The housing bubble is getting ready to implode: The scariest chart in real estate shows an impending correction because you can’t afford to buy a home today.

- 7 Comment

“Definition of economic bubble: A market phenomenon characterized by surges in asset prices to levels significantly above the fundamental value of that asset.â€Â We are definitely in another housing bubble. First, most Americans can’t afford to buy a home without utilizing artificially low interest rates and even then they are stretching their budgets like spandex. Second, home prices are surging in the face of stagnant household incomes. That is the biggest sign of a bubble. The underlying asset in housing is moving up even though incomes are not. So what is driving prices up? Speculation, flipping, investors, and what we would categorize as fickle money. This is the ultimate sign of a housing bubble. Homeownership is near a generational low because most households are living month to month unable to buy. If you want to see the housing bubble in one chart look no further.

The scariest chart in housing

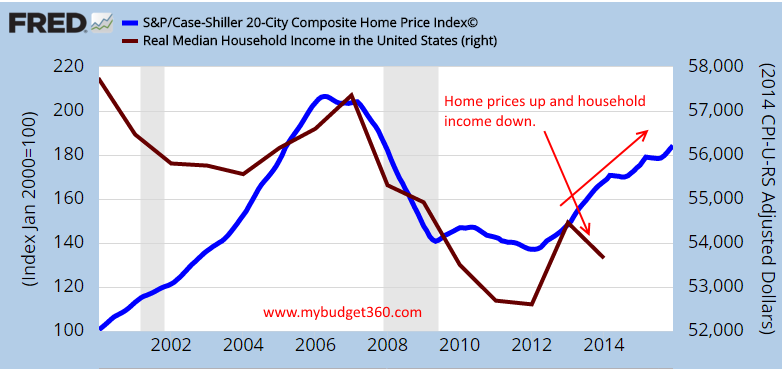

Home prices are up a stunning 34 percent from 2012. That is an incredible increase but this is not being driven by families buying homes. It would also be different if household incomes were going up. They are not. Take a look at this chart:

This might even be scarier than the years before the last bubble. Why? Take a look at the chart. From 2002 to 2008 housing prices and incomes went up together (but of course home values were already on an upward trajectory). The bubble hit and both home values and incomes went down. All of this makes sense. In 2012 housing prices and incomes went up. But that jump in income only lasted a brief period. Now, you have home prices surging 34 percent yet incomes are stagnant. That is a big problem.

You can even see this problem between new home prices and new homes sold:

New home sales are in the dumps yet prices are moving up dramatically. Most of this is speculation and of course the financial sector in our economy is thriving on the backs of the middle class. But are we in a bubble?

“Bubbles are often hard to detect in real time because there is disagreement over the fundamental value of the asset.â€

This is where we stand today. We are in the bubble. It is hard to assess value because people are disagreeing on whether this is a bubble or not. But take a look at commercial real estate values as well. This is definitely a bubble. You need to continue to have speculative money flowing in to keep values at their current levels.

Will the housing bubble pop this year? Bubbles can last longer than most people think. But there are already cracks in the system. You saw the market briefly correcting this year. Suddenly stocks are up on low volume and current prices are still overvalued. The same can be said for housing. Low supply, low demand, yet prices are going up. The Fed is completely afraid to raise rates knowing that it has no other option but to keep rates low. This policy move has made the middle class a minority.

Here is a good summary of where we are going:

“(The Sovereign Investor) I see one of two scenarios at play. Which one do you think will ring true?

- Homebuyers continue to fork over more dollars to buy properties while we sit with stagnant wage growth, stagnant economic growth and low-wage jobs being about all that’s created.

- We are on the edge of a bubble larger than the one we experienced less than a decade ago as housing prices race back down to where it is affordable and sees demand from new buyers.

The Federal Reserve is held accountable for this fiasco. If it goes forward with a rate increase in the near future, it will be us who pay the price of another bubble.

There’s only one action to take if you ask me — lower your exposure to the industry.

