The erosion of purchasing power via inflation – Federal Reserve and the permanent portfolio.

- 6 Comment

Inflation has a subtle and quite way of eroding your purchasing power. The process can unfold slowly and before you know it you suddenly wake up realizing your paycheck no longer stretches so far. This is happening across the US in many ways. Those on very tight budgets, especially those now on food stamps are feeling the pinch of higher food costs. Middle class Americans seeking to send their kids to college realize that it might be difficult to do so without going into deep student debt. Inflation as measured by the CPI understates the real change in purchasing power because our system is flooded with massive levels of debt. Access to debt is viewed as a vector in which you can pretend to have money and spend on things you are unable to afford. Yet debt and wealth are not the same. Inflation is creeping into the system and people are feeling it.

Change in prices

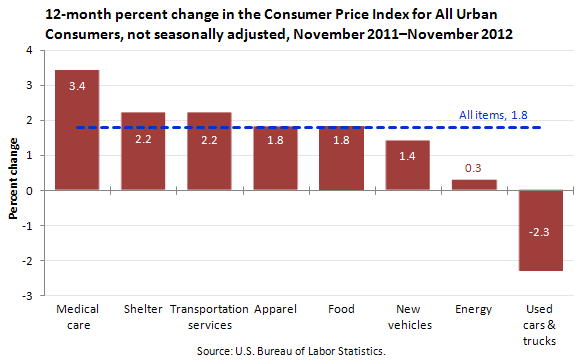

As household incomes have gone flat over the last year, the cost of many items has actually gone up:

The fastest rising sector is medical care cost. Do you think this is going to be an issue given the large number of baby boomers now retiring and requiring more medical care? Do you think this is going to put a strain on those Social Security checks indexed to the CPI? Of course it is.  Shelter went up by 2.2 percent over the last 12 months largely by the big push in rental prices and because banks are stunting the inventory available on the market. Again, if incomes are stagnant, all this means is more disposable income is now going to these sectors.

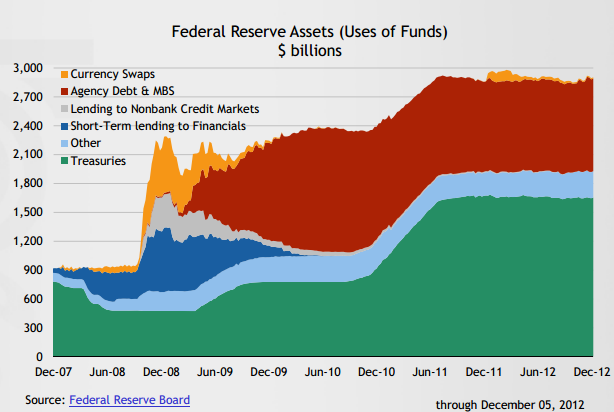

Food prices have also gone up by 1.8 percent over the last year and for the 47.7 million Americans on food stamps you can rest assured this is being felt. This is the slow eroding impact inflation has on your purchasing power. Americans feel poorer because they actually are. The Fed is purposely trying to devalue the dollar and create a low wage system where our nationwide debts are cheaply funded by low interest rates. The Fed is selecting winners and losers. This is no shock. Yet the Fed’s balance sheet is still near $3 trillion. Will they ever unload these items onto the market?

You’ll notice the large purchases done by the Fed starting in 2008. Not much has changed here. The Fed is the only player in town when it comes to mortgage backed securities. The Fed is keeping rates near zero to keep interest payments low but also to allow banks to unload their inflated assets onto the market at higher prices. Of course the public in order to compete will need to leverage itself with low rate mortgage but pay a much higher sticker price.

We are addicted to debt. That is clear. The Fed is creating a closed feedback loop here where the entire market now depends on its large action to keep rates low. They are now viewed as a permanent player in these sectors. You should not be surprised that the sectors being hit heaviest with price increases are those with maximum debt leverage. Think of housing and college. It comes as no surprise that these sectors see big price volatility. Housing has boomed, busted, and is now moving up again with the Fed keeping rates artificially low. Yet incomes are back to levels last seen in the 1990s. Tuition is rising across the nation in line with access to college debt. The large players in both markets are banks intertwined with the Fed.

Inflation is clearly here even as measured by the BLS data. Yet incomes are stagnant suggesting that people are seeing a real measurable decrease in the standard of living. The fiscal cliff is merely another method of funding spending with money we don’t have (more debt). It is part of human nature to want it all as quickly as possible without paying for it. Unfortunately the bill always comes due and many seem perfectly fine with passing the bill to future generations.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

6 Comments on this post

Trackbacks

-

johnjasonchundotcom said:

I agree with your analysis & conclusion. I don’t agree with your inflation numbers. The prices of Hard Assets such as real estate will more than double, more like 5-6x 2009 values. So if the 2009 value is 50% of 2006. Then the 2018-2020 prices should be 250-300% of 2006 or 500-600% of 2009 values. This FLEXIBLE SELL WINDOW OF 2018-2022 WHEN PRICES ARE VERY HIGH IS WHEN ALL REAL ESTATE MUST BE SOLD BECAUSE THE NEXT CRASH WILL DOWN ABOUT 60% TO 80% FROM THAT HIGH POINT…

How will I know? Well I have properly timed the Real Estate market from 1976 to 2012. I bought and sold over 22,000 acres, most in Calif. Just under 800 escrows closed. Batting Average from 1999 to 2008 was 198 sold escrows, average Gross Profit 1167%. Average of 49%/month for 10 years. Net Net Net after costs of 27.12% IRR for 10 years. My goal for the next “SELL WINDOW” 2018-2022 is to hit 50% NNN IRR/month…December 18th, 2012 at 8:15 am -

RUSS SMITH said:

SEASON’S GREETINGS PATRONS OF MY BUDGET 360 ET AL:

Tuition to attend a University in China runs from $400 – $2,200 per year plus scholastically the Chinese students are surpassing US students in their tests. The Chinese also get jobs, because they don’t have the entitlement programs that are rampant here in the US.

RUSS SMITH, CALIFORNIA (One Of OUR Broke States)

resmith@wcisp.comDecember 18th, 2012 at 7:18 pm -

KENNY G said:

truth be told

December 18th, 2012 at 11:54 pm -

Lady Liberty said:

Is the Government Wrong About Inflation? – It’s Actually OVER 5% In 2012

http://www.usnews.com/news/articles/2012/11/15/is-the-government-wrong-about-inflation

Our ‘How-to Manual’ for Betraying Seniors and People with Disabilities

http://www.huffingtonpost.com/nancy-altman/our-howto-manual-for-betr_b_2322950.html

December 19th, 2012 at 10:02 pm -

mike said:

Russ, education is free in Finland and very reasonably priced in France, Germany, and several other EU countries that have exceptionally strong social safety nets. Perhaps you should look to those for inspiration and admiration, rather than countries without social safety nets, unless you somehow believe you’ll be protected when others lose the only things standing between them and riots.

December 20th, 2012 at 9:10 pm -

TrapperGus said:

To follow up on an earlier poster’s point….the inflation which we may see when the economy from an employment point of view comes off the floor as the housing asset bubble is deflated was created during the housing asset bubble, not by the Fed covering it via the balance sheet…the question is can the Fed reduce its balance sheet as this occurs?…one option they can use but seldom have used is to just make the money on the balace sheet vanish by removing it from the books, just like they make money appear by addition it to the books…it will be interesting to see if that is what they do.

December 23rd, 2012 at 7:32 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!