Collective financial insanity – FDIC backing $5.4 trillion in total deposits on pure faith – US banking operating with negative deposit insurance fund and massive debt leverage. The greatest Ponzi scheme known in the financial world.

- 4 Comment

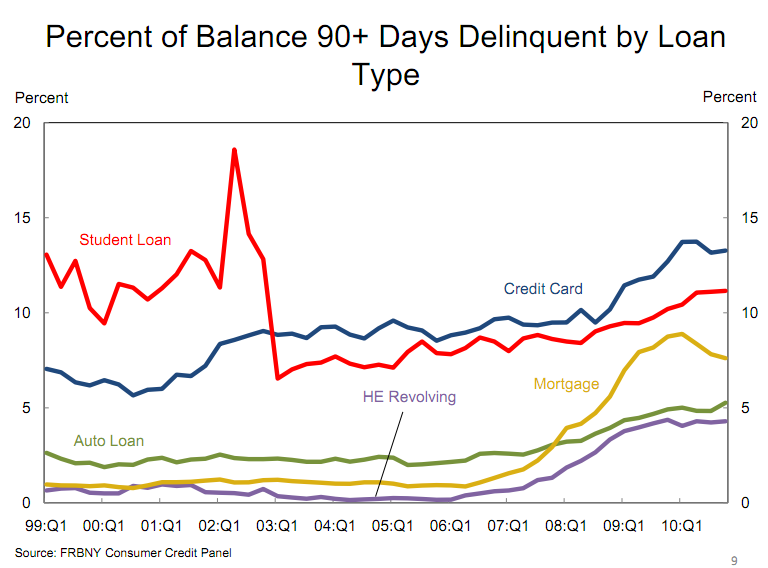

People psychologically are programmed to believe in financial realities that benefit their own cause even if they have no merit in empirical data. Many also forget that banks, especially the investment kind have a notorious track record of running amok when allowed to. The FDIC and US banking is a perfect example of a system built on nothing more than faith. Currently the FDIC insures individual deposit accounts up to $250,000. Given that most average Americans only have $2,000 saved up this is rarely an issue. However, FDIC insured banks have $5.4 trillion through insured deposits yet have a deposit insurance fund (DIF) that is in the negative to the tune of $8 billion. Is this a Ponzi scheme you ask? Not exactly but it shows that the entire financial edifice that we call US banking is built on largely a foundation of sand being held together by pure psychological confidence. Just look at this chart below; as insured deposits grow the insurance fund actually dwindles:

Source: FDIC

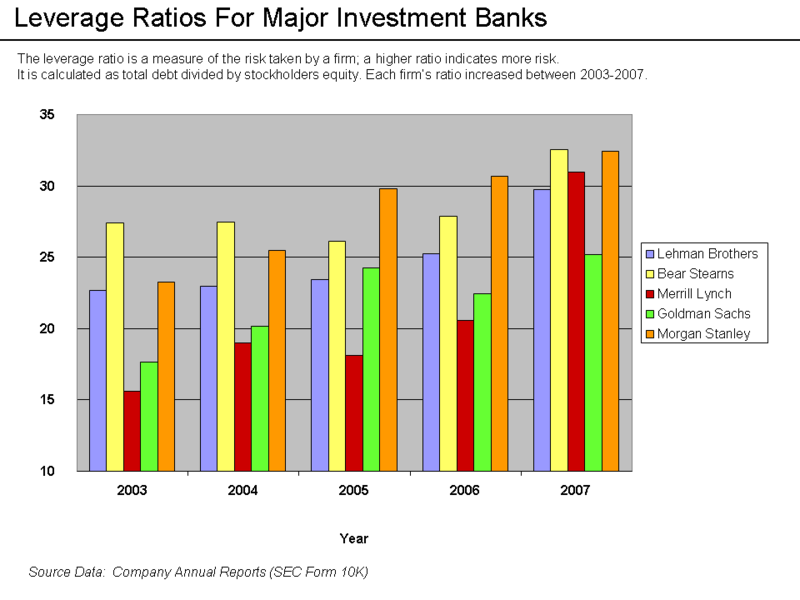

How is this even possible you may ask? Well at a very basic level we have fractional reserve banking. In the US banks have a 12 to 1 leverage ratio. This number is derived by assets divided by net worth. Yet banks have the benefit of calling over priced real estate loans “assets†even though all of us fully understand that much of what they have on the books is cooked at bubble level prices. Banks are hoping the public is naïve enough to allow this game to go on for long enough where time and the Federal Reserve can inflate away the debt at the expense of the middle class. Inflation is not the answer and we have many ruined economies throughout the old chapters of history to serve as testimony. The FDIC backs more bread and butter banks but the top investment banks that were the largest beneficiaries of taxpayer bailouts have some of the most outrageous leverage:

