Inflation eats away the new peak in stock market: Dow is down 11 percent since 2000 adjusting for inflation. Looking at the stock market and the impact of inflation.

- 3 Comment

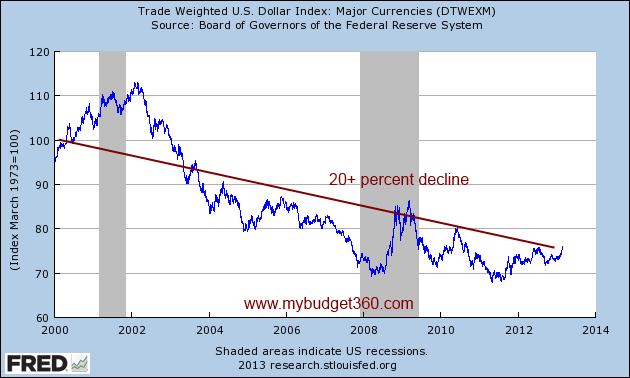

The Dow has now reached a new peak. The media is prancing up and down like a giddy school girl as if this had a significant impact on the bottom line for most Americans. Don’t let the details out that many companies have increased their bottom line by squeezing wages and cutting worker benefits. Yet the mainstream press can’t even get one thing straight with inflation. The Dow is actually down 11 percent from where it was in 2000 adjusting for inflation. After all, a dollar is only worth as much as it can purchase in the economy. The US dollar has been hit over this period as well. Real household wages are back to levels last seen in the mid-1990s. So the Dow “peak†is really more symbolic and many Americans realize this. Let us take a look at where the stock market stands today through the lens of inflation.

Inflation erodes stock gains

The Dow really isn’t the best indicator of overall stock performance since it only follows a small number of companies. These are handpicked companies and the track record isn’t perfect. After all, they even had AIG and Citigroup until a few years ago. A better measure would be the S&P 500. The S&P 500 adjusting for inflation is down in real terms about 26 percent from the peak reached in 2000:

The Dow itself is down about 11 percent. This matters because inflation has eaten away at the purchasing power of the dollar over this time. Think of the cost of health care and education over this period and you will realize that things have increased in price. The press is latching onto these gains because it makes for good headlines. However, the vast majority of stock wealth is accumulated in the hands of very few Americans.

It is also the case that many companies are making profits abroad and many are likely not paying their fair bill when it comes to taxes:

“(PolicyShop) The CTJ analysis focused on Fortune 500 companies and found “that 285 of these corporations had accumulated more than $1.5 trillion in overseas profits by the end of 2011. . . ” The analysis also found that much of these profits were untaxed because they were in tax havens — representing several hundred billion dollars in lost revenue to the U.S. Treasury.â€

While you and most other Americans need to pay taxes on what you earn here, many companies are not. So when you see the Dow peaking just remember that food stamp usage has also peaked and the average per capita wage is $26,000. This new gilded age is highlighting some serious fractures in our economy. The U7 rate of employment is still near a peak as well showing that many have dropped out, are part-time employed but looking for full-time work, or are simply disenfranchised from the current market. The U7 rate is over 16 percent.

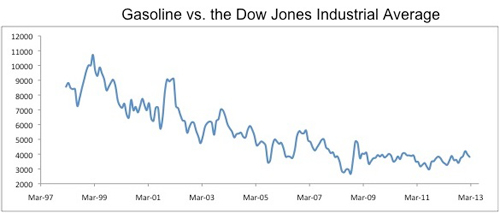

It might be helpful to illustrate the impact of inflation and how it skews the Dow. Let us look at the Dow priced in gasoline:

Source:Â Zero Hedge

This is a really interesting way to put the current Dow in perspective.

Dow will buy 3,812 gallons of gasoline (Today)

Dow bought 10,718 gallons in March of 1999

This is the impact of inflation on your purchasing power. Since most Americans own relatively little stock, much of what is going on does not really impact their quality of life. It should come as no surprise that half of Americans have absolutely no retirement plan. Maybe the plan is for the Dow to double from here yet again and hit 28,000. Remember this book?

This book was published back in 2000. Ironically, we are back where we were then but in real inflation adjusted terms, we are back to the 1990s. We’re only 22,000 points away from Dow 36,000. Maybe the Fed can go the way of Japan and flat out purchase stocks directly. I’m sure the $3 trillion on their balance sheet wouldn’t mind. The US dollar seems to enjoy this Fed policy:

Inflation does matter. Food stamps are a sign of prosperity. Down is up. Orwell would be proud of our financial press.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

ted Kramedas said:

In the 1950s, a family could live on 1 salary.

Today many families are struggling on 2.

No prosperity there.March 12th, 2013 at 1:01 pm -

John Galt said:

thanks for the article. this topic needs ALOT more attention as inflation has been eating away at everyone’s wallet and it’s only going to get worse. from the upper middle class down it hurts the most.

March 13th, 2013 at 5:29 am -

chris said:

One thing missing from your article is adding on dividends. I bet when you factor in the dividends, the market is about where it should be.

April 4th, 2013 at 6:27 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!