The financial elixir that is falling home prices – Lower home prices good for the economy – Median U.S. home price down to $157,000 taking up 3 times the annual household income instead of the bubble peak of 5. Adding jobs while home prices move lower? Banks big winners when home prices remain inflated.

- 4 Comment

It is interesting that in the short-term horizon of our economy falling home prices are occurring while jobs are being added. The banking sector during the early days of the crisis made it abundantly clear that falling home prices would lead to economic collapse. Yet the opposite is occurring. Why? First, inflated home prices eat up a deeper portion of a household’s income. With a large portion of our economy dependent on consumption this funnels consumption into a largely unproductive sector of our nation. The banking sector is largely linked to the real estate industry so it benefits their bottom line for home prices to simply go up even if household incomes have gone negative for over a decade. So it should come as no surprise that as home prices continue to move even lower that somehow jobs are being added. Middle class Americans will be better off with a boring housing market with 30 year fixed mortgages and a sizable down payment requirement of at least 10 percent so resources can be focused on more job supporting growth that also allows us to export abroad (there is zero exports with housing).

Home prices continue to move lower

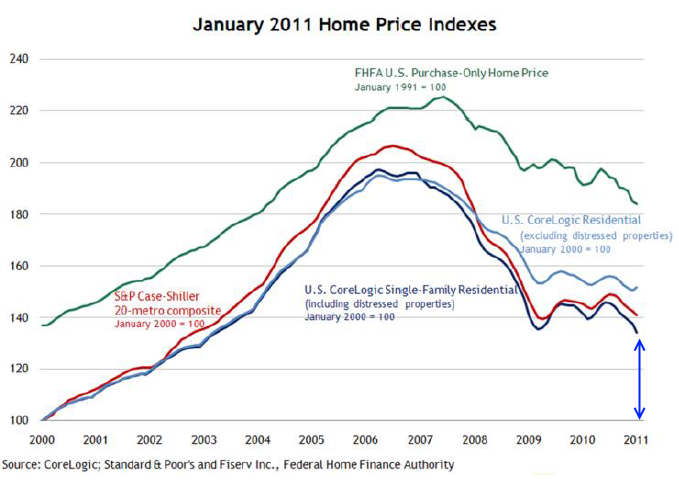

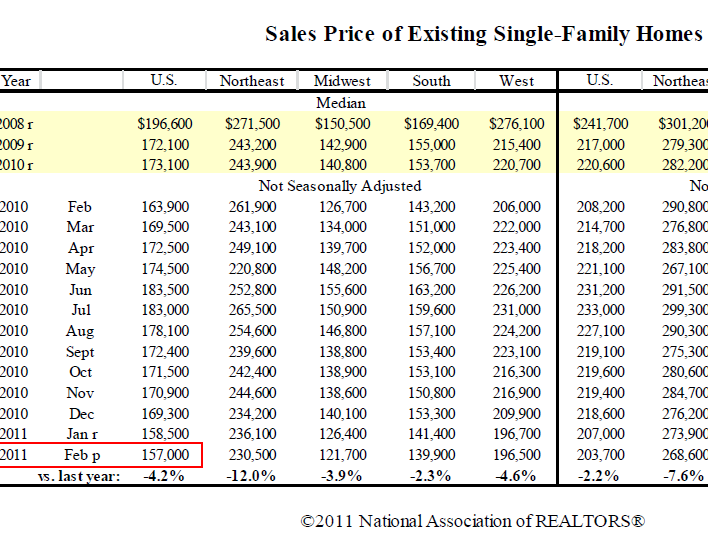

Every measurable home price index is moving lower. For the past two years distressed properties have dominated the sales volume. Households with less income are focusing their resources on buying cheaper priced homes that are more in line with their incomes. This is actually a positive. This is why there has been a massive decrease in residential construction as Americans purchase current inventory instead of going for newer and more expensive homes:

Source:Â Census

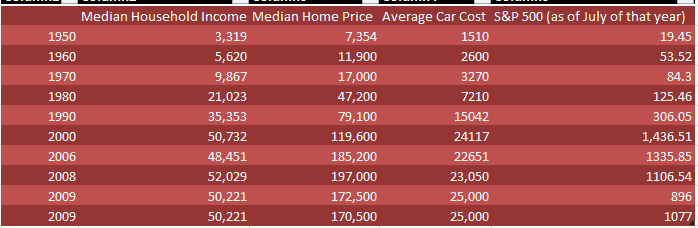

If we think about our post World War II prosperity home prices were relatively stable over this time. There seems to be some balance at having home prices at 2.2 times the annual household income:

This is data I gathered before but it is useful to bring up since home prices continue to move lower.

