How to spend $9 trillion in 10 years. How in the financial world did we end up with over $14 trillion in Federal government debt?

- 1 Comment

If we do a slow rewind back to 2001 U.S. debt stood at $5.8 trillion.  This today would seem like a bargain. So how in the world did we end up with the current $14.3 trillion figure in a matter of ten years? People like to ignore history but if you don’t know where your money is going then you are going to have massive holes in your budget. The fact of the matter is both political parties have setup a system where money is filtered up to the top one percent while the middle class wilts on a vine. This is the new economic system where wealth is distributed by political will while the working and middle class is forced into debt serfdom if they want to have any attempt at being middle class. Want a college education? It is virtually impossible to go to school without taking out onerous loans. Want to buy a home? Forget saving money when you can put it on tab and take on ludicrous amounts of debt that will set you closer to foreclosure down the road. Over the last decade the government has spent over $9 trillion and has put it on the national books. Let us examine what the biggest expenses were over this last decade.

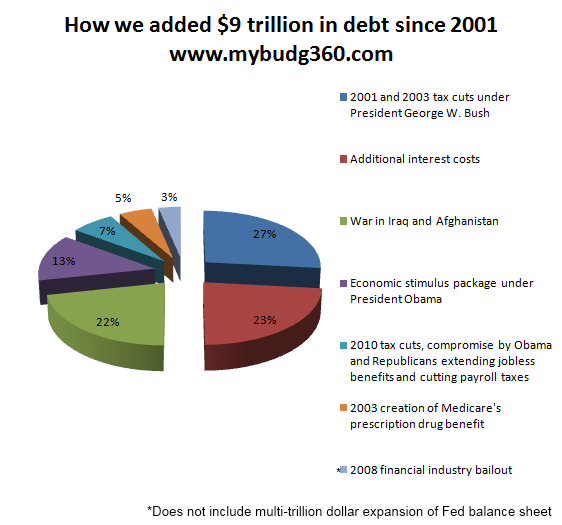

Where did the $9 trillion go?

The three biggest expenses that pushed the national debt to over $14.3 trillion from $5.8 trillion are:

-2001 and 2003 tax cuts:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1.6 trillion

-Additional interest costs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1.4 trillion

-War in Iraq and Afghanistan:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1.3 trillion

These are by far the three largest line items so why is it that we hear politicians and Wall Street bankers going after Social Security payments as a key place to balance the big debt that we have? If we look at the above, it doesn’t seem like Social Security is the largest reason for the U.S. debt running amok. In fact, out of the three top contributors to the increase in debt, the only item on the table at the moment is taxes and somehow this is garnering very little traction. Any sensible person is going to realize that we are going to have to cut and raise taxes to get the balance sheet back into equilibrium.

Much of what is going on right now is political theatre. Yet one thing is clear. The middle class is going to get hammered by either option because the amount of debt we have taken on over the last decade is simply amazing. Think about this. In 2001 we had $5.8 trillion and somehow over one decade we more than doubled that amount. Keep in mind the above is only factoring the banking bailouts as costing $200 billion but we all know that the Federal Reserve has done a shadow bailout and has increased its own balance sheet to over $2.8 trillion. Debt is piling up on debt.

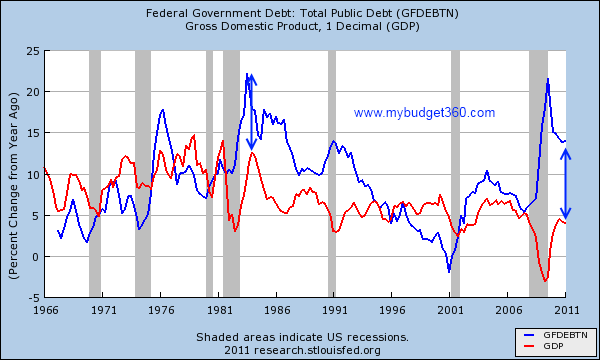

The velocity at which we are growing debt is stunning:

This is an interesting way at looking at the increase in government debt. We are comparing the annual changes in both GDP and government debt. You’ll notice that in the 1960s and the early 1970s that GDP was typically outpacing public debt in terms of year over year increases. This is good. You want to see your economy growing faster than your debt accumulation. But look at the mid-1970s and you’ll suddenly see government debt surpassing GDP growth. The 1980s look horrible when measured this way. Federal government debt was increasing at a much faster pace than GDP growth. This was an era of “deficits don’t matter†and obviously the good times had to come to an end. The 1990s had a couple of years where GDP outpaced government debt but then in the 2000s everything went haywire. Just look at the dip caused by the recession. We have spent money on many items but very little of that $9 trillion has trickled back down into the hands of the working and middle class.

This is why the income growth charts look like this:

Source:Â Mother Jones

The only group seeing solid income growth is at the top and much of their growth is secured by government favoritism and welfare for the rich. Think this isn’t so? How is it that hedge fund manager pay taxes at a much lower rate than your typical construction worker or miner? This is the new kind of system we live in and the fact that $9 trillion was spent in exercises that do very little for the middle class is simply stunning. 1 out of 3 Americans have no savings to their name so what are they financially trying to protect? A large portion of the population has bought into the notion that somehow these political parties are out to help them. Some movements have been taken over by corporate interests and no longer stay true to the core of their mission. Labels are misleading but the strategy being employed is divide and conquer. But when we look at the data carefully there is only a very small portion of the population that is benefitting from all this misinformation and political nonsense.

It would be one thing if this was all free market based but the bulk of the tax breaks go to the extremely wealthy. If you have no job or barely make any money what use is a tax break? Do people even realize that many of the bailed out companies, especially the banks now invest overseas and create jobs in other countries with U.S. taxpayer dollars? Most Americans would rather have a healthy economy instead of seeing their tax rate fall and having an economy that is producing low wage capitalism jobs. Just look at the facts above. We have spent so much in so many areas that have had a tiny impact on the middle class.

Do you think we have spent $9 trillion wisely over the last decade?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Larry said:

Might we be this broke if the 2000 election had not been hijacked? The country was taken over by a man just a decade sober and surrounded by scoundrels and scummers. What did we expect? So now we have to inflate our way out of it. Or, take those billion of barrels of oil we are finding all over America and start paying back. But will it do any good? Politicos have short memory spans shorter than their attention spans. In 15 years we’ll be back in the same boat. And around and around we go.

July 9th, 2012 at 8:56 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!