Financial raiders and the loss of the American middle class. 5 charts showing the slow erosion of the middle class in America. 12 states have underemployment rates above 17 percent, insiders selling out, Great Recession in perspective, and a race to the financial bottom.

- 3 Comment

The current economy is built on a flashy digital casino interface and most of the middle class in the United States is at risk of moving backwards in the coming years. Millions have already fallen a few rungs lower on the economic ladder. The stock market no longer benefits the buy and hold investor but those who have the ability to quickly jump in and exploit short term trends. The working and middle class have no chance against high frequency traders and sophisticated hedge funds that actually profit on the financial destruction of the middle class. Just think of the billion dollar bets placed by a hedge fund manager that millions of Americans would lose their home. In no shape or form does this even benefit the real economy. Many enjoy this fantasy world of derivatives but the unfortunate consequences of these bad bets are shouldered by the working public. Need we discuss the cost of the bailouts to banks and the $2.7 trillion Federal Reserve balance sheet? If we look closer at key data points in the economy, we see that the foundation is still largely made of financial sand and many are sinking fast even as a recovery is touted.

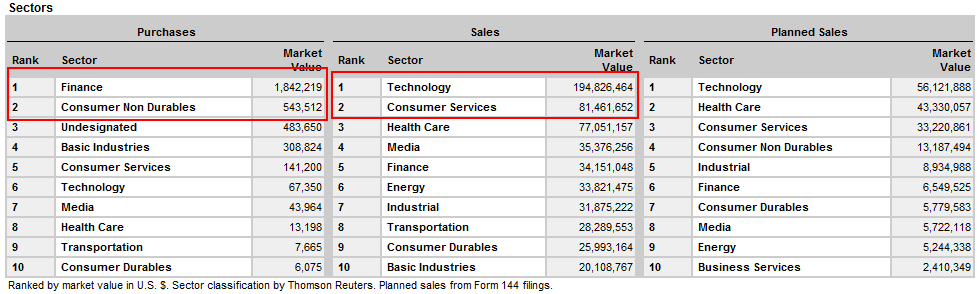

Insiders selling out

Source:Â WSJ

Who would know better about a company’s health than actual insiders? If we look at actual purchases and sales we start seeing a clear pattern. Insiders are moving out of their own positions. Now I realize that many of these people are simply cashing in but if you truly believed in your company and the health of the economy, wouldn’t you want to buy more stock in your organization? The above figures seem highly unbalanced with many more planning on selling their stock instead of buying. So much for buy and hold even from those at the very top.

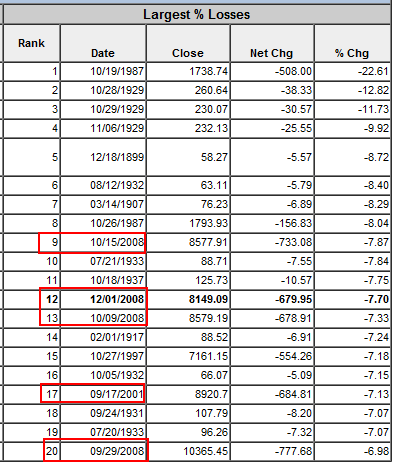

Great Recession losses

It usually takes financial reflection to realize how bad things are in this Great Recession. 4 of the worst 20 stock market days for the Dow Jones Industrial Average occurred in 2008. Now think about how significant this is. 20 percent of the 20 worst days in the last 120 years occurred in one year in 2008. This is how crazy and manic the market got during the Great Recession. Volatility is never a sign of a healthy market. We are seeing volatility shift from the stock market to other sectors of our economy. Most of this has to do with the massive amount of liquidity the Federal Reserve has pumped into the too big to fail banks. Without any reform, the casino is back to full capacity and money is seeking the places with the fastest potential spot for returns even if it doesn’t pertain to the real underlying economy.

Keep in mind these deep down days occurred during a time where investor transparency was supposedly high (i.e., 10-K filings, up to the second financial information, etc). Of course in a supposedly perfect and efficient market, the actual stock value should reflect the true worth of a company. Clearly people are irrational and act in fear, panic, or other human emotions that cloud judgment. It doesn’t help that the game is rigged in favor for the too big to fail banks while the public is fleeced.

