The Long Depression of 1873: Parallels and Comparisons. Are we Missing Economic Information from an Important Piece of American Financial History?

- 3 Comment

There have been many comparisons to the Great Depression with our current economic crisis. Massive speculation, rampant problems in the banking system, and exponential jumps in unemployment. Yet we may have a lot to learn by looking at the former Great Depression known as the Long Depression. The Long Depression lasted 65 months starting in October of 1873 and running until March of 1879. According to the National Bureau of Economic Research it is the longest period of contraction on record. There is great debate as to the reasons for the Long Depression. Much of the issues come from the fact that prices were falling because of improved productivity and also sound money in gold and silver. We are currently seeing prices falling in many items including homes, cars, and other consumer goods.

So what are some of the causes of this depression? First, production during this time was increasing on a global scale. So it is important to understand that. Yet what occurred is that prices fell at an incredible velocity. Just like any major calamity, the major turning point came when the Vienna Stock Exchange collapsed in May of 1873. The French economy was hurt because it had to make war reparations to Germany from the Franco-Prussian war. In the U.S. much of the price collapse was based on tighter monetary policy. The U.S. made a strong attempt to go back on the gold standard after the massive expansionary cost brought on by the Civil War. The U.S was doing virtually the opposite of what is currently going by taking money out of circulation. As we know, the U.S. Treasury and Federal Reserve in our current environment are exercising one of the most expansionary monetary policies ever witnessed. Yet the problem of course is this money is making it into the hands of banks and we are witnessing depression in prices once again.

It is interesting to note that the “greenback” which was specie came about in August of 1861 and was authorized via the Legal Tender Act of 1862 and stayed in circulation until 1971. This brought on rampant speculation and fraud including the building of the Union Pacific and exploded with the 1869 Credit Mobilier panic. There was a railway building bubble which collapsed in 1873. If you think of the housing bubble you can understand how over building in any industry can come crashing down once a fiat system is over leveraged.

Many nations around the world enacted protectionist policies to protect industries that were being hurt. There were fierce movements of nationalism during this time which pushed economies into their respective corners. Tariffs were enacted and President Harrison won the 1888 election on a protectionist message. Many believed and followed the tenets of classic liberalism and believed the government had little role to intervene in the economy and many followed this. This cannot be said for our current crisis. We are intervening like never before. Massive bailouts. Gigantic injections of liquidity. Fiscal and monetary stimulus. We are throwing everything at this crisis. Yet the world markets have still seen $50 trillion in wealth disappear. The problem of course is that we have been delaying any major correction for 30 years by hiding the technology bubble and housing bubble and now we are facing one major correction.

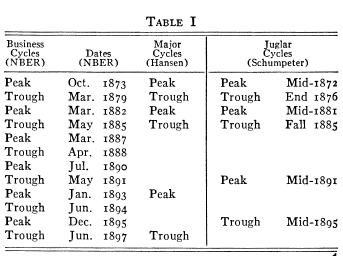

The Long Depression although it “only” officially lasted 65 months ran well into the 1890s:

The economy was in and out of depression many times for 30 years. Yet the U.S. was expanding  and wholesale giveaways of water, timber, fish, and minerals pushed major expansions and for those who were wealthy led to the Gilded Age. Another huge crash occurred in 1893.

And if you think bank runs are something from the past just think of the electronic bank run on IndyMac bank. Here is how the old bank runs used to look (New York City 1873, 4th National Bank):

Another factor setting off the crash was the implosion of the Jay Cooke & Company. This was a major component of the banking establishment. It collapsed when it found that it was unable to market several million dollars in Northern Pacific railway bonds (does this sound familiar?). At the time, much of the investment banking establishment was salivating for railroads much like our recent investment banks went off the edge with real estate. When the funding source dried up or too much over building occurred, multiple external forces collapsed the market.

After the Civil War many people found employment in the railway boom. Outside of agriculture it was the largest employer and also had the most money at risk. In fact, there are many parallels with our current employment situation and how many people are dependent on the finance and real estate industries. Once that industry imploded, many people found themselves out of work.

Europe recovered much quicker from the crash. For example, German businesses managed to avoid the major wage cuts brought on by the depression in the U.S. Also, the major influx of immigrants kept cheap labor on the market for the U.S. In 1876 unemployment reached 14% in the U.S. which is another interesting point from the Long Depression. For the most part, the Great Depression saw wider unemployment – as stated before much of the problems occurred by the price depression being seen in goods and wages. The U.S. also was the cheap labor market similar to what China and India are today. Some of the problems in Europe occurred because of cheap American goods flooding the markets.

How things change. The Long Depression was a troubling and long economic worldwide contraction. The Long Depression, the Great Depression, and our current crisis all have a global entrenched component. It would be wise for us to learn from these past events. In fact, our current crisis resembles much of what Japan did with their baburu keiki (asset bubble). Massive fiscal stimulus and injections into otherwise insolvent banks. We are in unchartered territory here.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Imee said:

This was a great piece– a bit of history lesson plus comparing the 1873 Depression to now is just what we need. A serious reality check, I believe, is what the world needs to know. The situation right now is not as bad as we all make it out to be. I mean, it’s no limo ride down the highway we’re experiencing right now, but at least we’re not walking barefoot and naked under the sweltering heat of the sun. Situations like these need optimistic thinkers and leaders to bring us out of the black hole of a recession.

March 17th, 2009 at 12:49 am -

Michael said:

I’m trying to figure out what the following sentence means:

“When the funding source tried up or two much over building occurred, multiple external forces collapsed the market.”

It’s inscrutable, I tell ya!

March 17th, 2009 at 9:53 am -

Jon said:

I hear a lot of talk from extremists that this country is heading for another Great Depression, like the one in the 1930s. I find this hard to believe since now we have backup systems that weren’t around in the 1930s such as the FDIC, Social Security, etc. I believe that we are heading into another Long Depression. I’ve done some research and have figured that a recession occurs every 10-15 years, which is a normal process of the business cycle. Some recessions are longer and more brutal than others; it’s a way of life. It’s like having a car; it has mechanical issues an x-number of times, some issues are more severe than others, but you learn from it.

I’m no expert in economics, in fact, it was a class I fell asleep in often in my college classes; but I believe that printing up massive amounts of money is going to create more problems rather than fix current ones.

This may sound biased since I am a student and considered a Middle Class individual, but I think that taxes either need to be frozen or lowered for the Middle Class and increase taxes for businesses and wealthier individuals. No I don’t mean people like doctors, lawyers, or high paid jobs; I’m talking about people like Bill Gates, Miley Cyrus, and other millionaire/billionaires! Include companies like Exxon Mobile, Wal-Mart, Apple Mac, and other large companies with millions maybe billions of dollars. You can’t tax people who don’t have money, it makes no sense and is simply impossible.

December 31st, 2010 at 3:31 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!