Are Millennials as broke as the media says they are? The answer is a resounding yes for the following reasons.

- 2 Comment

If you type in “characteristics of the Millennial generation†into trusty Google you will find a list of interesting headlines. Some of the titles given to Millennials are: Generation Y, Generation WE, The Boomerang Generation, and The Peter Pan Generation. Part of this stems from the way many were raised by baby boomers who were promising their kids the world. Many felt that leaving college with any degree would be enough for a high income and an avalanche of jobs hitting their email box. None of this really materialized. Unrealistically high expectations. Denmark, which typically ranks among the “happiest†countries in the world carries one interesting trait – have low expectations. In fact, most Millennials are struggling in the current economy. The Millennial generation leads the way in the amount of student debt it carries. Many are stuck in low wage jobs earning so little, they are living with their parents deep into adulthood. How broke are Millennials? Pretty broke when you look at the data.

Blame it on income

A very high number of Millennials don’t even work or if they are working, are stuck in a low wage job. Close to half of recent college graduates are working in jobs that don’t even relate to their undergraduate degree. Not a problem when you pay little for college but this can be an issue when you are going into tens of thousands of dollars of debt to finance your studies.

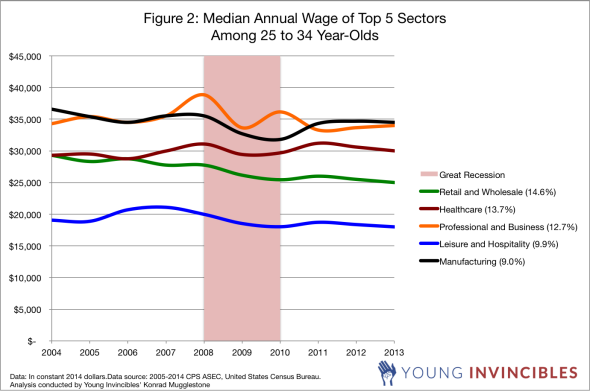

Income for Millennials has fallen across virtually all employment sectors:

It should be noted that the Great Recession officially ended in the summer of 2009 yet somehow, incomes continue to go down for Millennials. This is why younger Americans are angered and keenly focused on issues like income inequality and student debt.

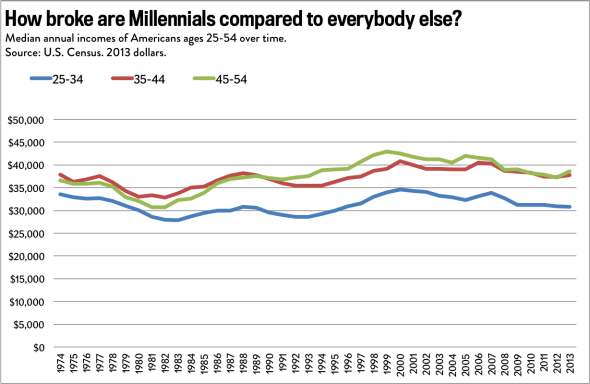

Millennials are the poorest income group in the United States:

This is expected given age and where they stand in their career but the problem is many Millennials are in positions that have little future progression. Millions are stuck in service industry jobs that provide no benefits aside from the immediate wages to pay daily bills.

This also ties into the problems of home buying. Millennials are in their prime home buying age, for some years now, yet somehow home buying isn’t picking up outside of big investors and boomers. So what happens? Millennials live at home.