In stocks, that’s homebuilders and mortgage originators. Avoid them at all costs. In your personal investments, that’s being prepared for another real estate shock.

These prices are unsustainable and due for a correction.

Once that happens, opportunity awaits you to pick up houses and housing-related stocks on the cheap.â€

You have been warned.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

roddy6667 said:

Five more charts this article needs:

The growth of household debt

Number of mortgages delinquent 60 or 90 days

Number of car loans that are delinquent

Growth of student loans

Delinquent student loansMarch 22nd, 2016 at 9:24 am -

Bob said:

The problem is that housing is not like buying, say, an Iphone. Most people would reluctantly agree to live with their old phone or a cheaper smartphone for a few years if they couldn’t afford and Iphone. Very few people are going to choose to live on the streets for a few years if buying a house or renting an apartment strains their budget. Housing is a necessity, and investors know this. If people can’t afford houses, investors will buy them and turn them into overpriced rentals, and people will rent them, even if it means cutting back drastically on other things, because you have to have a place to live, and when houses are too expensive, your only option is to rent. Even when people are scraping by month to month, giving up other consumer goods, just trying to make ends meet, they’re going to pay for housing, unless they have truly hit bottom.

March 22nd, 2016 at 11:14 pm -

Miker said:

Note that real estate is an investment with a intrinsic value. Isn’t this a potential place to hide from the decline of the dollar? Inflation hedge? Couldn’t big money moving into real estate in slow preparation for a dollar crash cause this kind of run-up?

March 23rd, 2016 at 5:33 am -

saul sweis said:

The reason housing prices are back up is not speculation. Large banks and hedge funds have bought billions of dollars of homes after the foreclosed on people. Try and buy a house and you will lose out to an all cash offer from guess who? An investment bank or hedge fund. So not only can you not buy a home because of them, they are causing rents to skyrocket. The government needs to step in and stop them from pricing out middle class America.

March 23rd, 2016 at 10:09 pm -

Harquebus said:

There is no need for prices and wages to increase. Inflation is theft of wages and erosion of savings. This is what happens in fiat economies.

March 24th, 2016 at 12:00 am -

Brian Richards said:

All real estate is local. There are certain locations in which demand is great, like Vancouver (Canada) Miami, FL, San Francisco, CA, New York City, NY. As long as there are wealthy people, demand in these areas is not likely to decline. Then, one has a great swath of areas in which demand is relatively normal: for instance the South Eastern part of the US, and much of the Midwest. Housing is very affordable (even cheap) in many very livable medium sized cities in these areas. There does seem to be “over valuation” in some areas, but I suspect it is partially due to lack of investment opportunities in our “upside down” world we live in. There is also great capital flows from less stable countries into the US, which is perceived to be much safer. I think these capital flows are of great significance, and will support asset prices in the US, like the stock market, real estate and at least for a few years, US Treasury securities. But good luck to all of us.

March 25th, 2016 at 8:18 am -

Inflation/deflation said:

All valid arguments! Bottom line is always going to boil down to consumption of goods, I think. If wages stay stagnant (Save the false positive mean wage the US government puts out (23 per hour),it’s manipulative and includes the super wealthy. Mean wages for 98 percent of the population is lower dollar per dollar than in 1997, at 12 per hour).

That said; if wages don’t go up we cant have inflation, right? If we do have inflation consumers can’t consume, if consumers can’t consume jobs are lost…at some point it all collapses. It’s collapsing, Trump/Brexit = direct proof. Wages lock everything in place and we have had low borrowing rates for many years. Sure make homes unaffordable, buy up all the homes and charge astronomical rates, that has already happened. At some point the tenants won’t be able to pay rent and feed their families, let alone consume and help the economy. Remember, food requires not paying sales tax, renters don’t pay property tax and the super wealthy don’t pay taxes at all. Endgame!

Regulation is poorly needed and corporations will eventually be taxed heavily making it a better idea to NOT own…and their tenants won’t be able to payJanuary 28th, 2017 at 7:09 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â