Housing and Banking Deception: 23,000 to 28,000 Foreclosed Homes kept off the MLS or Public View in California each Month.

- 7 Comment

The math in California housing simply does not add up. Given the amount of sales and monthly foreclosures over the past few months, it would appear that banks are sitting back while a gigantic backlog of foreclosures grows. A few in the media are calling attention to this obvious fraud but not many. The California housing market is reeling from an epic mulit-decade long real estate bubble. For the past few months, foreclosures have been hitting at a record pace yet the official MLS inventory is falling lower and lower. I have pulled up data for the largest California counties with MLS data from March and compared it to July and what you will see is simply astonishing. I will compare this data with actual foreclosures and what you see is banks are taking homes back, failing to list them on the MLS, and basically sitting back probably hoping the government bails them out.

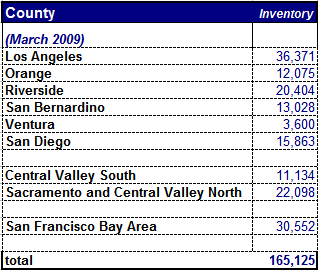

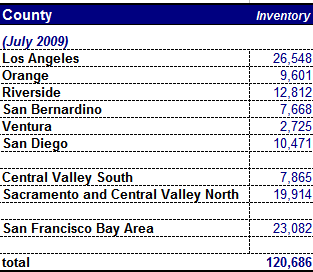

Let us first look at the March and July snapshots of inventory:

*Source:Â MLS data

As many of you know, the spring and summer are usually the hottest selling seasons and this normally will see both a jump in sales but also inventory. What we see here instead is a massive drop in inventory of 26 percent in 4 months! This data here isn’t the big shocker however. When we start looking at sales and actual foreclosures, that is when we start realizing something is terribly amiss:

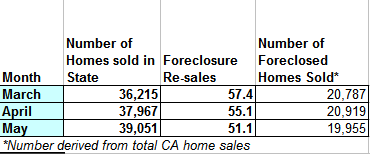

*Source:Â DataQuick

It is safe to assume that for June, taking an average from the past 3 months would give us a total of 38,000 to 40,000 additional homes sold in California for last month. So with that information, we can add the last 4 months to see that a total of approximately 151,000+ homes sold in California. Looking at our list of the largest California counties, we notice that the list on the MLS dropped by 44,439. But we know that over half of homes sold are foreclosure re-sales. This means in the last four months out of the 151,000 homes sold in California, some 75,000 to 80,000 homes that sold were distressed properties.

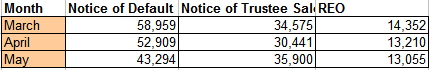

And here is where the major data discrepancies begin for the California housing market. Let us look at the distress inventory for this same timeframe:

In the same time that California was selling an average of 38,000 homes a month, an average 47,000 homes were being foreclosed on. So even looking at this basic data set for 4 months, we know that in March 20,787 homes that sold were foreclosure re-sales. But during March, we know that California had 48,927 actual foreclosures (we aren’t counting the 58,959 notice of defaults that will become foreclosures in 6 to 9 months). This pattern holds for April and May and I would assume June as well. So what is the bottom line? Some 23,000 to 28,000 homes per month that are foreclosed or now owned by the bank don’t make their way to the public MLS! That is why in this short time frame, we see the actual public data dwindle because organic sales from non-distressed properties are accounted for, but the building distress market is kept off the books and this is enormous. In fact, the MLS data is well accounted for:

Non-distress CA homes sold:

March:Â Â Â Â Â Â Â Â Â Â Â Â 15,428

April:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 17,048

May:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 19,096

June*:Â Â Â Â Â Â Â Â Â Â Â Â Â 17,191 (running average from previous 3 months)

Total:Â Â Â Â Â Â Â Â Â Â Â Â Â 68,763

And this would make sense since in our tiny subset, we accounted for 44,000+ homes that came off the MLS in this timeframe without including all California counties. Yet this is tremendously deceiving to the public. The pundits are spinning this data just like they spin the terrible unemployment numbers and are saying look at how quickly inventory is dropping. Well sure, this is the only data that we can see. But knowing the rest of the story we know that some 23,000 to 28,000 foreclosed properties are sitting somewhere either being sold off in bulk to investors or simply put, just sitting. We know that looking at closed escrow sales data that over half of the market is foreclosed properties so this is the market. I’m not the only one seeing this:

“(LA Times) The percentage of Los Angeles County mortgages delinquent by 90 days or more in May was nearly double the rate last year, First American CoreLogic reported today.

