When the middle class loses the battle to inflation: Census data shows household income continues to stagnant while debt continues to expand.

- 2 Comment

The annual Census data was recently released and showed a grim picture when it comes to household income. While GDP continues to grow and the stock market continues to reach new peaks, the middle class continues to fall further behind economically. Americans however continue to add mountains of student debt and auto debt as to make up for the lack of income growth. This appears to be a seminar of better living through debt. The middle class is witnessing the impact of inflation. While the CPI figures highlight moderate growth, just look at the cost of housing, cars, education, food, and healthcare and ask yourself if inflation really is that tame. It is not. Inflation is hitting middle class Americans where it hurts the most unfortunately. That is why the new Census data combined with figures on debt growth highlight a disturbing trend. That is a trend where middle class families are plugging gaps in income with going into deeper debt.

Household income going nowhere

While GDP continues to expand and the stock market makes new peaks, it is hard to tell how much of this is filtering down to working class Americans. Keep in mind that many companies were able to boost earnings via lower wages, cuts in benefits, and passing on higher profits to a few in a company. 90 percent of all stock wealth is held in the hands of 10 percent of the population. The Census data is released once a year but does a good job at highlighting where things stand in the current economy.

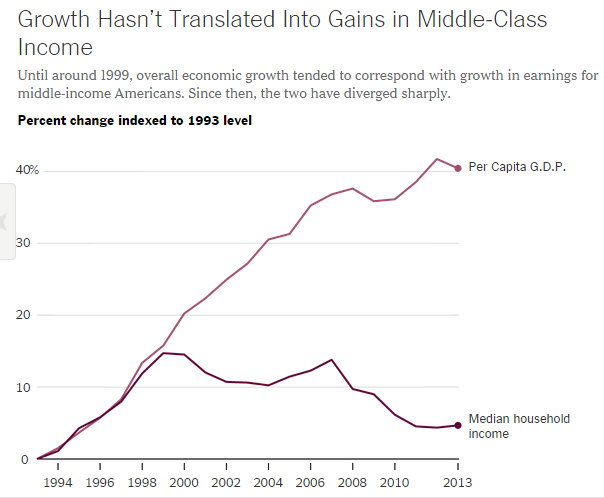

If we look at per capita GDP and household income growth we would find the following:

Source: NY Times

While per capita GDP growth is up significantly, little of this is showing up in household income growth. That is tough on households that are finding the cost of many things soaring through the roof. If a family would like to send their kids to college, they can expect to pay a very large price tag. Many families are unable to help so students merely take on incredible levels of debt. We’ve also documented how many lower income Americans are being given subprime auto loans to purchase their vehicles. A car is a necessity in many cities but it is hardly an item to be counted as an asset.

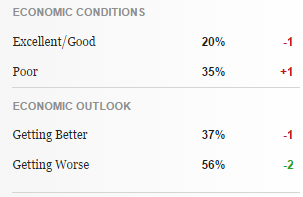

Incomes absolutely matter because they are a proxy to what Americans can purchase. If most items in life are increasing in price and incomes are not keeping up, the standard of living will go down. This is why with a record in the stock market, general economic sentiment in the population is not good:

The Census figures simply tie into what we already know and that is the cost of living is increasing via inflation. This inflation is occurring largely because of the way debt is funneled into the economy. With schooling for example, the loans are backed by the government so schools have every incentive to push prices up to the level of maximum student debt. Many for-profits rely on Federal funding for virtually 100 percent of their revenues. The argument is, education should be an option for all so funding needs to be there. Yet if you truly believe in education for all, why not make it free? After all, with the $1.2 trillion in student debt outstanding I’m sure we can give access to many students.

This is the first generation since World War II that is likely to see their children in a tougher economic situation than their children. It isn’t like older Americans are walking in paradise either. Just look at retirement accounts for most Americans and the picture isn’t pretty.

The Census data merely highlights what we already know and that is for middle class families life is becoming more expensive and costs are rising.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

TRexL said:

I always look forward to your blog posts.

If we really wanted to tackle the higher education problem, eliminate all federal funding for the for-profit paper mills. Throw all that money into community colleges and in state tuition. Students could then attend all those schools tuition free. They are legitimate institutions.

Of course, the lobbyists for the the University of Phoenix’s, National University’s, Argosy’s, etc will never let that happen. Just one more way corporations are robbing the taxpayers blind.

September 19th, 2014 at 6:07 pm -

Archy Don said:

Just one indicator of fundamental transformation.

September 20th, 2014 at 7:49 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!