European economy struggles under debt and staggering unemployment: EU unemployment at record while nations pile into massive levels of debt. Inflation censorship.

- 2 Comment

The European Union is the largest economy in the world combining the collective buying and selling power of multiple countries. If you’re biggest customer is having troubles, it is expected that the world would be concerned. Not so with the stock market. The EU is currently sitting at a high in respect to their unemployment rate and nations continue to be weighed down by enormous levels of debt. This is what is crushing Spain, Italy, and Greece. Yet there seems to be some underlying euphoria in all of it. Similar to our US market, the stock markets simply do not reflect the underlying fundamentals in these regions. This is why at the same time the Dow reached a peak, we reached a peak in food stamp usage. The EU is still facing deep economic issues but the markets do not seem to care. Probably because only a small portion of the population is even participating in the markets.

Unemployment

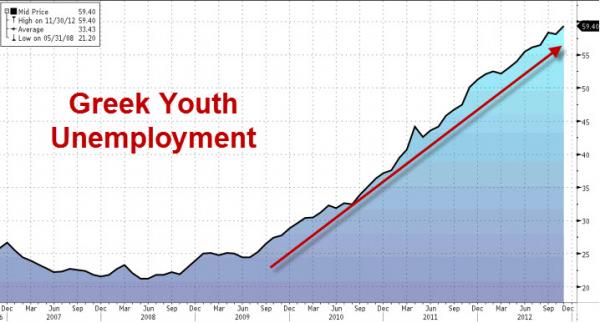

One of the more dramatic issues in Europe is that of youth unemployment. In both Spain and Greece the young are facing a very challenging market. I’ve seen articles talking about how Greece is recovering so I had to take a look at how the employment market is doing:

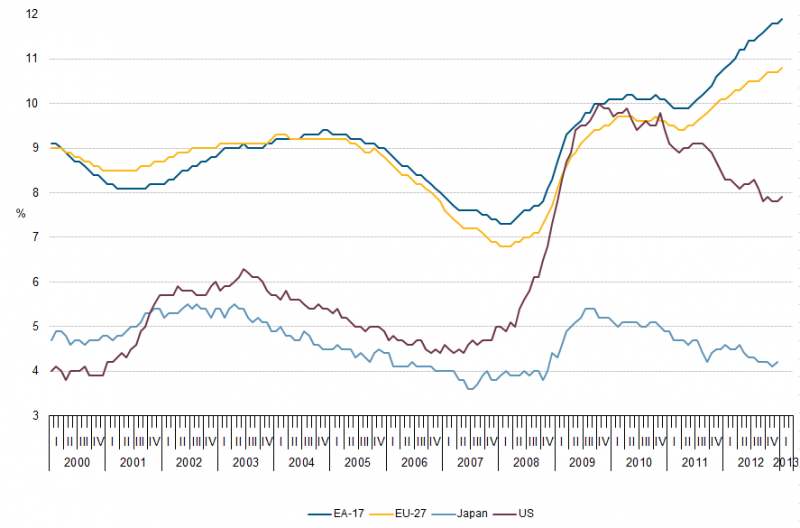

Almost 60 percent of Greek youth are unemployed. How is this even remotely construed as a recovery? Spain is over 50 percent. And the EU is struggling overall reaching a peak in their unemployment rate:

The EU has reached a peak level in unemployment so their underemployment is likely much higher just like it is in the US. The US has shifted more to a low wage capitalist economy. Japan looks healthy above but you need to remember that about one-third of all workers in Japan are on a contract basis. That is, they are temporary workers with very little job security. The US if we look at the part-time for economic reasons labor force has increased dramatically throughout this recession.

The rising stock markets in the US are also not trickling down to consumer sentiment that has reached a 15-month low:

Why are Americans not out on the streets celebrating the peak in the Dow? Could it be that the top 1 percent controls the vast majority of financial wealth and 1 out of 3 Americans don’t even have a penny to their name let alone are investing in the stock market? If the Dow were a better indicator of the true health of the economy, wouldn’t you expect to see consumer sentiment moving up as well? Of course. But household income has moved back to where it was in the mid-1990s and inflation contrary to what is being published in the press, is very much real. Since 2000 everything has gone up in price including housing, healthcare, and college tuition.

It is odd because the CPI looks at owner’s equivalent of rent as their main source for housing prices but this has been a poor indicator throughout the housing bubble and during the bust. Yet this is the biggest component of the CPI. The EU peak in unemployment also does not reflect the large levels of debt taken on by countries like Italy, Spain, or Portugal that have major issues for years to come.

The fact that the EU is currently facing a record unemployment level would give pause to massive euphoria. But the US consumer sentiment figures tell you that the only euphoria is really with the media and the misguided idea of thinking the Dow is telling the true story of the US economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Paul Verchinski said:

The stock market is being fueled thru out the world by easy money provided to banks by sovereign Central Banks. GDP for the FIRE sector is now about 25%. This does not translate to jobs and a healthy economy. Hedge funds have multiplied for the wealthiest that just trade financial paper unrelated to the Main Street economy. All central banks are now providing this easy money which is now resulting in currency wars. One misstep and this whole debt house of cards comes down! The rush for the exit when this occurrs will rival 1929.

March 16th, 2013 at 5:53 am -

John B. said:

This article is true, but I would not see it that serious right now. We know from a long empirical evidence that stock markets never reflect reality. It is much better to see long term data for unemployment and household income to be able to really see if there is a problem. Another important thing is immigration and influx of new people, who can´t re-establish new relatins and connections with the world.

Economic data serves our interpretation, and we can be wrong. So don´t overemphasize your thoughts. There are probably many more variables, and the whole system is so huge and interconnected that it would take decades to tear it down into ruins. Maybe it started right now, maybe there will be another economic boom and we will be better off in one decade again.

March 19th, 2013 at 2:36 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!