FDIC: Punishing Savers: How the United States Encourages Irresponsible Financial Management. Federal Deposit Insurance Corporation.

- 5 Comment

The FDIC insurers deposits at most institutions up to $100,000 for individual accounts. Many people haven’t put this to the test until the recent collapse and takeover of IndyMac Bank based out of Southern California. The bank when taken over had $32 billion in assets and $19 billion in deposits. $1 billion in these deposits was over the $100,000 limit.

The FDIC has a war chest of slightly over $53 billion to bailout these institutions with IndyMac expecting to come at a price tag of $4 to $8 billion. The reason for this article’s title is that in the United States, there are easy and simple ways to encourage saving money yet the government has purposefully created a system where the majority of people will end up with very little. How so? Well for one the FDIC with the implicit guarantee of $100,000 creates a false hope of stashing money with insolvent institutions. For example, just a few weeks before being taken over IndyMac was offering CDs with a rate over 4%. This is simply beyond what many solid institutions are offering. Yet they are able to offer this amount to shore up liquidity and savers, even those knowing the bank is on the verge of collapse rush in for the high yield knowing the FDIC will backstop their money.

What this does is encourages a feeding frenzy at the last minute before the institutions takes its last breath. Instead of depositors running away they see the high yield and dash in to load up. Now what if you as a saver knew your money had no backstop? Would you flush your money into this bank simply because of a higher yield rate?

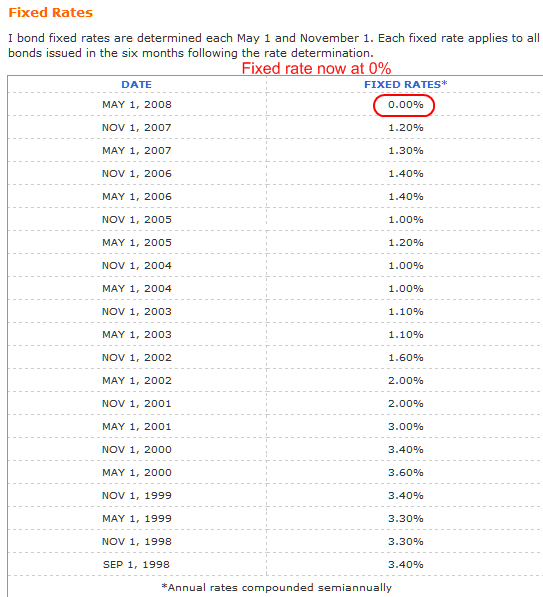

One way for Americans to save their money is with U.S. Treasury I-Bonds. Now during boom times, these investments were seen as a low-yield play with not much upside. The I-Bond has two components; a fixed component and one that tracks the CPI. The overall theme of the I-Bond was to protect your principal from inflation and provide a slightly better return. Pretty good deal right? Well during the fiasco with IndyMac the FDIC took them over while they were pushing higher rates while I-Bonds have gone the opposite direction:

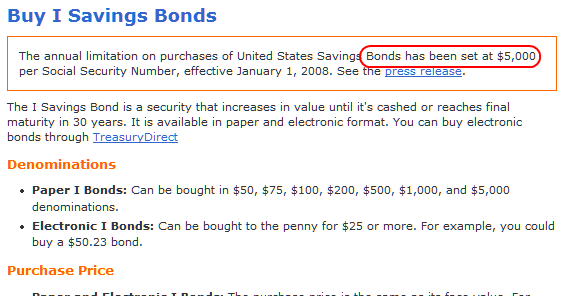

So the fixed rate on these I-Bonds have progressively gone lower and lower. Of course as anyone will learn in economics class, lowering your rate will actually push demand away from the investment. In addition, it used to be the case that people were able to invest up to $30,000 a year in I-Bonds but now, the U.S. Treasury in their infinite wisdom has dropped the maximum per year to $5,000:

Now if the United States really wanted people to be saving wouldn’t they market these more to the general public? Nope. Instead, they are trying to uphold problematic institutions like Fannie Mae and Freddie Mac which continue the debt spiral we are in.

The reason these I-Bonds are valuable is that at least your principal is secure. And as shoddy as the CPI is, you know that you will never lose your initial funds. But now with the fixed rate stripped out and only a $5,000 cap per year, this is a limited investment for investors. Also, their online accessibility isn’t as savvy as say an ING Direct account where you can easily access your account. In fact, you now have to use a key card to enter! So first, you have to enter your account (which isn’t memorized) and then, you have to use a plastic card to enter! ING and Emigrant Direct use other more accessible security features so you can enter into your account.

