The Federal Reserve’s elaborate financial charade on the American people – Big banks hold excess reserves that represent 10 percent of U.S. GDP. Federal Reserve has failed on largest goals for our economy.

- 2 Comment

The antics of our Federal Reserve rival those of the now disgraced IMF chief although they won’t grab as many gossip headlines. The Federal Reserve has fashioned a system that has allowed economic bubbles to surface every very few years like high school reunions. Bubbles are not normal. These are financial disequilibrium events that occur simply because excess money is flowing through the system. The housing bubble was the perfect example of what happens when a central bank does not mind its own store. The Federal Reserve, our central bank and supposed expert on all things money, sought to protect the banking system at all costs during this recent crisis. It is amazing how the actions conducted by the Fed were never fully scrutinized in the media thoroughly even though this is where most of the money was funneled. It was simply assumed that the trillions of dollars in loans, purchases, and accounting chicanery that went to the largest banks was somehow the perfect way to avoid a crisis. Who really avoided the crisis here? The working and middle class is still disappearing. Yet the large Wall Street banks are back to their profitable ways since they figured out that the best thing for business is a crisis. These banks (just like the Fed) have little desire to help the American public even though they are only standing because of the power of the people.

Banks withhold lending to the public

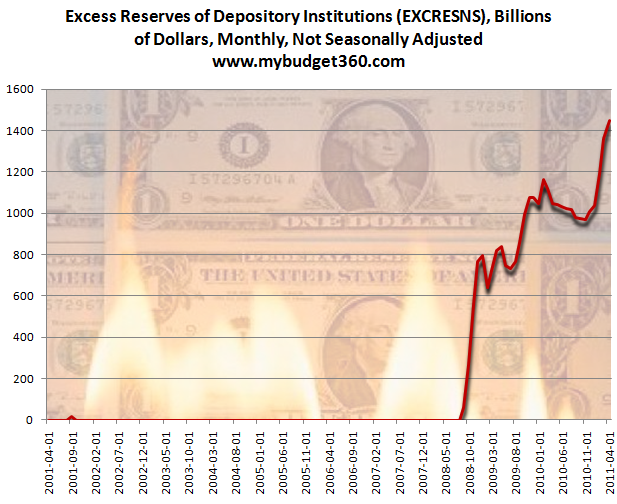

Prior to October of 2008 the Fed did not pay interest on excess reserve balances or required reserves. That all changed with the Economic Stabilization Act of 2008:

The Fed started paying 0.25% interest on these funds and as the chart above shows, banks are happier to stuff this money away at 0.25% instead of lending it to the cash strapped American public. By definition this is money that can be lent out in terms of loans. Yet the American middle class is struggling to get by so banks with more stringent lending requirements are simply hoarding or investing bailout funds that were targeted for working and middle class Americans. It is no coincidence that during this time excess reserves went from $1 billion in 2008 to over $1.4 trillion where they stand today. Banks are holding the equivalent of 10 percent of U.S. GDP in excess reserves!

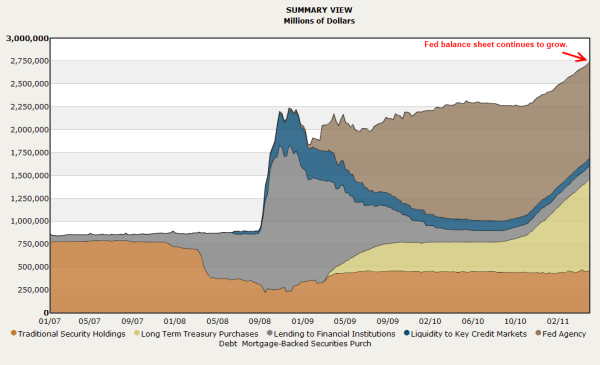

Contrary to what is being circulated in the typical press, the Federal Reserve is largely creating another bubble economy. The Fed balance sheet still stands at an all time record:

The charade is a simple one where banks pretend to help the economy while dumping toxic loans, risky paper, and other odd bets into the junk yard of the Fed. Why else would the Fed balance sheet be up to roughly $2.75 trillion? This is no tiny number. We never even hear this mentioned in the press. Don’t you think this is important to know especially when the future economic implications are enormous? The Federal Reserve has a mission and that is to protect the big banking interests in the country. That is it. So it should be no surprise that all the bailouts have benefitted the big banking interests disproportionately while the public struggles to get by.

