Millennials are worse off than their parents: Millennials earn 20% less than baby boomers at same stage in life.

- 4 Comment

It is now official that Millennials are worse off than their parents. The Federal Reserve released a study showing that Millennials are as broke as we suspected. According to the figures released Millennials earn 20% less than baby boomers did at the same stage in life. This is a major reason why so many Millennials are living at home but are also unable to save for retirement. What compounds this issue even more is that the Millennial generation is the most educated ever in the United States. What we also know is that Millennials carry the vast majority of the $1.4 trillion in student debt outstanding. This information puts our society at a fundamental crossroads in addressing the challenges faced by the young. Do we care if the next generation is worse off than the previous one?

Millennials not doing as financially well as parents

Being young and broke seems to be a common stage in life. The only difference is that Millennials are now getting into older adulthood and many are still struggling.

“(USA Today) Baby Boomers: your millennial children are worse off than you.

With a median household income of $40,581, millennials earn 20 percent less than boomers did at the same stage of life, despite being better educated, according to a new analysis of Federal Reserve data by the advocacy group Young Invincibles.

The analysis being released Friday gives concrete details about a troubling generational divide that helps to explain much of the anxiety that defined the 2016 election. Millennials have half the net worth of boomers. Their home ownership rate is lower, while their student debt is drastically higher.â€

This is something that we’ve discussed many times when analyzing the financial situation of young Americans. The standard net worth of someone 35 and younger is zero dollars. And in many cases many are worse off since they have a negative net worth courtesy of all the student debt they are carrying.

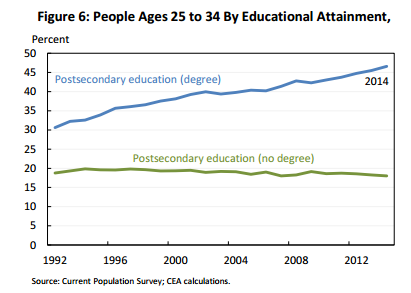

Young Americans are highly educated when it comes to college degree attainment:

However many are starting to question the worth of a college degree more carefully since many times getting a college degree does not mean you will be financially secure. It is troubling that so few colleges teach any basic personal finance course. It almost feels as if college is purposely trying to churn out consumers versus people that want to save for their future.

Millennials now face dramatically lower homeownership rates because of these changes. How are you going to take on a mortgage when you have a tiny mortgage in the form of a student loan already? This trend is important because for Americans overall, the home is the largest asset that they have since it acts as a forced savings account. Now, many young Americans are missing critical years when they could be paying down mortgage debt and building equity on a property.

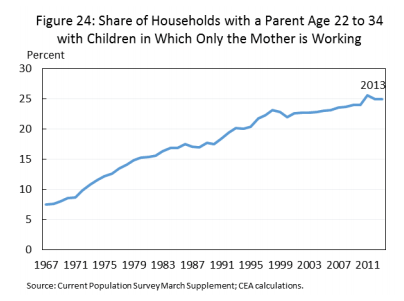

What is also telling is that there are now a record number of households where the mom is now the only person working:

We’ve talked about the two-income trap a few times in the past. While having two incomes is great, it is largely more out of necessity than want. Also, the cost of child care severely stunts what net income gains are made after working for many families.

The article gives an interesting example:

“Andrea Ledesma, 28, says her parents owned a house and were raising kids by her age.

Not so for her. Ledesma graduated from college four years ago. After moving through a series of jobs, she now earns $18,000 making pizza at Classic Slice in Milwaukee, shares a two-bedroom apartment with her boyfriend and has $33,000 in student debt.”

Do you need a college degree to make pizza? Her student debt is nearly twice her annual gross income. This is the new world for many young workers and now we know that financially speaking, Millennials are worse off than their parents.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

millilinials the new blacks said:

like blacks before them youngsters get suckered by the promise of free crap by the communist stalinist left like Obama and Clinton,result again after 8 years of obammy regime the black communities have been eviscerated and millinials are tragically in for the same fate,virtual extinction

January 19th, 2017 at 6:45 pm -

Heretoday said:

Theres a lot i agree with your post. The two parent trap and lack of personal finance education. It also has been said that the high cost of college may be partly caused by the ease of access not only loans to attend but also low bar to enter and complete college. But on the general point – of course a 30 something collge grad is not going to have income of someone who has been in the work force for 15 years already. At some colleges the average age is 27. But i would guess over a lifetime the income of grad of today would surpass that of yesteryear average income. Even with 35k debt. I dont agree rhat college should be free to all like bernie sanders belives. I am sure 70 percent of what is tuaght could be eliminated with no decrease in job skills.

January 20th, 2017 at 4:39 am -

brian said:

I would see where Gen X falls. Halfway between the two? better or worse?

January 27th, 2017 at 10:07 am -

The trueth said:

Dont go to an expensive college.

In fact. Go to the cheapest 4 year college you can find. A bachelor degree is a bachelor degree

January 28th, 2017 at 5:11 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â