May’s 9.5% delinquency rate for L.A. County was up from 5% of mortgages late by 90 days or more in May 2008. First American bases its foreclosure analyses on public records.

While the default rate has nearly doubled, the number of homes actually being sold at auction — the final foreclosure stage — has shrunk. In May, the L.A. County repossession rate was down to 1% of mortgages, from 1.1% a year ago. This discrepancy is the “foreclosure backlog” now looming over the housing market. It’s caused by various government-mandated and voluntary foreclosure moratoriums, and possibly by lenders trying to manage the flow of repossessed homes entering the market.

Nationally, First American reported 6.5% of mortgages were in default in May, up from 4% in May 2008. The national repossession rate was 0.7% in May, up from 0.6% in May 2007.”

The amount of inventory being kept off the public view is simply enormous. This is going to end badly for a state with a massive fiscal budget problem. I have yet to see any deeper analysis trying to pinpoint the actual figure since it is hard to get any accurate figures from banks, but looking at data we know to be true, we know something is absolutely rotten in Denmark.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

Keith Howard said:

You may find your answers by finding out “why” lenders like countrywide have been sitting on homes they filed foreclosure on and have not executed the final trustee sale for up to 18 months plus on thousands of homes>>>>>??????

Feel free to contact me for a true insider viewpoint.July 10th, 2009 at 8:26 am -

oscarmadison said:

can you get data on who pays the taxes?

do banks list somewhere if they are paying the property taxes?

do the mortgage foreclosers have to pay the property taxes or do they get relief through the moratorium schemes?

July 10th, 2009 at 12:35 pm -

CompaJD said:

How long can the Banksters keep this up?

July 10th, 2009 at 12:39 pm -

Qout said:

Many Trustee’s sales are canceled at the last moment. Therefore, a property may go through several notices of a trustee sale before it becomes REO. And even after a property becomes REO it is often not in a condition that is ready for market. A surprising number suffer from terminal neglect. I talked to someone today who is rehabbing a home where all of the copper water pipe was ripped out of the walls by the foreclosed homeowner. That’s actually better than another case that I heard of where the power was cut off and the pipes froze in the winter, creating an ice rink on the first floor so heavy that the floor collapsed. Or stories of the thousands of homes in Florida where mold thrives after the A/C is shut off.

July 10th, 2009 at 4:35 pm -

jmac said:

I have not seen much hard data on “shadow inventory” statistics. I like this article, since it has some data (although unverified). It would be nice to see the author’s name and credentials though, and the source for the 4th table. I have suspected there is mounting “shadow inventory”, but after reading this, the magnitude is still unclear to me.

Here is an interesting table of SFR default rates for the top 25 banks, which you might find interesting:

http://www.thehardmoneypros.com/Top25_Largest_Banks_Defaulted_Loans.shtm

July 10th, 2009 at 5:18 pm -

Fred Reynolds said:

I am in the real estate listing business and can shed a little light on this subject. There is no requirement that banks list foreclosed properties on MLS. The Multiple Listing Service contains only properties that have been listed through a Realtor that pay for the MLS service through their broker. The Realtors receive commissions from the actual sale and closing of those properties, and banks hate paying commission to sell property they have already lost money on. Banks are typically not brokers or Realtors, therefore foreclosed homes aren’t listed on MLS unless the bank has contracted with a Realtor to find a buyer for the property. For those wanting to see listings of foreclosed homes, there are a couple of Websites out there that list foreclosures exclusively – and the number of listings on those sites are growing very quickly.

July 11th, 2009 at 9:19 am -

Adam said:

would love an update to this data!!!

adam

June 13th, 2010 at 10:40 am