Federal Reserve punishes savers by subsidizing big banking bailouts – Two largest U.S. banks offer a paltry 0.05 annual percentage rate while increasing service fee charges and upping loan interest rates. S&P 500 not cheap.

- 3 Comment

The challenge most Americans are facing is first, trying to save money. If that hurdle is accomplished the next tougher question becomes where the money should be placed. The Federal Reserve by default with a negative interest rate policy has punished savers at the expense of massive debtors. The Fed for many decades since the 1960s had held the Fed funds rate over 5 percent. What this also meant was that Americans if they decided to step aside from the risky stock market would at least yield a decent return in U.S. Treasuries. Those days seem to be long gone with the funds rate near zero. Banks are using their easy access to the Fed to borrow cheap and to lend at much higher rates. They are also borrowing cheap and investing in global stock markets. The two biggest banks in the U.S. give depositors merely a place in the bank’s digital vault and pay almost no interest.

Savings accounts the new virtual mattress

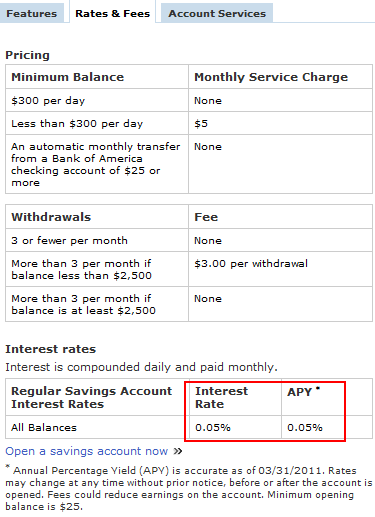

Bank of America, the largest U.S. bank in assets offers the below interest rate for depositors:

The annual percentage yield is 0.05%. In other words, if you had $10,000 saved in Bank of America in this savings account you would end up with $5 after one year. At the same time the average credit card rate is over 14 percent and mortgage rates are still above 5 percent. This margin is enormous and it is little wonder why banks are doing so well while many Americans are struggling financially. Bank of America isn’t the only one offering this low rate:

JP Morgan Chase offers the same rates. After taking over Washington Mutual with free checking they are now charging customers with less than $5,000 or other caveats a $10 or higher monthly service fee. There goes that $5 assuming you even have $10,000 to begin with. We already know that 1 out of 3 Americans don’t even have a penny to their name saved. What use is it charging these monthly fees especially when these are the banks that were bailed out to help protect consumers? The bailouts appear more and more a method for these banks to pickpocket what is left in the wallets of Americans leaving only lint and a penny if you are lucky.

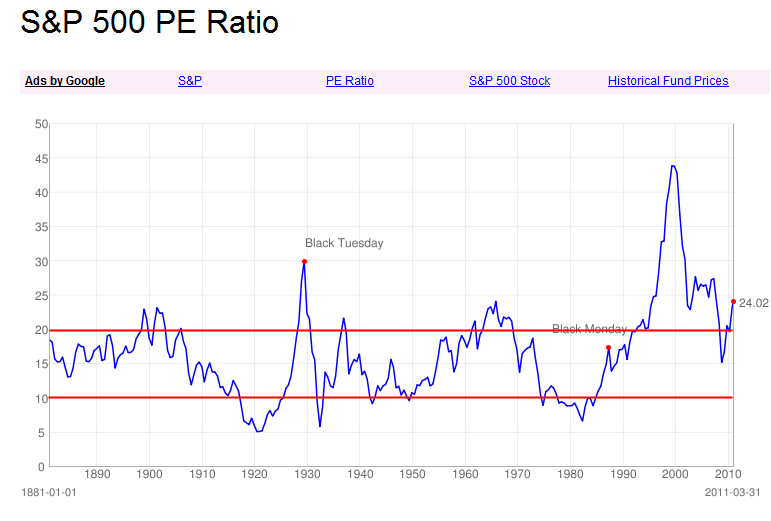

The Federal Reserve is content moving this way because it forces prudent savers into a precarious situation. Either you are forced to gamble in the overpriced and casino like stock market or suffer terrible rates that will dissolve after inflation is induced. Even the dubious headline inflation rates will tear apart that 0.05 percent savings rate so you are losing money by having it sit there. The stock market rally is largely on bailout funds and speculation. Take a look at the current P/E ratio:

Part of this is orchestrated. The Federal Reserve is doing everything within its power to get people to spend or speculate in the stock market and hopefully over time create enough inflation to devalue our current debts. This is why mortgage lending has gotten tougher (aside from government backed loans), getting a credit card is now for credit worthy customers, and getting a small business loan is much more stringent. The purpose is to work through the current banking led fiasco by pushing on the debt to working and middle class Americans through lower savings rate and a push for higher inflation. The gamble that most have to take is whether they want to compete with high frequency traders and Wall Street investment banks that have little vested interested in long-term company sustainability. They can be in and out. Buy and hold in this current model is tantamount to playing craps at a casino. This is why last May the stock market fell 1,000 points in a matter of minutes for no apparent reason (we still have no clear answer). Someone robs a bank for $50,000 and it is front page news but somehow the stock market loses over $1 trillion in wealth in a minute and it is buried in the press?

The challenge for Americans trying to save money with a per capita income of $25,000 after daily expenses is a challenge. Many younger workers are facing a prospect of a dwindling Social Security future so what will be left for retirement? The days of sustained 10 or 15 percent stock market gains are largely gone thanks to the technology bubble and real estate bubble. Those gains were simply unsustainable and even Bernard Madoff struggled to get those returns after a certain point and he wasn’t exactly doing things above board.

What people forget is that there is nothing Federal about the Federal Reserve. It is a quasi-governmental agency largely designed to protect the big banking sector. The American people cannot audit the Fed in a live meaningful fashion yet this institution has the ability to conduct massive trillion dollar bailouts at the behest of the banks.  If you really think about it, the Fed has done its job since their hidden mission is to protect the giant banking interests. In that they have succeeded but the cost will be shouldered by the American public.

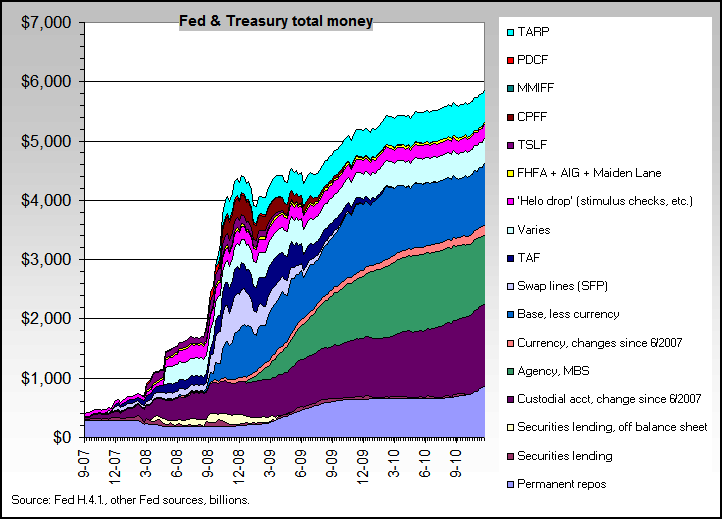

People think that the bailouts have somehow concluded. This is not the case. There are close to $6 trillion in random programs that the Fed and U.S. Treasury are still involved in but we have no way of knowing exactly what is in these programs because there is no ongoing audit:

As your purchasing power falls in the next few years just remember that is your little way of contributing to the big bank bailouts.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Al Falfa said:

“….the next tougher question becomes where the money should be placed.”

Into gold & silver naturally, particularly the latter.

And then, considering the way things are going with our increasingly corporate/fascist government, perhaps a significant portion should also be invested into purchasing an AK-47, abundant ammo, communication equipment & extensive weapons training.

It’ll come in handy when the government decides to come take by force your precious metals along with all the rest of your savings.

March 31st, 2011 at 11:43 pm -

peter said:

You haven”t seen nothing yet?

April 1st, 2011 at 6:15 am -

T. Valentino said:

OK Savers it’s time to vote with your feet.

Since we are earning virtually zero on our savings, how about driving down to your local bank(s) and simply withdrawing all of it.

Then stash the cash in your safety deposit box.

If enough of us did this, the bank(s) would suffer a serious decline in reserves.

Due to the fractional reserve nature of our banking system, this action would apply the magic of “reverse leverage” towards limiting the bank’s ability to make new loans.

Maybe this will encourage the bank(s) to invoke some free market principles and offer higher rates to convince us to re-deposit our cash.

This could work folks.

April 1st, 2011 at 7:12 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!