Back in 1950 the median home price cost a little above 2 times the annual median household income:

1950:Â Â Â $7354 / $3,319 =2.2

In 1960 the ratio remained roughly the same:

1960:Â Â Â Â $11,900 / $5,620 = 2.1

In fact, over this ten year period the typical household gained buying power when it came to housing. Even in 1970 the ratio became more favorable to US households:

1970:Â $17,000 / $9,867 =1.7

This was the lowest point at the start of any decade in modern history. After this point, with all the push for deregulation and allowing Wall Street to run rampant prices remained fairly stable only because of the two income household (that is until we hit 2000):

1980:Â Â Â Â $47,200 / $21,023 = 2.2

1990:Â Â Â $79,100 / $35,353 = 2.2

2000:Â Â Â $119,600 / $50,732 = 2.3

And where do we stand today?

2011:Â Â Â Â $157,000 / $50,300 = 3.1

Source:Â NAR

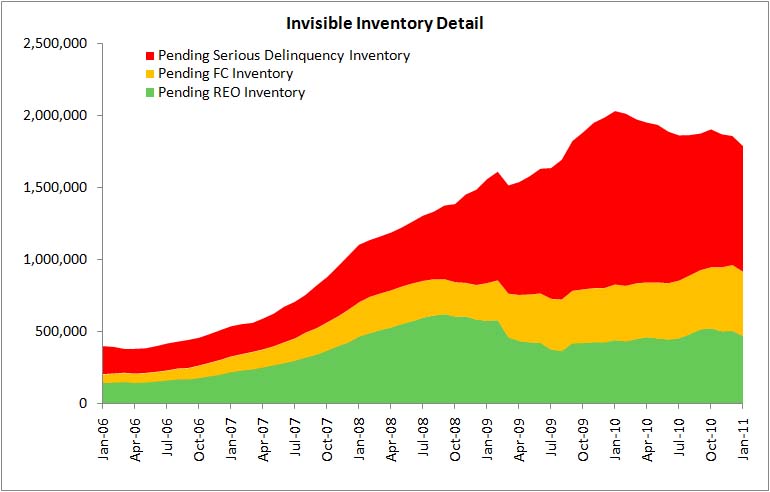

Home prices are getting closer to this 2.2 figure but we are still seeing home prices inflated in many markets across the country. Yet home prices will continue to decline because many working and middle class households cannot afford the homes purchased during bubble times. If we look at the invisible inventory we can still see that many households are unable to carry their mortgages:

Source:Â CoreLogic

This correction is necessary and it is no surprise that we are adding some jobs as home prices fall steeply. Again this frees up discretionary income to be spent on other good producing items in the economy instead of having a giant amount of money being sunk into homes while banks continue to collect their easy money from a stale asset. The bailouts were one large charade and a robbery from the public. Here we are four years into the crisis and as you are now seeing, home prices falling actually does help the overall economy because they refocus energy away from a sector that is largely a drag on household expenditures.

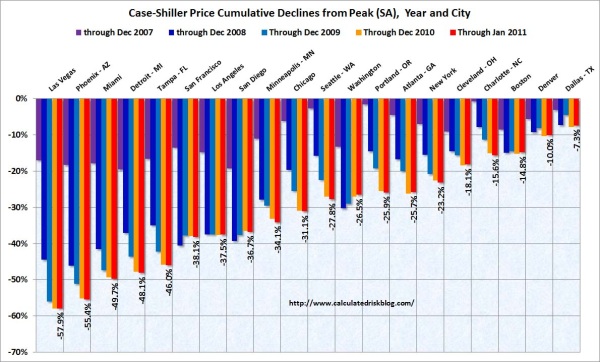

Many areas are experiencing new post-bubble lows:

Source:Â Calculated Risk

This is actually healthy for the economy. It would be one thing if we saw household income strongly increase in the last decade to justify high home prices. Yet we had a decade where household income fell in both real and nominal terms yet home prices soared. Banks enjoyed the billions of annual profits brought on by this bubble and they have insured that the losses would be shouldered by the public. Yet falling home prices are a positive especially if wage growth is looking to be stagnant. If you look again at the decades when the U.S. economy was booming the ratio between annual household income and median home price seemed to gravitate around 2.2. We are now moving back to that. During the peak it was getting closer to 5 then hovered in the 4 range for a few years. We are now at 3.1. Expect it to hit the high twos sometime this year if the trend continues.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Ryan said:

City of Alameda, CA may have to declare bankruptcy, per the City treasurer.

Reason? public employees retirement packages.April 3rd, 2011 at 8:29 am -

peter said:

I THINK YOUR THINKING IS ILLOGICAL. ADDRESS THE REAL PROBLEM THIS GOVT. IS DESTROYING THE MIDDLE CLASS. IT HAS TRANSFERRED WEALTH TO THE BANKS AND FOREIGN GOVT. AT THE COST OF THE MIDDLE CLASS. A DEPRECIATION OF AN ASSET WEATHER IT IS LAND OR THE DOLLAR DOES NOT SERVE THE MIDDLE CLASS. IT DESTROYS IT. WHAT HAS CAUSED PRICES TO GO DOWN IT WAS THE GOVT. PLUS THE FEDERAL RESERVE MANIPULATION OF OUR CURRENCY PLUS THE GOVT. DESTRUCTION THRU ITS POLICIES OF REDISTRIBUTION OF WEALTH. WHAT HAPPENS WHEN THE GOVT. EMPLOYEES AND ITS PENSION PLANS FALL APART? WE ARE BANKRUPT THAT IS WHY ASSETS ARE DECLINING. THEY HAVE AND CONTINUE TO DESTROY OUR CURRENCY. REDISTRIBUTION OF WEALTH TAKE FROM THE HAVES AND GIVE TO THE HAVE-NOTS A WONDERFUL COMMUNIST IDEA THAT HAS NEVER WORKED NO MATTER WHERE IT HAS OCCURRED. THE HAVES HAVE CREATED THE LIGHT BULB, CARS, AND ALL THE LATEST HI TECH. ADVANCEMENTS THAT HAVE MADE OUR LIVES BETTER EASIER ETC.WE ARE BEYOND HOPE WE WILL CONTINUE TO DESTROY THIS GREAT COUNTRY BECAUSE OUR GOVT. LEADERSHIP IS NOT CONCERNED ABOUT AMERICA FOR AMERICANS. REMEMBER WHEN GEORGE WASHINGTON WAS TOLD THAT MANY PEOPLE WERE HUNGRY HE SAID GOOD PROVIDE THEM WITH THE SEEDS TO GROW FOOD THEN THEY WILL IMPROVE THEIR CONDITIONS BASED UPON THEIR OWN EFFORTS WHICH WILL BE MORE APPRECIATED. SO WHAT DOES THIS GOVT. DO IT PASSES S510 WHICH PROVIDES FOR THE PROMOTION OF PLANTING SEEDLESS FOODS. OH OF CAUSE IT ALSO SAYS YOU CAN BY NEW SEEDS FROM MONSANTO. NICE BUNCH IN THIS GOVT.

April 3rd, 2011 at 3:08 pm -

clamboslice said:

There are still places like San Francisco, where the median house is 10 times the median income. I believe low prices for necessities like food, shelter and energy were good things, and huge debt is bad. Borrowing fantastic sums of money enriches those who lend the money, not the borrower.

April 4th, 2011 at 12:06 am -

tom jones said:

gd rpt:

but: 1870, home steading: free land if one works it 5 years.

til 1920, nolongterm mortgages ex 5 yr max.

EU has 1,000+ yr old stone houses.

some nations hold land (one only rents land, never ‘buys’ land).

see Kot. Lee

Koff. u.s. total debts c$197T, tril twelve zero,

cant pay prin. only borrow more 2 pay interest,

(Unless some one invents cheap energy asap)April 4th, 2011 at 10:27 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!