The crisis of solvency – peak debt, peak food stamp usage, and massive financial deception by media. The faux economy of solving a solvency issue with more debt. Job postings up but hiring flat.

- 6 Comment

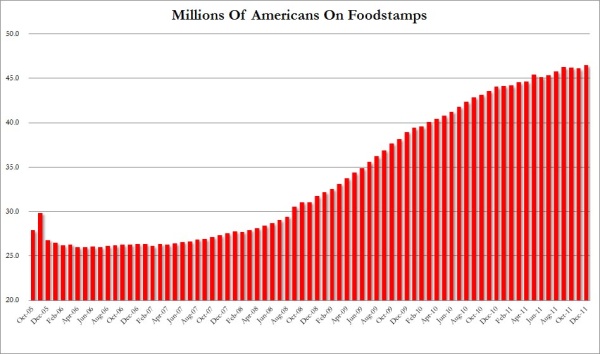

The economy is largely running on a solid amount of debt, Orwellian news, and selective perception. Take for example the absolute lack of coverage on our peak debt situation. The media simply assumes that going over the $15 trillion mark on national debt was somehow a story not worth reporting. The total amount we have taken on in borrowing is larger than our annual GDP yet countries around the world are being chastised for this exact problem. Or what about the peak number of Americans now on food stamps? One out of every seven men, women, and children is now on food assistance at well over 46,000,000. You get food assistance when you are economically scraping by. Yet the media is largely absent on this story. We are living in a crisis of solvency and much of the recent recovery is simply a choice of ignoring glaring issues of solvency.

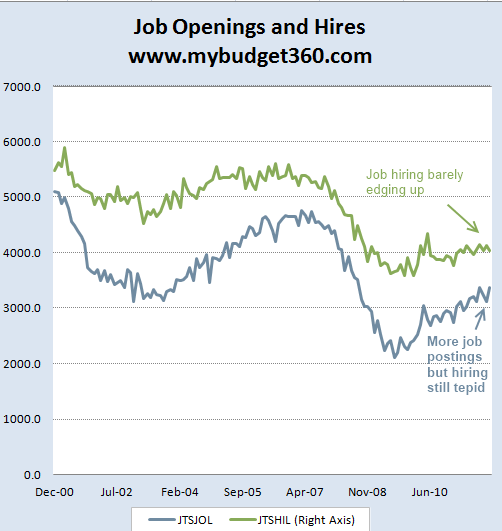

Are people really hiring in large numbers?

I keep seeing articles about the massive number of job hiring recently. Yet examining the data shows us a somewhat different perspective:

The above data is really a reason why most average Americans feel very little in the form of economic recovery. Job postings are solidly up from the lows in 2008 but look at the number of people actually getting hired. While job postings are up well over 1 million since the trough, job hires are still near bottom levels. It is very different to post a job than to hire an employee. From the hiring data we are seeing we are witnessing a large surge in low-wage service sector jobs. This of course is better than nothing but also explains why expensive items like housing continue to move lower in price. It would be hard to sustain a big mortgage on a minimum wage.

The above also leads us to the large number of Americans simply working on a part-time basis:

Source:Â Department of Labor

The employment numbers look healthier because we have over 2,500,000+ Americans working part-time jobs because they have no other choice. These people are not part of the media headline unemployment figures so of course the numbers look rosier than they are. Even if you were working a few hours at your local food chain you are technically not part of the headline unemployment number. In fact, you might even be receiving food assistance with that low-wage and are part of the working poor:

Source:Â Zero Hedge, SNAP

Does the above chart look like a recovery? Is it any wonder that a boom in the current economy is with dollar stores and that dollar stores now have roughly half of their stores made up of food items? I’m not sure if this is what we had in mind for a recovery. The fact that wages have ticked up recently is a misnomer because this reflects the few that are getting higher wage jobs but excludes those unemployed from the averages. If you throw in a bunch of zeros from those that dropped out of the labor force the figures would be dramatically different.

