The looming retirement crisis: 10,000 baby boomers a day turn 65 and most are inadequately prepared for retirement. Half of elderly Americans in poverty without Social Security.

- 6 Comment

There is a very common number that is thrown out regarding baby boomers and retirement. We consistently hear that every day 10,000 baby boomers hit the typical retirement age of 65. This trend is expected to go out until 2030. What is troubling with this narrative is the assumption that most have enough funds to actually retire. The reality is that most will depend on Social Security as their primary source of retirement income. When we examine net worth figures we find that the single largest asset for Americans is their primary residence. It is good to have a paid off home in retirement but no income is generated from this. You have taxes, insurance, and the costs associated with maintaining a home plus the costs of daily living: food, healthcare, and other expenses. For many, the new retirement plan is a form of working until you pass away.

The looming retirement crisis

Americans do a very poor job of saving money despite being one of the wealthiest countries in the world (although wealth inequality is at record levels). This partly has to do with our consumption driven economy. People go into mind boggling levels of debt to purchase cars for example. Many will take on subprime auto debt just to purchase a car that is out of their financial reach. Retirement planning is a slow and largely boring process. There is nothing exciting about setting aside a few hundred dollars per month for 40 years.

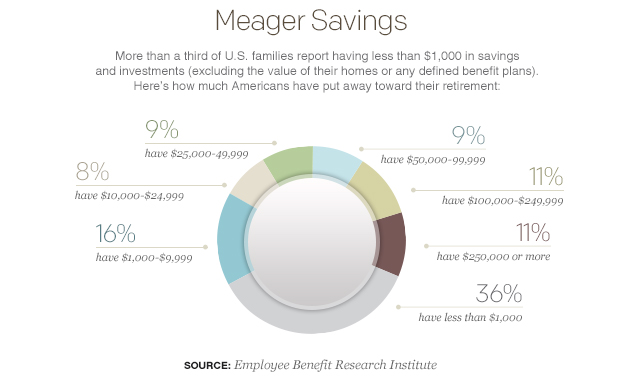

More than one-third of Americans report having less than $1,000 stashed away for retirement:

In fact 78 percent have less than $100,000 saved for retirement. 52 percent have less than $10,000 saved for retirement. One large medical expense is enough to blow right through these savings. And it is a fact of life that medical expenses rise as we go deeper into old age. Is this really a crisis?

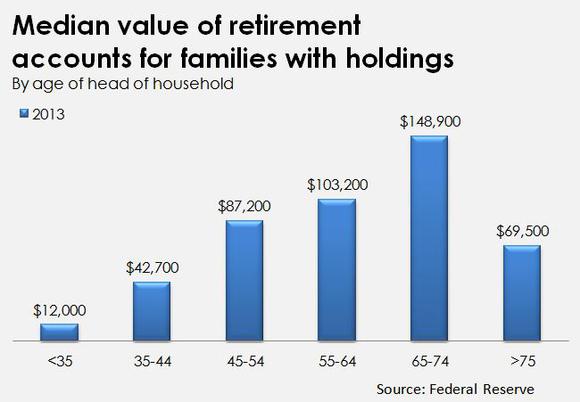

We also find that when we dig into Fed Survey research that most of the equity is tied up in real estate equity:

This might look good but you have to look at both charts together. One looks at retirement savings and the other looks at net worth. There is a massive gap between the two. Why? The Fed Survey data includes home equity into the net worth figure. So this chart overestimates how prepared Americans are for retirement. The reality is, most are not geared up for any sort of retirement. Many will rely on Social Security as a way to fund their retirement:

