Fed extends a helping hand to Hilton Hotels and takes over malls across the country – The Federal Reserve clandestine bailout of the $3 trillion commercial real estate industry. South Florida apartment building prices down 52 percent from peak.

- 1 Comment

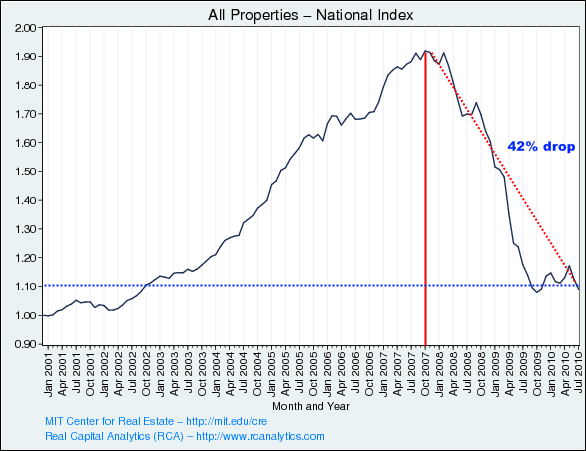

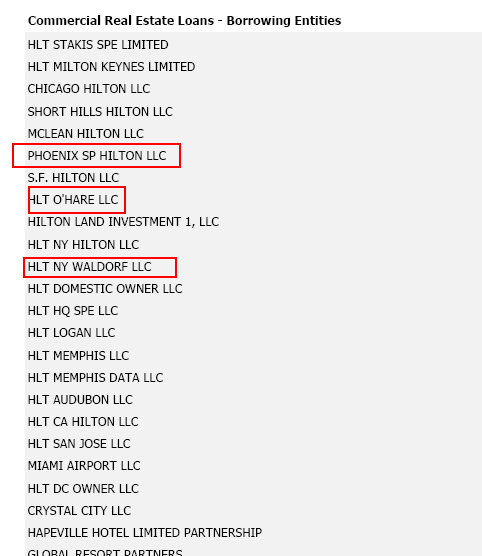

If you think residential real estate is having problems, you should shift your gaze to the mammoth issues confronting commercial real estate. Little is mentioned about commercial real estate (CRE) in the mainstream media yet this is a $3 trillion market (or twice the annual GDP of Texas). Much of the problems in CRE are profound and pose systemic risks to the banking sector. While the current attention is on fraudulent paperwork on residential housing, the biggest and most hushed bailout of commercial real estate is occurring. The Fed directly buying up questionable mortgages from banks is an indirect form of bailing out CRE. Yet in some instances, the Fed has gone ahead and directly taken on the role as owner for places such as a mall in Oklahoma. While U.S. residential property prices have fallen approximately 30 percent CRE has fallen by 42 percent.

Let us take a look to see where prices stand today:

Source:Â MIT

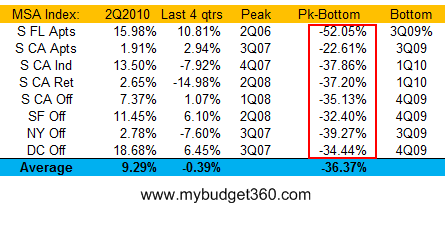

There is nothing that is remotely good for the economy with the data in the chart above. The CRE market has completely collapsed. Yet banks are simply rolling over loans even though values have collapsed and are merely keeping inflated assets on their balance sheet instead of recognizing losses. If we break out the above data into markets, we see the same coastal states with deep housing problems emerging again:

This is interesting data. For South Florida apartments prices have collapsed a stunning 52 percent from their peak. Yet in Southern California, apartment prices have fallen by 22 percent. The difference here is that residential home prices are still inflated in California while the Florida housing market has corrected fiercely. In many places it is nearly the same price to own as to rent (this is not the case in California). The above chart measures the actual price of the apartment building, not rents by the way. Yet these areas are not the only two suffering. New York office building property values are down nearly 40 percent from their peak. In other words, many banks would fail today if they had to mark to market the value of their CRE debt.  Â

