The global addiction of central banking stimulus – Contagion spreads to Spain as 10-year edges to 7 percent. Life in a perpetual quantitative easing world.

- 3 Comment

Financial markets around the world are now desperately dependent on central bank stimulus. The US recovery is largely dependent on the Federal Reserve funneling loans into the system via the quantitative easing process and other archaic forms of money development. It is interesting how the Greek stock market rallied this week merely on the notion that pro-bailout parties will be elected and thus allows even more debt to be injected into the system. Yet this does not solve the core problem that too much debt is swimming in the system. Central banks do not create any real tangible product in the economy. They have the incredible power to inject resources into banks and thus create “money†in the real economy. Yet this only happens if banks lend this out to consumers instead of using the funds to speculate in complicated global money making schemes. The whipsaw behavior of the market highlights the massive addiction to central banking stimulus we are in.

The Euro crisis reaches a critical stage

With record high unemployment in Spain and downgrades hitting, the Spanish 10-year bond crossed a troubling threshold this week hitting 7 percent:

This is a critical stage here especially with Greek elections approaching this weekend. But the problem is with any addiction, at some point you have to keep taking more and more of the drug simply to get the same impact:

“(SF Gate) The “markets are telling us that they’re unconvinced by the bank bailout and that the next step is that the government will have to concede, capitulate, and go for a sovereign loan,” James Stewart, head of macro research at AX Markets in London, said in an interview with Mark Barton on Bloomberg Television’s “Countdown.” “That seems to me quite likely, and even now I think it’s moving on from Spain to Italy.”

Spain’s 10-year yield climbed 16 basis points, or 0.16 percentage point, to 6.92 percent at 5 p.m. London time after rising to 6.998 percent, the highest since the euro was introduced in 1999. The 5.85 percent bond due in January 2022 fell 1.07, or 10.70 euros per 1,000-euro face amount, to 92.64. The yield has jumped 70 basis points this week.â€

The contagion is spreading across Europe. The politics are complicated but desire for more and more bailouts are running short:

“(Reuters) But German Chancellor Angela Merkel rebuffed pressure from EU partners and the United States for Europe’s most powerful economy to underwrite debt or guarantee bank deposits in the single currency area.â€

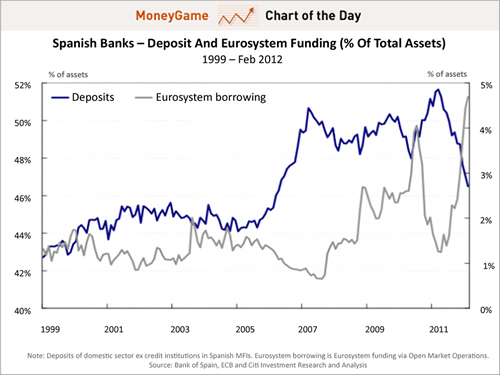

This run on the banks is nothing new and it is apparent that those within the system have been pulling out deposits from Spanish banks for some time. Apparently seeing your fellow neighbors with a 25 percent unemployment rate and youth at over 50 percent might make a few question the sustainability of the economy:

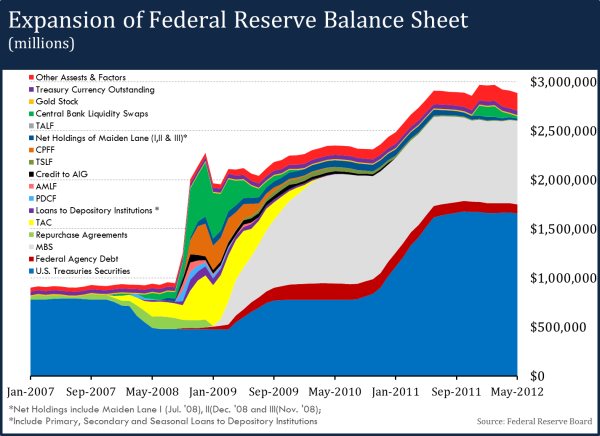

Yet here in the US the Federal Reserve has been acting as a ward for the banking system by bailing out the biggest banks at the expense of the public. If we look at the balance sheet at the Federal Reserve we realize the economy really hasn’t improved:

Source:Â Cofounded Interest

The above is astonishing. If the economy were truly in good shape, the banks would take back these “assets†and liquidate them back into the market. Instead, they sit in the balance sheet of the Fed with little audit oversight and banks receive trillions of dollars of injections and buffers. This has been going on since 2008 and what we get is national banks are using this money to speculate internationally even though they are using the full faith and credit of the United States. And you wonder why we still have a record 46,000,000 Americans on food stamps and most Americans saw their net worth evaporate by 40 percent between 2007 and 2010? The addiction to central banking stimulus serves one party primarily and that is the global banking system. The fact that the markets are “rooting†for the pro-bailout party in tiny Greece opposed to what system will best aid their working class should give you a perspective of what kind of system we are now in.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

JD said:

It won’t have a happy ending!

Hopefully the US can minimize the danger to our markets but I’m not convinced

June 15th, 2012 at 5:30 am -

Ray said:

This website needs a Facebook like button. I enjoy this website.

June 15th, 2012 at 9:40 am -

therooster said:

We’re all looking to the wrong entity for a solution. Our debt problem won’t be solved by more of the same and the elite are relegated to a specific role. The marketplace must take responsibility for monetizing assets (such as PM’s), add to liquidity by way of circulation and do so debt-free. This will actually allow debt to be purged and removed as Gresham’s Law reverses. Gresham’s Law is predicated on FIXED bullion values (people held on) , not floating values. The USD’s ultimate purpose is not that of a currency, it may surprise you. Its ultimate design is to act as a real-time measure to real-time gold-as-money in a new paradigm where real-time and real-time reflection is key. This was never possible before the 1990’s. The floating dollar’s currency role has been a stop-gap “band-aid” on route to its role as a measure in support of gold and acts to bridge the debt-money paradigm and the real-time gold-as-money paradigm.

June 19th, 2012 at 9:40 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!