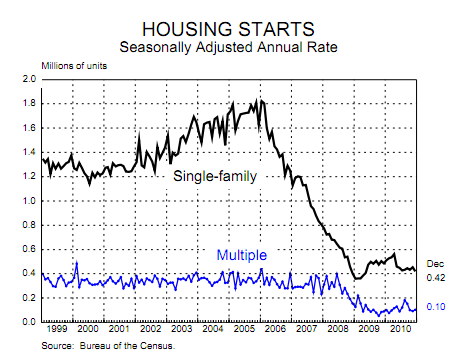

Housing Starts

Housing starts have fallen precipitously from the peak in 2006. They remain at multi-decade lows. Part of this involves the enormous amount of inventory on the market and another large pipeline of distressed properties that will eventually end up on the market. A good part of our economy revolves around building and selling homes. Yet that process has hit a road block because consumer demand is for cheap priced homes and this part of the market is being satisfied via the large number of foreclosures. Sadly many foreclosures are happening because working and middle class families are unable to cover their mortgage payment because of the transforming employment market.

I’ve put together an analysis showing a weak housing market well into 2020 based on demographics and current inventory trends. There is little reason to think this trend will suddenly reverse any time soon. When it does turn around, it will be a slow process out of the bottom.

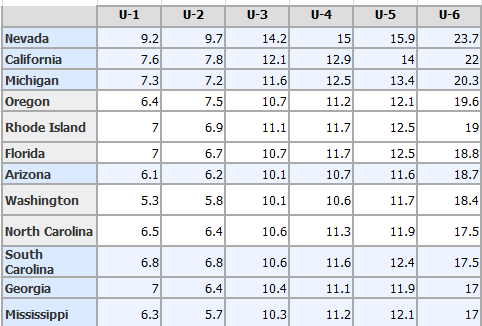

Significant underemployment

Continuing on the weak employment trend, just look at the above chart and the U-6 rate which reflects the underemployment rate. 3 states including the state with the largest population have a U-6 rate above 20 percent. A total of 12 states have a U-6 rate of 17 percent or higher. This is simply too high and little by little the middle class erodes into the ocean. We have another 45,000,000 Americans receiving food stamps ,which is stunning given that we are currently in a supposed recovery.

I’m sure many Americans are wondering what is actually meant by recovery. Is a recovery simply looking at GDP growing because big corporations and big banks are putting the average American in financial vices and squeezing out every ounce of productivity while not sharing the profits? The too big to fail bailouts are symptomatic of the problems in our current welfare for the rich.

The weaker U.S. Dollar

All the bailouts orchestrated by the Federal Reserve come at a very hefty cost. The fact that the U.S. dollar has fallen so strongly is reflected in higher food costs and also higher energy costs. Anyone that has traveled recently realizes how much the U.S. dollar has changed outside of our country. The Federal Reserve artificially keeps rates low but also bails out banks and grows its own balance sheet to $2.7 trillion and we are surprised that the above chart pattern occurs? This is on purpose.

We then hear the argument that we “need†to compete globally but nowhere in the world do banking CEOs make so much money for such bad performance. Plus, are we really looking forward to China like wages in the U.S.? This is the implication of what is being peddled in the media.

Ultimately we have to rethink what we want from our economy and government. If we want to go back to the days of the Gilded Age then we better gear up for the evaporation of the middle class. I think many Americans realize that there is a price to pay for fully unregulated banks running wild and buying out politicians via lobbyists. That cost is typically their future financial well being. The reason this is even allowed is that a large number of Americans believe they are only temporarily embarrassed millionaires and will someday be multi-millionaires (even though the average per capita income is $25,000 per year).

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Horizon$$ said:

Could someone explain what U-1, U-2 in the above chart means?

May 5th, 2011 at 6:29 am -

mile said:

try to shake a few vultures off the back and find out it is virtually imposible…….all demanding another piece of flesh..?…..vultures..!

May 5th, 2011 at 12:02 pm -

Dan said:

Horizon$$,

I believe U1 is the % of first time filers and that U2 is the 1st extention of benefits. U6 is the % of people who no longer qualify for benfits but are either unemployed or working part time at minimal wages. When DOL reports unemployment they use the U1 and U2 average as the official unemployment rate. Go to shadowstats or NIA for the U6 numbers which are still considered low because they do not include the historical 5% of Americans that are unable to work due to mental, physical, addiction problems that always keep them out of the system. The base for unemployment should be 5% and then grow from there. In the best of times U1 is 6 to 8%. I spent two months traveling the southern US and saw unbelievable unemployment with my own eyes. I saw instances of 500 people applying for one part time position at minimum wage. In times like these they should consider suspending minimum wages until businesses can justify hiring full time positions or creating small manufacturing jobs that will become full time skilled work as the company grows and expands its market. I think most people would consider that sort of work to get a company started with the knowledge that there would be a payoff in a few years. Maybe a company could issue stock as part of the compensation rather than be forced to pay minimum wages and benefits as start up costs. I would love to start a company and have the idea and knowledge but can not afford the start up costs. I am not the only one and the states and federal government regulations make it almost impossible to try a start up company other than a sandwich shop.May 19th, 2011 at 3:30 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!