Living paycheck to paycheck with the housing albatross – Survey finds one in three Americans unable to make their mortgage or rent payment beyond one month if they lost their job. 61 percent unable to make payments beyond five months.

- 1 Comment

One of the unnerving revelations brought about by the current recession is how many Americans are living precariously close to the economic edge. The Band-Aid of credit cards, home equity loans, and other vehicles of debt masked the problem for many years. Debt was rolled over on a continuous basis and as long as the debt bubble expanded the process seemed limitless. Yet the bursting of the debt bubble largely brought on by the collapse of the housing market is revealing the true state of the economy. A sobering new survey finds that one in three Americans would not be able to make their mortgage or rent payment beyond one month if they lost their job. For most Americans this means $1,000 to $1,500 a month. This also ties in to the grim reality that one in three Americans has no savings to their name. The housing market has been mired with problems for nearly half a decade now. This clouds the perception of future home buyers going forward. Because of this buffet of problems the U.S. housing market will forever be changed.

Living one paycheck away from being homeless

It really is an incredible fact that over 30 percent of Americans are one paycheck away from being homeless:

“(DSNews) One in three Americans would be unable to make their mortgage or rent payment beyond one month if they lost their job, according to the results of a national survey taken in mid-September.â€

This survey was only conducted a couple of weeks ago and continues to show the disappearing middle class in America. This data simply reinforces the problems housing will have moving forward. The mantra of “real estate only goes up†is forever shattered for the current generation. And even the few with solid incomes would be homeless if they lost their jobs:

“Despite being more affluent, the poll found that even those with higher annual household incomes indicate they are not guaranteed to make their next housing payment if they lost their source of income.

Ten percent of survey respondents earning $100K or more a year say they would immediately miss a payment.

The survey was conducted on behalf of a financial consortium comprised of the Certified Financial Planner Board of Standards, Financial Planning Association, Foundation for Financial Planning, and the U.S. Conference of Mayors.â€

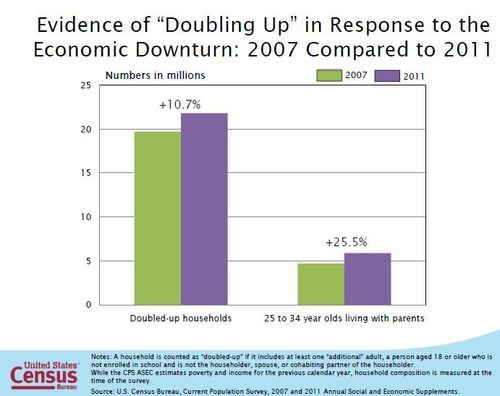

This shows a dramatic comfort with debt and how much we have come to rely on debt instead of actual generated income. As the recession rolled along many did find themselves unable to deal with the weak economy and households with “doubled-up†status grew by millions:

What I see above is simply more pent up demand for rentals. It is unlikely that those living in this situation will go straight into being homeowners after moving back home. When things improve, however long that may be, these individuals are likely to run out first and pickup a rental. Will they purchase homes? Hard to say given the negative stigma now being branded on the housing market.

The overhang of negative equity

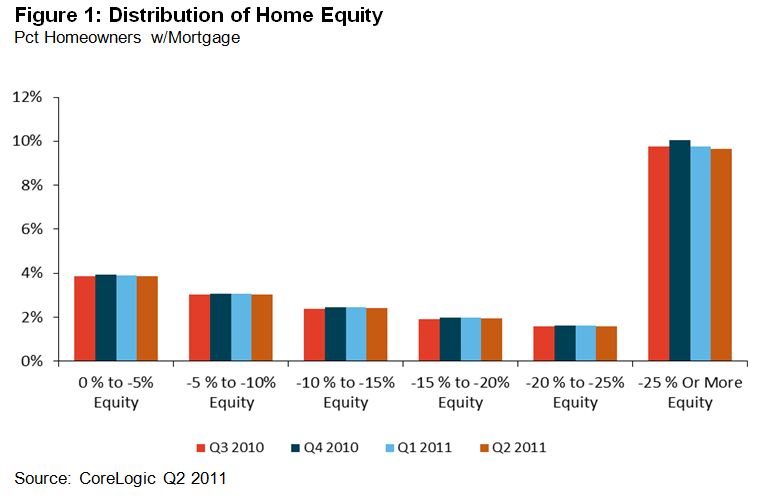

The country also still has many households living with an albatross of a mortgage that is worth more

than the value of their home:

“CoreLogic … released Q2 negative equity data showing that 10.9 million, or 22.5 percent, of all residential properties with a mortgage were in negative equity at the end of the second quarter of 2011, down very slightly from 22.7 percent in the first quarter. An additional 2.4 million borrowers had less than five percent equity, referred to as near-negative equity, in the second quarter. Together, negative equity and near-negative equity mortgages accounted for 27.5 percent of all residential properties with a mortgage nationwide. The new report also shows that nearly three-quarters of homeowners in negative equity situations are also paying higher, above-market interest on their mortgages.â€

Over 22 percent of all mortgage holders are still underwater. This is a stunning figure especially given the length of time of the crash and bailout programs aimed at the housing market. In reality, the bailout programs were largely designed to protect banks and not geared to saving home owners. There is now a wave of businesses picking up distressed bundles of loans and waiting to go after deficiency judgments against previous home owners in many states. In other words this albatross is going to follow many families for years to come.