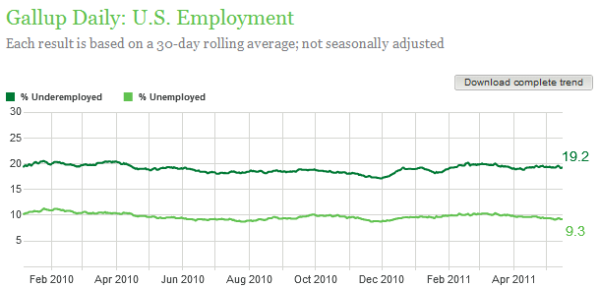

The underemployment rate in the country is still extremely high:

Over 19 percent of Americans are still underemployed. This is all happening while the economy is supposedly recovering. We are simply witnessing the ultimate bubble of the Federal Reserve and that is to steal from the taxpayer directly. Nothing can be easier than robbing the American taxpayer through a crushing realignment of the American middle class and blaming it on the global economy. That is, unless you are a large Wall Street bank connected to the Fed and then all you need to do is created some fancy alphabet labeled “program†and dump your toxic loans into it like loading paper into a shredder.

Without a doubt these actions are creating shadow inflation but I don’t need to tell you that. Just look at your grocery bill. Look at your kid’s tuition statement. What about filling up at the gas tank? Need to see a doctor? Americans without an unlimited credit card are adjusting their behaviors:

“(WSJ) Americans living paycheck to paycheck are looking at the gas gauge before they run their errands, and that’s hurting big retail chains such as Wal-Mart Stores Inc. and Lowe’s Cos.

“Our customers are consolidating trips due to higher gas prices,” said Wal-Mart U.S. head Bill Simon during the retailer’s earnings conference call Tuesday. “One in five Wal-Mart moms list gasoline as a top expense behind housing and car payments.”

As the cost of a good education becomes more inflated and paper mill schools crop up to scam the public, many people are ending up stuck in massive amounts of student debt. As you can see from the above story, families are consolidating shopping trips because of the price of gas. What is the big deal? Our nation as you know runs on consumption. The fact that people are shopping less signifies the reality that middle class families are being forced to cut back. This is the river that runs through our economy and without this our economy will sputter even further.

I was looking at some of the stated missions of the Federal Reserve and they have failed on so many fronts:

To strike a balance between private interests of banks and the centralized responsibility of government

To supervise and regulate banking institutions

To protect the credit rights of consumers

maximum employment

To strengthen U.S. standing in the world economy

To address the problem of banking panics

On all fronts they have failed. First, there is absolutely no balance since the big banks control the Fed and the big banks control government so virtually all their outcomes are met. Obviously they cannot regulate an industry that is run by an armada of cronies. Hence the enormous waste and speculative casino known as the housing bubble. They also talk about protecting credit rights of consumers. This is laughable and yes, another failure. Another stated goal is “maximum employment†which of course is another failure. The Fed has not strengthened the U.S. economy but has made the big banks more powerful. And finally the Fed’s answer to banking panics is ripping off the taxpayer for giant bailouts.

The Fed is leading us down a very troubling road of economic serfdom for the working and middle class. Their stated objectives are laughable and clearly do not relate to what is going on in the economy. If you had a doctor that couldn’t operate, didn’t understand medications, and hurt multiple patients you would want his license to practice revoked immediately. How then can our central bank, an organization designed to keep the flow of capital moving for the benefit of society keep on operating when they have failed on every key mission goal? The Federal Reserve will keep on pretending that there is no $2.75 trillion in assets on their balance sheet and the media will keep on pretending that everything is okay.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Julio Gonzales said:

I still don’t understand figure 2. I don’t know what the various curves represent. Also, I don’t know what an “excess reserve” is. It’s the obscurity of these terms that allows them to get away with… whatever it is that they are doing.

j

May 20th, 2011 at 11:16 am -

selig said:

One hundred percent right. But what does this mean to the overall Stock market? When does the bill ultimately come due? When can all the pretending stop? They have implemented Q1, now finsihing Q2. Possible q3. Seems like they can print unlimited money.

May 21st, 2011 at 9:36 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!