card Debt up to 15 Percent of Annual Household Income. Average Credit Card Debt in 1980 was $670 and Today it is up to $7,800. The Slimy World of Credit Card Lending.

- 4 Comment

Credit card companies have made it their passion to ensure that every eligible American has access to a credit card. They have also created a financial labyrinth with traps in every corner from tricky financial statements to interest rates that would make loan sharks blush. The credit card has become some form of financial rite of passage. Even colleges are plastered with credit card pushers trying to get their new batch of Americans hooked on the world of debt financing. In a way, this is an early initiation into the world of spending what you don’t have so when the U.S. Treasury and Federal Reserve create money out of thin air many Americans don’t find this concept foreign.

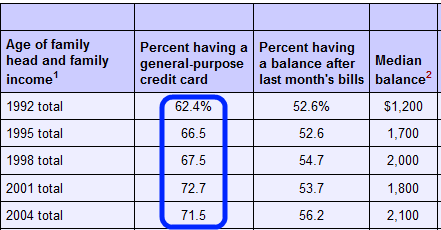

Credit card companies have expanded the scope of how many Americans actually hold the mighty plastic:

In 1965 only 5 million cards were in circulation and by 1996 some 1.4 billion cards were out floating in the market. How can this be? You have some people that have ten or more cards. As of today over 70 percent of eligible households have a credit card. This isn’t stunning since the average American needs to establish credit through this racket because of building up a FICO score. In many cases this score determines your interest rate or even whether you get a rental. How did people do it in the 1950s or before? They actually spent time vetting the person instead of deferring the hard work to some magical three digit number.

I’ve been trying to wrap my mind around the massive growth in credit card debt. This week Bank of America sent me a letter discussing the new changes to my credit card because of the new legislation kicking in 2010. A few key points include not being able to hike up your rates on all cards if you miss payment on one card. This is known as universal default. And another key was not being able to hike up your rate without advance notice. The letter was sent as if it were fantastic news. This is nonsense. This is like someone sending you a letter saying, “after 20 years of robbing your bank account, we have decided that we will no longer steal your money with both hands but only with one.” Is this really the kind of reform the corporate oligarchs have in mind for us?

And while this reform is coming, credit card companies are screwing as many customers as they can before the new legislation comes into effect. I made the inopportune mistake of acting in frustration and anger. One day as I arrived home after a tough day, I opened up a letter from Chase showing that my fixed rate of 4.9% was now going up to 18.99%.  The letter in point 6-print stated that if I did not want this, I should pick up the phone and call some person half way around the globe to discuss a very local problem. I dialed away and told them that I wanted to completely opt out. Who in the world would say yes to this? Well as it turns out the rate shot up anyway and the card was closed because somewhere in the clause, not opting in was reason to move on the change. Furious I had my attorney draft up a letter and we sent it to Chase. They managed to get the rate back down. No late payments. Years of on time loyalty mean nothing here. Even a solid FICO score. My attorney just shook his head and said he is seeing this over and over.

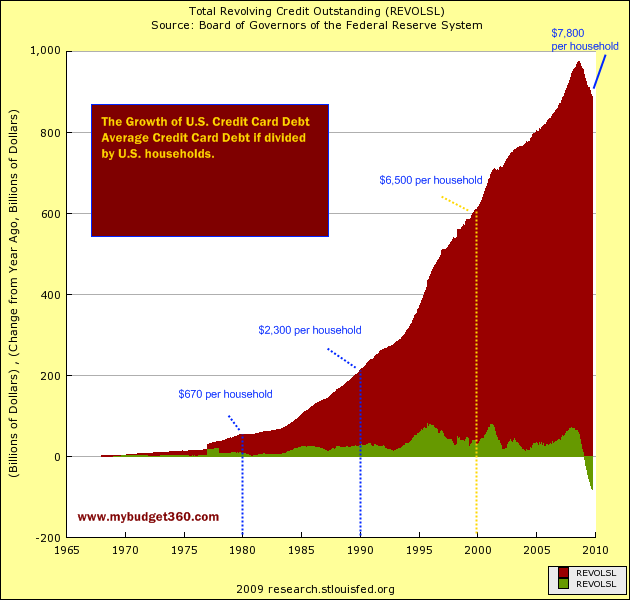

Part of this comes from the massive growth in credit card debt over the years:

In 1980 the average U.S. household held $670 in credit card debt. That number today is up to $7,800. Nearly $900 billion in credit card debt is outstanding. This is money that is created out of thin air. Think about a credit card transaction. You don’t have the money technically and neither does the credit card issuer. Once you buy say a flat screen or food, you’ve just created “X” amount of money on your purchase. Yet that money wasn’t there before your purchase even though you may think your credit line is actual money. As many people are now realizing many credit card issuers are now pulling back lines to shore up their beleaguered balance sheets. Many made the critical mistake of thinking of their credit line as some form of savings account.

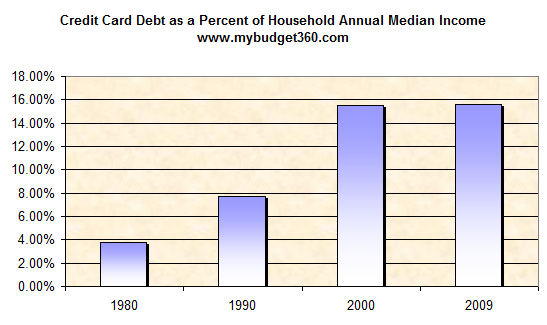

As you can see with the green above in the chart, for nearly 30 years each year saw more and more credit card debt. That is until this massive crisis. We have reached an apex of debt. You might say that incomes have grown during this time. That is true but more is eaten up as a percentage by credit card debt:

Back in 1980 credit card debt on average was slightly below 4% of U.S. household annual median income. Today that number is over 15 percent. This seems to be the breaking point. Let us not even couple in the massive amount of mortgage debt brought on by the gigantic housing bubble. Americans were spending more and more with debt that really didn’t connect to their actual economic status. Now, many are facing the grim prospect of paying inordinate amounts of money to credit card companies that are looking to suck every last penny out of debt holders. The same people credit card companies wooed with 0 percent 12 month offers are now getting rates jacked up and having traps setup in every imaginable path on the road. And the only legislation we can get is that they won’t scam Americans as much as they once did? Come on now.

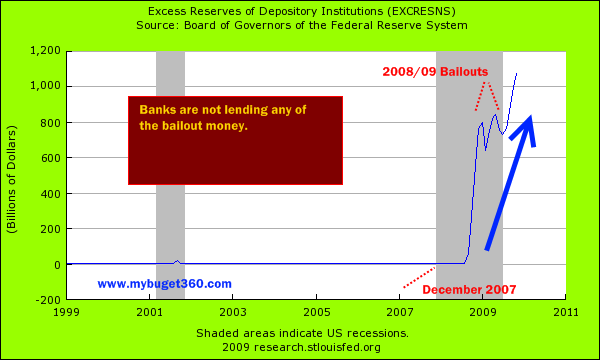

It would be one thing if credit card companies that are connected to the too big to fail banks didn’t take any taxpayer money. Instead, the American taxpayer is backstopping the banking and corporate oligarchs to the tune of $14 trillion. And what are banks doing? They are hoarding the money:

Banks are holding onto some $1.1 trillion in excess reserves. As we saw in our earlier chart they are doing the opposite of lending by pulling money out. It isn’t that banks don’t want to lend but they rather gamble in the stock market casino and make egregious amounts of money on the backs of struggling Americans. And what do we get? A nice letter in the mail telling us they will tone down their screwing of us via outrageous credit card practices.

I did an article a few months ago talking about an insane 79.9 percent credit card offer. Some doubted this but it is no joke:

“NEW YORK (AP) — It’s no mistake. This credit card’s interest rate is 79.9 percent.

The bloated APR is how First Premier Bank, a subprime credit card issuer, is skirting new regulations intended to curb abusive practices in the industry. It’s a strategy other subprime card issuers could start adopting to get around the new rules.