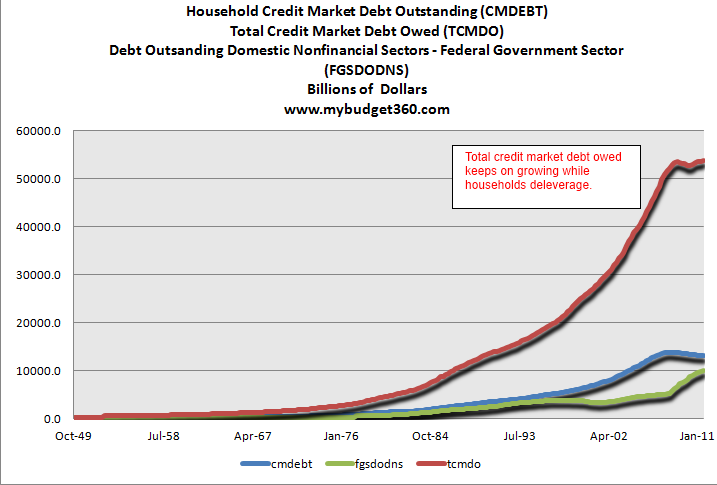

The crisis of debt

While American households are forced to painfully de-leverage the government and financial controllers basically keep printing and bailing each other out:

The total US credit market is now over $53 trillion. This amount will never be paid back just like the debt that Greece, Portugal, Japan, or many of the countries around the world have. The reason the bailouts in Greece are failing is that you can’t solve a solvency problem with more debt. If this were a short-term liquidity crisis then maybe these tools would work. But this is similar to those underwater homeowners that get mortgage modifications or extensions. Ultimately no amount of creative financing is going to allow someone making $25,000 to keep their $200,000 mortgage, low rate or not.

The media has largely ignored this massive surge in debt, the crippling number of Americans on food assistance, and has failed to examine the job numbers closely. In other words the media has chosen to willfully ignore the most pressing issues facing the current economy for working and middle class Americans. Let us not even begin to discuss the 5 million completed foreclosures and the 2 to 4 million that are sitting in the pipeline. Remember, a debt problem can be solved by more debt according to their logic.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

Terry Pratt said:

Interestingly, a low-wage job recovery could increase the number of people on food stamps.

Eligibility is based on income minus (rent/mortgage + medical expenses) with a maximum eligible income. Job growth drives household formation (e.g. Junior is unemployed and still (or again) lives with Mom and Dad, but when Junior gets a job he moves out and rents his own housing) and, in turn, reduces rental vacancy and promotes higher rents.

Low-wage workers currently employed (i.e.the vast majority of low-wage workers) will generally become worse off due to higher rents, increasing their eligibility for food stamps.

March 6th, 2012 at 10:09 am -

matthew schwartz said:

Brilliant and simply put. If I can understand this, not being a financial person in any way, you’ve explained it terrifically.

March 6th, 2012 at 6:00 pm -

john smith said:

keep up the good work! somebody needs to keep on telling the TRUTH!

March 7th, 2012 at 6:30 am -

clarence swinney said:

THANKS

March 7th, 2012 at 9:39 am -

BURTON ANDERS SVEINE said:

The real and causal necessity of stopping the insane spending of government will literally close down many of the open and notorious doors forever. Smaller government means less dependence and smaller programs thereby stopping the nonessential spending. Let us educate the undereducated and get them off the dole.

March 8th, 2012 at 12:14 pm -

daan said:

As long as household income increases only keep pace with the official CPI, while true cost of living increases at a rate much higher (see ‘real’ CPI at shadowstats.com) as has been the case for too long, American working households will become more and more impoverished. While this trend continues, even $3 trillion deficits will not succeed to kick start the economy – only make the bank bonuses bigger. To me this is the single factor that is going to topple the US off the top of the global heap.

August 7th, 2012 at 12:38 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!