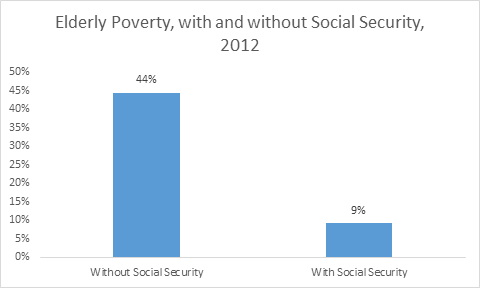

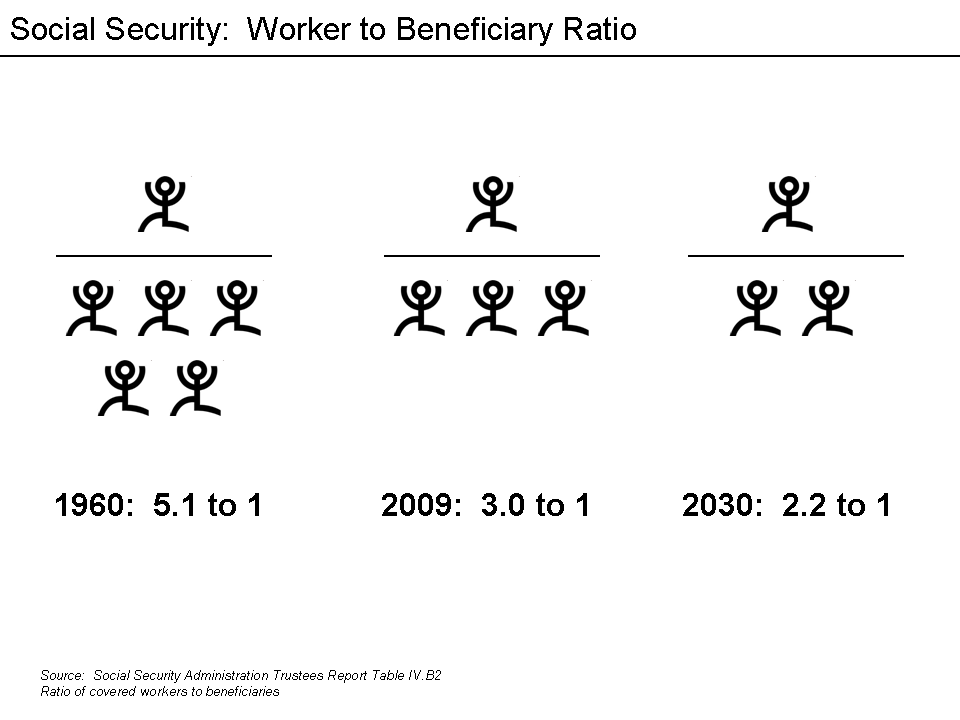

44 percent of elderly Americans would be in poverty without Social Security. The system relies on a large and young workforce to keep cash flow net positive. Here is a breakdown of this challenge:

In 1960 you had 5.1 workers to each retiree. Today it is closer to 3 to 1 and in 2030 it’ll be 2.2 to 1 retiree. What does it mean? It will be harder to sustain this system especially when we are bound to encounter recessions along the way.

It is hard to imagine how going into deeper debt as a nation and at the individual level is going to resolve this. Ultimately it seems like the topic is brushed aside and ignored until another crisis hits. This is an important topic to discuss and explore but it is largely being ignored. The fact remains that we have 10,000 Americans per day hitting the age of 65 and this trend won’t end until 2030.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

Rachel said:

The reality is that for many Americans, social security is their only source of income and that in and of itself equals poverty for the vast majority of those collecting it.

June 16th, 2015 at 5:06 pm -

gman said:

“Many will rely on Social Security as a way to fund their retirement”

ain’t gonna happen.

June 17th, 2015 at 8:36 am -

tinfoil hat davy said:

I’m in the 11% having over 100K thanks to my wife’s employer sponsored 401K.But I’m not putting a red cent of my earnings away into anything related to the USD. The minimum wage was $1.50. when I joined the workforce. Soon it will be ten times that. The stock market is doing great, just like in 1928. Time to run away!

June 17th, 2015 at 4:26 pm -

Ame said:

The graph of median retirement account values is from 2013. We all know that the stock market has been massively overinflated and is due for a “correction”. When that happens, like in 2008, these accounts are likely to go down by at least 40% or more. It’s a good time to move that money, imo.

We have been brainwashed from the cradle that the “American Dream” must include a home we own. So, we have dutifully saved for the down-payment on our “starter home” and then paid the bank whatever interest they required on our loan. Then we traded up to a larger home using the equity of our starter and also traded up into a jumbo loan. All because we needed to show our success and, of course, because the “property ladder” is the way to wealth.

Well, so many of us discovered the stock market and 401K’s do not always go up and stay there, and houses DO lose value and you CAN lose your down-payment and investment in that home due to foreclosure.

We as a nation are at a precipice financially.

June 22nd, 2015 at 3:08 pm -

Curt Taylor said:

I’m 61 and heading into retirement with plenty of cash and securities. The reason is as a 16 year old my Dad taught me how to save money. I have had the same job for 40 years , nose to the grindstone. Not many vacations, cars, etc. My time is coming. Raised two beautiful daughters who call me now to tell me how much they have in the bank. I’ve succeeded in passing along the gift of how to save money to my daughters. This makes me proud. Lets not blame the system. No matter what you make , you must pay yourself first , even if it’s only 5 dollars a week. Doesn’t matter, over time this will grow and put you in a better place. Think about “needs’ vs. wants” Get what you absolutely need and take a pass for now on what you want.

January 23rd, 2016 at 6:57 am -

Richard Cook said:

I was taught a budget by my boss when I started my first job at one dollar and 25 cents per hour.He said pay yourself 10 percent of your check first,thenask yourself one question before spending any money,is it absolutely necessary to spend this money,IF the answer is no,then dont spend it.I did this until I became very wealthy.I am retired now and never have to think about money.Ive been able to give my children thousands of dollars when they have money problems.

August 9th, 2016 at 12:35 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â