They say these are security features but I assure you these features only keep people from logging in and making say a $200 deposit when funds come in. This is the problem with the way things are going. Those that want to save and save prudently are being completely punished and are forced to put their money into what, the stock market? How’s that going for people? Some will be happy simply tracking inflation and now with major bank failures, these securities should be marketed as a way of bolstering the balance sheet of the United States. Yet the fact of the matter is the United States doesn’t want you to save. The way they set things up is simply punishing savers.

Is it any wonder why the U.S. Dollar keeps falling lower and lower?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

5 Comments on this post

Trackbacks

-

John said:

At what point will people start seeing, and admitting, that we are in the end game of what the Reagan-elevating cabal set up 30 years ago–the corrida of the nouveau riche? The age of designer this, luxury that, and gourmet the other. The age where everyone spent like a drunken Congressman (on other people’s dollar), where bling was king, and, as Gore Vidal said, “There is a lot to be said for being nouveau riche, and the Reagans intend to say it all.”

This is, of course, also part of a larger contraction of the 60-year postwar expansion. But I’m a news junkie–with a strong taste for economic news. I’m convinced that things need not have been this bad, never mind how much worse it’s going to get, if “scamming uber alles” and the worship of Benjamins hadn’t been the national philosophy for the past three decades.

Saving, investing, frugality, working for one’s living–all these have become games for chumps. REAL Americans go into debt, shop, spent, take luxury cruises, fly to Las Vegas for Hallmark holidays, and compete to see just how much they can waste in how little time.

It would be nice to think that only the reckless and irresponsible will be ruined. But just as with environmental overshoot, everyone is going to suffer for the greedy. It’s a bit like a family where both parents are alcoholics or drug addicts: there comes a time when things really have to change, and should have changed long ago. But mom and dad have nothing to reach back to, having wasted it all.

John

July 15th, 2008 at 3:40 pm -

Johnny said:

Excellent article and also a good cooment by John. I’ll only add that whenever you hear a MSM talking head saying “nobody saw this coming” or something akin to that, call BS immediately. There are lots of us who “saw this coming” for years. The web is loaded with historical records of this. I saw it coming back in 1980, in high school, having classmates who threatened lawsuits when teachers made them work too hard. Truly, it HAS been a Nation of (under-productive, over-consuming) Whiners for about 30 years.

July 15th, 2008 at 9:28 pm -

Donald Mayfield said:

This is an excellent article and reflects my personal experience. In 1998, my business failed and I had lots of debt. I had an acceptable business plan for my business but not for family finances. I sold my house and started over again. I slowly started paying all off credit card and other debt while working in low paying jobs. My business sector was on technology. I started saving and saving every nickel and dime. In a few years I noticed that I was now in the black. Business got better but I never spent more than I needed to survive. No cell phones, cable TV or extras. I shut off my AC in the summer and shut off the heat in the winter. I only bought food (rice and beans) on sale and bought clothes at the second hand store. I discovered I bonds and bought the maximum amount possible which was 60k per year. If I received money I put it in another bond or a saving account. All this time Realtors and other liars tried to humiliate me and tell me that I was a loser for not paying $400,000 for an old 1926 fixer. I quickly noticed that my voluntary 401K and IRA (no employer contributions) were looking suspicious. I found that NONE of the long titled “financial planners” aka commissioned salesmen knew these terms: MBS, CDO or securitized assets. I gave them two weeks, and got nothing but HOT AIR and excuses: This is just a typical market cycle blah blah lie lie. SI I asked them if they would cover me if their investment advice LOST my self financed pension plan. The said “No” and I said NO THANKS. I am pulling out ALL OF MY MONEY including the conservative money market funds. I did this last summer, and have been watching daily as my pension and savings would have lost the value representing all OF MY HARD WORK AND SAVINGS. I told them I saw nothing wrong with waiting for the depression to hit big time and start dollar cost averaging slowly back in. The most I would have ton lsoe was less by doing it this way than riding the roller coaster which was spitting out commission checks to them along the way.

