The drop in the labor force is coming from prime-age Americans, not aging retirees: Examining the 94.6 million Americans not in the labor force.

- 3 Comment

Those not in the labor force hit a record number in the last month. While the mainstream press tries to spin it as a retirement trend, the reality is most Americans are too broke to retire. The Atlanta Fed added some color to explain the big decline in labor force participation. As it turns out, the decline is coming from structurally problematic areas. We have many that are in the prime-age category (25 to 54 years of age) that simply say they don’t want a job. There is also a big jump in those on disability beyond normal population growth. And finally, we have a larger share of younger Americans going to college and loading up on mega amounts of student debt. Another contributing factor that is nicely left out is that we have many older Americans continuing to work into old age because as we have mentioned, many older Americans are too broke to retire. Let us look at the research more closely.

Not in the labor force and not wanting a job

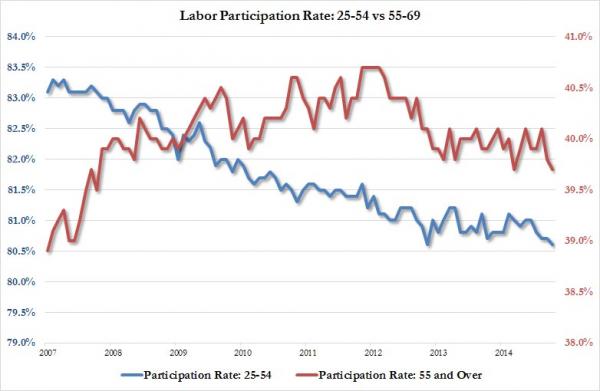

What is probably more troubling about the growth in the “not in the labor force†category is that a big jump has come from those 25 to 54 years of age. This is the prime 30 year window when Americans typically work. Yet something is dramatically shifting. While the labor force participation rate of older Americans is holding steady, the rate of those in the prime-age range has collapsed.

The collapse of the labor force participation rate of those 25 to 54 years of age goes completely against the mainstream narrative. Take a look at the trend:

The group leading the way lower is coming from the group that should be working. There is now a deeper attempt to explain this rate decline beyond the party line that Americans are simply getting older and are taking their non-existent retirement nest egg into the sunset. That is not the case. Half of elderly Americans would be out on the street without Social Security.

So what is driving the rate lower?

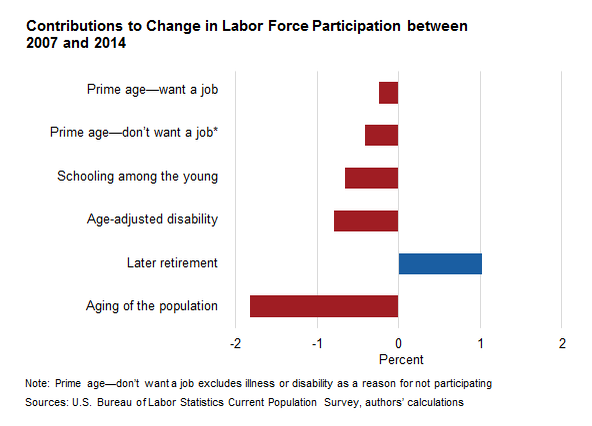

Source:Â Atlanta Fed

“(Atlanta Fed) The decrease in labor force participation among prime-age individuals has been driven mostly by the share who say they currently don’t want a job. As of December 2014, prime-age labor force participation was 2.4 percentage points below its prerecession average. Of that, 0.5 percentage point is accounted for by a higher share who indicate they currently want a job; 2 percentage points can be attributed to a higher share who say they currently don’t want a job.â€

While the aging of the population is a factor (of course) there are other categories that are pushing the rate lower. Let us go through them one by one:

Prime age – want a job: This is the most obvious one. These are people that want a job but are simply not counted. Many of the long term unemployed fall in this category.

Prime-age –don’t want a job: This is an odd category and accounts for a large number of Americans not in the labor force. You can have folks that were so exhausted at looking for work that they simply have given up.

Schooling amount the young: We have a record number of Americans in college and we also have $1.36 trillion in student debt outstanding. While an education is important, what is the true value of going to college and how do you choose when there are nearly 5,000 universities and colleges? What about those that get sucked into for-profit paper mills?

Age-adjusted disability: What is interesting in this category is that we have seen a high jump in this group adjusting for population growth. In other words, we are seeing more people claiming disability beyond the actual expected growth in the population.

Later retirement: This one obviously goes against the media squawking. More Americans are working later into life because they simply don’t have the means to retire.

Aging of the population:Â This is the baby boomer party line here.

In other words, the big drop in labor force participation is happening largely because of weak performance in the economy, not old people cashing out and heading into Margaritaville.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Miggy said:

You make it sound like social security is a handout. Last time I checked my paystub, and every time before that, I was minus social security money. I can’t let you sneak that in. It’s our money.

October 11th, 2015 at 6:35 pm -

Rachel said:

For those who are prime age & wanting a job, they will do one of 3 things.

1. They will find what they are looking for or find something even better.

2. They will find something less than what they wanted and settle for it, possibly hoping to find what they were looking for at a later date. Good luck with that, it’s not as if employers will give you time off to go on interviews & filling out applications elsewhere despite hiding your intent to do so. Most employers will not give you time off even for the best of reasons.

3. They will give up after months or even years of looking.For those who are prime age & NOT wanting a job, they either have someone else (relatives/spouse/friends/government programs) subsidizing them, they have some savings, may even have some illegal income, or possibly some combination of these things. Many people have looked for work for months and some for years and give up for the short term but FEW have the ability to do so long term.

October 12th, 2015 at 2:33 pm -

Gary said:

We’ve made it far to easy to live off the work of others in this country and it shows in the entitlement mentality of the “don’t want a job” category. It’s time for a little tough love. We need to implement the “if you mentally don’t want to work, you physically aren’t going to eat” program. I’m tired of joking at tax time about all the dependents I have that I’ve never met.

October 14th, 2015 at 10:27 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â