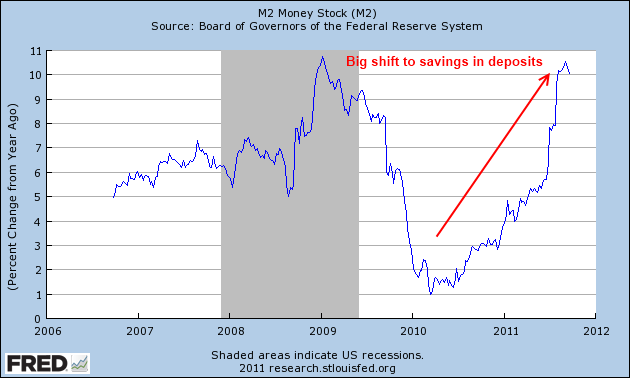

Banking on safety

In a twisted system you have banks trying to punish savers because deposits for banks are actually held as liabilities:

“Americans are pumping money into bank accounts at a blistering pace this year, sending deposits to record levels near $10 trillion.â€

Banks are slashing rates trying to dissuade deposits since this increases the amount of deposit insurance they need to pay. Banks would want nothing more than to lend money out and create more debt slaves but now with some modicum of due diligence, banks have very few qualified people to lend to. Just refer up to the recent survey that over 33 percent of Americans would not be able to make one mortgage or rental payment beyond the next month if they lost their job.

The unhealthy housing market

The housing market continues to face an unhealthy mix of foreclosure resales and all-cash invstors:

“All-cash sales accounted for 29 percent of transactions in August, unchanged from July; they were 28 percent in August 2010; investors account for the bulk of cash purchases.â€

There is still no semblance of normalcy in the housing market. I doubt we’ll ever see another housing boom like we did during this bubble in our lifetime. The needs of this generation and the fact that we have a disappearing middle class change the dynamics of housing needs going forward. Many of the baby boomers looking to sell at peak prices will be horribly disappointed as a new generation has different housing needs. Many boomers are seeing this first hand as their children move back home. Housing has become the focal point of this economic collapse and many are questioning the future of the housing market. New households will form and life will go on but nothing like it looked like pre-2007. This is a new era.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

clarence swinney said:

INEQUALITY IN FEW NUMBERS

FAIR EQUALITY WOULD BE 30%-60%-10%

TODAY OUR NET WEALTH IS 80%-20%-0%OUR INDIVIDUAL INCOME IS 87-10-3 NOT 30-60-10

70,000,000 GET 87%

70,000.000 GET 13%FEDERAL-STATE-LOCAL INCOME TAXES–

AMERICA RANKS 26TH OF 28 OECD NATIONS

ONLY CHILE AND MEXICO TAX LESS THAN RICHEST NATION ON EARTH

INSTEAD OF TAXING TO PAY OUR BILLS WE BORROWED AND THE RICH GOT ULTRA RICH. WE OWE 14,000 BILLION.

THAT IS A MAJOR REASON 5% OWN 62% OF OUR WEALTH AND 25% TAKE 67% OF OUR INCOMEA MAJOR EXAMPLE IS DISGUSTING—ARE WE DUMB OR CRAZY?

HUGE TAX CUT FOR TOP 2% this takes the cake!

2% OWN 50% FINANCIAL WEALTH

2% TAKE 25% ALL INDIVIDUAL INCOME

2% INCLUDES SOME OF THESE INCOMES—MILLIONS—4000-3000-2000-1000

HOW CAN ANYONE JUSTIFY A TAX CUT FOR THAT MUCH WEALHT AND INCOME?????THIS LITTLE LISTING TELLS AS MUCH AS 1000 PAGE BOOK.

AMERICA WAS IN TOP 5 ON EQUALITY IN 1980

AMERICA IS IN BOTTOM 5 TODAY.TOP 1% GOT 10% OF OUR INCOME IN 1980 AND 20% TODAY

TOP 1% OWNED 20% OF OUR FINANCIAL WEALTH IN 1980 AND 43% TODAYIN 1980 WE HAD 10 BILLIONIARES. IN 1989 WE HAD 51.

WE TAXED TO PAY OUR WAY FROM WWII TO 1980.

IN THAT PERIOD WE HAD LARGEST JOB AND GDP GROWTH IN HISTORYIN 1980, REAGAN POLICIES BEGAN REDISTRIBUTION UPWWARD TO TOP 1%

BUSH POLICIES INCREASED IT AND ADDED ON 6000 BILLION DEBT INSTEAD OF GETTING REVENUE TO PAY OUR WAY. HOW MUCH DID WE BORROW THAT WENT INTO RICH BANK ACCOUNTS?THAT UPWARD SHIFT OF INCOME AND WEALTH BY 3 PRESIDENTS CREATED 99,000 NET NEW JOBS PER MONTH OR JUST ENOUGH TO COVER NEW ENTRIES INTO THE WORK FORCE. TWO PRESIDENTS GOT 222,000. JIMMY AND BILLY.

Clarence Swinney-Political Historian-Lifeaholics of America-Burlington nc.

Author-Lifeaholic—Success by working for a Life (Family-Health-Work-Finances)not just a Living ($$$$$$)October 4th, 2011 at 7:29 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!