Here I am today, my investments are almost dead, but they ARE NOT GOING DOWN APPRECIABLY—since I still save everything into 95K maximum savings accounts. I learned two things. I would have MORE sacings and the GOVERMENT could use MORE of my money— IF and only IF Secretary Paulson would have not changed the rules on buying I bonds. I found out through a banker that hundreds of millions of dollars were being pulled out of banks and were going into the purcahse of I bonds. PAULSON WAS INTENTIONALLY PUNISHING SAVERS to help his BANKER FRIENDS. HE IS A TRAITOR and should indicted for criminal fraud. The banks and Wall street figured they would get “their” money back by choking off I bonds.

Mr Paulson took an OATH OF OFFICE under false pretenses. His REAL OATH is to the Banking industry ONLY. How can the CEO of Goldman Sachs switvh go being a capitalist to being an advocate for ALL Americans—NOT JUST BANKS AND WALL STREET. When I learned of the new policy last December, I wrote letters to all my congressman and Senators from California. My responses. Both Senators Boxer and Feinstein wanted to know WHY I WAS SAVING MONEY. They recommended other investments — OTHER THAN I BONDS. They are also traitors and advocates for the bankers.

I contacted the Secy of Treasury Offices and asked them WHY the change in policy? Were there studies to show that the US Treasury was being injured by savers. Their response was. Our studies show that few people used I bonds and therefore we thought it best to not emphasize using them. Okay…I asked what congessional committees or other studies were involved in making the decision. THERE WERE NONE. Secy Paulson sneaked his decision through NOT BASED ON ANY economic studies===Try to find them. They don’t exist. At least until they make them up after they get indicted. Paulson is a crook plain and simple, HE IS A LIAR. He can show us his studies and congressional discussions to show us—NOTHING. HE IS ONLY a WOLF in a chicken coop. He must be removed and replaced with an advocate for all Americans . This is where I am today.

I still have a modest income. I am a renter. I received the full amount of my IRS stimulus payments—REMEMBER President Bush and Bernake and Paulson–THE THREE STOOGES said many times—PAY OFF BILLS – BUY STUFF. DON’T SAVE THE MONEY. I saved it all—and still live frugally. I have saved over $400,000 CASH savings ALL POST TAX. I can easily pay cash for a house BUT WILL NOT until prices get back to 1998-1999 levels. I still drive my 1992 car and wear my 1998 clothes. I LOVE TO WATCH the people who have made fun of me all these years—struggle with the DEBTS THEY MADE> My last landlord was evil—In 2004 he bought and flipped my residence and doubled the rent OVERNIGHT. He was an evil person—angry nasty laughing at me–“YOU ARE RENTER—stupid dumb yuppy” “Me” is smart—I own millions of dollars worth of houses. He bought six houses that year.

Today, he is a renter—he owes unpiad taxes to the IRS for the next ten years- with interest and penalties. He had all houses foreclosed—

He had all his expensive cars and boats repossessed he bought via HELOCS.

NOW THE GOVERNMENT WANTS ME TO BAIL THAT CRIMINAL OUT!!~! AND MILLIONS LIKE HIM? NO WAY—I ate beans and rice for ten years—and he will eat his crap for the rest of his life. If I want. I can yank all of my money out of CREDIT UNIONS. QUIT WORK–so I can STOP PAYING TAXES. GO ON WELFARE—I KNOW HOW TO LIVE FRUGALLY–and let those crooks pay for me. I will do it all with legal advice first. LOL ROFL

July 15th, 2008 at 11:26 pm -

Donald Mayfield said:

This is an excellent article and reflects my personal experience. In 1998, my business failed and I had lots of debt. I had an acceptable business plan for my business, but not for family finances. I sold my house and started over again. I slowly started paying all off credit card and other concumer debt while working in low paying jobs. My business sector was in technology. I started saving and saving every nickel and dime. In a few years, I noticed that I was now in the black. My new business (self-employed) got better but I never spent more than I needed to survive. NO LOANS — NO soda pop, no fast food, No cell phones, cable TV or extras. I shut off my AC in the summer and shut off the heat in the winter. I only bought food (rice and beans) on sale and bought clothes at the second hand store. I discovered “I bonds” and bought the maximum amount possible which was 60k per year. If I received money I put it in another bond or a saving account. All of this time Realtors and other liars tried to humiliate me and tell me that I was a loser for not paying $400,000 for an old 1926 fixer. I quickly noticed that my voluntary 401K and IRA (no employer contributions) were looking suspicious. I found that NONE of the fancy titled and degreed accountant- “financial planners” aka commissioned salesmen knew these terms: MBS, CDO or securitized assets. I gave them two weeks, and got nothing but HOT AIR and excuses: “This is just a typical market cycle blah blah lie lie”. So I asked them if they would “cover me” if their investment advice LOST my self financed pension plan. The said “No” and I said NO THANKS. I am pulled out ALL OF MY MONEY including the conservative money market funds. TOO MUCH LYING—NO ACCOUNTABILITY– NO TRANSPARENCY—NO GOVERNMENT REGULATION—I did this last summer, and have been watching daily as my pension and savings would have lost the value representing all OF MY HARD WORK AND SAVINGS. I told them I saw nothing wrong with waiting for the depression to hit big time and start dollar cost averaging slowly back in. The most I would have to lose was less by doing it this way than riding the roller coaster which was spitting out commission checks TO THEM along the way.

Here I am today, my investments are substantial but do not keep up with REAL inflation (10-11% /year—I know the REAL value of a dollar), but they are not going MINUS APPRECIABLY—since I still save everything into 95K maximum savings per credit union accounts. I learned two things. I would have MORE savings and the GOVERNMENT could use MORE of my money— IF and only IF Secretary Paulson would have not changed the rules on buying I bonds. I found out through a banker that hundreds of millions of dollars were being pulled out of banks and were going into the purcahse of I bonds. PAULSON WAS INTENTIONALLY PUNISHING SAVERS to help his BANKER FRIENDS. HE IS A TRAITOR to the USA and should be indicted for criminal fraud and violation of his sworn oath to protect our constitution. The banks and Wall street figured they would get “their” money back by choking off I bonds.

Mr Paulson took an OATH OF OFFICE under false pretenses. His REAL OATH is to the Banking industry ONLY. How can the Ex-CEO of Goldman Sachs switch from being a capitalist to being an advocate for ALL Americans—NOT JUST BANKS AND WALL STREET? When I learned of the new policy last December, I wrote letters to all my congressman and Senators from California. Their responses. Both Senators Boxer and Feinstein wanted to know “WHY I WAS SAVING MONEY”—“spending is good for America” (Senator Feinsteins husband MR Richard BLUM owns a REAL ESTATE company and is a BANKER—He represents European bankers everywhere). The Senators recommended other investments — OTHER THAN I BONDS. They are also traitors and advocates for the bankers.

I contacted the Secy of Treasury Offices and asked them WHY the change in policy? Were there studies to show that the US Treasury was being injured by savers? Their response: ” Our studies show that few people used I bonds and therefore we thought it best to not emphasize using them.” OKAY where are the studies? “They are not published-but are classified” Okay…I asked what congessional committees or other studies were involved in making the decision. THERE WERE NONE. Secy Paulson sneaked his decision through NOT BASED ON ANY REAL economic studies===Try to find them. They don’t exist. At least until HE fabricates them after he is indicted. Paulson is a crook plain and simple. HE IS A LIAR AND A CHEAT. He can show us his studies and congressional discussions to show us—NOTHING. WHERE ARE THEY? Wwhere is the evidence? HE IS ONLY a WOLF in a chicken coop. He must be removed and replaced with an advocate for all Americans . This is where I am today.

I still have a modest income. I am a renter. I received the full amount of my IRS stimulus payments—REMEMBER President Bush and Bernake and Paulson–THE THREE STOOGES said many times—PAY OFF BILLS – BUY STUFF. DON’T SAVE THE MONEY. I save it all—and still live frugally. I have saved over $400,000 CASH savings ALL POST TAX. I can easily pay cash for a house BUT WILL NOT until prices get back to 1998-1999 levels. I still drive my 1992 car and wear my 1998 clothes. I LOVE TO WATCH the people who have made fun of me all these years—struggle with the DEBTS THEY MADE!!! I LOVE THEIR PAIN !! THIS IS MY ENJOYMENT!! YESS!!! My last landlord was evil—In 2004 he bought and flipped my residence and doubled the rent OVERNIGHT. He was an evil person—angry nasty laughing at me–“YOU ARE RENTER—stupid dumb yuppy” “Me” “is smart” —“I own millions of dollars wort of housez.” He bought six houses that year.

