Global debt enters terminal velocity mode: Why central banks have no intention of slowing their public and private debt binge.

- 1 Comment

Central banks around the world are following one core mission. That mission revolves around expanding debt to goose equity markets and attempting to solve a debt crisis with more debt. Even the more conservative European Central Bank bowed down to easy digital money printing by announcing they too would follow in the footsteps of the Fed and Bank of Japan. Global banking is now fully addicted to non-stop debt. Every dollar of debt is having a smaller impact on what it can do to the real economy. The Fed’s balance sheet is now well over $4.3 trillion and while talks of tapering are made in public, there is no visible action being taken to show this is the intended goal. At the core of the global crisis was an expansion built on too much debt. Banks attacked this issue as one of liquidity but in reality this was a crisis of solvency. Banks never dealt with writing down assets but have decided to use modern day inflation methods to boost banking profits at the expense of working class families. Global debt has now reached a terminal velocity mode and central banks have no choice but to continue to expand their balance sheets.

Central banks follow one mandate

Some people act as if the crisis never happened. US stock markets are at record levels and those with access to wealth continue to get richer. The policies that are creating a massive low wage economy in the US are also part of the other side of the coin expanding debt based bubbles. It is no coincidence that items financed by debt (i.e., college, housing, cars, etc) are seeing inflation many times higher than that of wages. In fact, wages are stagnant. Central banks realize that keeping interest rates low through whatever means necessary is the only endgame for their current charade.

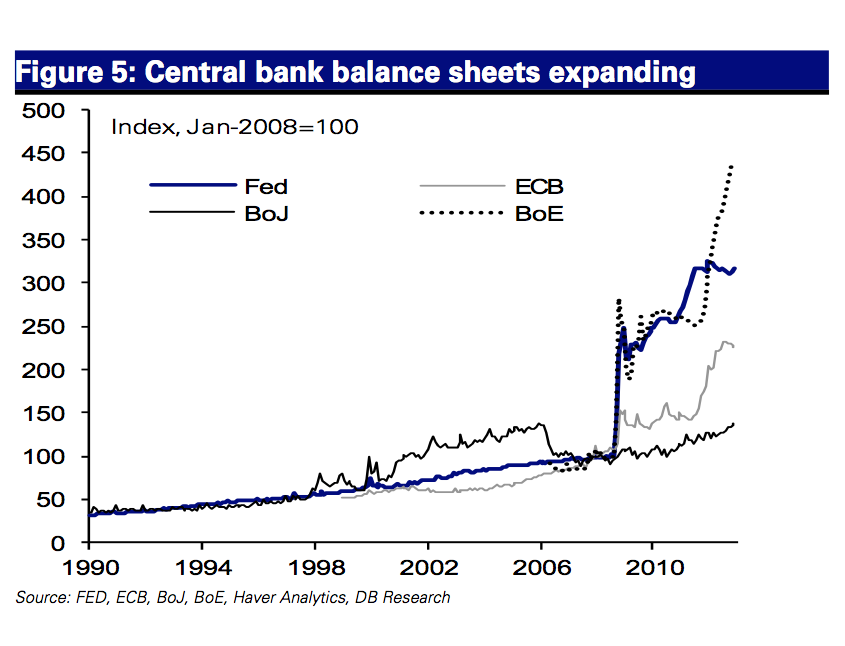

Would you lend someone money if you knew you would never get paid back? Probably not. Yet this is the trajectory being followed by central banks. Take a look at the below illuminating chart and tell me if central banks are operating as if we are in a full recovery:

Central banks are taking on policies that appear to indicate a deep and profound recession. The only issue with this is that the US recession ended in 2009. Why continue expanding at such an aggressive pace? The chart above shows continued aggressive expansion of central bank balance sheets. First, many US banks were fully insolvent. That is, they had overplayed their hand and were holding onto assets that were way overvalued. This led to the foreclosure crisis. But a funny thing happened. The US allowed these toxic assets to fall into the Fed’s balance sheet and policy makers allowed mark to market accounting to be suspended. Little by little banks inflated the housing market back up. This dramatically helped banks stay afloat while fully manipulating the market at the public’s expense. Keep in mind millions of people lost their homes yet every large major bank actually has become bigger and salaries of these financiers are back to where they once were. In an incestuous twist, many of those foreclosures are now owned by the new rentier class as they chase yields in every asset class.

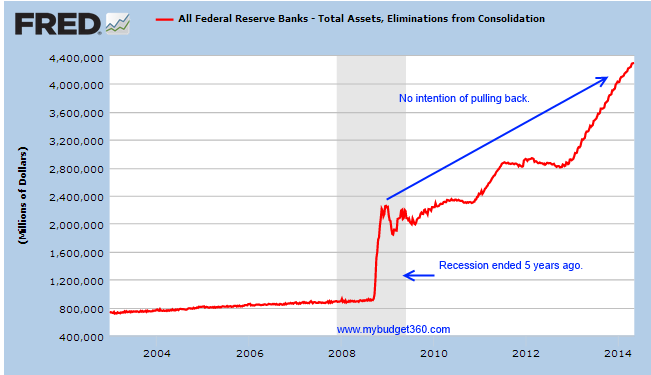

The Fed’s balance sheet only continues to grow since they essentially own the US mortgage market:

Where is the taper talk being reflected in the chart above? The Fed now has a $4.3 trillion balance sheet. The Fed is operating in full crisis Great Recession mode. Don’t believe any of the hype that the Fed is in control here. Look at the Bank of Japan and you will realize that when you are a debt making hammer, everything looks like nail.

The global markets are controlled by central banks. This is a central bank market rally. It is also, once again, causing global property bubbles from Canada, China, Australia, to the United States (again). The small globally connected elite realize this and that is why you have foreign money buying condos in New York, flats in London, and single family homes in California. They understand what is playing out and are doing their best to purchase real assets before the public starts waking up to this slow inflationary robbery despite what official statistics show. Central banks have no desire to taper. Once you give a market low rates, an addiction takes hold. Similar to low wage capitalism, once people get used to a low price good luck trying to push higher costs. Everything gets driven down for the prosperity of the few. We live in a world of limited assets and central banks dealt with this debt crisis by creating more debt. So it is no surprise that global property bubbles are once again raging.

The fact that tapering talks have been going on for some time with no real reversal (take a look at the Fed balance sheet chart above), you start to realize central banks are in full terminal velocity mode. They only have one hand to play. Convince the public they have all of this under control until it spirals out of control, again. Keep in mind Ben Bernanke thought the housing market issues were confined to the subprime market in 2007, right at the peak of all the global debt madness. All central banks are playing out of the same rule book; keep pushing rates lower for the main purpose of keeping wealth inflated for those that actually have wealth higher by simply going into deeper debt.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Walter Ruggieri said:

The FED is doing all it can to keep interest rates down. That will come to an end one day. The market will not let interest rates stay this low forever. When that happens we are going to see a wave of bankruptcies like never before. It’s going to get ugly.

May 12th, 2014 at 4:44 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!