Federal Government Budget Deficit in October is Three Times the Annual Budget Deficits of the Banana Republic of California.

- 1 Comment

California has been the poster child of ineffective state government. Bickering politicians, constant spending, and budget deficits that baffle the economic bottom line. But California isn’t alone in this spend more than you earn reality. Last year, California had to patch up $60 billion in budget deficits. A large and historical sum no doubt. Yet the federal government ran a $176 billion deficit in one month alone! In October the federal government brought in $135 billion in revenues (taxes) and spent $311 billion. This is not the kind of math you want to be seeing.

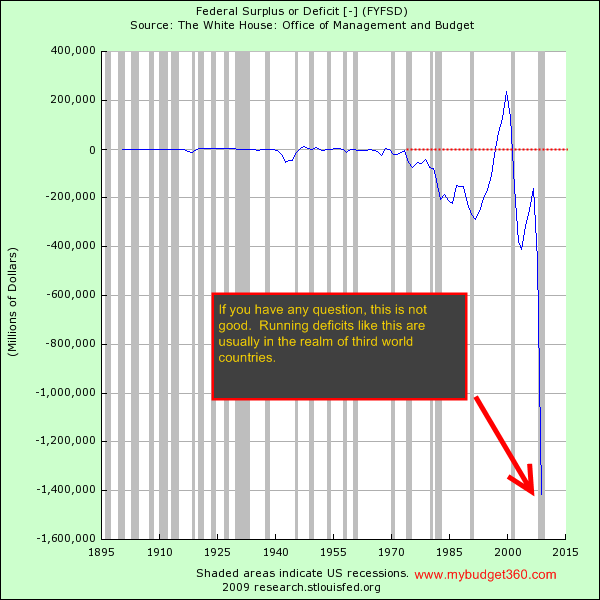

In fact, let us put this on a graph. Be warned, this is a financially scary graph but get used to it, since this is the future:

What a coincidence that in the 1970s when President Nixon took us off the gold standard, we suddenly started having epic swings in surplus and deficit spending. Without any standard, the fiat money world allowed our government to spend as much as the world would allow us and gave incredible power to the U.S. Treasury and Federal Reserve to print money out of thin air. The government is arrogant at best if it thinks it can print money and at same time, allow revenues to decline. Any company operating like this would be bankrupt in a short time. In our case, foreigners are starting to worry and are exiting dollar trades and pushing up commodities like gold.

I’m not a gold bug and I won’t recommend you go 100 percent in to gold. But make no mistake, gold is a trade against the stability of the U.S. dollar and the trust people have in the U.S. Treasury and ultimately our government. There is good reason to believe this is going to go on given the massive budget deficits we are now operating under. Now we are hearing whispers of stimulus version 2.0 and the Treasury has already talked about secretly bailing out the commercial real estate market.

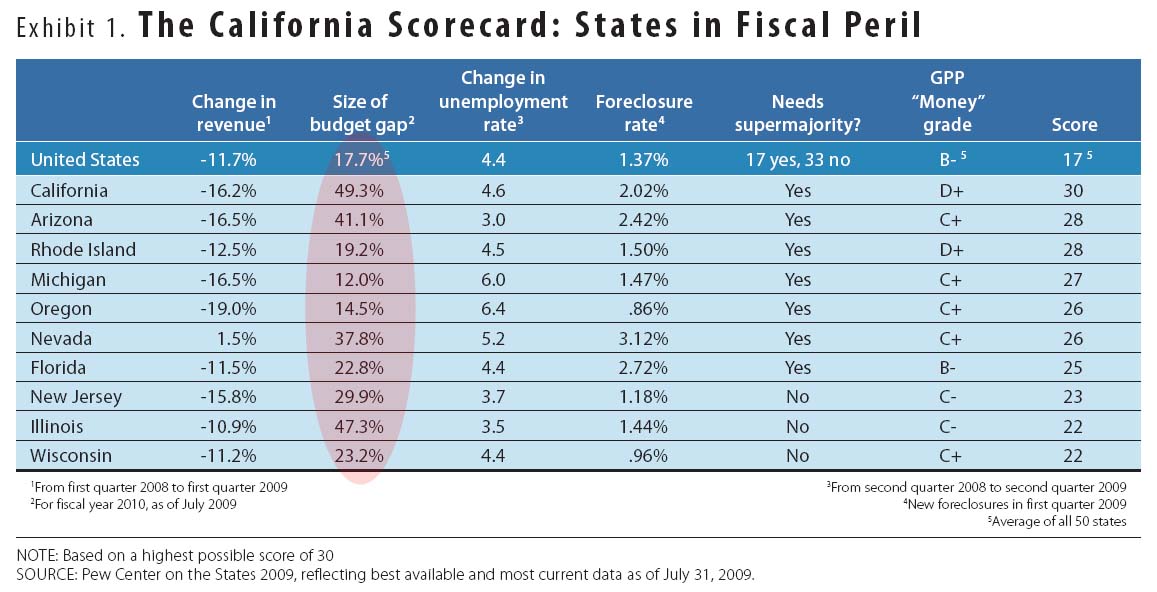

States unlike the federal government, have to balance their budgets. And many states are facing epic problems:

Source:Â Pew Center, Zero Hedge

The sizes of the budget gaps are simply incredible. It is a basic arithmetic problem. The recession has caused record unemployment and profits to fall in the real world. Sure, Wall Street is seeing markets up by 60 percent but this is casino like profits. In the real world, unemployment is up to 10.2 percent and in states like California, the underemployment rate is up to 22 percent. This is depression like statistics.