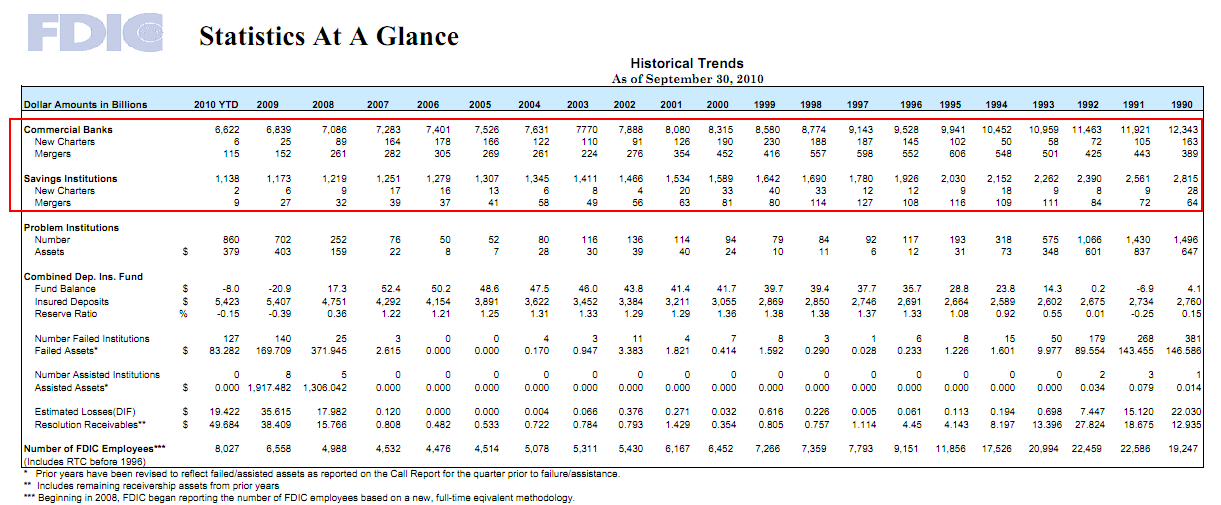

Only two of the five now stand (Goldman Sachs and Morgan Stanley) as standalone investment banks. Merrill Lynch is now part of Bank of America while Bear Stearns and Lehman Brothers are both gone. Yet we are not better off because what has occurred is the too big to fail have become even bigger. Take for example the number of FDIC banks:

In 1992 over 12,000 banks and savings institutions were backed by the FDIC. Today that number is slightly above 7,700 yet total assets are even larger on a percentage basis. More and more banks fail but where tiny regional banks go down another too big to fail bank takes over and sets up shop. You’ve probably seen this in your own neighborhood. These are the same banks that created most of the toxic debt that infected the financial system to begin with. Now we are allowing them to setup shop all around the country. The FDIC is backing over $5 trillion in deposits purely on faith. Let us assume there is a bank run. Who will be there to bailout the FDIC? The US Treasury and Federal Reserve but since the nation is in the hole to the tune of $14 trillion in national debt this would only dilute the currency even further. In the end you would get paid back but with deflated dollars. This is why inflation is never really a solid option out of economic malaise. Otherwise we should just print and send $1 million to each American household.