Today, he is a renter—he owes unpaid taxes to the IRS for the next ten years- with interest and penalties. He had all houses foreclosed—

He had all his expensive cars and boats repossessed he bought via HELOCS.

NOW THE GOVERNMENT WANTS ME TO BAIL THAT CRIMINAL OUT!!~! AND MILLIONS LIKE HIM? NO WAY—I ate beans and rice for ten years—and he will eat his crap for the rest of his life. If I want. I can yank all of my money out of CREDIT UNIONS. QUIT WORK–so I can STOP PAYING TAXES. GO ON WELFARE—I KNOW HOW TO LIVE FRUGALLY–and let those crooks pay for me. I will do it all with legal advice first. LOL ROFL

MY PLEASURE TODAY? I got a call from a total stranger. He started acting sickeningly nice nice. Okay what do you want from me? I asked. He said I need a little money for two weeks. How much? I need 5–80 thousand dollars by tomorrow. I started laughing. You know, I am “only a renter” —“a stupid dumb renter”—and YOU own several houses and buildings and new cars. Why ask me? “I will pay you 50% of the loan – in two weeks. $75,000 for a 50k loan and $120,000 for an 80k loan”. Why don’t you get a second ot third on one of your properties? I asked. They aren’t giving loans anymore. How about your credit cards? They are all maxed out. How about those movie star friends of yours (true)? I don’t like to mix business with personal finance. Okay is that what you recommend? “YES” Than my answer is NO. Why should I mix business with personal finance–and you won’t? choke choke. Why do you need the money tomorrow? “I am really good for it – you know that?” Than why are YOU who owns all this stuff asking me–a lowly renter, for a loan?

Why tomorrow? HERE IS THE CLINCHER FOLKS. IF I DON’T HAVE THE MONEY TOMORROW- they will repossess my HUMMER! WHAT? I am renting—driving an old car–so this asshole wants me to loan him 50k for two weeks so he wont lose A HUMMER? BTW This jerk owns FOUR HUMMERS. CANDY APPLE colored paint jobs.

FOLKS THIS IS NOT FUNNY. PAULSON AND BERNANKE AND BUSH are DOING THE SAME THING. THEY WANT US LITTLE PEOPLE —who save money—who are frugal to eat beans and rice TO PAY TAXES SO THE BANKERS GET TRILLION DOLLAR BAILOUTS —so that billionaire investors keep sucking out billions and flying in private jets and we eat beans? EVERY CFIO AND CEO should go to PRISON —At ABU GRAIB OR GUANTANAMO if they lose ONE DIME—after the opportunity THEY ALL HAD to be prudent and make ggod profit with these mortgages. BUT THEY ALL GOT GREEDY.

I told the guy on the telepphone—who asked me for 50K— I have a “friend in Vegas” “his name is Guido or Luigi I forgot a spaghetti name”. If I have him call you—he will make you an “offer that you can’t refuse”. DO you want me to have him contact you? “Yes please”…”it sounds like you have more worries than a Hummer”

How will he know how to get in touch with me–you or he doesn’t have my telephone number” Ha ha ha OH I don’t think that will be a problem.

Well guess what? “—no Guido—No LUIGI–no Vegas” But the asshole doesn’t know that. He will be waiting –praying and bank interest is TICKING like a dripping faucet every second, every minute, every day, drip drip drip “money to the bankers” “money to the bankers” BUT NOT ME- when you are asleep — drip drip drip interest to the bankers—

on the weekend—on a holiday — drip drip drip more interest to a greedy banker. ALL THE BANKERS CAN FAIL… ITS FINE WITH ME.LOL LOL ROFL

July 16th, 2008 at 12:15 am -

Italian said:

Looks like the FDIC wants everyone put the savings into stocks, houses…

Here in Italy they tried to do similar things with our severance pay, that amounts to 4 weeks pay each year, and by law yelds interest automatically calculated to (1.5% + 75% of official italian CPI index, that is now 1.5% + 75%*3.8% = about 4.4%).

The amounts, you see, is not huge, but it is nice to know that it is earning interests, 4.4% pretax and risk free is not that bad.

Now they passed a new law “allowing” workers to take this money to fund a personal private pension account, managed by a fund of your choice.

This was done beginning last year, perfect timing…

40% or so italian workers agreed to take their money out of severance pay accounts and to put it in this vehicles.

You guess how these funds are going now…July 16th, 2008 at 8:00 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!