Living at home

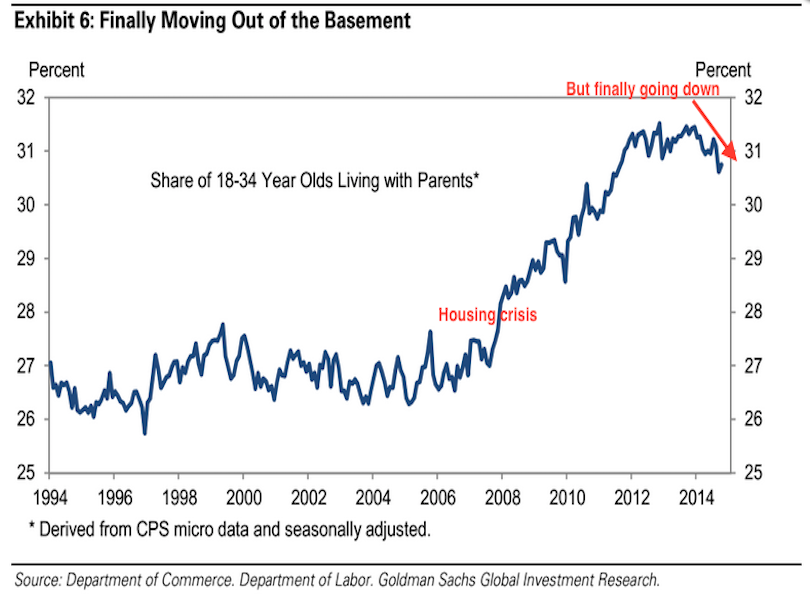

The number of Millennials living at home is staggering:

The number jumped from 27 percent from 1994 to 2008 to nearly 32 percent in recent years. This percentage change represented millions of Millennials. The number is slightly moving lower but this is partly due to some Millennials moving out to form rental households, not in purchasing new properties.

And when you look at their current income level and the typical home price, it is clear that many Millennials shouldn’t be buying homes. Many already carry levels of debt looking like mortgages.

High levels of debt

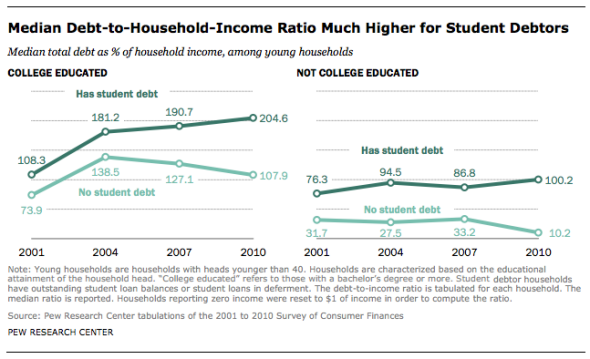

Millennials already have a massive amount of debt from going to college:

Just look at the debt-to-income ratio for college educated Millennials. It is expected that younger generations start at the lower range of the income scale but in the past, people simply weren’t saddled with ungodly amounts of debt starting off their careers. How broke are Millennials? Much more broke than their baby boomer parents.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

DougDiggler said:

Don’t blame the Millennials for the absolutely hellish turn the economy has taken since they were in diapers. There are lots of other reasons to hate millennials, but the bottoming out of the econ is the fault of the overdependence on finance to drive our entire economy.

I mean, I hate millennials for their complete addiction to social networks, their ridiculously rosy view of their own importance, their unquestioning acceptance of any BS the media shoves in their faces. But they live at home because 1) manufacturing has mostly been offshored, the US now has about 10 million manufacturing jobs left and wages are stagnant there 2) entry level jobs are taken by immigrants who will work for less than minimum wage and 3) supervisory and management positions have been both outsourced abroad and have just disappeared with a high degree of workplace automation (software doing jobs humans used to do 25 years ago).November 27th, 2015 at 3:06 pm -

Ragnar said:

Millennialis have been given a raw deal by their boomer parents who sold out the country through unlimited social welfare plans, and exporting all the good jobs to the third world for a one time bump in quarterly stock dividends. The boomers were the most rapacious, selfish, wantonly reckless generation in American history. Unfortunately, a great deal of the Millenials wasted their time on soft humanities in college, and went to schools that were not a good return on investment. They ridiculed any subject that required an apprenticeship, or physical labor. They ridiculed the subjects that you couldn’t do drunk: economics, engineering, accounting, mathematics, etc… Now they are mewling social justice warriors, who sue universities into submission over odious concepts such as “safe spaces” and “micro aggressions”; while they behave like entitled rare and delicate flowers. Life is not fair. Never was, never will be.

Until these people grow up, drop the victim act and learn a skill that makes them marketable, they will continue to live in their parents basements. I have yet to meet a data scientist who is not gainfully employed.November 30th, 2015 at 12:38 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â