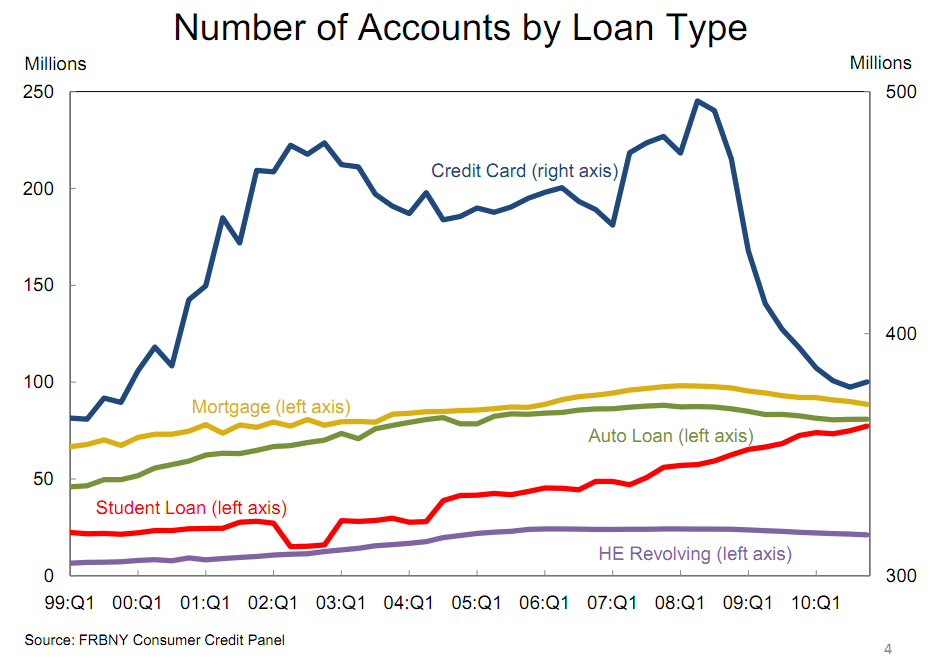

Debt problems continue to plague the economy:

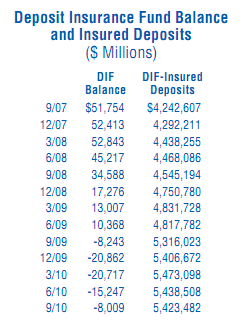

Source:Â Federal Reserve

This is stunning data. Nearly 14 percent of all credit card accounts are 90 days or more delinquent. Given that there is $850 billion in this market alone, this is cause for concern. The next biggest delinquent category by percent of all loans isn’t mortgages but student loan debt. We’ve discussed the higher education bubble and here you are seeing the end results. Ultimately what the above shows is a country that fueled its last decade largely on massive amounts of debt. That debt is now due and many people are unable to pay. Keep in mind what this signifies. We aren’t talking about paying off the entire balance. You have people unable to make the $200 payment on their $7,000 credit card debt. Or you have people unable to pay the $1,500 mortgage on their $175,000 home. This debt is actually an asset to the banking system. Does the above chart make you feel confident that the value of banking assets is increasing overall?