Take a look at the chart above. 7 states have budget gaps of over 20 percent. 9 out of the 10 states researched by the Pew Center study have seen revenues fall by over 10 percent. These are reflections of the Great Recession. States like California, Arizona, Florida, and Nevada built entire economies on the decade long housing bubble. Short of seeing another housing bubble, these states are going to be in an economic funk for over a decade. Where is the revenue going to come from? So far, the federal government has demonstrated that all they care about is protecting the profits of Wall Street. Did your paycheck go up by 60 percent? Is healthcare 60 percent cheaper? Is education 60 percent more affordable? The 60 percent rally is a joke. It is based on hot money and as you might have noticed, the only folks pushing out record profits are the banks. Other bread and butter companies are showing profits because of firing workers and restocking inventory. Is that really something to jump in the air for?

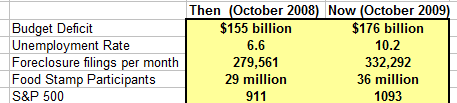

Just run the score card. Let us see how things have changed over a one year timeframe:

Every measure seems to be worse except the stock market. The unemployment rate nearly doubled in the year, 7 million more Americans are on food stamps, and foreclosures are higher. But things are getting better supposedly.

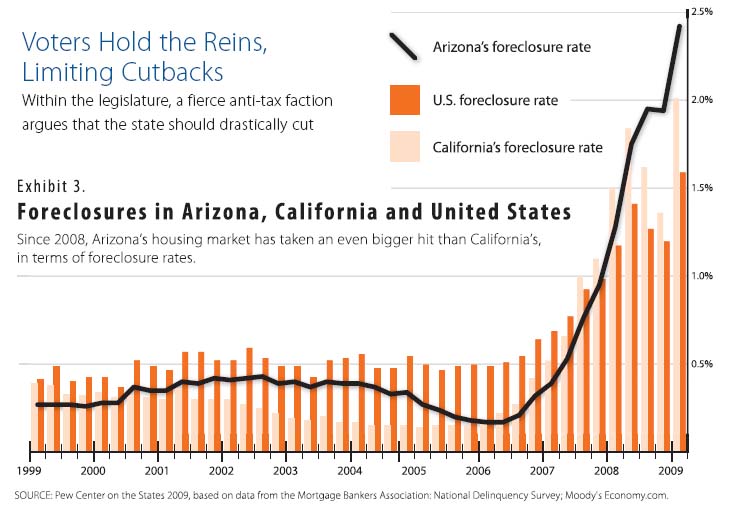

And the foreclosure rate isn’t abating:

From 1999 to 2007, the U.S. foreclosure rate was much higher than that of California. But after that, California’s housing market completely imploded. This wasn’t any accident. Much of this was brought on by toxic mortgages like option ARMs that were nothing more than financial time bombs. The chart above is troubling on many fronts because it shows no abatement to the ongoing foreclosure disaster. Most can understand that until foreclosures trend lower, any talk of a real recovery is rather mute.

States, like average American households, are dealing with the realities of a shrinking balance sheet. Or to be more precise, the revenue side of the equation is quickly shrinking while debts are still elevated to bubble levels. That is why some $12 trillion has evaporated from the net worth of U.S. households.

The October federal budget deficit is troubling. Last October the government brought in $164 billion compared to $135 billion this October.  A 17 percent drop in revenues. The federal government makes the state budget deficits look like child’s play. At some point, the government is going to need to adjust the revenue side of the equation. You can either raise revenues (taxes) or cut spending. Since they are choosing to do none of the previous options, they are opting to devalue the U.S. dollar and putting all their faith in Wall Street and the banks to save us.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

John said:

You have the same deficite as almost everyone else but if you go to us treasury direct and look at the amount of bills and bonds sold the 2 year total is 3 trillion not the stated .4 and 1.4 that the gov is claiming, I do not know if that is off budget spending or what but the problem is way bigger then everyone is claming. The privte part where we acually have to put the money back out into the economy and do not get to steal it from SS or just write a bond and call it an intrest payment to ourselves went up from 5 trill to 7.? because it is growing fast and that money will hit the economy. so wait for intrest rates to go up and then we talk subprime usa.

November 15th, 2009 at 2:31 pm