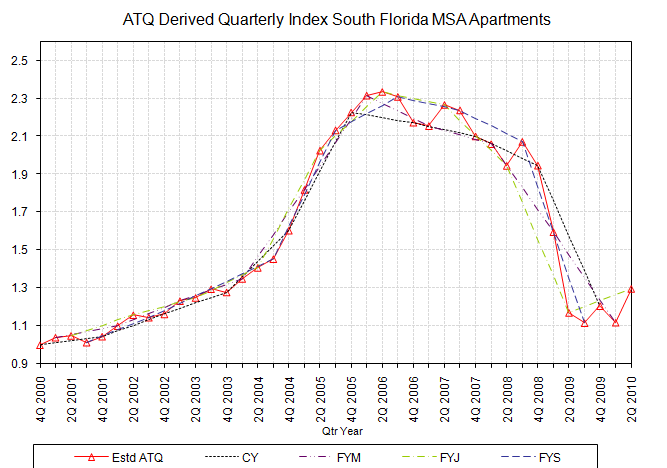

While the residential real estate market peaked in 2006, CRE values peaked in late 2007 and collapsed in 2008. Take a look at South Florida for example:

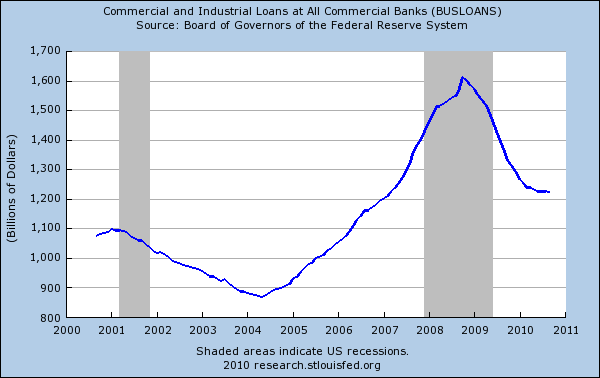

The dramatic price changes occurred in 2008. Many of the commercial and smaller banks are failing because of commercial and industrial loans. Contrary to market liquidity, these loans have been contracting slowly over the last few years but they are contracting because of smaller bank failures and the Fed taking assets off the books:

“So much for increasing liquidity.â€

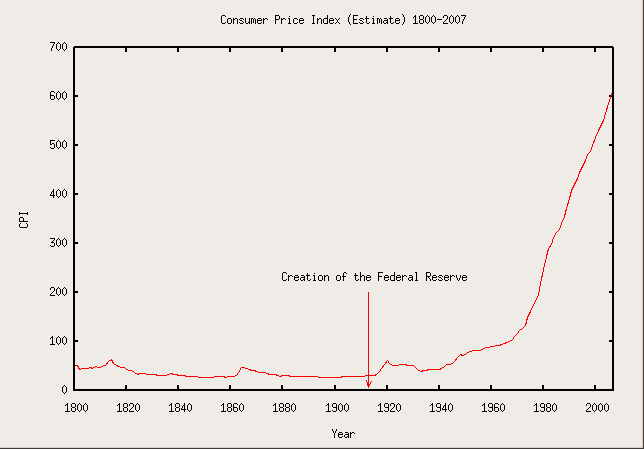

The problem with the Federal Reserve is that we aren’t allowed to do a full audit to see what they own. It is a fallacy to believe that what is occurring right now is typical of a central bank. Look at this chart and see if you see any normalcy:

And you can even look into the odd Maiden Lanes and other devices created by the Fed to purposely obscure what is going on:

Source:Â New York Fed

I’m glad we’re helping out those poor Hilton Hotels. I’m sure the 43 million Americans in poverty are glad that their bailout funds are being used to support the neediest in our country. No wonder why this bailout is happening behind the scenes. The public would be up in revolution if they only knew what the Fed has actually bailed out with their tax dollars. Some will say that none of this matters since we will earn our money back at some point in the distant future. But since the Federal Reserve was put into business in 1913 purchasing power has eroded with inflation:

“Can you spot where the Fed was created?â€

Either way, this entire real estate crisis is far from over and banks know it. Their data tells you everything you need to know and their raiding of the American people is simply incredible.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

robertsgt40 said:

Does this mean Paris Hilton will have to start smoking weed instead of doing coke?

October 19th, 2010 at 7:21 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!