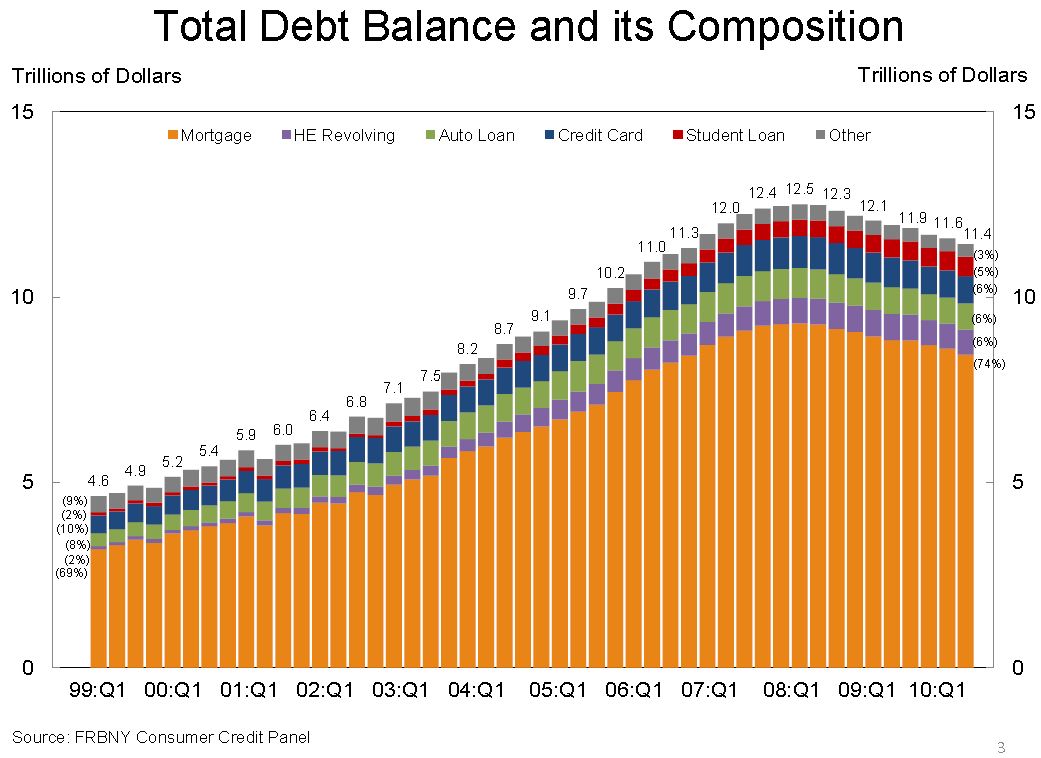

Look at the total debt outstanding:

Source:Â Federal Reserve

Currently US households have $11.4 trillion in debt outstanding. This is off from the $12.5 trillion peak in Q3 of 2008. The big difference is also the amount of equity Americans have in their home. That $11.4 trillion in debt seems more painful when overall US housing has fallen by over 30 percent and has chopped into the biggest asset of average Americans. Home prices are down by 30 percent while overall debt levels are down by 8.8 percent. That is simply unsustainable and that is why banks keep failing on a weekly basis. But the banks that have the most fantasy in their balance sheets, the too big to fail continue to eat away at taxpayer money through the hidden cost of quantitative easing and the destruction of the US dollar. These aren’t speculative notions but just look at where your financial life is today versus where it was over a decade ago.

As people struggle with extremely high unemployment many are jumping into the higher education bubble and getting into massive debt:

Many of these graduates will have no savings with FDIC insured banks but will owe the government and banks money they don’t have. How will they pay this off? The high delinquency rate is telling us they can’t. In the end you need a sustainable economy but right now the FDIC is merely the Wizard of Oz. We are pretending that over $5 trillion in deposits is actually backed by some “lock box†fund somewhere. It isn’t. It is simply faith in a system that has largely failed the middle class. As we see protests around the world when will Americans protest against this banking system that has led them down this path of debt servitude? Is robbing your financial future or your kid’s financial future not enough to call for serious reforms in the system? Let us just keep pretending that the $13 trillion in “assets†at FDIC insured institutions is really worth that and keep going on with our business. Just like everyone believed real estate was actually worth what it was at the peak just because it inflated balance sheets all around the country.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Byron said:

What burns my toes (your too, I’m sure) is how ‘they will hang the Stewarts, Madoff’s etc of the world to hang out and dry, ‘they’ are guilty of greater schemes but are considered ‘hic ups’ to ‘them’! I’m a strong believer in what goes around ‘will’ come around, it’s just a matter of time and in these cases, maybe not that much time! To me, the term ‘useless eater’ belongs to the leaches of the world that think ‘they’ know best! Unbelievable of the lack of judgement along w/ there narcissus ways, the Geo. S’s think it’s funny!

February 15th, 2011 at 5:43 pm -

Iowa Farmer said:

I got me some corn I’ll sell ya to put in your gas tanks. That oughta help (with food prices going higher)! Course, the Fed printing money is the real cause. Never see that on t.v. for some reason.

February 15th, 2011 at 9:26 pm -

Emery said:

Nice know what “back from the brink” really means. As as average working guy that is only able to find part time employment now I can relate to the delinquencies. So far I’ve been able to make the 1st mortgage payment but many can’t the 2nd one. I feel I was baited into a system that will not allow us to survive, never mind pay off our loans. But in 1998 it didn’t look to bad. Now I’m a slave of the FED debt system. The bailed out banks are now free to take our homes and properties……. Nice work congress. They should have let them go bankrupt. Start a new system on the rubble of FED debt.

February 16th, 2011 at 5:05 pm -

NadePaulKuciGravMcKi said:

we have FDIC;

Sleep Well !!!February 17th, 2011 at 2:57 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!