Typically, the First Premier card comes with a minimum of $256 in fees in the first year for a credit line of $250. Starting in February, however, a new law will cap such fees at 25 percent of a card’s credit line.

In a recent mailing for a preapproved card, First Premier lowers fees to just that limit — $75 in the first year for a credit line of $300. But the new law doesn’t set a cap on interest rates. Hence the 79.9 APR, up from the previous 9.9 percent.”

And before you think that poor people are going out of their way to seek this kind of financial destruction, think again:

“The bank typically mails offers to subprime households, meaning those with credit scores below 700. In the third quarter, however, 84 percent of its offers were sent to subprime households, down from 91 percent the same period last year, according to Synovate.

First Premier could be cleaning up its credit card portfolio since the new regulations will limit its ability to raise interest rates. That could mean First Premier won’t issue cards as liberally to those with bad credit.”

It is enough to make your head turn. How is this beneficial to anyone? How is this even legal after we just went through an economic collapse that came close to rivaling that of the Great Depression? Credit card companies and their banking parents have absolutely no shame. Time to bust these trusts up.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Willow said:

Like I said earlier, just stop. Go with cash only. Stop paying your credit cards. Those assholes have been paid already with your tax money. Why pay twice? If they want money tell them to get it from your personal account at the Federal Reserve. If everybody just blew them off they’d been out of business and you’d have cash. Forget your FICO score. It’s a scam to keep you in line. You are not your FICO score. Seriously, what are they going to do when over half the population’s FICO score is in the toilet? They’ll just change the criteria.

This is a Ponzi scheme. With what the banks are paying in interest on your savings account you might as well stuff your cash in the mattress. Forget the stock market. Get your money out. It’s like lending cash to a casino. Why bother? If you need to put you money somewhere (and who doesn’t?) buy a small house for cheap and rent it out. Plenty of tax exemptions there. Otherwise, the cereal box seems to be just as good.

Seriously, is there ANY BANK in the world that is run right? Mr. 360 do you know if there is ANY BANK that isn’t a rip off? I’d certainly like to know.

Thank for the articles. I read them all the time!

December 23rd, 2009 at 7:59 pm -

Lloyd G. said:

The banks are not lending, so we have the gov’t stepping in to play the role of subprime lender: Encouraging people to consume through programs like Cash 4 Clunkers and the homebuyer’s tax credit. Unlike subprime lending, the gov’t dumps the cost of these programs on people who do not benefit.

December 27th, 2009 at 7:06 am -

JP Merzetti said:

I like Willow’s take.

I’ve been thinking for some time now….that if more folks just plain stopped: do what they can actually afford to do, and no more.

Can’t afford the house? Rent. Can’t afford the tuition? Use a library for free. Can’t afford the car payments? Save up for a decent beater.

And so on…..Why does this seem so radical? Why do so many seemingly intelligent people jump on this line of reasoning as some kind of cop out? If you only earn 40 thousand a year, this means you don’t earn 80. Hell, it means you don’t even earn 50. It means just what it means….a number that is only representational of itself.

Numbers have a way of biting your butt, if you ignore them. They’re worse than terrible toddlers.

I dunno…..if they offered me the job of star spangled dictator or something……..the first thing I’d do is make debt and its accompanying interest payments illegal for a year. No-one buys anything on credit.

But seriously – I guess they’ve pushed the envelope far enough and hard enough that a lot of people are going to arrive at this point all by themselves anyway.

And then we’ll see what the credit hounds do….as all that tasty compound interest slips away like wolves into the mist.Get ready, Freddy…..the American dream has turned into a nightmare.

March 13th, 2010 at 8:18 pm -

Spyderbilt said:

Lengthening the maturity of outstanding fixed interest US debt will increase inflation fears. A longer average maturity allows the US to inflate its debt away. Debt holders will not trust the Fed to keep inflation low while the US has a very high debt level.

April 19th, 2010 at 12:15 am